RBC Earnings Miss Estimates Amidst Rising Loan Concerns

Table of Contents

RBC's Q[Quarter] Earnings Report: A Detailed Breakdown

RBC's recent earnings report painted a concerning picture, falling short of projected figures in several key areas. This section provides a detailed breakdown of the financial metrics and explores the underlying factors contributing to the disappointing results.

Key Financial Metrics: A Disappointing Performance

- Net Income: RBC's net income for Q[Quarter] was [Insert Actual Net Income Figure], significantly lower than the anticipated [Insert Analyst Expectation Figure] and representing a [Percentage Change]% decrease compared to the same quarter last year. This reflects a considerable drop in profitability.

- Revenue Growth: Revenue growth was reported at [Insert Actual Revenue Growth Figure]%, falling short of the predicted [Insert Analyst Expectation Figure]% and indicating slower-than-expected business activity.

- Profit Margin: The profit margin experienced a notable decline, reaching [Insert Actual Profit Margin Figure]%, compared to [Insert Previous Quarter/Year Figure]% and the projected [Insert Analyst Expectation Figure]%.

- Return on Equity (ROE): ROE, a key measure of profitability, dropped to [Insert Actual ROE Figure]%, a significant decrease from [Insert Previous Quarter/Year Figure]%, further highlighting the financial challenges faced by the bank.

These figures clearly indicate that RBC's performance fell considerably short of expectations across several key metrics, sparking concerns among investors.

Reasons for the Earnings Miss: Unpacking the Challenges

Several factors contributed to RBC's disappointing earnings. These include:

- Increased Loan Losses: A notable increase in non-performing loans was reported, driven by a combination of factors including the economic slowdown, rising interest rates, and struggles within specific sectors like commercial real estate. This resulted in a higher-than-anticipated provision for credit losses.

- Higher Operating Expenses: Increased operational costs, possibly due to investments in technology, regulatory compliance, or increased staffing, also played a role in squeezing profit margins.

- Impact of Market Volatility: The fluctuating interest rate environment and broader market volatility significantly impacted RBC's trading activities and investment portfolios, contributing to reduced profitability.

- Provision for Credit Losses: RBC had to significantly increase its provision for credit losses, a substantial charge directly impacting net income and reflecting concerns about the increasing risk of loan defaults.

Rising Loan Concerns in the Canadian Banking Sector

The issues facing RBC are not isolated incidents; they reflect broader concerns within the Canadian banking sector regarding rising loan defaults.

Macroeconomic Factors: A Storm Brewing

Several macroeconomic factors are contributing to the increased risk of loan defaults across the Canadian banking sector:

- Interest Rate Hikes: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have significantly increased borrowing costs for consumers and businesses, making it harder for many to repay their loans.

- Inflationary Pressures: Persistent inflationary pressures erode purchasing power, impacting borrowers' ability to manage debt repayments.

- Economic Slowdown: Concerns of an impending economic recession further exacerbate the situation, increasing the likelihood of defaults across various loan categories.

- Credit Risk: The overall credit risk within the Canadian economy has increased significantly, leading to heightened caution among lenders and increased provisions for potential losses.

Specific Industry Risks: Vulnerable Sectors

Certain sectors are particularly vulnerable to loan defaults:

- Real Estate: The housing market slowdown, combined with higher interest rates, poses a significant risk to mortgages and real estate-related loans.

- Commercial Lending: Businesses facing economic headwinds are at increased risk of defaulting on their commercial loans.

- Consumer Credit: High levels of household debt, coupled with rising interest rates, put pressure on consumer credit repayment abilities.

Regulatory Response: Preparing for the Storm

Regulators are likely to increase scrutiny on lending practices and capital requirements for banks to mitigate the increasing risk of loan defaults. We can expect a more cautious approach to lending and potentially stricter regulatory oversight in the coming months.

Investor Reaction and Future Outlook for RBC

The release of RBC's disappointing earnings report had a significant impact on investor sentiment and the bank's share price.

Stock Price Performance: Immediate Market Reaction

RBC's stock price experienced a [Percentage Change]% drop following the release of the earnings report, reflecting investor concerns about the bank's future performance and the wider economic climate. Market capitalization also took a hit, indicating a loss of investor confidence.

Analyst Predictions: Divided Opinions

Financial analysts offer a mixed outlook for RBC's future performance. While some remain optimistic about the bank's long-term prospects and its ability to navigate the challenges, others express caution, pointing to the potential for further loan losses and economic uncertainty.

Management's Response: Addressing the Challenges

RBC's management has acknowledged the challenges and outlined plans to address the increased loan losses and navigate the difficult economic climate. Their strategy involves [Summarize RBC's stated response here, including cost-cutting measures, changes to lending policies etc.].

Conclusion: RBC Earnings Miss Estimates Amidst Rising Loan Concerns – What's Next?

RBC's disappointing Q[Quarter] earnings, significantly below expectations, highlight the growing concerns surrounding rising loan defaults within the Canadian banking sector. Macroeconomic factors, including interest rate hikes, inflation, and an impending economic slowdown, are increasing the risk of defaults across various loan categories, particularly within the real estate and commercial lending sectors. The impact on RBC's stock price and investor sentiment underscores the seriousness of the situation. The uncertainty surrounding future economic conditions and their impact on the Canadian banking sector remains a key concern.

To stay informed about future developments related to RBC earnings, the Canadian banking sector, and loan defaults, subscribe to our updates, follow reputable financial news sources, and consider seeking professional financial advice. Understanding the ongoing evolution of this situation is crucial for investors and anyone interested in the Canadian economy.

Featured Posts

-

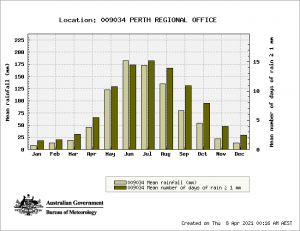

Aprils Rainfall A Month By Month Comparison

May 31, 2025

Aprils Rainfall A Month By Month Comparison

May 31, 2025 -

Nyt Mini Crossword March 30 2025 Complete Answers And Clues

May 31, 2025

Nyt Mini Crossword March 30 2025 Complete Answers And Clues

May 31, 2025 -

Spain Blackout Iberdrola Blames Grid Blame Game Intensifies

May 31, 2025

Spain Blackout Iberdrola Blames Grid Blame Game Intensifies

May 31, 2025 -

Braintree And Witham Times Kelvedon Resident Sentenced For Animal Pornography

May 31, 2025

Braintree And Witham Times Kelvedon Resident Sentenced For Animal Pornography

May 31, 2025 -

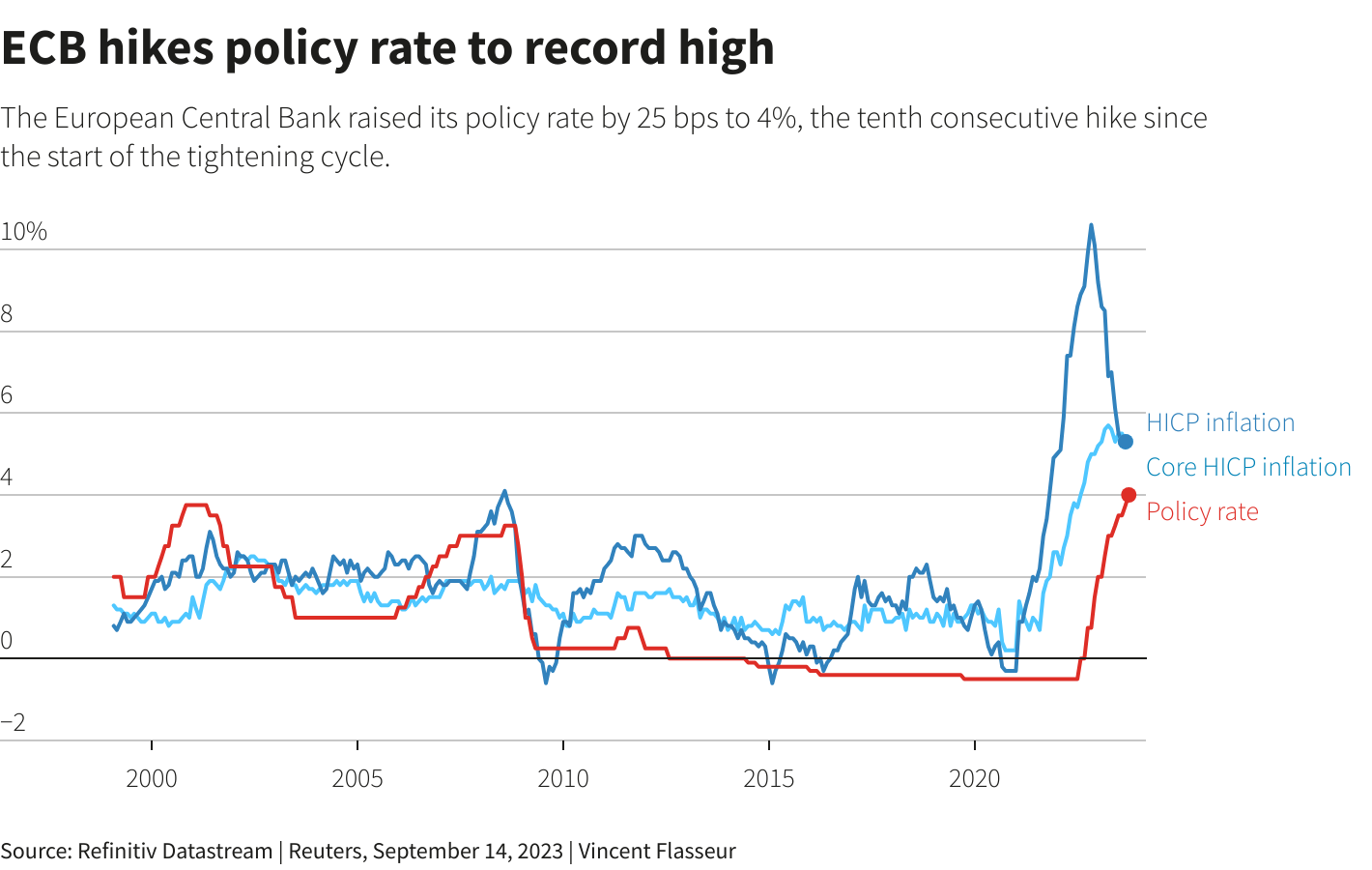

Spanish Inflation Slowdown Exceeds Forecasts Hints At Ecb Rate Reduction

May 31, 2025

Spanish Inflation Slowdown Exceeds Forecasts Hints At Ecb Rate Reduction

May 31, 2025