Rebalancing Canadian Ownership: Addressing U.S. Investment Dominance

Table of Contents

The Current State of Foreign Investment in Canada

U.S. Investment's Impact on Key Sectors

U.S. investment significantly shapes key Canadian sectors. The energy sector, for instance, sees substantial U.S. involvement in oil and gas extraction, refining, and distribution. Similarly, the technology sector witnesses significant U.S. acquisitions and influence over research and development. The natural resources sector, encompassing mining and forestry, also displays a notable U.S. presence.

- Examples: The acquisition of Canadian energy companies by U.S. giants like ExxonMobil and Chevron. The significant U.S. ownership in Canadian technology firms operating in artificial intelligence and software development.

- Market Share: Data indicating the percentage of market share held by U.S. firms in various sectors – energy, technology, natural resources – highlighting the level of dominance. (Specific data would be inserted here, sourced from reliable statistics Canada reports)

Economic Consequences of U.S. Investment Dominance

The economic consequences of U.S. investment dominance are multifaceted. While it undeniably creates jobs and brings capital into the country, it also raises concerns.

- Pros: Increased investment leads to job creation, technological advancements, and economic growth. Access to global markets and expertise.

- Cons: Potential loss of control over strategic assets, reduced Canadian economic sovereignty, vulnerability to external economic shocks, and potential capital flight if U.S. interests shift. Concerns over corporate tax avoidance strategies employed by foreign multinationals.

Comparison with Other Countries

Compared to other developed nations, Canada's level of foreign investment, particularly from the U.S., is relatively high. (Comparative data on foreign ownership in similar economies like Australia, the UK, or Germany would be included here, sourced from reputable international economic organizations).

- Statistics: Quantitative comparisons of foreign ownership percentages across different sectors in Canada and peer countries. This would illustrate Canada's relative position in terms of foreign investment.

Strategies for Rebalancing Canadian Ownership

Strengthening Canadian Investment Policies

Rebalancing Canadian ownership requires proactive policy changes. This includes creating incentives for domestic investment and implementing stricter regulatory oversight of foreign acquisitions.

- Policy Recommendations: Implementing tax credits for Canadian investors acquiring Canadian businesses. Introducing stricter review processes for foreign acquisitions in sensitive sectors, potentially including national security reviews. Creating a Canadian sovereign wealth fund to invest in strategically important domestic companies.

Promoting Canadian Entrepreneurship and Innovation

Supporting Canadian entrepreneurship and fostering innovation is crucial to reducing reliance on foreign investment.

- Government Initiatives: Increased funding for research and development in key sectors. Tax breaks and grants for Canadian startups and small businesses. Mentorship programs to support entrepreneurs. Streamlining business regulations to reduce bureaucratic hurdles.

Encouraging Pension Fund and Institutional Investment in Canadian Assets

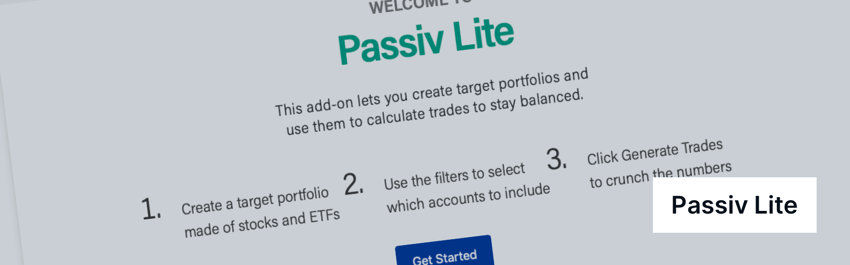

Redirecting domestic capital towards Canadian companies is vital. Pension funds and institutional investors hold significant assets that could be channeled into bolstering Canadian businesses.

- Incentives: Tax incentives for pension funds investing in Canadian equities. Government-backed investment programs to reduce risk and encourage participation. Public awareness campaigns highlighting the benefits of investing in Canadian companies.

The Role of Government and Regulatory Bodies

Review of Existing Regulatory Frameworks

Canada's current regulatory framework governing foreign investment needs thorough review. While regulations exist, their effectiveness in protecting Canadian interests requires evaluation.

- Analysis: Assessment of the Investment Canada Act and other relevant legislation. Identifying loopholes or weaknesses in the current regulatory framework.

Potential for Enhanced Regulatory Oversight

Strengthening regulatory oversight is crucial. More stringent regulations could protect Canadian interests and ensure fair competition.

- Regulatory Improvements: Increased transparency in foreign investment transactions. More robust review processes for foreign acquisitions, especially in strategic sectors. Increased penalties for violations of investment regulations.

International Cooperation and Trade Agreements

Trade agreements significantly influence foreign investment. Negotiations should prioritize safeguarding Canadian ownership.

- Trade Agreement Impact: Analysis of how existing trade agreements (e.g., CUSMA) affect foreign investment flows. Exploring avenues for renegotiating agreements to include stronger provisions protecting Canadian economic interests.

Conclusion: Rebalancing Canadian Ownership for a Stronger Future

Rebalancing Canadian ownership is not about rejecting foreign investment but about achieving a more balanced and sustainable economic landscape. This requires a multifaceted approach involving policy changes, support for domestic businesses, and strengthened regulatory oversight. Addressing the dominance of U.S. investment is crucial for safeguarding Canada's economic sovereignty and ensuring long-term prosperity. Learn more about how you can support policies that promote Canadian ownership and contribute to a stronger, more independent Canadian economy. Engage in the conversation and advocate for a future where Canadian businesses thrive and Canadian interests are paramount.

Featured Posts

-

Five Year Funding Plan Telus Bolsters Network Infrastructure

May 29, 2025

Five Year Funding Plan Telus Bolsters Network Infrastructure

May 29, 2025 -

Drive And Watch A Curated List Of Great Movies And Tv Shows

May 29, 2025

Drive And Watch A Curated List Of Great Movies And Tv Shows

May 29, 2025 -

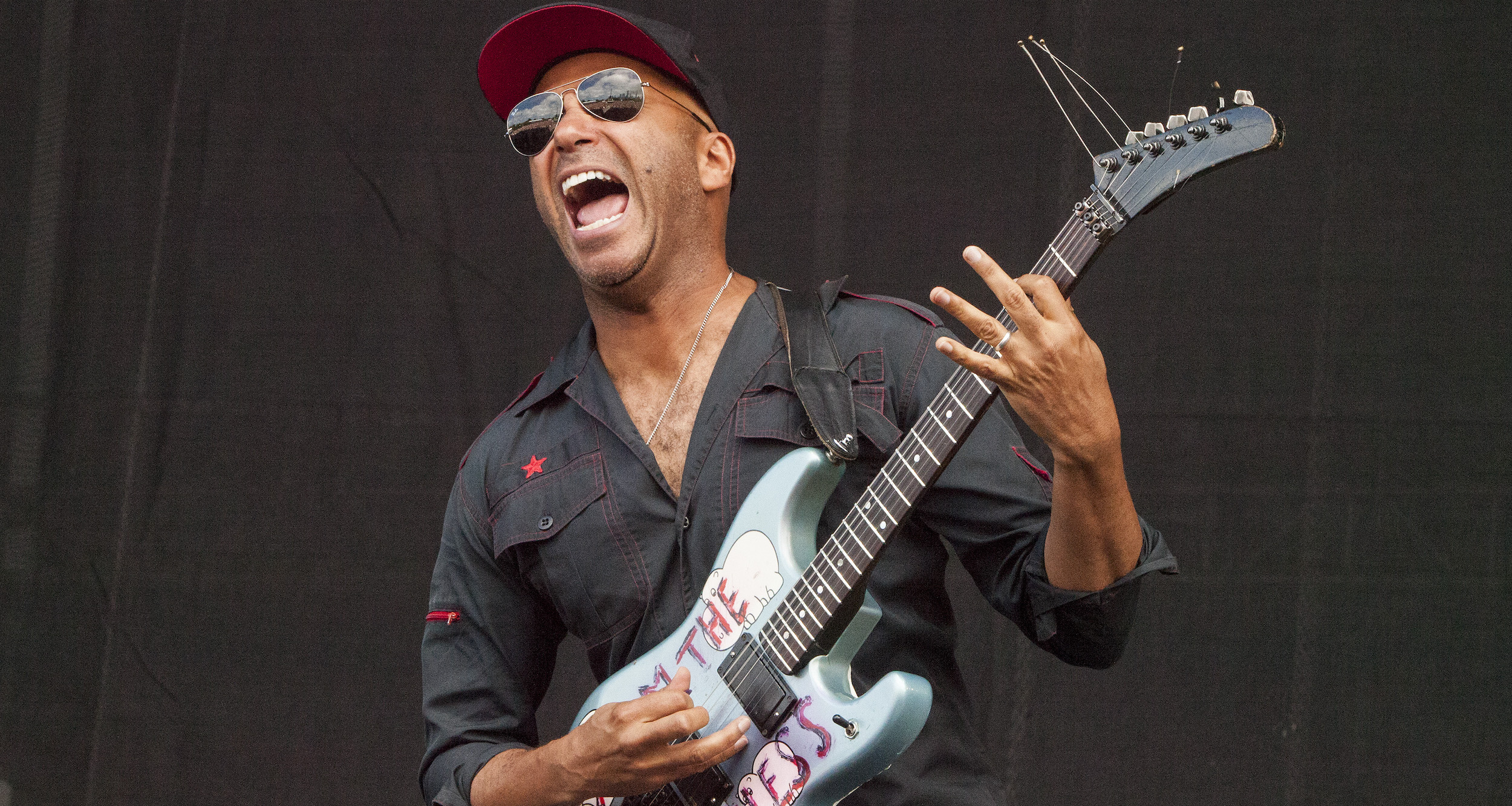

Rage Against The Machine O Morello Katakeraynonei Ton Tramp

May 29, 2025

Rage Against The Machine O Morello Katakeraynonei Ton Tramp

May 29, 2025 -

Pacers Vs Kings Latest Injury News Before March 31st Game

May 29, 2025

Pacers Vs Kings Latest Injury News Before March 31st Game

May 29, 2025 -

Hujan Di Jawa Tengah Peringatan Dini Cuaca 23 April

May 29, 2025

Hujan Di Jawa Tengah Peringatan Dini Cuaca 23 April

May 29, 2025