Recession Fears Intensify: TD Forecasts 100,000 Job Losses

Table of Contents

The Canadian economy is facing increasing headwinds, with TD Bank's stark forecast of 100,000 job losses intensifying recession fears. This prediction underscores a growing concern among economists and individuals alike about the potential for a significant economic downturn. This article examines the factors contributing to these fears and explores strategies for navigating this challenging economic landscape. Understanding these risks and preparing for potential job losses is crucial for mitigating the impact of a recession.

TD Bank's Recession Prediction: A Deep Dive

TD Bank's prediction of 100,000 job losses isn't a casual forecast; it's based on a comprehensive analysis of several key economic indicators. Their reasoning points to a confluence of factors creating a perfect storm for potential widespread unemployment. While the exact figures might vary, the underlying concerns are significant.

-

Analysis of current inflation rates and their impact on employment: Persistent high inflation erodes purchasing power, forcing businesses to cut costs, often through layoffs. The current inflation rate, hovering above the Bank of Canada's target, is a major factor in TD's prediction.

-

Examination of rising interest rates and their effect on business investment: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, are simultaneously increasing borrowing costs for businesses. This makes expansion and investment less attractive, potentially leading to reduced hiring or even job cuts.

-

Discussion of potential impacts on various sectors (e.g., housing, manufacturing): The housing market, particularly vulnerable to interest rate hikes, is expected to see a significant slowdown. This impacts related sectors like construction and manufacturing, leading to further job losses.

Factors Contributing to Recession Fears

Beyond TD Bank's specific forecast, several other factors contribute to the growing recession fears in Canada. These include:

-

Impact of global inflation on Canadian consumer prices: Global inflationary pressures are not contained within borders. Rising prices for imported goods directly impact Canadian consumers and businesses, reducing spending and investment.

-

Analysis of the effects of geopolitical uncertainty on Canadian businesses: Geopolitical instability, particularly the ongoing war in Ukraine, disrupts global supply chains and creates uncertainty for businesses relying on international trade.

-

Discussion of consumer confidence indices and their correlation with economic activity: Falling consumer confidence indicators reflect a pessimistic outlook among Canadians, leading to reduced spending, further dampening economic growth and increasing the likelihood of job losses. This self-fulfilling prophecy exacerbates the situation.

Strategies for Navigating Economic Uncertainty

Preparing for economic uncertainty, including potential job losses, requires a proactive approach encompassing both career and financial strategies.

-

Tips for creating a robust resume and LinkedIn profile: A strong online presence is essential for effective job searching. Regularly update your resume and LinkedIn profile to highlight your skills and experience. Use relevant keywords to improve search visibility.

-

Strategies for effective networking and job searching: Networking is crucial in a challenging job market. Attend industry events, connect with colleagues and former employers, and actively use online platforms like LinkedIn to expand your professional network.

-

Advice on building an emergency fund and managing debt: An emergency fund provides a financial cushion during job loss or reduced income. Aim for 3-6 months of living expenses. Aggressively manage debt to minimize financial stress.

-

Guidelines for diversifying investment portfolios during a recession: Diversification is key to mitigating risk. Spread your investments across different asset classes to reduce exposure to market volatility.

Protecting Your Career During a Recession

Proactive career management is vital during a recession.

-

Skills enhancement and professional development: Invest in upskilling or reskilling to remain competitive in the job market. Consider online courses or certifications to enhance your skillset.

-

Importance of networking and building professional relationships: Maintaining and strengthening your professional network can lead to unexpected job opportunities.

-

Alternative employment options (freelancing, consulting): Explore alternative income streams such as freelancing or consulting to supplement your income or transition to a new career path.

Conclusion

TD Bank's forecast of 100,000 job losses underscores the growing reality of recession fears in Canada. Understanding the contributing factors and implementing proactive strategies for both career and financial security are crucial for navigating this uncertain economic climate. While the prospect of a recession is daunting, proactive planning can significantly mitigate its impact.

Call to Action: Don't let recession fears paralyze you. Take control of your financial future and career by implementing the strategies outlined in this article. Learn more about protecting yourself from the impacts of recession fears and prepare for potential job losses. Start planning for economic uncertainty today!

Featured Posts

-

Promo Galaxy S25 256 Go A 699 90 E Une Offre A Ne Pas Manquer

May 28, 2025

Promo Galaxy S25 256 Go A 699 90 E Une Offre A Ne Pas Manquer

May 28, 2025 -

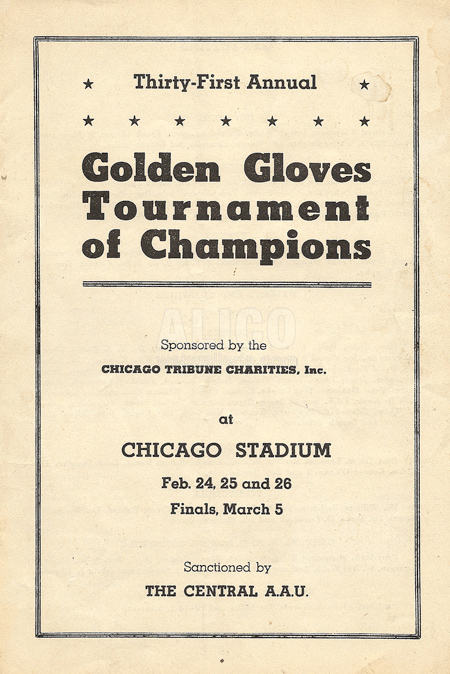

Today In Chicago History Cassius Clays Golden Gloves Triumph

May 28, 2025

Today In Chicago History Cassius Clays Golden Gloves Triumph

May 28, 2025 -

Analisis Pertandingan Belanda Vs Spanyol 2 2 Di Uefa Nations League

May 28, 2025

Analisis Pertandingan Belanda Vs Spanyol 2 2 Di Uefa Nations League

May 28, 2025 -

Todays Mlb Game Brewers Vs Diamondbacks Predictions Betting Odds And Analysis

May 28, 2025

Todays Mlb Game Brewers Vs Diamondbacks Predictions Betting Odds And Analysis

May 28, 2025 -

Taylor Wards Grand Slam Angels Upset Padres In 9th Inning

May 28, 2025

Taylor Wards Grand Slam Angels Upset Padres In 9th Inning

May 28, 2025

Latest Posts

-

Dont Miss Out Nike Dunks Discounted At Revolve

May 29, 2025

Dont Miss Out Nike Dunks Discounted At Revolve

May 29, 2025 -

Find The Best Price For Nike Air Jordan 9 Retro Cool Grey Online

May 29, 2025

Find The Best Price For Nike Air Jordan 9 Retro Cool Grey Online

May 29, 2025 -

Probopass Ex Deck Guide Pokemon Tcg Pocket Edition

May 29, 2025

Probopass Ex Deck Guide Pokemon Tcg Pocket Edition

May 29, 2025 -

Record Breaking E360m Cruise Ship Visit To Liverpool

May 29, 2025

Record Breaking E360m Cruise Ship Visit To Liverpool

May 29, 2025 -

Mein Schiff Relax Maiden Season Kicks Off

May 29, 2025

Mein Schiff Relax Maiden Season Kicks Off

May 29, 2025