PwC's Strategic Retreat: Country Exits And The Fallout

Table of Contents

Reasons Behind PwC's Country Exits

PwC's decisions to exit certain countries are multifaceted and stem from a confluence of factors. Understanding these reasons is crucial to grasping the full implications of this strategic shift.

Regulatory Scrutiny and Compliance Costs

Increased regulatory scrutiny and the associated compliance costs are significant drivers behind PwC's strategic retreat. Many jurisdictions are implementing stricter regulations and enforcement measures, leading to substantially higher operational burdens for professional services firms.

- Increased compliance costs: The cost of adhering to ever-evolving regulations, including those related to data privacy, anti-money laundering, and tax compliance, has become increasingly prohibitive in some markets.

- Stringent regulations and stricter enforcement: Heavier penalties for non-compliance and increased audit scrutiny have raised the stakes significantly, impacting profitability.

- Examples: Specific countries with particularly challenging regulatory environments might include those with newly implemented data privacy laws (e.g., GDPR-like regulations) or stricter financial reporting requirements. These regulations can impose significant financial and operational strains on firms like PwC.

- Financial Implications:

- Increased audit fees and legal expenses

- Investment in new compliance technologies and personnel

- Potential fines and penalties for non-compliance

Market Volatility and Economic Downturns

Economic downturns and market volatility play a crucial role in PwC's strategic decisions. Periods of economic instability often lead to reduced demand for professional services, making certain markets less attractive.

- Impact of economic slowdowns: Regions experiencing prolonged economic recession or significant market contraction see a drop in demand for consulting, auditing, and tax services.

- Decreased demand: Companies facing financial difficulties often cut back on non-essential expenses, including professional services fees.

- Market trends and forecasts: PwC likely bases its exit strategies on thorough market analysis, including long-term economic forecasts and projections for industry growth.

- Correlation between economic indicators and country exits: A correlation can be observed between negative economic indicators (e.g., declining GDP, rising unemployment) and PwC's decision to exit certain markets.

Strategic Realignment and Focus on Core Markets

PwC's strategic retreat also reflects a broader effort to realign its resources and focus on core markets offering higher growth potential and profitability.

- Consolidation in high-growth markets: PwC is likely concentrating its efforts in regions experiencing robust economic growth and a strong demand for professional services.

- Service diversification and specialization: The firm may be streamlining its operations, focusing on niche areas where it possesses a competitive advantage.

- Strengthening presence in core markets: Instead of spreading resources thinly across numerous markets, PwC may be investing more heavily in key regions to maintain its market leadership.

- Strategic shift towards core competencies:

- Investing in technology and digital services

- Focusing on high-value consulting engagements

- Developing specialized expertise in emerging industries

The Fallout from PwC's Strategic Retreat

PwC's strategic decisions have significant ramifications for its reputation, clients, employees, and the broader accounting industry.

Impact on PwC's Reputation and Brand Image

Country exits can impact PwC's brand image and stakeholder perception. The perception of abandonment or lack of commitment might damage trust and credibility.

- Client and stakeholder perception: Clients and other stakeholders might interpret these exits negatively, questioning the firm's long-term commitment and stability.

- Damage to brand trust: A perception of instability could lead to loss of client confidence and difficulty attracting new clients.

- Public relations strategies: PwC is likely employing proactive PR strategies to manage the narrative surrounding its country exits and mitigate any negative impact.

- Long-term reputational risks: The long-term consequences of these decisions on PwC's reputation will depend on how effectively the firm manages communication and addresses stakeholder concerns.

Implications for Clients and Employees in Affected Countries

Clients in exiting countries face the challenge of finding alternative service providers, while employees face job security concerns.

- Challenges for clients: The transition to new service providers can be disruptive and costly for clients, requiring significant effort and resources.

- Support and transition plans: PwC's commitment to providing support and smooth transition plans for affected clients will be critical in mitigating negative impact.

- Job security concerns for employees: Employees in the affected countries face uncertainty regarding their future employment, requiring robust support and outplacement services from PwC.

- Support for impacted employees: PwC should provide comprehensive support, including outplacement services, job search assistance, and severance packages.

Broader Implications for the Global Accounting Industry

PwC's strategic retreat could trigger a domino effect within the global accounting industry.

- Potential domino effect: Other large accounting firms might follow suit, leading to increased industry consolidation and changes in market dynamics.

- Shifting dynamics: The competitive landscape of the global professional services market is likely to undergo significant restructuring.

- Long-term trends and predictions: PwC's actions highlight ongoing trends in the industry, such as increased regulatory burden, market volatility, and the need for strategic adaptation.

- Impact on industry competition and consolidation: The industry could see increased mergers and acquisitions, as firms seek to strengthen their market positions and optimize their resources.

Conclusion: Navigating PwC's Strategic Retreat and its Lasting Consequences

PwC's strategic retreat, characterized by country exits, is a complex issue driven by a combination of regulatory pressures, market volatility, and a strategic realignment focused on core markets. The consequences are far-reaching, impacting the firm's reputation, its clients, employees, and the global accounting landscape. Understanding "PwC's Strategic Retreat" is critical for all stakeholders. For further insights into the evolving landscape of the global accounting industry and the implications of PwC's strategic decisions, continue your research and stay informed about future developments related to PwC's Strategic Retreat and similar corporate restructuring initiatives.

Featured Posts

-

Jeff And Emilie Goldblums Sons Attend Football Match In Italy

Apr 29, 2025

Jeff And Emilie Goldblums Sons Attend Football Match In Italy

Apr 29, 2025 -

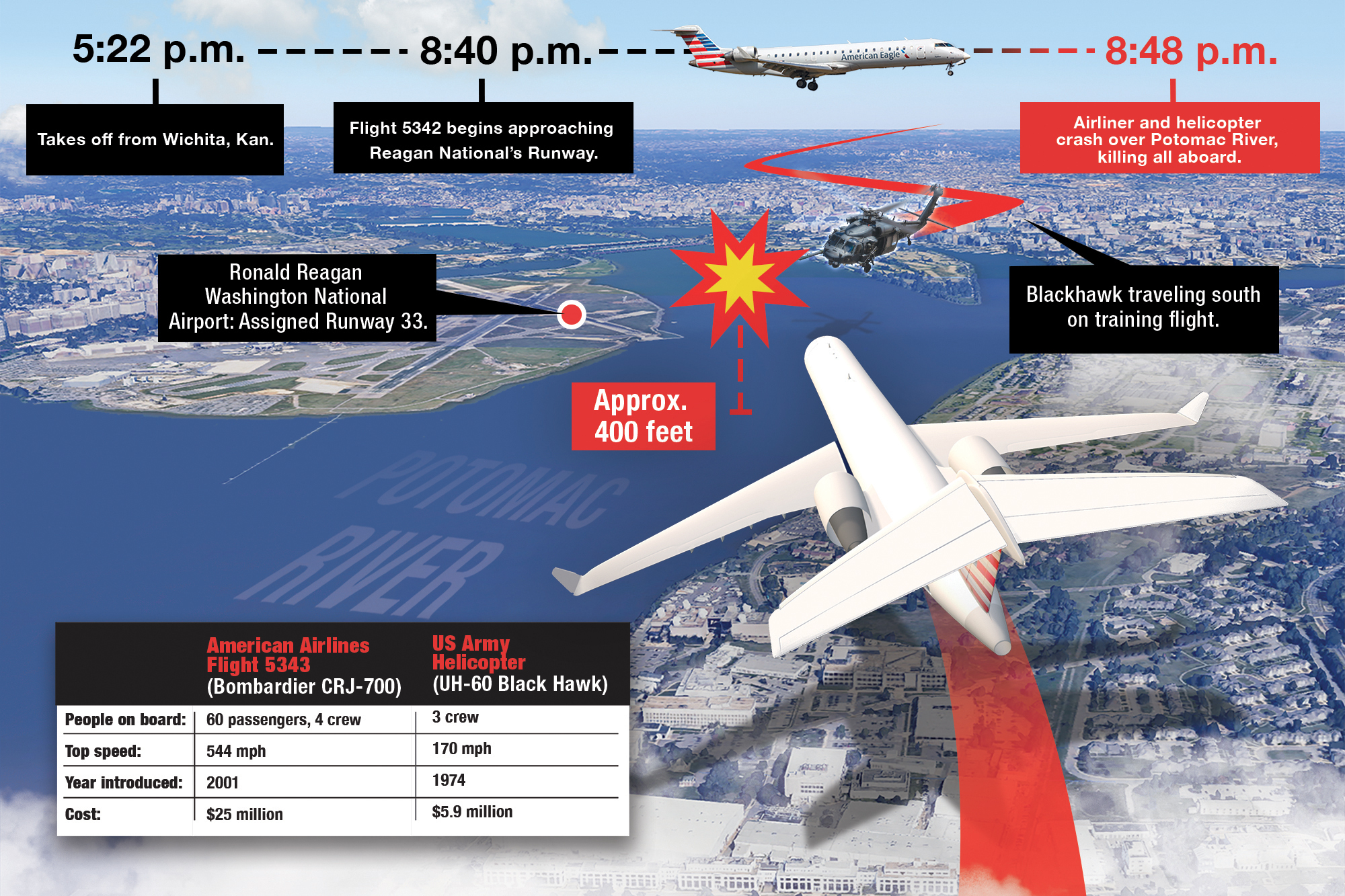

Black Hawk Pilots Actions Before Fatal D C Crash A Detailed Account

Apr 29, 2025

Black Hawk Pilots Actions Before Fatal D C Crash A Detailed Account

Apr 29, 2025 -

Ai Browser Wars An Interview With Perplexitys Ceo

Apr 29, 2025

Ai Browser Wars An Interview With Perplexitys Ceo

Apr 29, 2025 -

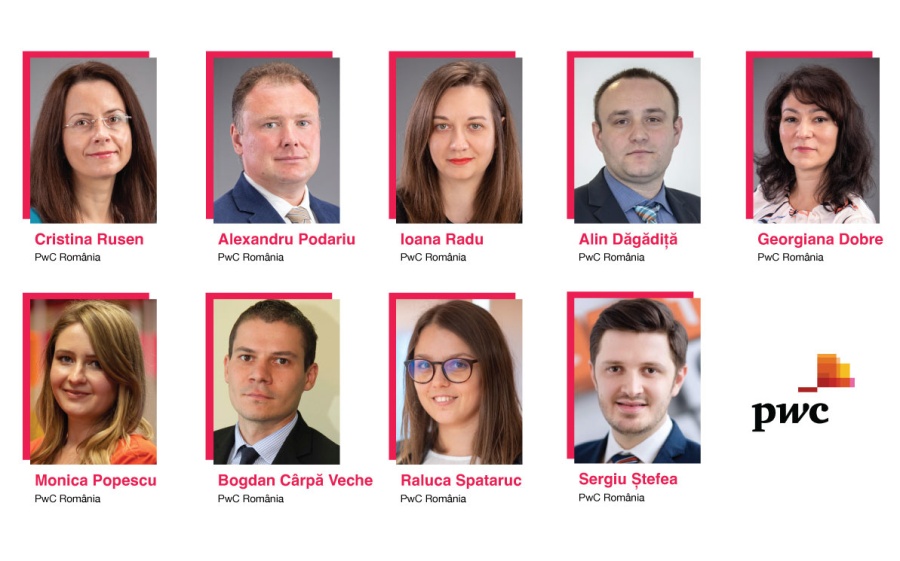

Conferinta Pw C Romania Actualizari Fiscale Pentru 2025

Apr 29, 2025

Conferinta Pw C Romania Actualizari Fiscale Pentru 2025

Apr 29, 2025 -

Mlb Considering Petition To Reinstate Pete Rose A Report

Apr 29, 2025

Mlb Considering Petition To Reinstate Pete Rose A Report

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni