Recent Semiconductor Market Volatility: Examining The Role Of Leveraged ETFs

Table of Contents

Understanding Leveraged ETFs in the Semiconductor Sector

Leveraged ETFs, specifically those focused on the semiconductor sector, aim to deliver a multiple of the daily performance of a benchmark index. For example, a 2x leveraged ETF seeks to provide double the daily return of its underlying index. However, this daily rebalancing mechanism is crucial to understand. It means the ETF's returns are reset daily, not over the long term. This daily compounding effect can significantly impact performance, particularly over extended periods of market movement in either direction.

- Definition of leveraged ETFs and their use in the semiconductor market. Leveraged ETFs provide magnified exposure to the semiconductor industry, allowing investors to potentially amplify gains but also significantly increase losses. Popular choices among investors include those seeking to profit from positive trends in the technology sector.

- Explanation of daily rebalancing and its effect on long-term performance. Daily rebalancing means the ETF adjusts its holdings each day to maintain its targeted leverage. This can lead to "volatility decay," where the long-term returns deviate significantly from the simple multiple of the underlying index's performance, especially during periods of high volatility or sustained trends. A prolonged upward trend might seem ideal, but daily rebalancing can, counterintuitively, lead to less than double the gain expected. Similarly, a prolonged downward trend will magnify losses.

- Examples of popular leveraged semiconductor ETFs (e.g., SOXL, SMH). While SOXL (Direxion Daily Semiconductor Bull 3X Shares) is a prime example of a 3x leveraged ETF, SMH (iShares Semiconductor ETF) offers unleveraged exposure to the semiconductor sector, serving as a useful comparison. Understanding the differences between leveraged and unleveraged ETFs is key.

- Risks associated with leveraged ETFs, particularly during periods of high volatility. The inherent risk of leveraged ETFs is amplified during volatile periods. A sharp market downturn can quickly erase investment gains and even result in substantial losses.

Beyond volatility decay, investors should be aware of the impact of prolonged market trends. While a 2x leveraged ETF aims for double the daily returns, over longer periods, the actual return may significantly differ from a simple doubling due to daily rebalancing. Inverse and leveraged inverse ETFs further complicate this. These ETFs aim to deliver the inverse of the daily performance of an index, magnifying potential losses but also offering opportunities in a bearish market. Understanding these products' implications requires meticulous research.

The Impact of Geopolitical Factors on Semiconductor ETF Volatility

Geopolitical events significantly influence the semiconductor industry, impacting supply chains, manufacturing, and pricing. These disruptions directly impact the performance of semiconductor ETFs, particularly the leveraged ones.

- US-China trade relations and their effect on semiconductor prices. Trade tensions and sanctions between the US and China have created uncertainty in the semiconductor supply chain, leading to price fluctuations. These events can trigger significant volatility in both leveraged and unleveraged semiconductor ETFs.

- Impact of geopolitical instability on semiconductor manufacturing and distribution. Global instability can disrupt manufacturing, logistics, and distribution networks, causing shortages and price increases, thus impacting ETF performance.

- Analysis of how these factors affect leveraged ETF performance. Because leveraged ETFs amplify daily movements, the impact of geopolitical events is magnified, leading to potentially substantial gains or losses depending on the direction of the market reaction.

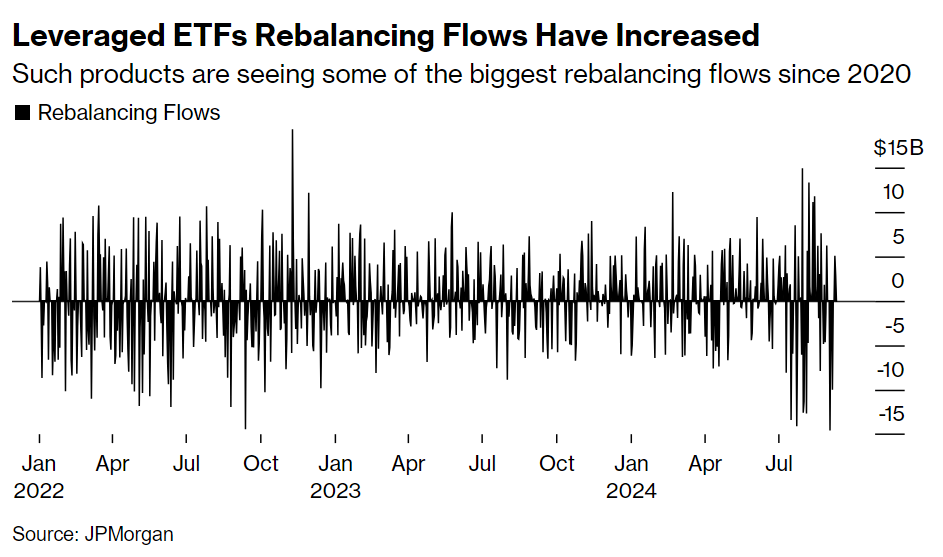

For example, the imposition of tariffs on semiconductor components can lead to a sharp increase in prices, benefiting leveraged bull ETFs, while a sudden escalation of tensions might cause a market sell-off and significantly hurt their value. Charts illustrating price movements of leveraged semiconductor ETFs around specific geopolitical events would effectively demonstrate this correlation.

Analyzing the Role of Market Sentiment and Speculation

Market sentiment and speculation play a substantial role in driving volatility within semiconductor ETFs, especially leveraged ones.

- The influence of news and analyst reports on investor behavior. Positive news about a major semiconductor company or positive industry forecasts can trigger buying frenzies, pushing up prices, particularly in leveraged ETFs. Conversely, negative news can lead to sharp sell-offs.

- The role of social media and online forums in shaping market sentiment. Social media platforms and online forums can rapidly spread information (and misinformation), amplifying market sentiment and contributing to price swings in semiconductor ETFs. FOMO (fear of missing out) and speculative trading can exacerbate price volatility, particularly in leveraged products.

- How speculation can amplify price swings in leveraged ETFs. Speculative trading can drive short-term price increases or decreases unrelated to the underlying fundamentals of the semiconductor market. This can greatly benefit or harm those invested in leveraged ETFs.

Short-term trading strategies might exploit these short-term price swings, but long-term investors need to be aware of the risks associated with leveraged ETFs and understand the potential for market bubbles and corrections. Understanding the difference between short-term speculation and long-term investment is key to managing risk.

Case Study: A Recent Example of Semiconductor Market Volatility

The recent announcement of [Insert specific recent event, e.g., new chip manufacturing facility delays by a major player] caused significant volatility in the semiconductor market. Before the announcement, SOXL traded at [Price X]. Immediately following the news, the price dropped to [Price Y], representing a [Percentage] decline. In the following days, the price partially recovered to [Price Z]. This example underscores how quickly even short-term news can impact the price of leveraged semiconductor ETFs. (Include a chart visualizing these price fluctuations if possible).

Conclusion

Leveraged semiconductor ETFs offer the potential for amplified returns, but they also carry substantial risk. Geopolitical factors, market sentiment, and the inherent characteristics of leveraged investment products significantly impact their volatility. The daily rebalancing mechanism and the effect of compounding are critical aspects to understand. Volatility decay and the magnification of both gains and losses must be carefully considered.

Before investing in leveraged semiconductor ETFs, carefully consider your risk tolerance, investment goals, and thoroughly research the specific ETF and its underlying holdings. Conduct your own due diligence and consult with a financial advisor if necessary. Remember, understanding the intricacies of leveraged semiconductor ETFs, including their inherent risks, is crucial for effective risk management in this dynamic market.

Featured Posts

-

Nba Draft 2025 Teams Most Likely To Land Cooper Flagg

May 13, 2025

Nba Draft 2025 Teams Most Likely To Land Cooper Flagg

May 13, 2025 -

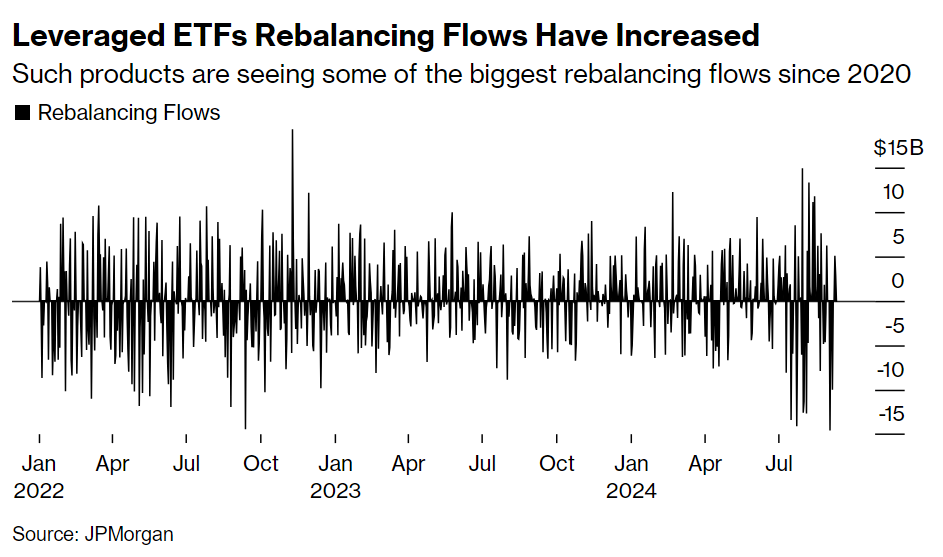

Four Walls Announces New Ceo

May 13, 2025

Four Walls Announces New Ceo

May 13, 2025 -

Syn Kadyshevoy Brosil Beremennuyu Model Merman V Oae Podrobnosti

May 13, 2025

Syn Kadyshevoy Brosil Beremennuyu Model Merman V Oae Podrobnosti

May 13, 2025 -

Coinsilium Group Limited Forza Launch Highlights From Gibraltar

May 13, 2025

Coinsilium Group Limited Forza Launch Highlights From Gibraltar

May 13, 2025 -

Elsbeth Season 2 Preview A Look At Episode 15 I See Murder

May 13, 2025

Elsbeth Season 2 Preview A Look At Episode 15 I See Murder

May 13, 2025