Recent Bitcoin Mining Activity: Causes And Implications

Table of Contents

The Rise of Institutional Investment in Bitcoin Mining

The increased Bitcoin mining activity isn't solely driven by individual miners. A significant factor is the growing involvement of institutional investors. This shift towards large-scale, professional Bitcoin mining operations has profoundly impacted the network's hash rate and security.

Increased Hash Rate and its Correlation with Institutional Adoption

The Bitcoin network's hash rate, a measure of its computational power, directly correlates with the level of mining activity. The surge in institutional investment has led to a considerable increase in this hash rate, strengthening the network's security against attacks.

- Examples of major players: Companies like Riot Platforms, Marathon Digital Holdings, and Argo Blockchain are publicly traded mining companies that have significantly increased their mining capacity. This institutional involvement brings substantial financial resources and expertise to the Bitcoin mining ecosystem.

- Impact on network security: The higher hash rate makes it exponentially more difficult and expensive for malicious actors to attempt a 51% attack, thereby enhancing the security and stability of the Bitcoin network.

- Publicly traded mining companies: The rise of publicly traded mining companies allows investors to gain exposure to Bitcoin mining through traditional stock markets, further driving investment and expansion.

Sophisticated Mining Hardware and Economies of Scale

Institutional miners benefit from access to advanced mining hardware and economies of scale, giving them a significant competitive advantage over smaller, individual miners.

- Advances in ASIC technology: Application-Specific Integrated Circuits (ASICs) are highly specialized chips designed solely for Bitcoin mining, offering significantly higher hashing power and energy efficiency compared to general-purpose hardware.

- The role of specialized mining farms: Large-scale mining farms, often located in areas with low electricity costs, leverage economies of scale to maximize profitability. These farms house thousands of ASIC miners, operating 24/7.

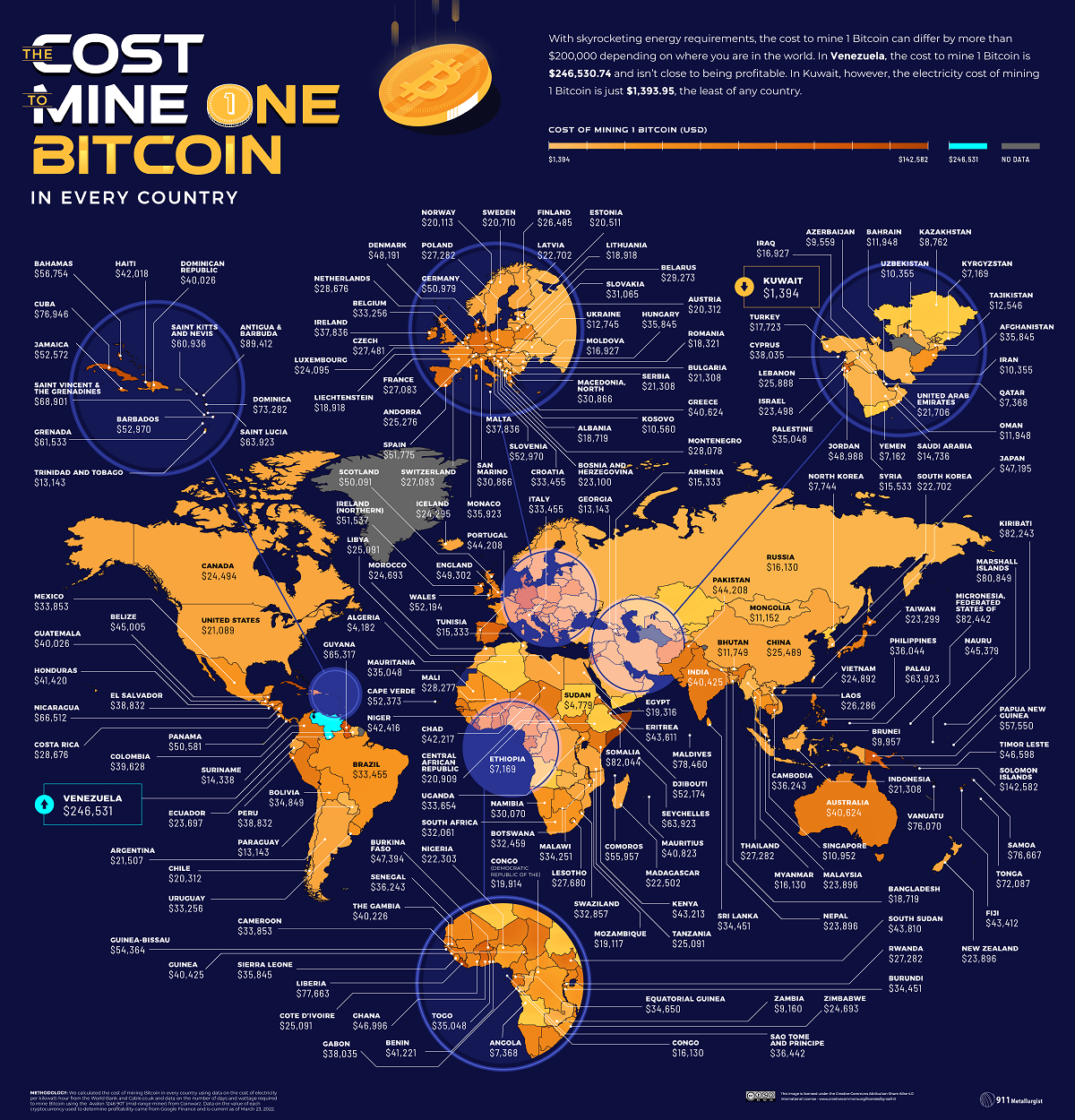

- The impact of energy costs on profitability: Electricity costs are a major factor in Bitcoin mining profitability. Institutional miners often negotiate favorable energy contracts or locate their operations in regions with low electricity prices to maintain a competitive edge.

The Influence of Bitcoin's Price on Mining Activity

Bitcoin's price is intrinsically linked to the profitability of Bitcoin mining. Price fluctuations directly impact miner incentives and consequently, the overall Bitcoin mining activity.

Price Volatility and its Effect on Miner Profitability

Bitcoin's volatile price directly influences miner profitability.

- How price increases incentivize more mining activity: When Bitcoin's price rises, the reward for successfully mining a block increases, making mining more profitable and attracting more miners to the network.

- The impact of price drops on miner profitability and potential shutdowns: Conversely, price drops can reduce profitability to the point where some miners become unprofitable and are forced to shut down their operations. This can lead to a temporary decrease in the hash rate.

- Discussion of the break-even price for miners: Each miner has a break-even price, the point at which their operating costs equal their revenue. When the Bitcoin price falls below this level, miners become unprofitable.

Mining Difficulty Adjustment and its Role in Maintaining Network Stability

The Bitcoin network incorporates a difficulty adjustment mechanism to maintain a consistent block generation time (approximately 10 minutes).

- How the difficulty adjustment works: The network automatically adjusts the mining difficulty every 2016 blocks based on the average block generation time. If the hash rate increases, the difficulty increases to maintain the target block time; conversely, if the hash rate decreases, the difficulty decreases.

- Its importance in preventing network centralization: The difficulty adjustment mechanism helps prevent network centralization by ensuring that no single entity or group can easily dominate the mining process.

- The implications of a rapidly increasing or decreasing hash rate: Rapid changes in the hash rate can lead to temporary fluctuations in block generation times, but the difficulty adjustment mechanism generally keeps these fluctuations within acceptable bounds.

Environmental Concerns Surrounding Bitcoin Mining

The substantial energy consumption of Bitcoin mining raises significant environmental concerns. This has led to increased regulatory scrutiny and a push towards more sustainable practices.

Energy Consumption and its Impact on Sustainability

The energy consumption associated with Bitcoin mining is a major point of contention.

- Discussion of the carbon footprint of Bitcoin mining: The carbon footprint of Bitcoin mining varies significantly depending on the energy sources used. Mining operations powered by fossil fuels have a larger carbon footprint than those using renewable energy sources.

- The use of renewable energy sources in Bitcoin mining: Many mining operations are now actively seeking renewable energy sources, such as hydro, solar, and wind power, to reduce their environmental impact.

- Initiatives to improve the environmental sustainability of the Bitcoin network: The Bitcoin mining industry is exploring various initiatives, including the adoption of more energy-efficient hardware and the use of renewable energy sources, to minimize its environmental impact.

Regulatory Scrutiny and its Potential Effects on Mining Activity

Growing environmental concerns have resulted in increased regulatory scrutiny of Bitcoin mining.

- Examples of government regulations aimed at controlling energy consumption: Some governments have implemented or are considering regulations aimed at limiting energy consumption by Bitcoin mining operations or restricting their location.

- The impact of environmental regulations on mining operations: Environmental regulations can increase the operating costs for miners, potentially leading to some miners shutting down or relocating to regions with less stringent regulations.

- Potential future regulatory hurdles: The regulatory landscape surrounding Bitcoin mining is still evolving, and future regulations could significantly impact the industry.

Conclusion

Recent Bitcoin mining activity is a complex interplay of institutional investment, Bitcoin's price, and growing environmental concerns. The influx of institutional capital has led to an increased hash rate, strengthening network security, while price volatility continues to influence miner profitability and the overall mining landscape. Furthermore, the environmental impact of Bitcoin mining is driving regulatory scrutiny and a push towards greater sustainability.

Key Takeaways: Institutional investment is significantly driving Bitcoin mining activity, increasing hash rate and security. Bitcoin's price directly impacts miner profitability, leading to fluctuations in mining activity. Environmental concerns are leading to increased regulation and a focus on sustainable mining practices.

To stay informed about future trends in Bitcoin mining activity, continue your research with additional resources available online. Understanding these dynamics is crucial for navigating the evolving world of cryptocurrency.

Featured Posts

-

Abcs High Potential A Ballsy Season Finale

May 09, 2025

Abcs High Potential A Ballsy Season Finale

May 09, 2025 -

F1 Alpine Boss Delivers Blunt Message To Doohan

May 09, 2025

F1 Alpine Boss Delivers Blunt Message To Doohan

May 09, 2025 -

When Does The Next High Potential Episode Air On Abc

May 09, 2025

When Does The Next High Potential Episode Air On Abc

May 09, 2025 -

Metas Whats App Spyware Verdict A 168 Million Setback

May 09, 2025

Metas Whats App Spyware Verdict A 168 Million Setback

May 09, 2025 -

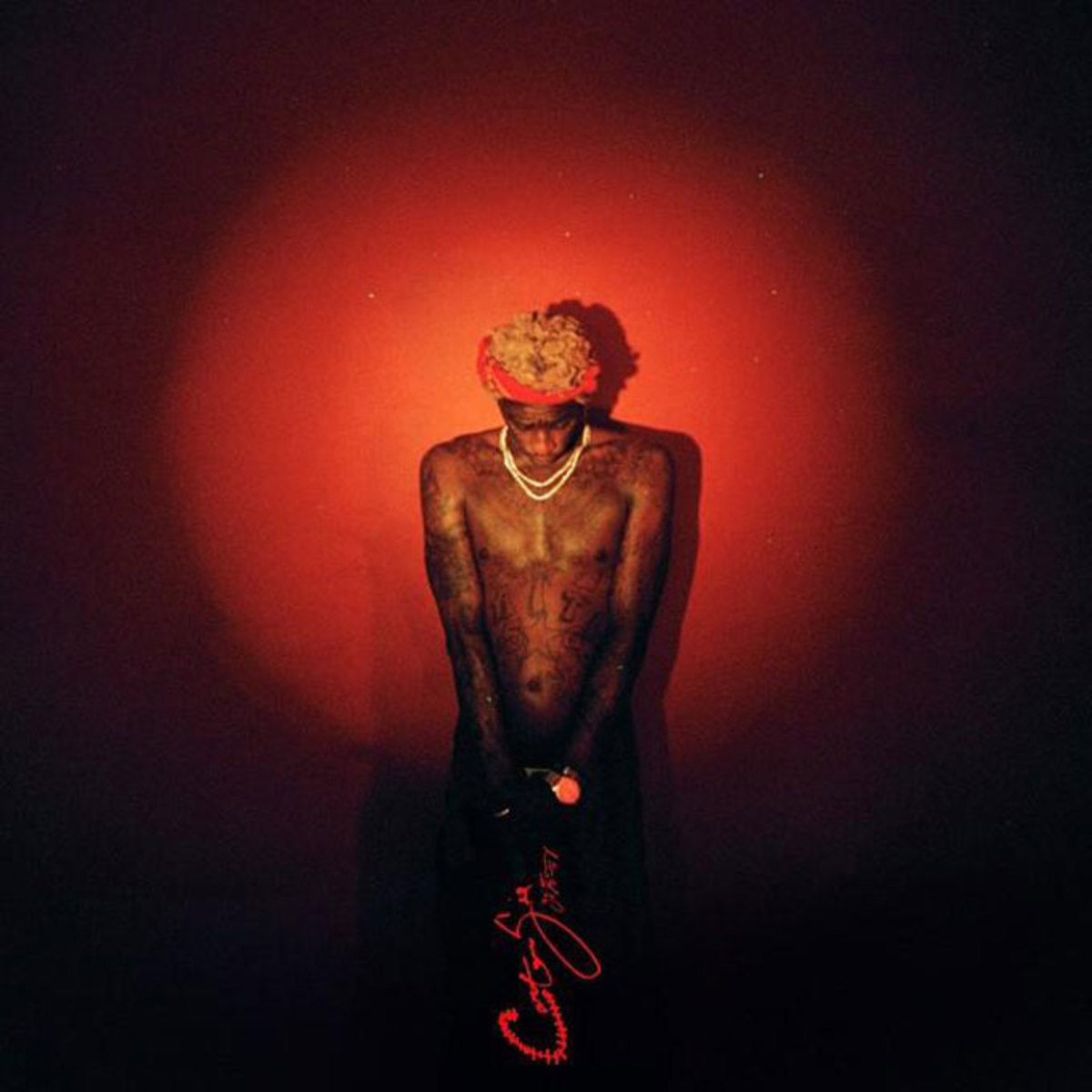

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Clues

May 09, 2025

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Clues

May 09, 2025

Latest Posts

-

The Imminent Arrival Of Young Thugs Back Outside Album

May 09, 2025

The Imminent Arrival Of Young Thugs Back Outside Album

May 09, 2025 -

Singer Summer Walker Shares Terrifying Birth Story

May 09, 2025

Singer Summer Walker Shares Terrifying Birth Story

May 09, 2025 -

Young Thug Reacts The Not Like U Name Drop And His Post Prison Interview

May 09, 2025

Young Thug Reacts The Not Like U Name Drop And His Post Prison Interview

May 09, 2025 -

Elon Musks Net Worth A Deep Dive Into His Business Ventures

May 09, 2025

Elon Musks Net Worth A Deep Dive Into His Business Ventures

May 09, 2025 -

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Clues

May 09, 2025

Is Young Thugs Back Outside Album Really Coming Soon A Look At The Clues

May 09, 2025