Real Estate In Crisis: Low Home Sales Signal Market Downturn

Table of Contents

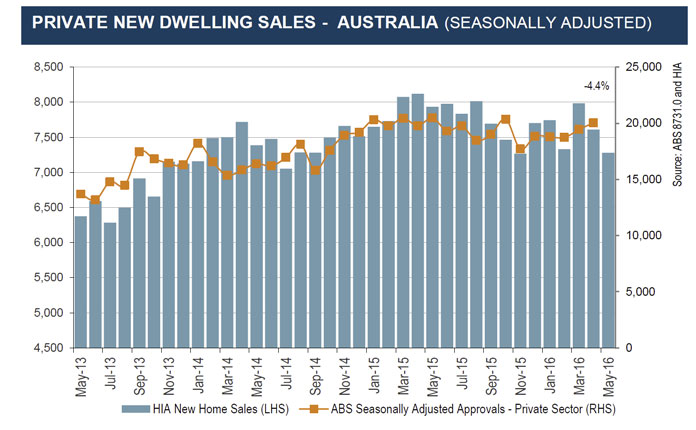

Declining Home Sales: A Key Indicator of Market Instability

Low sales volume is a critical barometer of market health. When fewer homes are changing hands, it indicates underlying instability. The correlation between low sales and market distress is undeniable. We're seeing this manifested in several ways:

- Increased Days on Market (DOM): Properties are staying on the market significantly longer than in previous years, indicating reduced buyer demand.

- Price Reductions Becoming More Common: Sellers are increasingly forced to lower their asking prices to attract buyers in this competitive landscape.

- Reduced Buyer Activity: Fewer potential buyers are actively searching for properties, leading to a slowdown in transactions.

- Shifting Buyer and Seller Expectations: Both buyers and sellers must adjust their expectations to the realities of a slowing market. Buyers need to be prepared for negotiation, and sellers need to price realistically.

According to the National Association of Realtors (NAR), the median sales price has decreased, and the inventory of unsold homes is rising. These figures, coupled with increased Days on Market (DOM) reported by Zillow, paint a clear picture of a weakening market. High interest rates, rampant inflation, and persistent economic uncertainty are major contributing factors to this decline.

Impact of High Interest Rates on Affordability

Rising interest rates are significantly impacting home affordability. Higher rates translate to more expensive mortgages, effectively reducing buyer purchasing power. This has several consequences:

- Impact on Monthly Mortgage Payments: Even a small increase in interest rates can dramatically increase monthly mortgage payments, pricing many potential buyers out of the market.

- Reduced Borrowing Capacity: With higher rates, lenders approve smaller loan amounts, further limiting buyer purchasing power.

- Impact on First-Time Homebuyers: First-time homebuyers, often relying on smaller down payments, are particularly vulnerable to higher interest rates.

- Increase in Rental Market Demand: As homeownership becomes less accessible, demand in the rental market increases, potentially driving up rental costs.

For example, a 2% increase in interest rates on a $300,000 mortgage could add hundreds of dollars to the monthly payment, making a significant difference in affordability for many families.

Increased Inventory and Oversupply Concerns

The combination of low sales and new construction continues to fuel an increasing inventory of unsold properties. This oversupply has several significant implications:

- Implications of Oversupply on Property Values: A surplus of homes on the market puts downward pressure on property values, potentially leading to price corrections or decreases.

- Potential for Price Corrections or Decreases: As inventory rises, sellers may need to reduce their asking prices to compete, resulting in price declines.

- Geographic Variations in Inventory Levels: The impact of oversupply varies geographically, with some markets experiencing more significant increases in inventory than others.

- Impact on New Construction Projects: Builders may slow or halt new construction projects due to reduced demand and concerns about unsold inventory.

Regional data from various real estate portals shows a significant increase in inventory in several major metropolitan areas, further confirming the oversupply concerns.

Economic Uncertainty and its Role in the Real Estate Crisis

Economic uncertainty plays a pivotal role in shaping buyer confidence and purchasing decisions. Factors such as inflation, recessionary fears, and geopolitical instability significantly impact the real estate market:

- Impact of Inflation on Consumer Spending: High inflation reduces disposable income, limiting consumers' ability to afford homes and impacting overall demand.

- Concerns about Job Security and Income Stability: Economic uncertainty leads to concerns about job security and income stability, making people hesitant to commit to large financial obligations like mortgages.

- Effects of Global Economic Events on the Real Estate Market: Global economic events, such as wars or international crises, can influence investor sentiment and market stability.

- Investor Sentiment and Market Volatility: Negative economic news can trigger a sell-off in the real estate market, leading to increased volatility and price fluctuations.

The psychological impact of economic uncertainty is substantial. Fear and uncertainty can cause potential buyers to delay purchases, exacerbating the real estate crisis.

Navigating the Real Estate Crisis: Strategies for the Future

Low sales, high interest rates, increased inventory, and pervasive economic uncertainty all contribute to the current real estate crisis. The significance of low home sales as a leading indicator cannot be overstated. However, there are strategies for both buyers and sellers to navigate this challenging market:

For Buyers:

- Consider adjustable-rate mortgages (ARMs), which offer lower initial interest rates.

- Look for deals in less competitive markets.

- Be prepared to negotiate aggressively.

For Sellers:

- Price your property competitively.

- Stage your home effectively.

- Consider offering concessions to attract buyers.

Understanding the real estate market downturn and seeking professional advice is crucial for effectively managing your real estate investments during this period of real estate crisis. Stay informed, adapt your strategies, and seek guidance from experienced real estate professionals to navigate this complex market successfully.

Norries Upset Of Medvedev Djokovics Smooth French Open Win

Norries Upset Of Medvedev Djokovics Smooth French Open Win

Laurent Jacobelli Et Arcelor Mittal Focus Sur La Russie Le 9 Mai 2025

Laurent Jacobelli Et Arcelor Mittal Focus Sur La Russie Le 9 Mai 2025

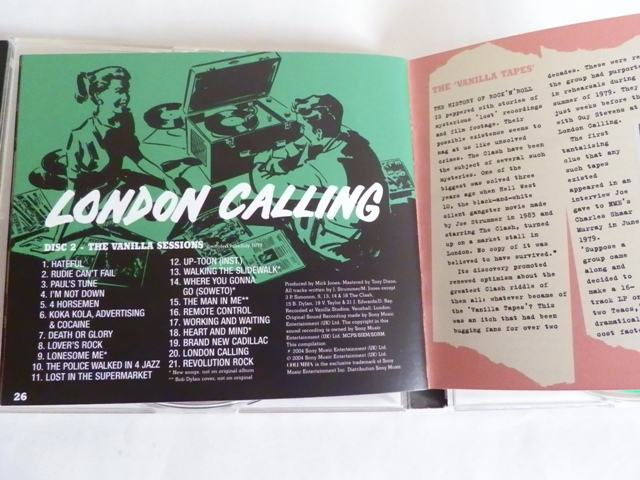

London Calling Gorillazs 25th Anniversary Gigs And Exhibition

London Calling Gorillazs 25th Anniversary Gigs And Exhibition

Wet And Windy Weather Expected San Diego County Forecast

Wet And Windy Weather Expected San Diego County Forecast

Longorias Retirement End Of An Era For The Tampa Bay Rays

Longorias Retirement End Of An Era For The Tampa Bay Rays