PwC's African Pullback: A Detailed Look At Senegal, Gabon, Madagascar, And Beyond

Table of Contents

The Senegal Situation: A Case Study of PwC's Withdrawal

PwC's decision to reduce its footprint in Senegal offers a compelling case study for understanding the complexities driving this broader African retreat.

Reasons behind the Senegal Pullback

Several interconnected factors contributed to PwC's decision in Senegal. These include:

- Economic Slowdown: Senegal, while experiencing growth, has faced economic headwinds in recent years impacting the demand for professional services. A decline in foreign direct investment and overall economic uncertainty likely influenced PwC's assessment of the market.

- Increased Competition: The Senegalese auditing and consulting market has become increasingly competitive, with both local and international firms vying for market share. This heightened competition may have squeezed PwC's profit margins, leading to a reassessment of their investment.

- Regulatory Changes: Shifting regulatory landscapes and compliance requirements in Senegal may have presented additional challenges and increased operational costs for PwC, impacting their profitability and prompting a strategic repositioning.

Impact on the Senegalese Economy

The impact of PwC's withdrawal on the Senegalese economy is multifaceted.

- Loss of Expertise: The departure of a major player like PwC represents a loss of significant expertise in areas such as Senegalese auditing, financial services Senegal, and business consulting. This expertise gap could hinder economic growth and development.

- Impact on Local Firms: The withdrawal could create opportunities for smaller, local firms, but it may also lead to increased competition and pressure on existing players. Some clients might struggle to find comparable services locally.

- Foreign Investment Perception: The news of PwC's pullback could negatively impact the perception of Senegal's investment climate, potentially deterring foreign investors looking for established service providers.

Gabon's Experience: Similar Trends, Different Nuances

Gabon presents a similar, yet distinct, case study compared to Senegal.

Comparing Gabon and Senegal

Both Senegal and Gabon experienced economic challenges, increased competition, and possibly regulatory hurdles influencing PwC's decisions. However, the specific nuances differ. For example, Gabon's economy is more heavily reliant on the oil sector, making it more vulnerable to price fluctuations. Understanding these unique contexts is crucial for analyzing PwC's strategic choices.

The Role of Political and Economic Factors

In Gabon, political stability and economic diversification played a crucial role in PwC's assessment.

- Political Risk: Political instability or uncertainty can significantly impact foreign investment decisions. PwC may have weighed the political risk in Gabon more heavily than in Senegal.

- Economic Diversification: Gabon's dependence on the oil sector creates vulnerabilities. A lack of economic diversification may have contributed to PwC's reassessment of its long-term prospects.

Madagascar and Beyond: A Broader Perspective on PwC's African Strategy

Madagascar, and other African nations where PwC is adjusting its presence, present a broader lens through which to examine the firm's evolving African strategy.

Madagascar's Unique Challenges

Madagascar faces its own unique set of challenges, such as infrastructure limitations, bureaucratic hurdles, and varying levels of economic development across the country. These factors, alongside the general trends impacting PwC across Africa, may have influenced their strategic decisions in the region.

The Wider Implications for Africa

PwC's adjustments signify a broader trend affecting the African continent and foreign investment.

- Shifting Investment Landscape: This could potentially lead other multinational firms to reassess their strategies in Africa, particularly in countries with similar challenges.

- Opportunities for Local Firms: The departure of large firms creates openings for local accounting and consulting firms to expand their services and gain market share.

- Impact on African Economic Growth: The overall impact on African economic growth remains to be seen, but it necessitates a critical examination of the business environment and policies needed to attract and retain foreign investment.

Analyzing the Underlying Factors: A Pan-African View

Understanding PwC's African pullback requires a pan-African perspective considering several underlying factors.

Economic Instability and its Impact

Significant economic instability across parts of Africa, including volatility in commodity prices, currency fluctuations, and debt burdens, can deter multinational companies from maintaining a large presence.

Competition and Market Saturation

The increasingly competitive landscape in the African auditing and consulting market, with both global and regional players, has impacted profit margins, influencing PwC's strategic choices.

Regulatory Hurdles and Compliance Issues

Navigating the varying regulatory environments and compliance requirements across different African countries can be complex and costly, affecting the operational efficiency and profitability of firms like PwC.

Conclusion: The Future of PwC's Presence in Africa

PwC's strategic adjustments in Africa are driven by a complex interplay of economic instability, increased competition, regulatory challenges, and a reassessment of market opportunities. This pullback highlights the need for African nations to create a more stable, predictable, and attractive business environment to attract and retain foreign investment. The future of PwC's engagement in Africa may involve a shift towards a more focused strategy, concentrating resources in specific countries or sectors where opportunities are perceived as more favorable.

We encourage you to share your thoughts and perspectives on PwC's African pullback. What are your observations, and how do you see this impacting the future of business in Africa? Let's continue this crucial conversation in the comments below.

Featured Posts

-

Hagia Sophia Architectural Marvel Across Empires

Apr 29, 2025

Hagia Sophia Architectural Marvel Across Empires

Apr 29, 2025 -

Pacult Freigestellt Jancker Uebernimmt Klagenfurt

Apr 29, 2025

Pacult Freigestellt Jancker Uebernimmt Klagenfurt

Apr 29, 2025 -

Trump To Issue Full Pardon For Rose

Apr 29, 2025

Trump To Issue Full Pardon For Rose

Apr 29, 2025 -

Kentucky Severe Weather Awareness Week Nws Preparedness

Apr 29, 2025

Kentucky Severe Weather Awareness Week Nws Preparedness

Apr 29, 2025 -

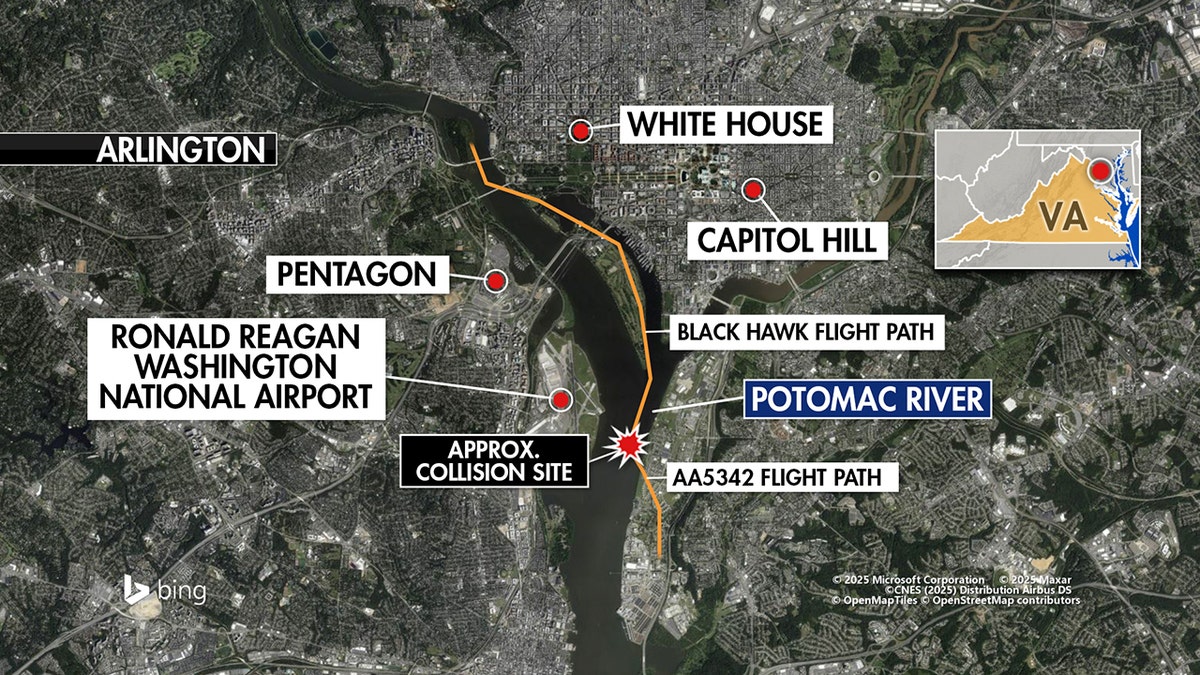

D C Blackhawk Passenger Jet Crash A New Report Reveals Disturbing Details

Apr 29, 2025

D C Blackhawk Passenger Jet Crash A New Report Reveals Disturbing Details

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni