PwC Shuts Down Operations In Nine African Nations

Table of Contents

PwC, a global network of firms providing assurance, tax, and consulting services, boasts a vast international presence. Its decision to withdraw from parts of Africa marks a significant shift in its global strategy. This article aims to clarify the reasons behind PwC's withdrawal and assess the resulting impact.

Reasons Behind PwC's Withdrawal from Nine African Nations

While PwC hasn't released a comprehensive public statement explicitly detailing the reasons for its withdrawal, several factors likely contributed to this decision. Analyzing these factors reveals a complex interplay of economic, regulatory, and strategic considerations.

Economic Challenges

Many of the affected African nations have faced significant economic headwinds in recent years. Keywords like "economic downturn," "market instability," and "profitability challenges" accurately reflect the situation.

- Market Volatility: Fluctuating exchange rates, inflation, and unpredictable political landscapes create unstable business environments, impacting profitability and making long-term investment planning difficult.

- Low Profitability: The return on investment in these specific markets may have fallen below PwC's internal thresholds, prompting a strategic reassessment of their African portfolio.

- Economic Downturn: Recessions or prolonged periods of slow economic growth in these regions may have rendered the markets unsustainable for PwC's operations.

Regulatory and Compliance Issues

Navigating the regulatory landscape in some African nations can be complex and challenging. Keywords like "regulatory environment," "compliance costs," and "bureaucracy" highlight these hurdles.

- Stricter Regulations: Increasing regulatory scrutiny and compliance requirements can significantly increase operational costs and administrative burden.

- Bureaucratic Hurdles: Excessive paperwork, lengthy approvals processes, and navigating complex legal frameworks contribute to inefficiencies and delays.

- Compliance Costs: The cost of ensuring full compliance with evolving regulations may outweigh the potential returns in certain markets.

Strategic Restructuring

PwC's decision is likely part of a broader global strategic restructuring initiative. Keywords such as "global restructuring," "strategic review," and "business optimization" are pertinent here.

- Global Restructuring: The withdrawal might be part of a larger plan to streamline operations, focus resources on more profitable markets, and optimize the firm's global footprint.

- Strategic Review: A thorough review of PwC's global portfolio likely led to the identification of these nine African nations as less strategically important or less profitable.

- Business Optimization: This restructuring aims to enhance efficiency, improve profitability, and ensure the long-term sustainability of PwC's global operations.

Security Concerns

Security risks, including political instability and operational security challenges, could have also influenced PwC's decision. Keywords like "operational security," "political instability," and "risk assessment" are relevant in this context.

- Political Instability: Political unrest, civil conflict, or high levels of corruption can create significant operational risks and security concerns for businesses.

- Operational Security: Ensuring the safety and security of employees and assets in high-risk environments requires substantial investment and resources.

- Risk Assessment: A comprehensive risk assessment might have determined that the security risks in these nine nations outweigh the potential benefits of maintaining operations.

Affected African Nations and Impact on Local Economies

PwC's withdrawal affects nine African nations (the specific countries should be listed here). The impact on these local economies will likely be significant, particularly within the auditing and consulting sectors.

- Job Losses: The closure will lead to job losses for PwC employees in these countries, potentially impacting their families and the wider community.

- Economic Impact: The loss of PwC's services might affect other businesses reliant on their auditing, tax, and consulting expertise, leading to a ripple effect across the local economies.

- Auditing Services: The reduced availability of reputable auditing services could negatively impact investor confidence and hinder economic growth.

- Consulting Sector: Local consulting firms may face increased competition or a reduced demand for their services in the short term. Long-term consequences may include a brain drain as skilled professionals seek opportunities elsewhere.

PwC's Support for Affected Employees and Clients

PwC has a responsibility to support its affected employees and clients through this transition. Keywords such as "employee support," "severance packages," "relocation assistance," "client transition," "service continuity," and "business continuity" are key here.

- Employee Support: PwC should provide comprehensive support for affected employees, including severance packages, relocation assistance, and career counseling to help them find new opportunities.

- Client Transition: PwC needs to ensure a smooth transition for its existing clients, outlining clear plans for service continuity and minimizing disruption to their businesses.

- Service Continuity: PwC should work to establish transition plans to ensure that clients continue to receive essential services without significant interruptions.

- Business Continuity: Measures should be implemented to ensure the business continuity of clients who relied heavily on PwC's expertise.

Conclusion: The Future of PwC in Africa – Analyzing the Impact of the Shutdowns

PwC's decision to shut down operations in nine African nations stems from a complex interplay of economic challenges, regulatory hurdles, strategic restructuring, and security concerns. The consequences are likely to be felt across various sectors, impacting jobs, economic growth, and investor confidence. The long-term impact remains to be seen, but this restructuring signifies a substantial shift in PwC's engagement with the African continent. It will be crucial to monitor the long-term consequences for both the affected nations and PwC's overall African strategy. Stay informed about the evolving situation with PwC's operations in Africa. Continue to monitor news and updates on the impact of PwC shutting down operations in these key markets. For more detailed information about the impact of PwC's operational shutdowns on the African continent, visit [link to relevant resources].

Featured Posts

-

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025 -

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025

Akeso Stock Drops After Cancer Drug Trial Fails To Meet Expectations

Apr 29, 2025 -

1 33 Mln Zl Za Porsche 911 Czy To Oplacalna Inwestycja Analiza Sprzedazy W Polsce

Apr 29, 2025

1 33 Mln Zl Za Porsche 911 Czy To Oplacalna Inwestycja Analiza Sprzedazy W Polsce

Apr 29, 2025 -

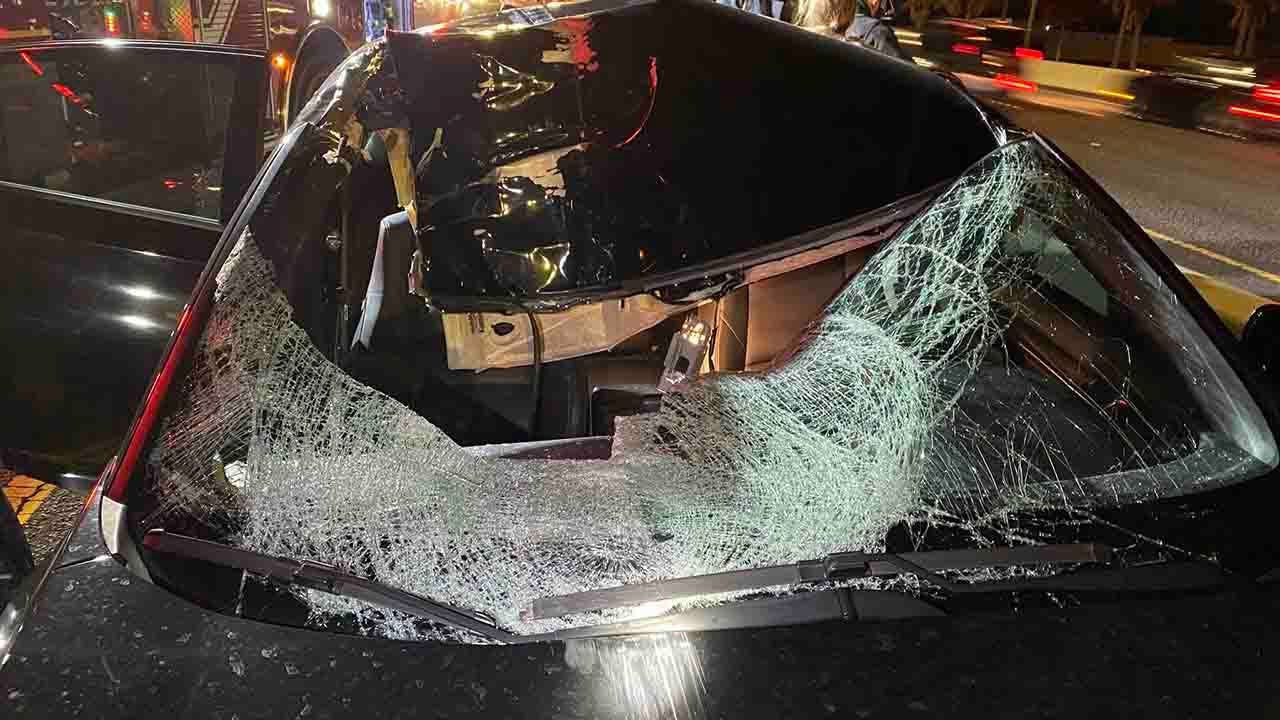

One Killed Several Hurt In Clearwater Ferry Collision

Apr 29, 2025

One Killed Several Hurt In Clearwater Ferry Collision

Apr 29, 2025 -

Will Pete Rose Be Reinstated Mlb Reviews Petition

Apr 29, 2025

Will Pete Rose Be Reinstated Mlb Reviews Petition

Apr 29, 2025