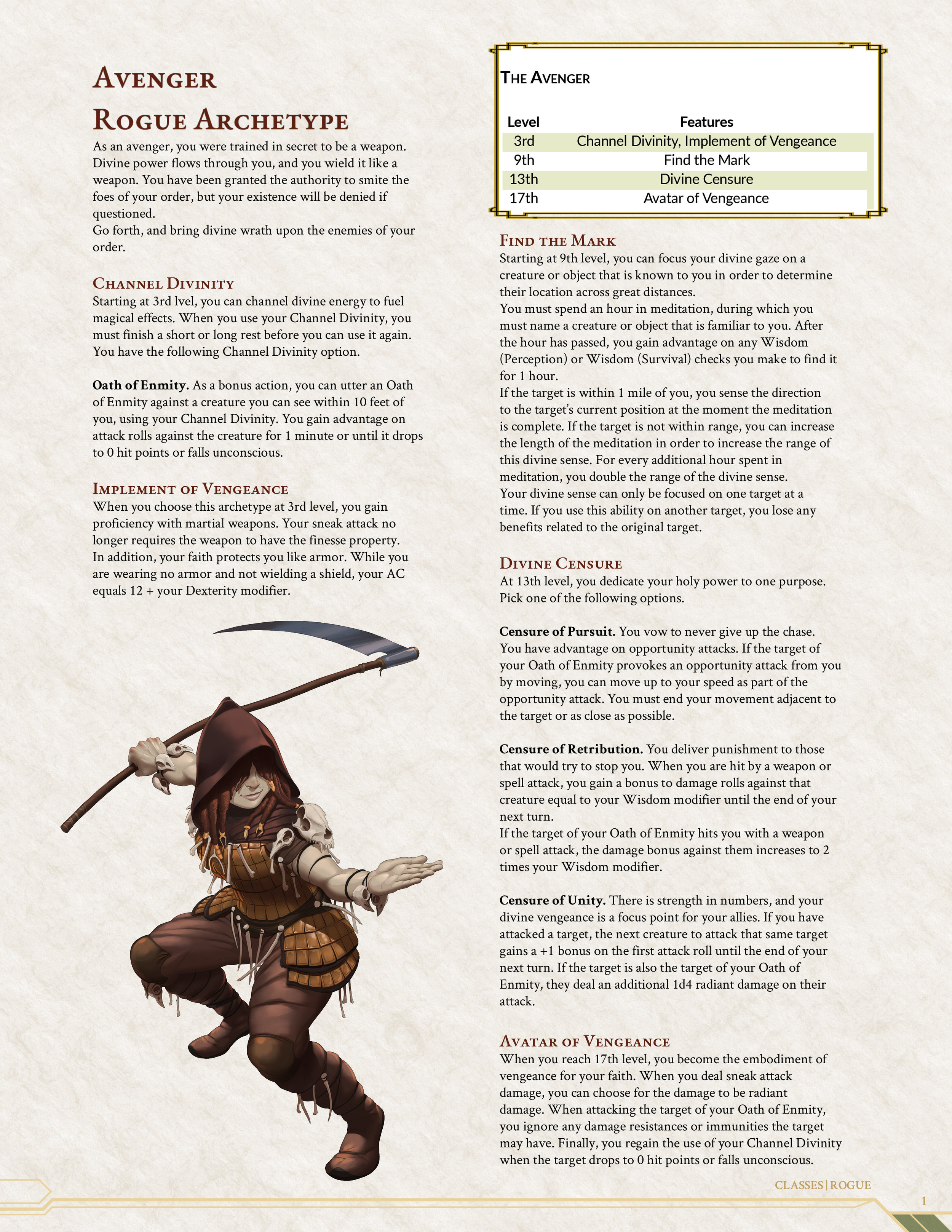

ProShares Launching XRP ETFs This Week: Details On The Non-Spot Offerings

Table of Contents

Understanding the Significance of ProShares Entering the XRP ETF Market

ProShares' entry into the XRP ETF market is a monumental event. As a well-established and reputable ETF provider, their involvement lends significant credibility to XRP and the broader cryptocurrency space. This move could dramatically impact XRP's price and accelerate its market adoption. The competitive landscape of cryptocurrency ETFs is heating up, and ProShares’ entry positions them as a major player.

- Increased Institutional Investment in XRP: ProShares' ETFs will likely attract significant institutional investment, bringing a new level of legitimacy and stability to XRP.

- Greater Liquidity for XRP Trading: The increased trading volume facilitated by these ETFs will boost liquidity, making it easier and cheaper to buy and sell XRP.

- Enhanced Accessibility for Retail Investors: Investing in XRP will become significantly more accessible to retail investors through the simplicity of ETF trading.

- Potential for Price Volatility due to Increased Trading Volume: While increased liquidity is generally positive, a surge in trading volume can also lead to increased price volatility.

Types of Non-Spot XRP ETFs Offered by ProShares

ProShares' XRP ETFs will likely be non-spot offerings, meaning they won't directly hold XRP. Instead, they'll likely utilize derivatives like futures and options contracts to track XRP's price. This approach allows ProShares to circumvent some of the regulatory hurdles associated with spot cryptocurrency ETFs.

- Futures-Based ETFs: These ETFs will invest in XRP futures contracts, effectively betting on the future price of XRP. The mechanics involve buying and selling futures contracts to mirror XRP's price movements.

- Options-Based ETFs: These ETFs might utilize XRP options contracts, offering exposure to XRP's price fluctuations through options trading strategies. This approach can provide different risk-reward profiles compared to futures-based ETFs.

- Comparison of Risk Profiles: Futures-based ETFs generally carry higher risk due to leverage and potential margin calls, while options-based ETFs can offer more controlled risk profiles depending on the employed strategies.

- Potential Tracking Errors: It's crucial to understand that non-spot ETFs might not perfectly track XRP's price due to factors like tracking errors and the cost of hedging strategies.

Analyzing the Risks and Benefits of Investing in ProShares' XRP ETFs

Investing in ProShares' XRP ETFs presents both opportunities and risks. While they offer easier access and potential diversification benefits, it's vital to understand the inherent risks involved.

Benefits:

- Diversification: Adding an XRP ETF to a diversified portfolio can help spread risk across different asset classes.

- Ease of Access: Investing in an XRP ETF is simpler than directly buying and securing XRP.

Risks:

- High Returns, High Losses: The cryptocurrency market is notoriously volatile, meaning high potential returns come with significant risks of substantial losses.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, potentially impacting the viability and performance of XRP ETFs.

- Market Volatility: The price of XRP, and consequently these ETFs, can experience dramatic swings due to market sentiment and news events.

- Understanding Your Risk Tolerance: Before investing, honestly assess your risk tolerance and only invest an amount you can comfortably afford to lose.

How to Invest in ProShares' XRP ETFs

Once launched, investing in ProShares' XRP ETFs will be relatively straightforward for those with brokerage accounts.

- Opening a Brokerage Account: You'll need a brokerage account that supports ETF trading. Major brokerage firms are expected to list these ETFs promptly.

- Searching for the Ticker Symbol: Locate the specific ticker symbol for the chosen ProShares XRP ETF.

- Placing an Order: Place an order to buy shares of the ETF, specifying the desired quantity.

- Understanding Brokerage Fees and Commissions: Be aware of any brokerage fees or commissions associated with buying and selling ETFs.

Conclusion

ProShares' launch of non-spot XRP ETFs marks a significant moment for both XRP and the cryptocurrency ETF landscape. While these ETFs offer a relatively accessible way to gain XRP exposure, it's crucial to understand the potential benefits and risks involved. Before investing in ProShares’ XRP ETFs or any other cryptocurrency-related investment, conduct thorough due diligence, consider your risk tolerance, and seek professional financial advice if necessary. Stay informed about the ProShares XRP ETF launch and make informed decisions regarding your XRP ETF investment. Remember to carefully weigh the potential rewards against the considerable risks inherent in this volatile market.

Featured Posts

-

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025 -

Psg Nice Maci Canli Izle Hangi Kanalda Nasil Izlenir

May 08, 2025

Psg Nice Maci Canli Izle Hangi Kanalda Nasil Izlenir

May 08, 2025 -

12th April Saturday Lotto Winning Numbers And Results

May 08, 2025

12th April Saturday Lotto Winning Numbers And Results

May 08, 2025 -

Andor Season 2 How It Will Change Star Wars Canon

May 08, 2025

Andor Season 2 How It Will Change Star Wars Canon

May 08, 2025 -

The Complicated Case Of Rogue Avenger Or Mutant

May 08, 2025

The Complicated Case Of Rogue Avenger Or Mutant

May 08, 2025

Latest Posts

-

Tatums Post All Star Game Remarks On Steph Currys Performance

May 08, 2025

Tatums Post All Star Game Remarks On Steph Currys Performance

May 08, 2025 -

Boston Celtics Coach Provides Update On Jayson Tatums Wrist Injury

May 08, 2025

Boston Celtics Coach Provides Update On Jayson Tatums Wrist Injury

May 08, 2025 -

Jayson Tatum On Steph Curry Post All Star Game Honesty

May 08, 2025

Jayson Tatum On Steph Curry Post All Star Game Honesty

May 08, 2025 -

Tatums Respectful Comments On Curry Following The Nba All Star Game

May 08, 2025

Tatums Respectful Comments On Curry Following The Nba All Star Game

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025