Recordati: Tariff Volatility And M&A Opportunities In Italy

Table of Contents

Recordati's Current Market Position and Vulnerabilities to Tariff Changes

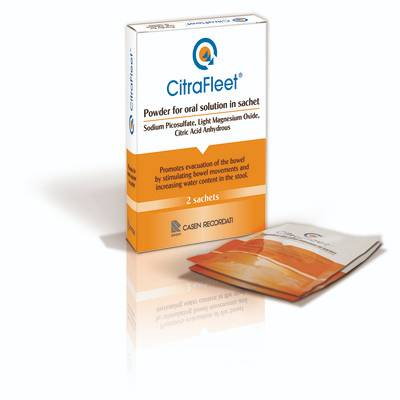

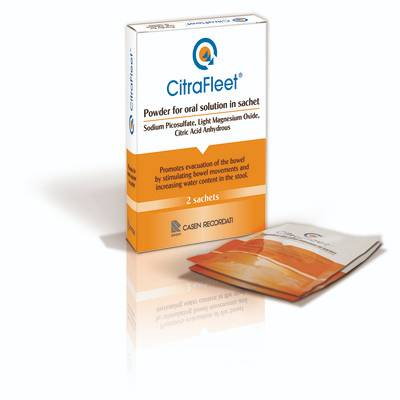

Recordati, known for its specialized pharmaceutical products, holds a significant market share in Italy. Its core business revolves around the development, manufacturing, and distribution of a diverse portfolio of pharmaceutical products, predominantly focusing on therapeutic areas such as cardiovascular, central nervous system, and gastroenterology. However, its revenue streams are susceptible to external factors, particularly tariff volatility.

Recordati's reliance on imported raw materials and its export activities expose it to several vulnerabilities:

- Dependency on specific import sources for raw materials: Fluctuations in import tariffs can significantly impact production costs.

- Exposure to export tariffs in key markets: Changes in tariff policies in countries where Recordati exports its products can directly affect profitability.

- Impact of currency fluctuations on profitability: Exchange rate volatility between the Euro and other currencies can affect the cost of imports and the revenue generated from exports.

While Recordati has a history of successfully adapting to market changes, past instances of tariff adjustments have undoubtedly presented challenges, highlighting the need for a robust risk management strategy to mitigate future disruptions. Understanding these vulnerabilities is crucial for evaluating the potential benefits of future M&A activity.

Analyzing the Italian Pharmaceutical Market and Regulatory Landscape

The Italian pharmaceutical market is characterized by its size, growth potential, and complex regulatory environment. This market is notable for its strict pricing regulations and reimbursement policies, which directly influence the profitability of pharmaceutical companies and the accessibility of drugs for patients.

Key regulatory factors impacting Recordati and the broader market include:

- Pricing regulations: Strict price controls limit the potential for significant price increases, impacting profit margins.

- Reimbursement policies: The reimbursement system dictates which drugs are covered by the national healthcare system, significantly affecting market access and demand.

- Regulatory hurdles for new drug approvals: The lengthy and rigorous approval process for new drugs adds complexity and delays to product launches.

This intricate regulatory landscape, coupled with tariff volatility, contributes to significant market uncertainty and influences strategic decisions, particularly regarding M&A activities. Companies are actively looking to consolidate and expand their portfolios to navigate these challenges.

M&A Opportunities for Recordati in the Current Climate

The current market climate presents compelling M&A opportunities for Recordati. Strategic acquisitions can significantly enhance the company's competitive position and mitigate the risks associated with tariff volatility. Potential targets could include:

- Smaller pharmaceutical companies with established product portfolios in complementary therapeutic areas.

- Specialized drug developers possessing promising new drug candidates to diversify Recordati's pipeline.

- Companies with strong market presence in geographic regions where Recordati seeks to expand.

The potential benefits of M&A for Recordati include:

- Diversification of product portfolio: Reducing reliance on specific products vulnerable to tariff changes.

- Acquisition of intellectual property: Gaining access to new drug candidates and extending patent lifecycles.

- Expansion into new therapeutic areas or geographic markets: Growing market share and reducing geographical concentration risk.

- Cost synergies and economies of scale: Improving operational efficiency and profitability through consolidation.

However, challenges exist, including thorough due diligence, securing regulatory approvals, and ensuring a smooth integration process. Careful consideration of these factors is critical for successful M&A endeavors in the Italian pharmaceutical sector.

Competitive Analysis: Recordati's Position Amongst Competitors

Recordati faces competition from several established pharmaceutical companies in Italy. A detailed competitive analysis comparing Recordati's strengths and weaknesses against its rivals regarding tariff volatility and M&A strategies is crucial. Key factors to consider include:

- Market share comparisons: Analyzing Recordati's market position relative to its competitors.

- Product portfolio overlap and differentiation: Identifying areas of competition and unique product offerings.

- Financial performance and resilience to market fluctuations: Assessing the financial strength and stability of each company.

- M&A activity and strategic partnerships: Evaluating the competitive landscape in terms of strategic alliances and acquisitions.

Understanding this competitive dynamics is essential for developing effective M&A strategies that provide Recordati with a sustainable competitive advantage.

Conclusion: Navigating the Future for Recordati in Italy

The impact of tariff volatility on Recordati’s profitability is undeniable, highlighting the need for strategic adaptation. However, this challenging market also presents significant M&A opportunities for growth and diversification. A proactive M&A strategy is crucial for Recordati to navigate the complexities of the Italian pharmaceutical market and capitalize on its growth potential. Further research could focus on specific case studies of Recordati's past M&A activities or in-depth analyses of potential target companies to gain even deeper insights. Continued discussion on "Recordati: Tariff Volatility and M&A Opportunities in Italy" is vital to understanding the evolving dynamics of this sector and the strategic choices facing key players like Recordati.

Featured Posts

-

Canada Election Looms Trumps Stance On Us Canada Dependence

Apr 30, 2025

Canada Election Looms Trumps Stance On Us Canada Dependence

Apr 30, 2025 -

Ramaphosas Agreement Establishing A Truth And Reconciliation Commission For Apartheid

Apr 30, 2025

Ramaphosas Agreement Establishing A Truth And Reconciliation Commission For Apartheid

Apr 30, 2025 -

Dagskra Bestu Deildarinnar Leikir Dagsins Og Valur Moeguleikar

Apr 30, 2025

Dagskra Bestu Deildarinnar Leikir Dagsins Og Valur Moeguleikar

Apr 30, 2025 -

Theo Doi Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

Apr 30, 2025

Theo Doi Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

Apr 30, 2025 -

Get To Know Remember Monday The Uks Eurovision 2025 Choice

Apr 30, 2025

Get To Know Remember Monday The Uks Eurovision 2025 Choice

Apr 30, 2025