Real-time Stock Market Data: Dow, S&P 500, And Nasdaq (May 29)

Table of Contents

Understanding Real-time Data and its Benefits

Real-time data refers to information that is updated continuously, reflecting the current market conditions. This differs significantly from delayed data, which provides information with a time lag, often 15-20 minutes. The advantages of using real-time stock market data are substantial:

- Faster Response to Market Changes: Real-time data allows investors to react instantly to breaking news, price swings, and other market events, potentially minimizing losses or capitalizing on opportunities.

- Improved Accuracy of Analysis: Real-time information provides a more accurate picture of the current market situation, enabling more precise analysis and better-informed trading decisions.

- Potential for Higher Returns: Access to real-time data can increase the potential for higher returns, although it’s crucial to remember that trading involves inherent risks. Successful use requires skill, knowledge, and a well-defined strategy.

Several sources provide real-time stock market data, including:

- Financial News Websites: Many reputable financial news websites offer real-time quotes and market data, often with accompanying analysis.

- Brokerage Platforms: Most online brokerage platforms provide real-time data as part of their services, often integrated directly into their trading interfaces.

- Dedicated Data Providers: Specialized data providers offer comprehensive real-time data feeds, often used by institutional investors and high-frequency traders.

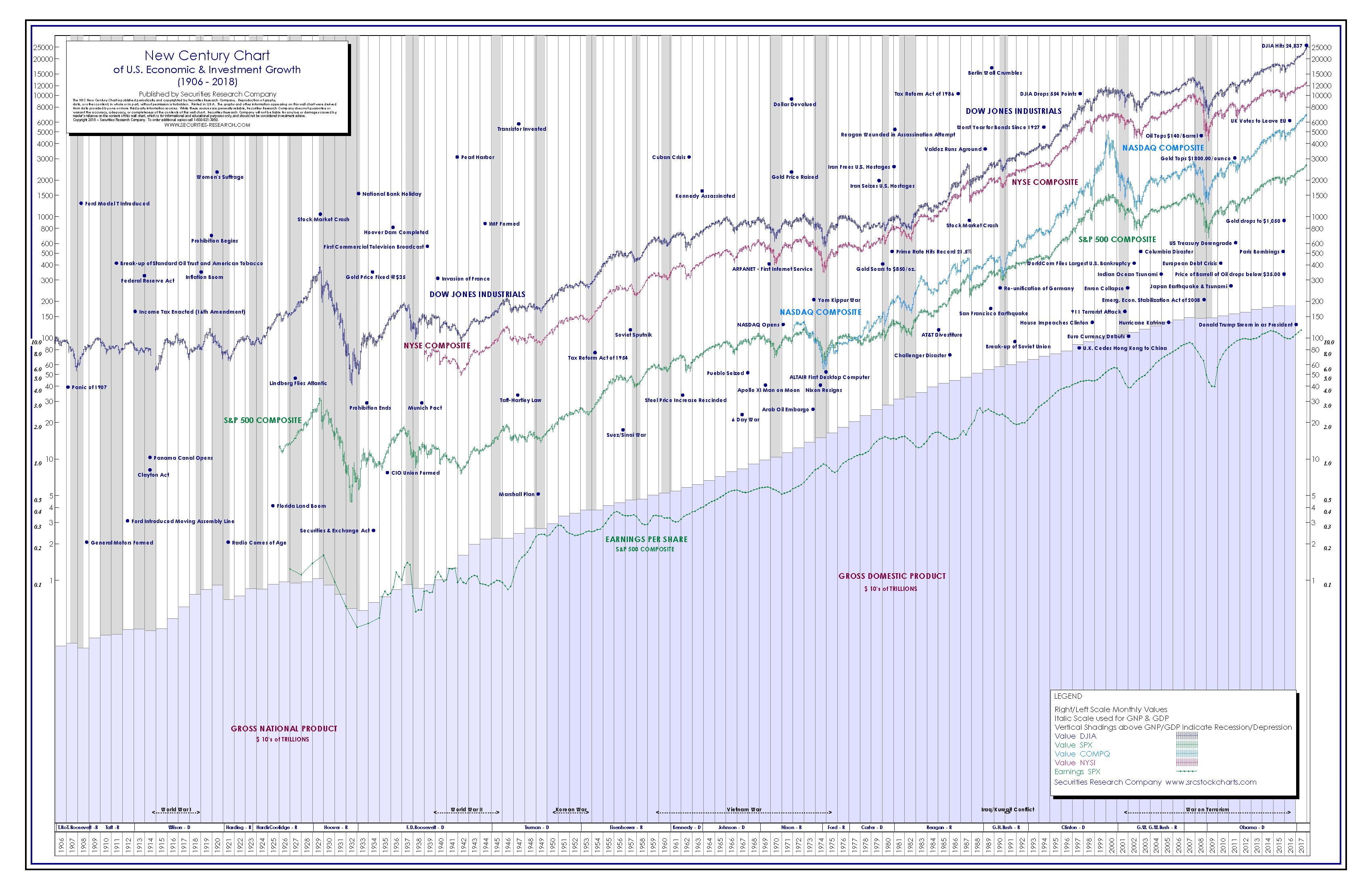

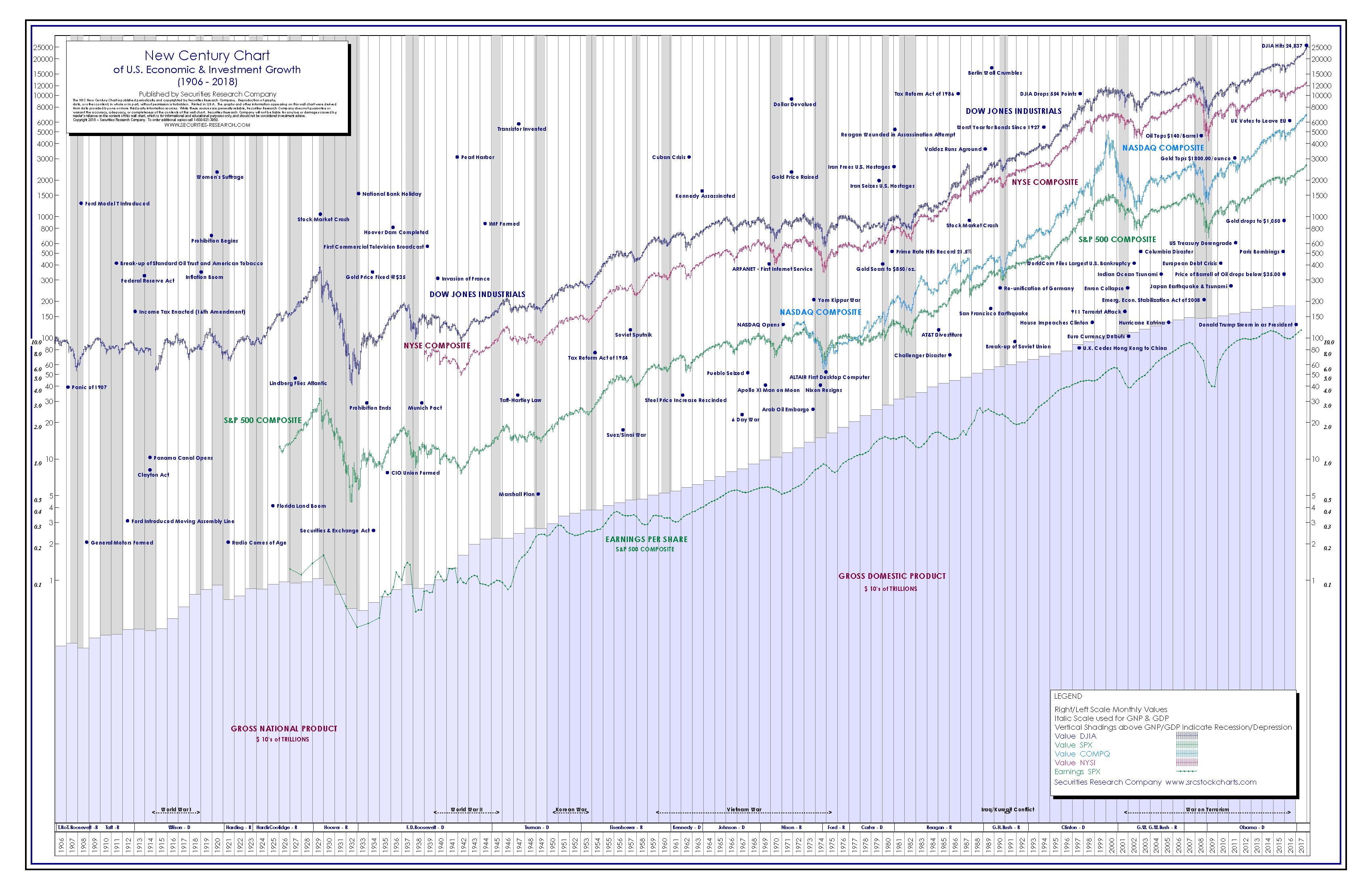

Analyzing the Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the Dow, is a price-weighted average of 30 large, publicly-owned companies in the US. It’s a widely followed indicator of the overall health of the US economy. Monitoring real-time Dow Jones data is vital for both:

- Day Trading: Day traders rely heavily on real-time Dow data to identify short-term price movements and execute trades within the same day.

- Long-Term Investment Strategies: Even long-term investors benefit from real-time Dow data to track the overall market trend and make adjustments to their portfolios as needed. Analyzing the Dow's reaction to significant news events, for example, can be crucial in long-term decision-making.

Deciphering the S&P 500 Index

The S&P 500 index represents a broader picture of the US stock market than the Dow, tracking 500 large-cap companies across various sectors. Real-time S&P 500 data offers significant insights into:

- Overall Market Sentiment: The S&P 500's performance often reflects the general sentiment of the market. Real-time data helps understand shifts in investor confidence and expectations.

- Market Trends: By analyzing real-time S&P 500 data, investors can identify emerging market trends, helping them to anticipate future price movements and position their portfolios accordingly.

Interpreting the Nasdaq Composite

The Nasdaq Composite is a technology-heavy index, tracking over 3,000 companies, predominantly in the technology sector. Real-time Nasdaq data is particularly important for:

- Investors Focused on Tech: Individuals interested in investing in technology stocks need real-time Nasdaq data to closely monitor the performance of their holdings and identify emerging opportunities within the tech sector.

- Understanding Tech Market Trends: The Nasdaq is highly sensitive to technological advancements and regulatory changes. Real-time data helps understand the impact of these factors on the tech market.

Utilizing Real-time Data for Effective Portfolio Management

Real-time stock market data is essential for effective portfolio management. It allows for:

- Dynamic Portfolio Adjustments: Investors can make quick adjustments to their portfolio based on real-time market movements, helping to manage risk and capitalize on opportunities.

- Risk Mitigation: By monitoring real-time data, investors can identify potential risks and take steps to mitigate them, such as diversifying their portfolio or adjusting their position sizes.

- Return Maximization: Informed decisions based on real-time data increase the potential for higher returns by allowing investors to act swiftly and strategically. Diversification across different asset classes, as guided by real-time data analysis, forms an integral part of this strategy.

Conclusion: Leveraging Real-time Stock Market Data for Success

Accessing reliable real-time stock market data, encompassing the Dow, S&P 500, and Nasdaq, provides a significant advantage for investors. Informed decision-making, driven by accurate and timely information, is key to successful investing. Stay ahead of the market by consistently monitoring real-time stock market data from reputable sources. Gain insights into the Dow, S&P 500, and Nasdaq to optimize your investment strategy.

Featured Posts

-

Acabara Trump Con La Reventa De Boletos De Ticketmaster Analisis De Su Orden Ejecutiva

May 30, 2025

Acabara Trump Con La Reventa De Boletos De Ticketmaster Analisis De Su Orden Ejecutiva

May 30, 2025 -

Sncf Greve Reactions A La Contestation Des Revendications Syndicales

May 30, 2025

Sncf Greve Reactions A La Contestation Des Revendications Syndicales

May 30, 2025 -

Augsburg Bayern Muenih Maci Canli Izleme Rehberi

May 30, 2025

Augsburg Bayern Muenih Maci Canli Izleme Rehberi

May 30, 2025 -

Droits De Douane Votre Guide Pas A Pas

May 30, 2025

Droits De Douane Votre Guide Pas A Pas

May 30, 2025 -

Municipales A Metz 2026 Jacobelli Dans La Course

May 30, 2025

Municipales A Metz 2026 Jacobelli Dans La Course

May 30, 2025