Private Equity Buys Boston Celtics For $6.1 Billion: What This Means For Fans

Table of Contents

- Potential Impact on Ticket Prices and Fan Experience

- Rising Ticket Costs?

- Enhanced Fan Engagement Initiatives?

- Effect on Team Performance and Player Acquisitions

- Increased Spending on Players?

- Focus on Financial Returns vs. Winning?

- Long-Term Implications for the Franchise and the Boston Community

- Community Involvement

- Maintaining the Celtics' Legacy

- Conclusion

Potential Impact on Ticket Prices and Fan Experience

The $6.1 billion price tag raises immediate concerns about the future cost of attending Celtics games.

Rising Ticket Costs?

The sheer financial investment in the Boston Celtics Private Equity Buyout necessitates a return for the investors. This could translate to increased ticket prices, potentially pricing out some long-time fans.

- Historical precedent: Analyzing historical trends following similar ownership changes in other major sports leagues reveals a pattern of rising ticket prices, particularly for premium seating.

- Accessibility concerns: Higher ticket costs could significantly impact the accessibility of games for average fans, potentially shrinking the fanbase and altering the vibrant atmosphere of TD Garden.

- Premium seating surge: Expect to see a particularly sharp increase in the cost of premium seating options, luxury boxes, and courtside tickets.

Enhanced Fan Engagement Initiatives?

Conversely, the influx of private equity capital could lead to significant investments in enhancing the fan experience.

- Technological upgrades: The new owners might invest in a state-of-the-art mobile app with improved ticketing, in-game features, and interactive experiences.

- Stadium improvements: Renovations to TD Garden could lead to improved concessions, more comfortable seating, and enhanced amenities throughout the arena.

- Increased fan interaction: Initiatives aimed at increasing fan interaction with players and the organization, such as exclusive events and meet-and-greets, are also plausible.

Effect on Team Performance and Player Acquisitions

The financial muscle of a private equity firm can significantly impact the team's on-court performance.

Increased Spending on Players?

The massive financial resources resulting from the Boston Celtics Private Equity Buyout could lead to a more aggressive approach to player acquisitions.

- Increased salary cap flexibility: The buyout potentially provides the Celtics with greater flexibility to navigate the salary cap and compete for top-tier free agents.

- Improved draft strategy: The team might be able to invest more heavily in scouting and player development, leading to better draft picks and a stronger farm system.

- Attracting star players: The financial resources could prove crucial in attracting established stars and bolstering the team's competitiveness.

Focus on Financial Returns vs. Winning?

However, a potential conflict arises between the private equity firm's primary goal—maximizing financial returns—and the team's pursuit of championships.

- Cost-cutting measures: To improve profitability, the private equity firm might pressure the organization to implement cost-cutting measures, potentially impacting player salaries or other operational expenses.

- Balancing act: The key will be striking a balance between maintaining a winning team and maximizing profits. This will be a crucial test for the new ownership group.

- Long-term vision: The long-term vision of the private equity firm regarding the team's competitive standing will be a critical factor in determining future success.

Long-Term Implications for the Franchise and the Boston Community

The impact of the Boston Celtics Private Equity Buyout extends beyond the court and into the wider Boston community.

Community Involvement

The new ownership's commitment to the community is a vital aspect to consider.

- Maintaining community programs: It's essential that the private equity firm maintains and potentially expands the Celtics' existing community outreach programs and charitable initiatives.

- Corporate social responsibility: The firm's approach to corporate social responsibility (CSR) will be a key indicator of their long-term commitment to the Boston community.

- Increased community engagement: A successful buyout will involve continued and perhaps increased engagement with local communities, schools, and charitable organizations.

Maintaining the Celtics' Legacy

Preserving the Celtics' rich history and tradition is paramount for fans.

- Respecting the legacy: The new owners must understand and respect the historical significance of the Celtics franchise, its iconic players, and its passionate fanbase.

- Maintaining cultural identity: Strategies to maintain the team's cultural identity and its connection to the city of Boston are critical for sustaining fan loyalty.

- Celebrating the history: Continued celebration of past successes and players is vital for preserving the team's legacy and its connection to the community.

Conclusion

The Boston Celtics Private Equity Buyout presents both exciting opportunities and potential challenges for fans. While increased spending on players and improved fan experiences are possible, concerns remain regarding rising ticket prices and the potential conflict between profit maximization and on-court success. The long-term impact on the community and the preservation of the Celtics' rich legacy will also be critical factors in determining the success of this transaction. Stay informed about the developments surrounding the Boston Celtics Private Equity Buyout to understand how this major transaction will affect your experience as a fan! Keep an eye on how this impacts the future of the franchise.

Knicks Brunson Responds To Thibodeaus Job Security Questions

Knicks Brunson Responds To Thibodeaus Job Security Questions

Liverpool Fc Transfer News Latest On Schlotterbeck And Stiller

Liverpool Fc Transfer News Latest On Schlotterbeck And Stiller

Angel Reeses Reebok Deal A Game Changer In Womens Basketball Sponsorship

Angel Reeses Reebok Deal A Game Changer In Womens Basketball Sponsorship

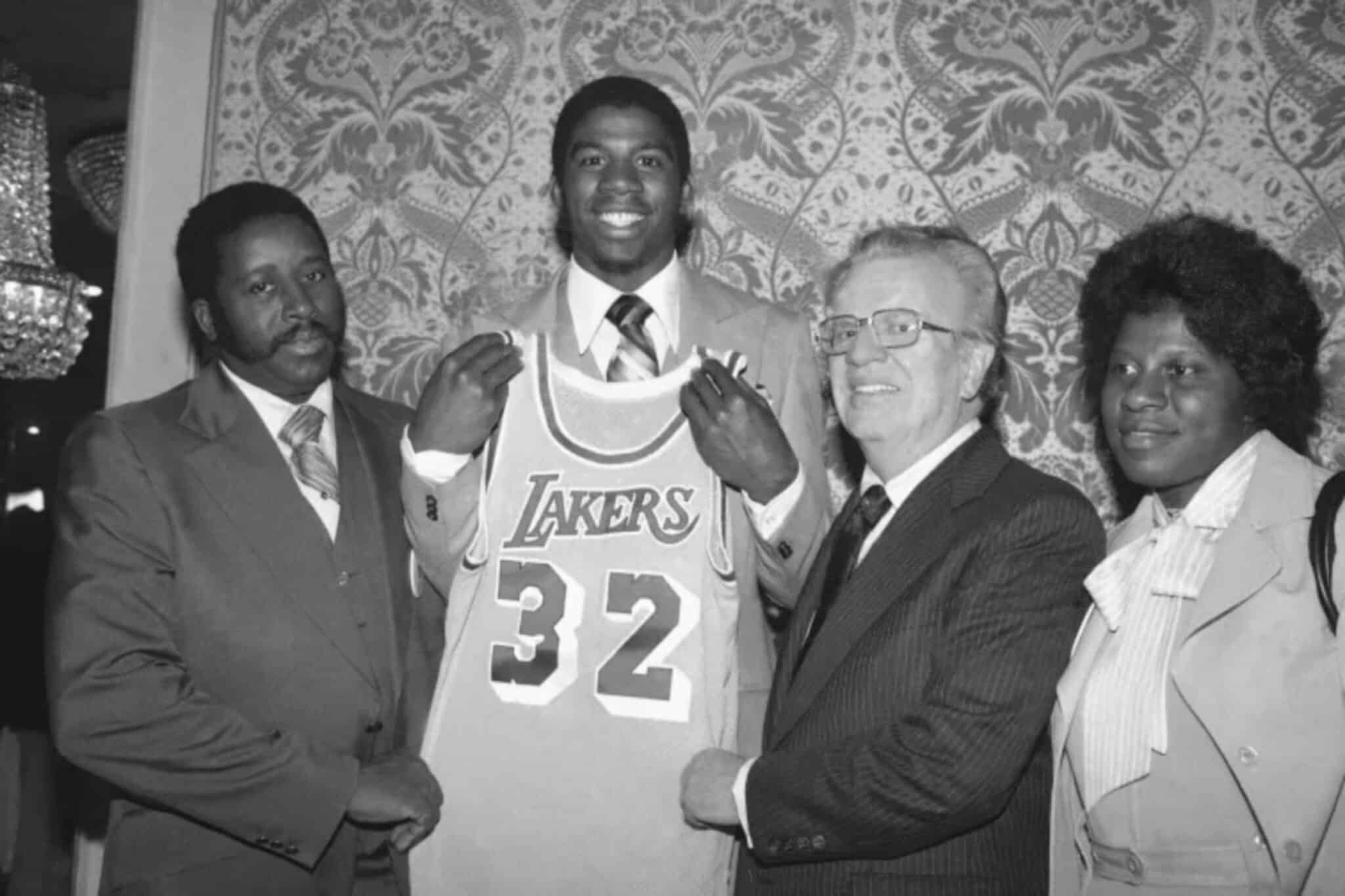

Magic Johnsons Expert Analysis Who Will Win The Knicks Pistons Series

Magic Johnsons Expert Analysis Who Will Win The Knicks Pistons Series

Doctor Who Season 2 Trailer The Fifteenth Doctors New Companion And Killer Cartoons

Doctor Who Season 2 Trailer The Fifteenth Doctors New Companion And Killer Cartoons