Recent Bitcoin Mining Increase: Factors Contributing To The Growth

Table of Contents

The Rise of Institutional Investment in Bitcoin Mining

Large-scale institutional investors are increasingly entering the Bitcoin mining arena. This influx of capital is fundamentally reshaping the landscape. These institutional players bring significant advantages, primarily economies of scale and access to sophisticated technologies. Their participation translates to:

- Increased capital inflow for mining operations: Massive investments fuel the expansion of existing mining farms and the creation of new ones.

- Development of large-scale Bitcoin mining farms: These farms leverage cutting-edge technology and infrastructure to maximize efficiency and profitability.

- Access to advanced technologies and infrastructure: Institutional investors can procure and implement the latest ASICs (Application-Specific Integrated Circuits), leading to higher hash rates and reduced energy consumption.

- Reduced operational costs through economies of scale: Bulk purchasing of equipment and energy contracts leads to significantly lower operational costs per Bitcoin mined, enhancing profitability.

This shift towards institutional Bitcoin mining represents a significant change in the industry, moving away from a more decentralized model towards one dominated by larger players. The keywords Institutional Bitcoin mining, large-scale Bitcoin mining, and Bitcoin mining investment accurately reflect this trend.

Technological Advancements and Mining Efficiency

Technological progress is another pivotal factor in the Bitcoin mining increase. Advancements in ASIC technology have significantly boosted mining efficiency. This isn't just about processing power; it's also about energy efficiency. Improved cooling solutions and sophisticated energy management strategies have played a crucial role:

- Higher hash rate per unit of energy consumption: Newer ASICs deliver significantly more hashing power for the same amount of energy, increasing the return on investment.

- Reduced operational costs per Bitcoin mined: Greater efficiency directly translates to lower operational expenditures, making Bitcoin mining more attractive and profitable.

- Increased profitability for miners: Higher efficiency and lower costs contribute to better profit margins, encouraging more individuals and entities to engage in Bitcoin mining.

- Faster transaction processing on the Bitcoin network: The increased hash rate contributes to faster block times and a more robust Bitcoin network.

The keywords Bitcoin mining hardware, ASIC technology, Bitcoin mining efficiency, and energy-efficient Bitcoin mining highlight the impact of technological innovation on the recent surge in mining activity.

The Increasing Price of Bitcoin and Miner Profitability

A fundamental driver of the Bitcoin mining increase is the direct correlation between Bitcoin's price and miner profitability. A higher Bitcoin price translates directly into higher rewards for miners. This creates a positive feedback loop:

- Higher returns on investment for miners: As the Bitcoin price rises, the financial incentives for mining increase dramatically.

- Attraction of new miners to the network: Higher profitability draws new entrants into the Bitcoin mining ecosystem, further boosting the overall hash rate.

- Increased competition within the Bitcoin mining ecosystem: The increased number of miners leads to intensified competition for block rewards.

- Potential impact on Bitcoin's decentralization: The concentration of mining power in the hands of larger players raises concerns about the long-term decentralization of the Bitcoin network.

The keywords Bitcoin price, Bitcoin mining profitability, and Bitcoin miner returns accurately reflect this crucial relationship.

Regulatory Changes and Geographic Shifts in Mining Activity

Regulatory environments and energy costs play a significant role in shaping the geographical distribution of Bitcoin mining activity. Changes in regulations across various countries have influenced where mining operations are established:

- Impact of stricter regulations in some regions: Some countries have implemented stricter regulations on cryptocurrency mining, leading to the relocation of mining operations to more favorable jurisdictions.

- Emergence of new mining hubs with lower energy costs: Regions with abundant and inexpensive renewable energy sources are becoming attractive destinations for large-scale Bitcoin mining operations.

- Influence of government policies on Bitcoin mining: Government policies, including tax incentives and regulatory frameworks, play a crucial role in attracting or deterring Bitcoin mining investments.

- Geographical distribution of Bitcoin mining hash rate: The hash rate is becoming increasingly concentrated in regions with favorable regulatory environments and low energy costs.

The keywords Bitcoin mining regulations, Bitcoin mining locations, and energy costs Bitcoin mining underscore the importance of regulatory and geographical factors.

Conclusion: The Future of Bitcoin Mining Growth – A Look Ahead

The recent Bitcoin mining increase is a multifaceted phenomenon driven by a combination of institutional investment, technological advancements, the price of Bitcoin, and evolving regulatory landscapes. The interplay of these factors will continue to shape the future of Bitcoin mining. The ongoing evolution of the Bitcoin mining landscape demands constant attention. Stay informed about the dynamic world of Bitcoin mining increase and its impact on the cryptocurrency market. Learn more about the latest trends in Bitcoin mining growth and how it shapes the future of digital currencies. Understand the factors driving Bitcoin mining activity to make informed decisions in this rapidly evolving sector.

Featured Posts

-

Bitcoin Seoul 2025 Global Leaders Converge In Asia

May 08, 2025

Bitcoin Seoul 2025 Global Leaders Converge In Asia

May 08, 2025 -

Sht Ky Bhtr Shwlyat Lahwr Hayykwrt Ke Jjz Ke Lye Tby Anshwrns

May 08, 2025

Sht Ky Bhtr Shwlyat Lahwr Hayykwrt Ke Jjz Ke Lye Tby Anshwrns

May 08, 2025 -

Bayern Munich Stunned By Inter Milan In Champions League Quarterfinal

May 08, 2025

Bayern Munich Stunned By Inter Milan In Champions League Quarterfinal

May 08, 2025 -

Thunders Williams Highlights Exceptional Team Leadership

May 08, 2025

Thunders Williams Highlights Exceptional Team Leadership

May 08, 2025 -

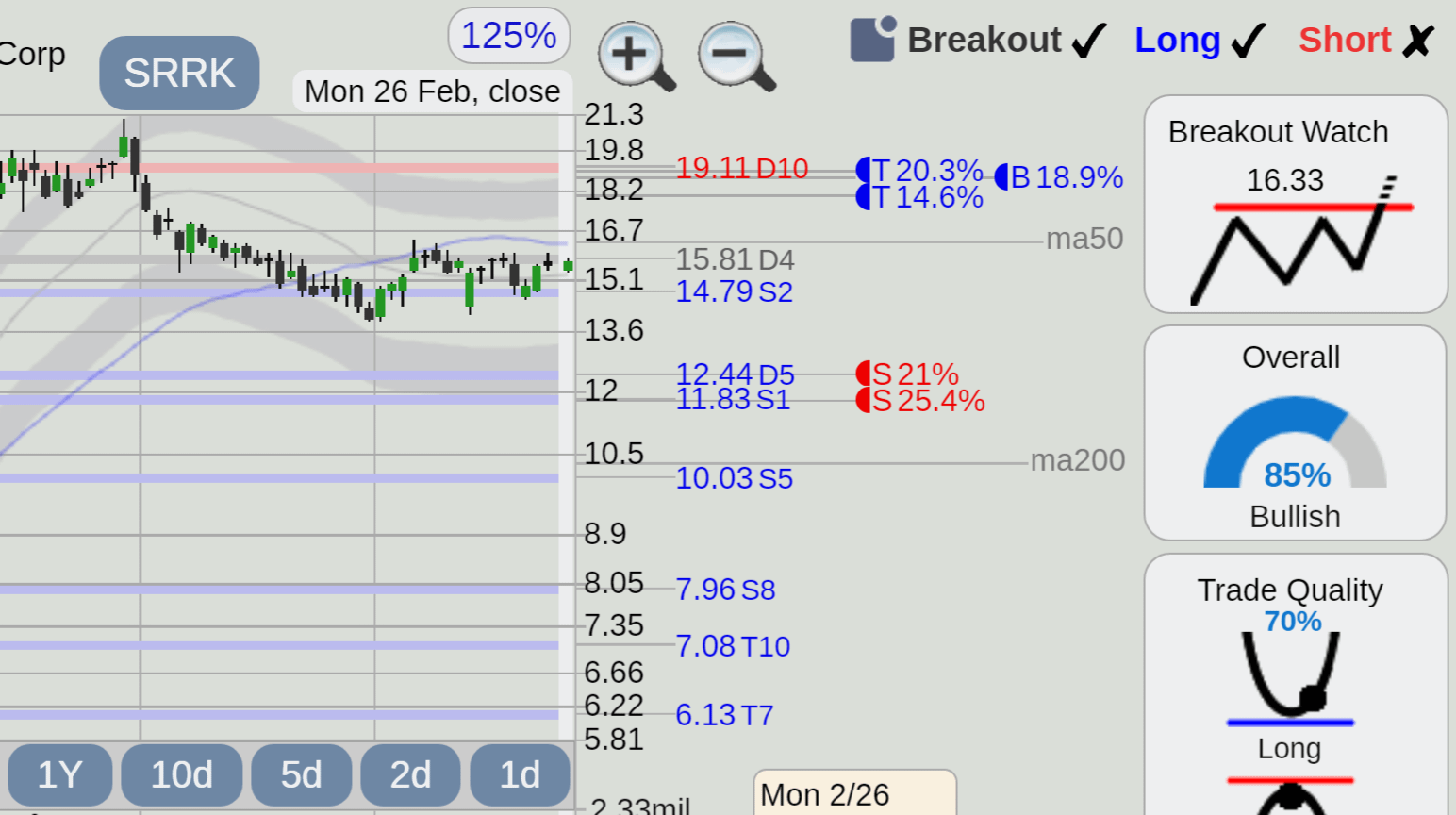

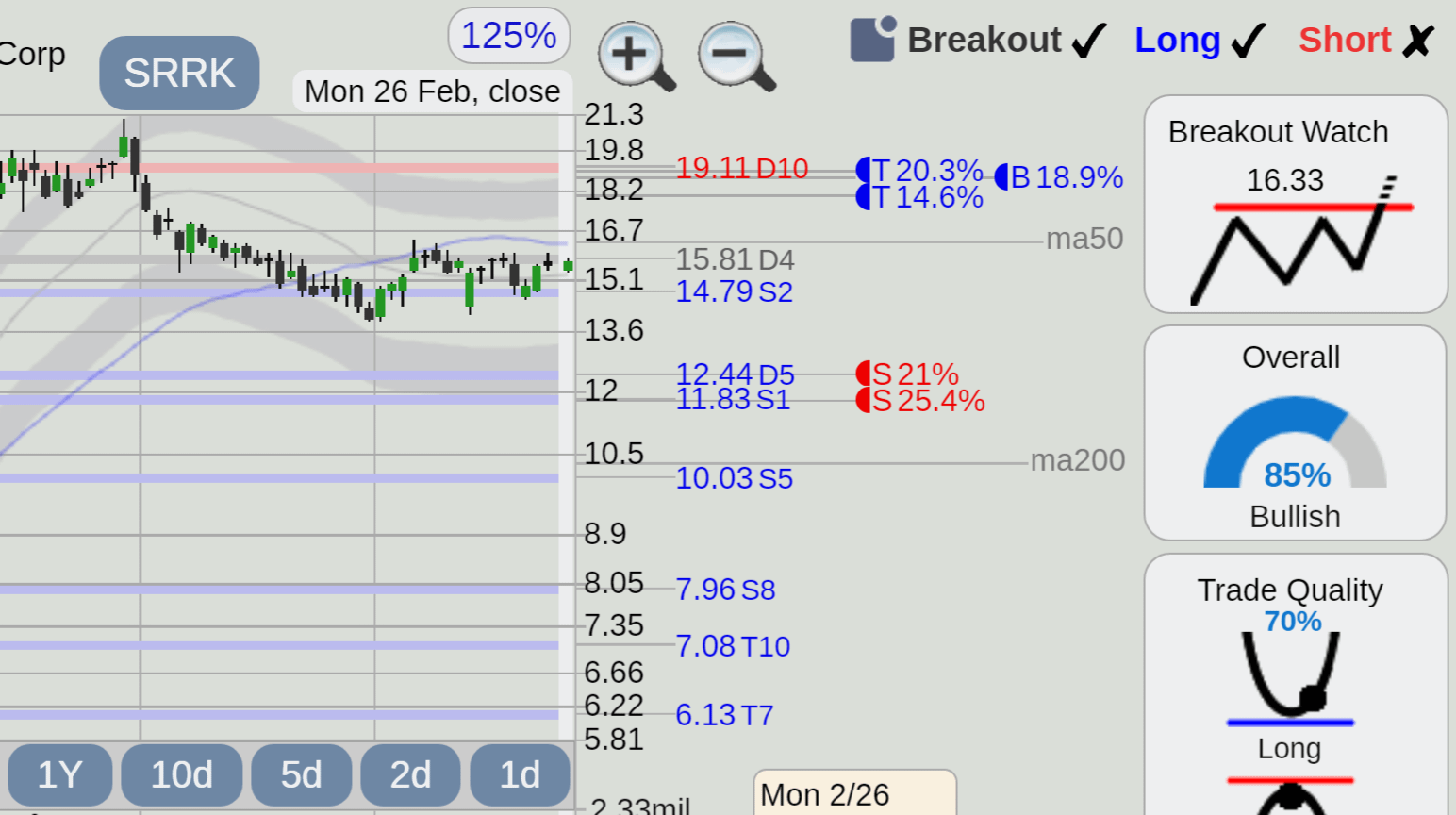

Mondays Market Volatility Impact On Scholar Rock Stock

May 08, 2025

Mondays Market Volatility Impact On Scholar Rock Stock

May 08, 2025

Latest Posts

-

Mondays Market Volatility Impact On Scholar Rock Stock

May 08, 2025

Mondays Market Volatility Impact On Scholar Rock Stock

May 08, 2025 -

Understanding The Dwps 3 Month Warning 355 000 Benefits Affected

May 08, 2025

Understanding The Dwps 3 Month Warning 355 000 Benefits Affected

May 08, 2025 -

Dwp Benefit Cuts Thousands Affected By April 5th Changes

May 08, 2025

Dwp Benefit Cuts Thousands Affected By April 5th Changes

May 08, 2025 -

Dwps Increased Home Visits What Benefit Claimants Need To Know

May 08, 2025

Dwps Increased Home Visits What Benefit Claimants Need To Know

May 08, 2025 -

Scholar Rock Stock Decline Analyzing Mondays Market Reaction

May 08, 2025

Scholar Rock Stock Decline Analyzing Mondays Market Reaction

May 08, 2025