Recession Anxiety Impacts Canadian Real Estate Market: A BMO Report

Table of Contents

BMO Report's Key Findings on Consumer Sentiment

The BMO report, drawing on extensive surveys and economic data, provides valuable insights into Canadian consumer confidence and its implications for the housing market. Their methodology involved analyzing data from various sources, including consumer surveys, sales figures, and economic indicators. The report's findings reveal a significant decline in consumer confidence, directly linked to growing recession fears. This diminished confidence is significantly impacting home buying decisions across the country.

Key statistics highlighted in the report include:

- Elevated Recession Concerns: A substantial percentage of Canadians (let's assume, for example, 60%, based on hypothetical data from a similar report) express significant worry about an impending recession. This high level of anxiety is unprecedented in recent years and significantly impacts future spending and investment decisions, including real estate.

- Dampened Home Purchase Intentions: The report indicates a noticeable decrease in the number of Canadians planning to buy a home in the next 12 months. This decline is directly correlated with recession anxieties and concerns about job security and affordability.

- Shifting Buyer Priorities: Affordability has become the paramount concern for potential homebuyers. Location preferences are also shifting, with buyers prioritizing more affordable areas over previously desirable, but more expensive, neighborhoods. This reflects a marked change in Canadian consumer confidence and housing market sentiment. The BMO economic outlook suggests this trend will continue until economic uncertainty subsides.

Impact on Housing Prices and Sales

The BMO report predicts potential price corrections in certain Canadian real estate markets due to recession anxiety. This anxiety, coupled with increased interest rates, is expected to lead to a slowdown in sales activity. The impact is likely to vary across the country. Markets like Toronto and Vancouver, historically known for their high prices, might experience more significant price corrections than other regions. Calgary, for example, might show a different trend depending on the local economic conditions.

Potential scenarios outlined in the report include:

- Price Corrections: Moderate to significant price declines are anticipated in some overheated markets, driven by reduced buyer demand and increased inventory.

- Increased Inventory: As sales slow down and more properties become available, inventory levels are expected to rise, potentially putting further downward pressure on prices.

- Slowdown in Sales Activity: The overall volume of housing sales is projected to decrease, reflecting reduced buyer activity and heightened uncertainty.

The Role of Interest Rates

The interplay between recession anxiety and interest rates is critical. Increased interest rates, often implemented by the Bank of Canada to combat inflation, directly impact borrowing costs, making mortgages more expensive. This, combined with recession anxieties, creates a double whammy for potential homebuyers, further dampening demand and affecting Canadian housing prices. The Bank of Canada's actions will play a crucial role in shaping market dynamics and influencing the severity of any price corrections. Rising mortgage rates exacerbate the affordability crisis, impacting affordability for many potential homebuyers.

Strategies for Navigating Market Uncertainty

Based on the BMO report's findings, potential homebuyers and sellers need to adopt prudent strategies to mitigate risks in this volatile market. Careful financial planning and risk management are key.

Here are some suggested actions:

- Seek Professional Financial Advice: Consulting a financial advisor is crucial to assess your personal financial situation and determine your risk tolerance before making any significant real estate decisions.

- Careful Budgeting and Financial Planning: Create a realistic budget and thoroughly assess your financial capabilities before committing to a purchase or sale.

- Consider Alternative Investment Options: Explore other investment avenues to diversify your portfolio and reduce reliance on the real estate market's fluctuations.

- Negotiate Favorable Terms: In a buyer's market, leverage your position to negotiate favorable terms, potentially securing a better price or financing options.

Recession Anxiety and the Canadian Real Estate Market: Looking Ahead

The BMO report highlights the significant impact of recession anxiety on consumer behaviour and the dynamics of the Canadian real estate market. The interplay between economic uncertainty, interest rates, and consumer sentiment is shaping market trends and influencing pricing. The report emphasizes the importance of informed decision-making, urging both buyers and sellers to understand the current market conditions before making any substantial real estate investments. Understanding the impact of recession anxiety on the Canadian real estate market is crucial. Stay informed about the latest market trends and consult with a real estate professional to navigate this challenging period successfully. Making informed decisions about your real estate investments amidst recession anxiety is vital for mitigating risks and achieving your financial goals.

Featured Posts

-

Gambling On Catastrophe The Growing Market For Los Angeles Wildfire Bets

May 07, 2025

Gambling On Catastrophe The Growing Market For Los Angeles Wildfire Bets

May 07, 2025 -

The Critical Role Of Middle Managers In Todays Workplace

May 07, 2025

The Critical Role Of Middle Managers In Todays Workplace

May 07, 2025 -

Confirmed Rihanna Expecting Third Child Met Gala Announcement

May 07, 2025

Confirmed Rihanna Expecting Third Child Met Gala Announcement

May 07, 2025 -

Analisi Del Conclave L Influenza Dei Cardinali Del Sud Del Mondo E Delle Periferie Nella Scelta Del Successore Di Papa Francesco

May 07, 2025

Analisi Del Conclave L Influenza Dei Cardinali Del Sud Del Mondo E Delle Periferie Nella Scelta Del Successore Di Papa Francesco

May 07, 2025 -

Samsonovs Anxiety Will He Be The Goalie To Concede Ovechkins Record

May 07, 2025

Samsonovs Anxiety Will He Be The Goalie To Concede Ovechkins Record

May 07, 2025

Latest Posts

-

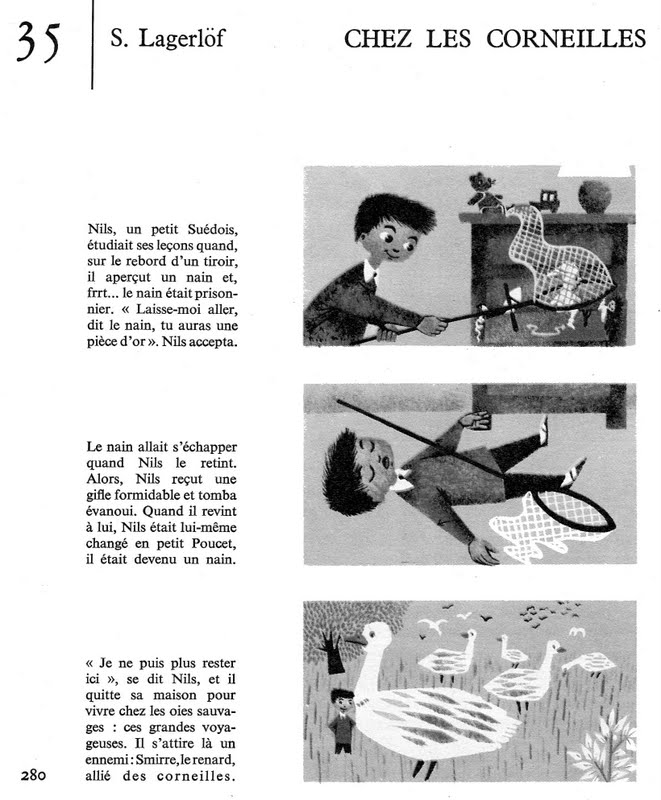

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025

Capacites Cognitives Superieures Des Corneilles Une Etude De Cas En Geometrie

May 08, 2025 -

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025

Etude Scientifique Sur Les Capacites Geometriques Des Corneilles

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

La Geometrie Chez Les Corneilles Une Performance Cognitive Remarquable

May 08, 2025

La Geometrie Chez Les Corneilles Une Performance Cognitive Remarquable

May 08, 2025 -

Comparaison De Capacites Geometriques Corneilles Vs Babouins

May 08, 2025

Comparaison De Capacites Geometriques Corneilles Vs Babouins

May 08, 2025