Refinancing Federal Student Loans: Is It Right For You?

Table of Contents

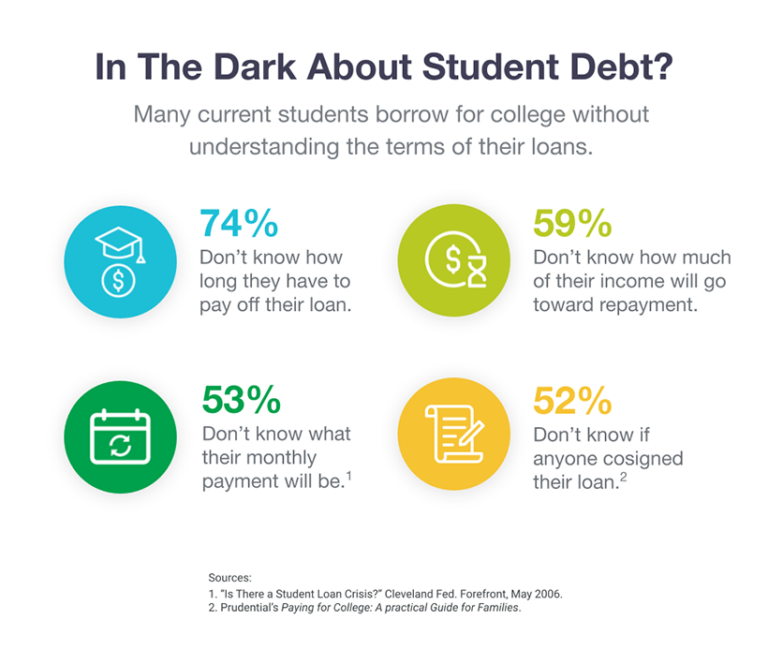

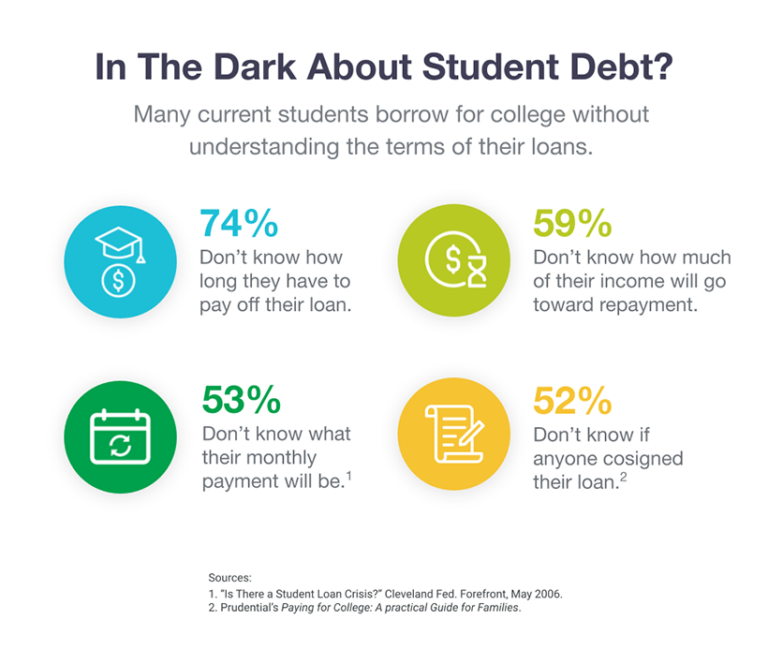

Understanding Federal Student Loan Refinancing

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a private lender. This is different from federal loan consolidation, which keeps your loans under the federal government's umbrella. Understanding the key differences between federal and private loan refinancing is crucial. Federal loans often come with benefits like income-driven repayment plans and potential loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF).

- Refinancing replaces your federal loans with a new private loan. This means you're essentially transferring your debt to a private financial institution.

- Private lenders offer various repayment terms and interest rates. These can be more favorable than your current federal loan terms, but they can also be less favorable depending on your creditworthiness.

- You lose federal protections and benefits upon refinancing. This includes income-driven repayment plans and potential loan forgiveness programs. This is a significant trade-off to consider.

- Consider your credit score and financial stability before applying. Private lenders assess your creditworthiness rigorously before approving your application. A good credit score will be essential to secure favorable interest rates.

Benefits of Refinancing Federal Student Loans

While refinancing means sacrificing some federal protections, there are several potential advantages:

- Potentially lower interest rates compared to your current federal loans. This can lead to significant savings over the life of the loan. Lower interest rates directly translate to less money spent on interest payments.

- Reduced monthly payments, freeing up cash flow. A lower interest rate or a longer repayment term can result in smaller monthly installments, providing financial relief.

- Fixed interest rates, offering predictability. Unlike some variable-rate loans, refinancing often secures a fixed interest rate, eliminating the uncertainty of fluctuating interest payments.

- Simplified repayment with debt consolidation. If you have multiple federal student loans, refinancing can consolidate them into a single loan with one monthly payment, simplifying your repayment process.

- Potentially shorter repayment term. While this can lead to higher monthly payments, it can also significantly reduce the total interest paid over the loan's lifetime.

Drawbacks of Refinancing Federal Student Loans

Before diving into refinancing, it's essential to weigh the potential downsides:

- Loss of access to income-driven repayment plans. Income-driven repayment plans adjust your monthly payments based on your income, making them more manageable for those facing financial hardship. Refinancing forfeits this crucial safety net.

- Potential loss of eligibility for loan forgiveness programs. Programs like PSLF forgive student loan debt after a certain period of qualifying employment in public service. Refinancing typically eliminates eligibility for such programs.

- Higher interest rates possible if your credit score is low. Lenders assess applicants' credit scores, and a low score may result in higher interest rates than expected, negating the potential benefits of refinancing.

- Strict eligibility requirements from private lenders. Meeting the lender's eligibility criteria, including having a good credit history and stable income, is vital.

- Complex application process may require extensive documentation. Gathering the necessary documents and completing the application can be time-consuming and complex.

How to Determine if Refinancing is Right for You

Deciding whether to refinance requires careful consideration of your individual circumstances. Here's a step-by-step guide:

- Check your credit score and improve it if necessary. A higher credit score significantly impacts the interest rates you'll qualify for.

- Compare interest rates from multiple lenders. Don't settle for the first offer; shop around and compare rates from different private lenders.

- Analyze your current repayment plan and financial situation. Assess your current monthly payments and budget to determine if lower payments are truly feasible.

- Use a student loan calculator to project savings. Many online calculators can help project potential savings based on different interest rates and repayment terms.

- Consider your long-term financial goals. Refinancing should align with your overall financial strategy, whether it's saving for a house or retirement.

Conclusion

Refinancing federal student loans presents a complex decision with potential benefits and drawbacks. While the prospect of lower monthly payments and lower interest rates is attractive, the loss of federal benefits like income-driven repayment and loan forgiveness programs is a significant consideration. Careful evaluation of your individual circumstances, credit score, and long-term financial goals is crucial. Compare interest rates from multiple lenders, utilize student loan calculators, and understand the implications before making a decision. Ready to explore your federal student loan refinancing options? Start your research today!

Featured Posts

-

Josh Harts Injury Status Will He Play Against The Celtics On February 23rd

May 17, 2025

Josh Harts Injury Status Will He Play Against The Celtics On February 23rd

May 17, 2025 -

Analysis Japans Economic Slowdown Before Trump Tariffs

May 17, 2025

Analysis Japans Economic Slowdown Before Trump Tariffs

May 17, 2025 -

Exploring The Viability Of Modular Homes In Canadas Housing Market

May 17, 2025

Exploring The Viability Of Modular Homes In Canadas Housing Market

May 17, 2025 -

Andor First Impressions Deliver On 31 Years Of Star Wars Teases

May 17, 2025

Andor First Impressions Deliver On 31 Years Of Star Wars Teases

May 17, 2025 -

Indias Greenko Founders Aim For Orix Stake Acquisition

May 17, 2025

Indias Greenko Founders Aim For Orix Stake Acquisition

May 17, 2025

Latest Posts

-

Granit Xhaka Statistikat E Pasimeve Dhe Nderkohe Ne Bundeslige

May 17, 2025

Granit Xhaka Statistikat E Pasimeve Dhe Nderkohe Ne Bundeslige

May 17, 2025 -

Reddit Issues Resolved Platform Back Online After Outage

May 17, 2025

Reddit Issues Resolved Platform Back Online After Outage

May 17, 2025 -

Reddit Issues Resolved What Happened And What To Expect

May 17, 2025

Reddit Issues Resolved What Happened And What To Expect

May 17, 2025 -

Analiza E Pasimeve Te Granit Xhakes Ne Bundeslige

May 17, 2025

Analiza E Pasimeve Te Granit Xhakes Ne Bundeslige

May 17, 2025 -

Reddit Downtime Resolved Official Statement On Recent Service Disruption

May 17, 2025

Reddit Downtime Resolved Official Statement On Recent Service Disruption

May 17, 2025