Private Equity Acquires Boston Celtics For $6.1 Billion: Future Uncertain For Fans

Table of Contents

The Impact of Private Equity Ownership on the Boston Celtics

The entry of private equity into professional sports ownership is a complex issue with both potential benefits and drawbacks. The Boston Celtics acquisition by a private equity firm presents a unique case study.

Financial Implications: A Balancing Act of Profit and Performance

The $6.1 billion price tag represents a significant financial commitment. This Boston Celtics acquisition could lead to several financial implications for the team and its fans:

- Increased Debt Burden: The acquisition likely involved significant debt financing. This could necessitate cost-cutting measures to service the debt, potentially impacting various aspects of team operations.

- Revenue Maximization: Private equity firms typically prioritize maximizing profitability. This might lead to an increased focus on revenue generation through higher ticket prices, concessions, and merchandise sales. Strategies to enhance the fan experience while increasing revenue will be crucial.

- Strategic Investment: Conversely, the influx of capital could also allow for significant investment in team infrastructure improvements, state-of-the-art training facilities, and strategic player acquisitions to bolster the team's competitiveness. This would be a key aspect of a successful Boston Celtics acquisition.

Changes in Team Management and Strategy: A New Era for the Celtics?

A change in ownership often brings about changes in management and strategic direction. This Boston Celtics acquisition is no exception, potentially leading to:

- New Leadership: The private equity firm may install a new general manager or coaching staff aligned with their vision for the team. This could mean a shift in team philosophy and playing style.

- Short-Term vs. Long-Term Goals: Private equity firms often operate on shorter time horizons than traditional owners. This could lead to a greater emphasis on short-term gains, potentially impacting long-term strategic planning and player development.

- Data-Driven Decision Making: Private equity firms often leverage sophisticated data analytics to inform their decisions. This could lead to a more data-driven approach to player recruitment, coaching strategies, and overall team management within the Boston Celtics organization.

The Role of Private Equity in Professional Sports: Lessons from the Past

Analyzing the historical trends of private equity ownership in professional sports leagues provides valuable insight into the potential outcomes of this Boston Celtics acquisition.

- Success Stories and Failures: Examining previous private equity investments in sports franchises reveals both success stories and notable failures. Understanding the factors that contributed to success or failure can offer valuable lessons for the Celtics' future.

- Typical Private Equity Strategies: Private equity firms often employ similar strategies across different industries. Understanding these strategies – including cost-cutting, asset optimization, and revenue enhancement – is vital in predicting the potential impact on the Celtics.

- Potential Conflicts of Interest: The pursuit of profit maximization might sometimes clash with the long-term interests of the team and its fans. Transparency and careful consideration of the potential for conflicts of interest are paramount.

Fan Concerns and Potential Outcomes: Navigating the Uncertain Future

The Boston Celtics acquisition has understandably generated concern among fans. Addressing these concerns is vital for the long-term success of the franchise.

Ticket Prices and Accessibility: Will the Games Remain Affordable?

The increased focus on profitability associated with private equity ownership raises concerns about ticket prices and accessibility for average fans:

- Price Increases: The potential for increased ticket prices is a significant concern. Analyzing current pricing trends and the impact of the acquisition on future pricing strategies is crucial.

- Maintaining Fan Accessibility: The team needs to develop strategies to maintain accessibility for fans of all income levels. This could involve offering various ticket options, discounts, and promotions.

- Impact on Season Ticket Holders: Understanding the potential impact on existing season ticket holders and the measures taken to retain their loyalty is crucial.

The Impact on Player Recruitment and Team Performance: Maintaining Competitive Edge

Concerns exist regarding the potential impact of the acquisition on player recruitment and team performance:

- Roster Changes: The new ownership might lead to changes in the team's roster, affecting player salaries and contract negotiations.

- Impact on Player Salaries: Cost-cutting measures could impact player salaries and the team's ability to attract top talent.

- Scouting and Development: Changes to the team's scouting and player development strategies might also impact its long-term competitiveness.

The Future of the Boston Celtics Brand: Protecting Legacy and Reputation

The Boston Celtics acquisition has implications for the team's brand and image:

- Marketing and Branding: Changes in marketing and branding strategies might be implemented to enhance revenue generation.

- Community Engagement: The team's commitment to community outreach programs and fan engagement initiatives could be affected by the shift in ownership.

- Long-Term Legacy: The long-term impact on the team's legacy and reputation depends on how the new owners balance profitability with the team's rich history and the needs of its loyal fanbase.

Conclusion: A Pivotal Moment for the Boston Celtics

The $6.1 billion Boston Celtics acquisition by a private equity firm marks a significant turning point. While the potential for increased investment exists, there are legitimate concerns about ticket prices, player recruitment, and fan experience. Monitoring the team's actions in the coming years is essential to understand the long-term effects of this historic deal. Stay informed about the future of the Boston Celtics and the implications of this significant Boston Celtics acquisition. Continue to follow our updates for further analysis.

Featured Posts

-

Japans Economic Performance Q1 Impact Of Potential Trade Wars

May 17, 2025

Japans Economic Performance Q1 Impact Of Potential Trade Wars

May 17, 2025 -

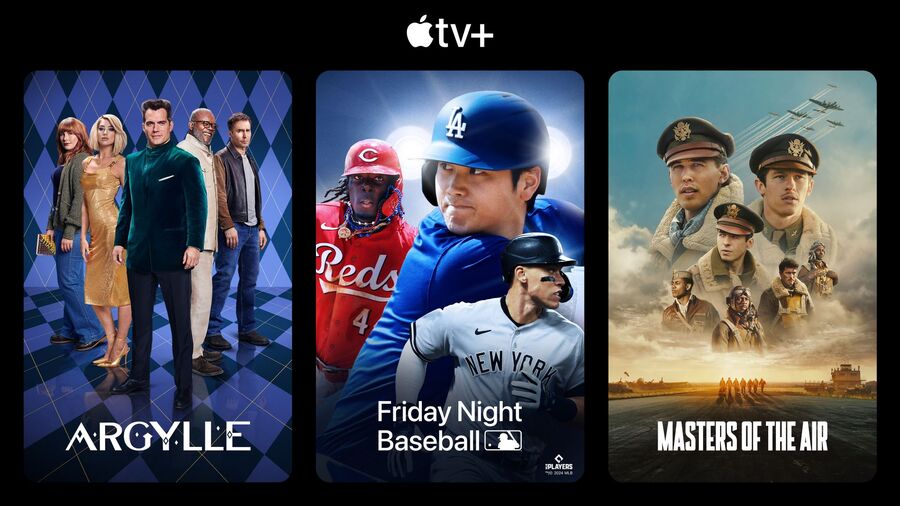

Grab This Deal Apple Tv At 3 For 3 Months

May 17, 2025

Grab This Deal Apple Tv At 3 For 3 Months

May 17, 2025 -

Q1 Economic Report Japans Contraction And The Threat Of Tariffs

May 17, 2025

Q1 Economic Report Japans Contraction And The Threat Of Tariffs

May 17, 2025 -

High Stock Valuations Why Bof A Thinks Investors Shouldnt Panic

May 17, 2025

High Stock Valuations Why Bof A Thinks Investors Shouldnt Panic

May 17, 2025 -

The Donald Trump Presidency Examining The Role Of Controversies And Scandals

May 17, 2025

The Donald Trump Presidency Examining The Role Of Controversies And Scandals

May 17, 2025

Latest Posts

-

True Crime Docuseries Overtakes 96 Rt Rated Netflix Romance Drama

May 18, 2025

True Crime Docuseries Overtakes 96 Rt Rated Netflix Romance Drama

May 18, 2025 -

The Most Controversial Eurovision Acts And The Uks 2025 Hopeful

May 18, 2025

The Most Controversial Eurovision Acts And The Uks 2025 Hopeful

May 18, 2025 -

Rekord Teylor Svift Naybilshe Prodanikh Vinilovikh Plativok Za Desyatilittya

May 18, 2025

Rekord Teylor Svift Naybilshe Prodanikh Vinilovikh Plativok Za Desyatilittya

May 18, 2025 -

Japans Metropolis Beyond The Tourist Trail

May 18, 2025

Japans Metropolis Beyond The Tourist Trail

May 18, 2025 -

Selena Gomez Vs Taylor Swift The Blake Lively Dispute And Its Fallout

May 18, 2025

Selena Gomez Vs Taylor Swift The Blake Lively Dispute And Its Fallout

May 18, 2025