Real Estate Market Crash: Home Sales Plummet To Crisis Levels

Table of Contents

Plummeting Home Sales: A Key Indicator of a Market Crash

The sharp decrease in home sales is a primary indicator of a potential housing market crash. Data from the National Association of Realtors (NAR) – and other relevant regional sources – reveals a consistent downward trend.

-

Data & Statistics: [Insert relevant charts and graphs showing the decline in home sales nationally and regionally. For example: "Nationally, existing home sales fell by 20% in Q3 2023 compared to Q3 2022. In specific regions like [Region A], the decline was even steeper, reaching [Percentage]".] These housing market crash statistics paint a concerning picture of a rapidly cooling market.

-

Inventory Levels: The number of unsold homes on the market is also a critical factor. Increased housing inventory, signifying a surplus of properties compared to buyer demand, directly contributes to price drops. [Insert data on inventory levels. For example: "The national housing inventory currently stands at X months' supply, significantly higher than the typical Y months' supply considered a balanced market."]. This increased market supply indicates a buyer's market, where buyers hold more leverage in negotiations.

-

Days on Market (DOM): The average time homes are staying on the market has substantially increased. [Insert data showing the increase in DOM. For example: "The average days on market has risen from Z days in Q3 2022 to X days in Q3 2023"]. This prolonged selling time reflects weakened demand and signals a potential real estate downturn.

Rising Interest Rates Fueling the Real Estate Market Crisis

The Federal Reserve's aggressive interest rate hikes have significantly impacted the real estate market, making homeownership less accessible for many.

-

Impact of Interest Rate Hikes: Increased mortgage rates directly translate to higher borrowing costs for potential homebuyers. A modest increase in interest rates can dramatically increase monthly mortgage payments, pushing homes out of reach for many potential buyers. [Include data on interest rate increases and their impact on monthly payments for an average-priced home].

-

Affordability Crisis: The combination of rising interest rates and persistently high home prices has created a severe housing affordability crisis. This reduced buyer affordability limits the pool of potential buyers, thereby slowing down sales.

-

Impact on Mortgage Lending: The mortgage industry is also feeling the effects. Mortgage applications have declined, and lenders are implementing stricter lending criteria, making it harder for people to qualify for loans. This reduced access to credit further dampens demand.

Economic Headwinds Exacerbating the Real Estate Market Crash

The current economic climate, characterized by inflation and recessionary fears, is further fueling the real estate market crisis.

-

Inflation and Recessionary Fears: High inflation erodes purchasing power, impacting consumer confidence and reducing discretionary spending on big-ticket items like homes. The fear of a recession adds to the uncertainty, making potential buyers hesitant to commit to significant financial obligations.

-

Job Market Uncertainty: Job losses or fears of job losses significantly impact buyer confidence. Uncertainty about future income makes many potential buyers postpone their home-buying plans, reducing demand even further.

-

Geopolitical Factors: Global events, such as ongoing conflicts and supply chain disruptions, introduce additional uncertainty into the market and can influence economic conditions, potentially worsening the real estate downturn.

What Does the Future Hold for the Real Estate Market?

Predicting the future of the real estate market is challenging, but analyzing expert opinions and potential scenarios can shed some light.

-

Expert Opinions: [Include quotes from real estate experts and economists, citing their sources. For example: "According to Dr. X, Chief Economist at [Institution], 'We anticipate a period of market correction, but a full-blown crash is unlikely.'"].

-

Potential Scenarios: Several scenarios are possible, ranging from a soft landing with a gradual market correction to a more prolonged downturn or a severe market crash. The eventual outcome will depend on various factors, including the trajectory of interest rates, inflation, and overall economic growth.

-

Advice for Buyers and Sellers: For buyers, this could be an opportune time to negotiate favorable prices, but careful consideration of affordability and long-term financial stability is paramount. For sellers, realistic pricing strategies and patience are essential.

Conclusion: Navigating the Real Estate Market Crash – A Call to Action

The confluence of plummeting home sales, rising interest rates, and a challenging economic climate paints a concerning picture for the real estate market. The potential for a significant real estate market crash is undeniable, though the severity and duration remain uncertain. Understanding these factors and their potential impact is crucial for making informed decisions. Stay informed about the current real estate market crash and consult with a real estate professional before making any major decisions regarding buying or selling a home. Navigating this complex landscape requires careful planning and expert guidance to mitigate risks and seize potential opportunities.

Canelo Vs Ggg Start Time Full Ppv Fight Card And More

Canelo Vs Ggg Start Time Full Ppv Fight Card And More

Seattle Rain Weekend Outlook And Forecast

Seattle Rain Weekend Outlook And Forecast

Provincial Power Unlocking Faster Homebuilding Through Policy Reform

Provincial Power Unlocking Faster Homebuilding Through Policy Reform

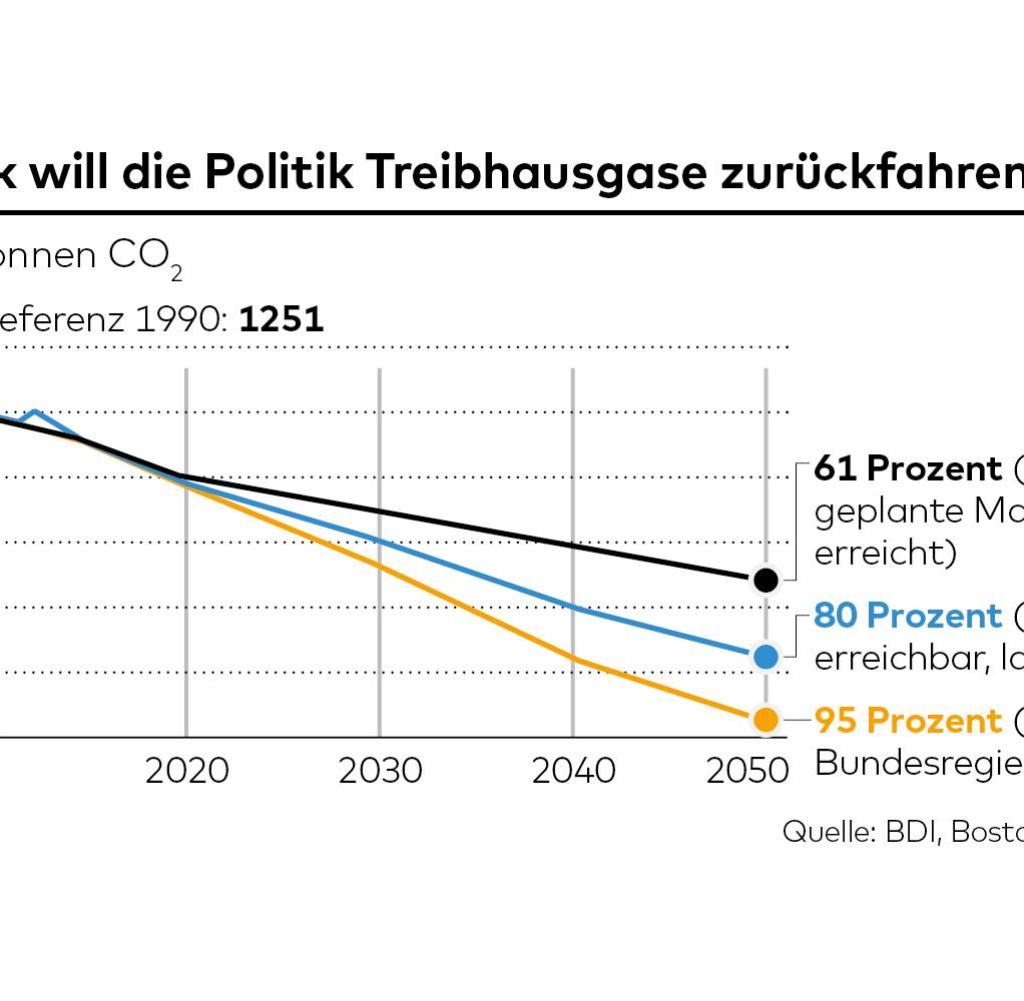

Der Bodensee In 20 000 Jahren Ist Klimaschutz Dann Noch Noetig

Der Bodensee In 20 000 Jahren Ist Klimaschutz Dann Noch Noetig

A Public Health Threat Drug Addicted Rats In Houston

A Public Health Threat Drug Addicted Rats In Houston