Recordati And The Impact Of Tariff Volatility On M&A Activity In Italy

Table of Contents

Recordati's Business Model and Exposure to Tariff Fluctuations

Recordati's business model, like many pharmaceutical companies, is intricately linked to international trade. Understanding this reliance is crucial to grasping the impact of tariff volatility.

Import and Export Dependency

Recordati relies heavily on both imports and exports.

- Imports: Raw materials, active pharmaceutical ingredients (APIs), and specialized equipment are sourced globally, making the company vulnerable to import tariffs. Specific examples could include APIs sourced from India or China, or specialized machinery from Germany.

- Exports: Recordati distributes its finished products across multiple international markets. Export tariffs imposed by these markets directly impact profitability. This includes exports to key European markets and potentially emerging markets with growing pharmaceutical demands.

Fluctuations in tariffs directly affect Recordati's supply chain costs and overall profitability. Higher tariffs increase input costs, potentially squeezing margins and reducing competitiveness. Conversely, lower tariffs in export markets can boost revenue.

Pricing Strategies and Competitive Landscape

Tariff volatility significantly impacts Recordati's pricing strategies. Increased import tariffs may necessitate price increases for finished products, potentially reducing market share if competitors with different sourcing strategies are less affected.

- Competitive Dynamics: Competitors with more diversified supply chains or those located in regions with lower tariff burdens may gain a competitive edge during periods of tariff instability.

- Price Adjustments: Recordati must carefully balance price adjustments to offset increased input costs with the risk of reduced demand and market share erosion. The elasticity of demand for its specific products will play a key role in this decision-making process.

The Impact of Tariff Volatility on Italian M&A Activity

The uncertainty generated by fluctuating tariffs casts a long shadow over M&A activity in Italy's pharmaceutical sector.

Reduced Deal Flow

Unpredictable tariffs create significant headwinds for M&A transactions.

- Valuation Challenges: Accurately valuing a company becomes exceedingly difficult when future profitability is uncertain due to potential tariff changes. This uncertainty can lead to fewer deals being initiated.

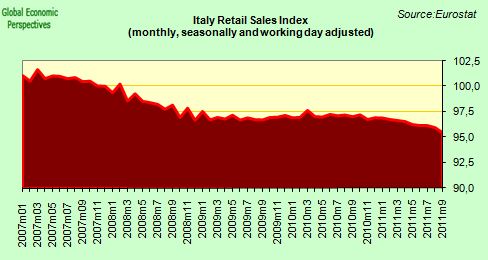

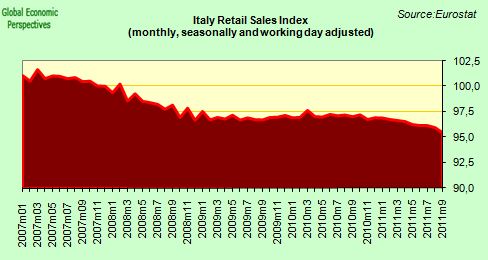

- Statistical Correlation: While specific data may be limited, a general correlation between tariff instability and decreased M&A activity can be observed in sectors heavily reliant on international trade, suggesting a similar trend within Italy's pharmaceutical industry.

Changes in Deal Structure and Valuation

To mitigate tariff risks, buyers and sellers adapt deal structures.

- Earn-outs and Contingent Payments: Deal structures increasingly incorporate earn-outs or contingent payments, tying part of the purchase price to the company's future performance, which is directly influenced by tariff fluctuations.

- Valuation Multiples: Valuation multiples applied to target companies are likely to be adjusted downwards to reflect the heightened risk associated with tariff volatility. The discount applied will depend on the target's exposure to international trade.

Increased Due Diligence

Thorough due diligence has become paramount in M&A transactions.

- Tariff Risk Assessment: Buyers must conduct detailed assessments of tariff-related risks, including potential future tariff increases and their impact on the target company's profitability.

- Legal and Regulatory Expertise: Navigating the complexities of international trade regulations necessitates expert legal and regulatory advice throughout the due diligence process and throughout the lifetime of the acquisition.

Recordati's Strategic Response to Tariff Volatility

Recordati is likely employing several strategies to navigate this challenging environment.

Supply Chain Diversification

Diversifying its supply chain is crucial for mitigating risks.

- Alternative Sourcing: Recordati is likely exploring alternative sourcing options for raw materials and APIs to reduce its reliance on specific countries or regions subject to high tariffs. This could involve reshoring production, or seeking alternative suppliers in different regions.

Mergers and Acquisitions as a Strategic Tool

M&A can serve as a potent tool to navigate tariff-related challenges.

- Strategic Acquisitions: Acquisitions of companies with a diverse geographical presence or specialized production capabilities can offer significant advantages in mitigating supply chain risks and diversifying export markets.

Lobbying and Advocacy

Engagement with policymakers is a vital aspect of managing tariff risks.

- Influence on Trade Policies: Recordati may be actively involved in lobbying efforts to advocate for favorable trade policies, aiming to reduce or eliminate tariffs that disproportionately affect its business.

Conclusion: Navigating the Future of Recordati and Italian M&A in a Volatile Tariff Environment

Tariff volatility significantly impacts Recordati and the broader Italian pharmaceutical M&A landscape. Understanding these implications is crucial for investors and businesses alike. The uncertainty surrounding tariffs necessitates careful evaluation of risk, detailed due diligence, and adaptive strategic responses. Conduct thorough research and seek professional advice before making any investment decisions involving companies potentially affected by tariff volatility on M&A activity in Italy. Continue to investigate how companies like Recordati are strategically navigating this challenging environment and adapt your own strategies accordingly. The future of M&A in Italy's pharmaceutical sector depends on successfully managing the complexities of global trade.

Featured Posts

-

White House Cocaine Incident Secret Service Investigation Results

May 01, 2025

White House Cocaine Incident Secret Service Investigation Results

May 01, 2025 -

Kort Geding Kampen Tegen Enexis Aansluiting Stroomnet Vertraagd

May 01, 2025

Kort Geding Kampen Tegen Enexis Aansluiting Stroomnet Vertraagd

May 01, 2025 -

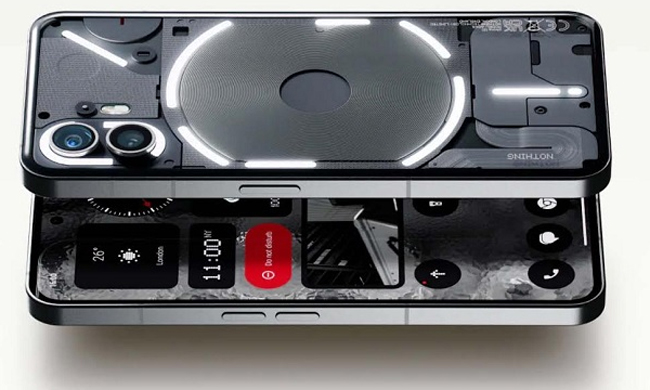

A Review Of Nothings Modular Phone And Its Unique Features

May 01, 2025

A Review Of Nothings Modular Phone And Its Unique Features

May 01, 2025 -

Ripple Xrp Settlement Latest News And Sec Commodity Classification

May 01, 2025

Ripple Xrp Settlement Latest News And Sec Commodity Classification

May 01, 2025 -

Automating Workboat Efficiency And Safety With Tbs And Nebofleet

May 01, 2025

Automating Workboat Efficiency And Safety With Tbs And Nebofleet

May 01, 2025

Latest Posts

-

Nclh Stock Soars Strong Earnings And Upgraded Guidance

May 01, 2025

Nclh Stock Soars Strong Earnings And Upgraded Guidance

May 01, 2025 -

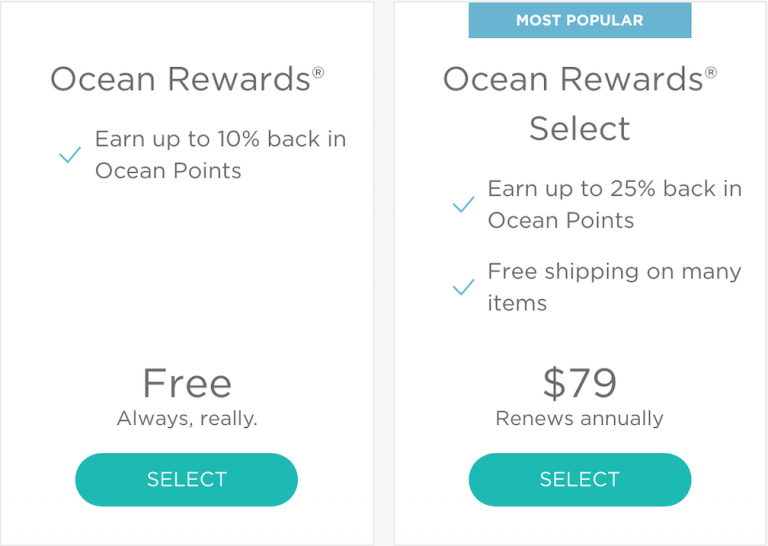

Cruises Com Revolutionizes Cruise Rewards With Points Based System

May 01, 2025

Cruises Com Revolutionizes Cruise Rewards With Points Based System

May 01, 2025 -

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

May 01, 2025

New Cruise Rewards Program From Cruises Com How To Maximize Your Points

May 01, 2025 -

Seven Carnival Cruise Line Updates Revealed Next Month

May 01, 2025

Seven Carnival Cruise Line Updates Revealed Next Month

May 01, 2025 -

Dissenting Voice Pushes For Sweeping Changes At Parkland School Board

May 01, 2025

Dissenting Voice Pushes For Sweeping Changes At Parkland School Board

May 01, 2025