Private Equity Acquires Boston Celtics For $6.1 Billion: Fan Concerns And Analysis

Table of Contents

The Details of the Private Equity Deal

The acquisition of the Boston Celtics involved [Insert Names of Acquiring Firm(s)], a prominent private equity firm with a history of investing in high-profile businesses. While specific details of the deal's financial structure remain confidential, the $6.1 billion valuation highlights the immense value placed on the Celtics' brand and its potential for future growth. This represents one of the largest private equity acquisitions in the history of professional sports. The ownership structure post-acquisition will likely involve [Explain ownership structure - e.g., a majority stake held by the PE firm, with minority ownership retained by previous owners].

- Key Players: [List key individuals involved in the acquisition from both the buyer and seller sides].

- Previous PE Involvement in Sports: This acquisition builds upon a growing trend of private equity investment in professional sports franchises, with previous examples including [Cite examples of similar acquisitions].

- Financial Implications: The significant financial injection could lead to substantial improvements in team infrastructure, player recruitment, and overall operational efficiency. However, it also raises concerns about potential cost-cutting measures to maximize returns.

Fan Concerns Regarding the Private Equity Acquisition

The Private Equity Acquisition Boston Celtics has understandably sparked anxiety amongst the dedicated fanbase. Many fear that prioritizing profit maximization over winning could negatively impact the team's on-court performance and overall culture.

-

Ticket Price Increases: A major concern revolves around potential increases in ticket prices, making attending games less accessible to long-time fans. This is a common criticism leveled against private equity ownership in sports, where profit margins are often a top priority.

-

Prioritizing Profit over Winning: Fans worry that the focus on maximizing returns might lead to decisions that compromise the team's competitive edge, such as trading star players for financial gain or neglecting player development.

-

Impact on Player Personnel: Concerns exist about potential changes in player personnel, with the possibility of beloved players being traded to cut costs or improve the team's financial standing in the short term.

-

Changes in Team Culture: There are worries that the acquisition could lead to a shift in the team's culture, potentially diminishing the sense of community and connection with the fans that has historically defined the Celtics.

-

Examples from Other Teams: [Provide examples of other sports teams acquired by private equity firms, highlighting both positive and negative outcomes for fans].

-

Fan Reactions: Social media and online forums are filled with comments from concerned fans expressing their anxieties. [Include relevant quotes from fans expressing their concerns].

-

Fan-led Initiatives: [Mention any petitions, protests, or fan-led initiatives in response to the acquisition].

Potential Benefits of the Private Equity Investment

While concerns exist, the Private Equity Acquisition Boston Celtics also presents opportunities for positive change. The substantial financial resources brought by private equity could significantly benefit the team.

-

Improved Infrastructure: The investment could lead to upgrades in team facilities, including the arena, training facilities, and other infrastructure that enhances the fan experience and supports player development.

-

Increased Investment in Player Development: The influx of capital could enable greater investment in player development programs, leading to a stronger, more competitive team in the long run.

-

Advancements in Marketing and Branding: Private equity firms often bring expertise in marketing and branding, potentially leading to a more effective and far-reaching brand strategy for the Celtics.

-

Enhanced Financial Stability: The acquisition could provide greater financial stability, securing the team's long-term future and mitigating the risks associated with fluctuating revenue streams.

-

Successful Examples: [Provide examples of successful private equity investments in sports teams that have resulted in positive outcomes].

-

Upgraded Fan Experience: The investment could lead to a more enjoyable game-day experience for fans, with improved facilities and amenities.

-

Economic Benefits for Boston: The increased investment could stimulate the local economy, creating jobs and boosting tourism.

Analyzing the Long-Term Implications

The long-term impact of this Private Equity Acquisition Boston Celtics remains to be seen. However, several key factors will shape the team's future trajectory.

-

Increased NBA Competition: The influx of capital into the NBA through private equity investments will likely increase competition across the league, demanding greater strategic management and investment in player talent.

-

Impact on the Celtics' Legacy: The acquisition could affect the Celtics' long-standing legacy and brand identity, depending on the approach taken by the new owners.

-

Future Performance Predictions: Predicting the team's future performance is challenging, but the increased financial resources could translate into improved on-court results, provided these are managed effectively.

-

Wider Implications for Professional Sports: This acquisition reflects a broader trend of private equity involvement in professional sports, setting a precedent for future transactions and shaping the competitive landscape of the industry.

-

Expert Opinions: [Include quotes and analysis from sports analysts and financial experts].

-

Potential Scenarios: [Outline several possible scenarios for the Celtics' future under private equity ownership, ranging from highly optimistic to more cautious predictions].

-

Lessons from Similar Acquisitions: [Discuss the long-term outcomes of similar acquisitions in professional sports].

Conclusion

The $6.1 billion private equity acquisition of the Boston Celtics represents a pivotal moment in the franchise’s history. While the influx of capital offers potential benefits like improved infrastructure and player development, concerns regarding ticket prices, prioritizing profit over winning, and changes to team culture remain valid. The $6.1 billion price tag underscores the significant financial stakes involved. Analyzing the long-term implications requires careful consideration of various factors, including increased competition within the NBA and the overall impact on the Celtics' legacy and fan experience.

The acquisition of the Boston Celtics by private equity marks a pivotal moment in the franchise's history. Staying informed about the developments and engaging in constructive dialogue is crucial for ensuring the long-term success and well-being of the team. Keep following the news for updates on the Boston Celtics and the impact of this significant private equity acquisition and how it affects the beloved Celtics franchise. Learn more about the financial implications of private equity in sports by researching related articles and analysis.

Featured Posts

-

Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 Domina Nominalizarile Lista Completa

May 17, 2025

Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 Domina Nominalizarile Lista Completa

May 17, 2025 -

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025 -

6 1 Billion Celtics Sale Analyzing The Impact On The Franchise And Its Fans

May 17, 2025

6 1 Billion Celtics Sale Analyzing The Impact On The Franchise And Its Fans

May 17, 2025 -

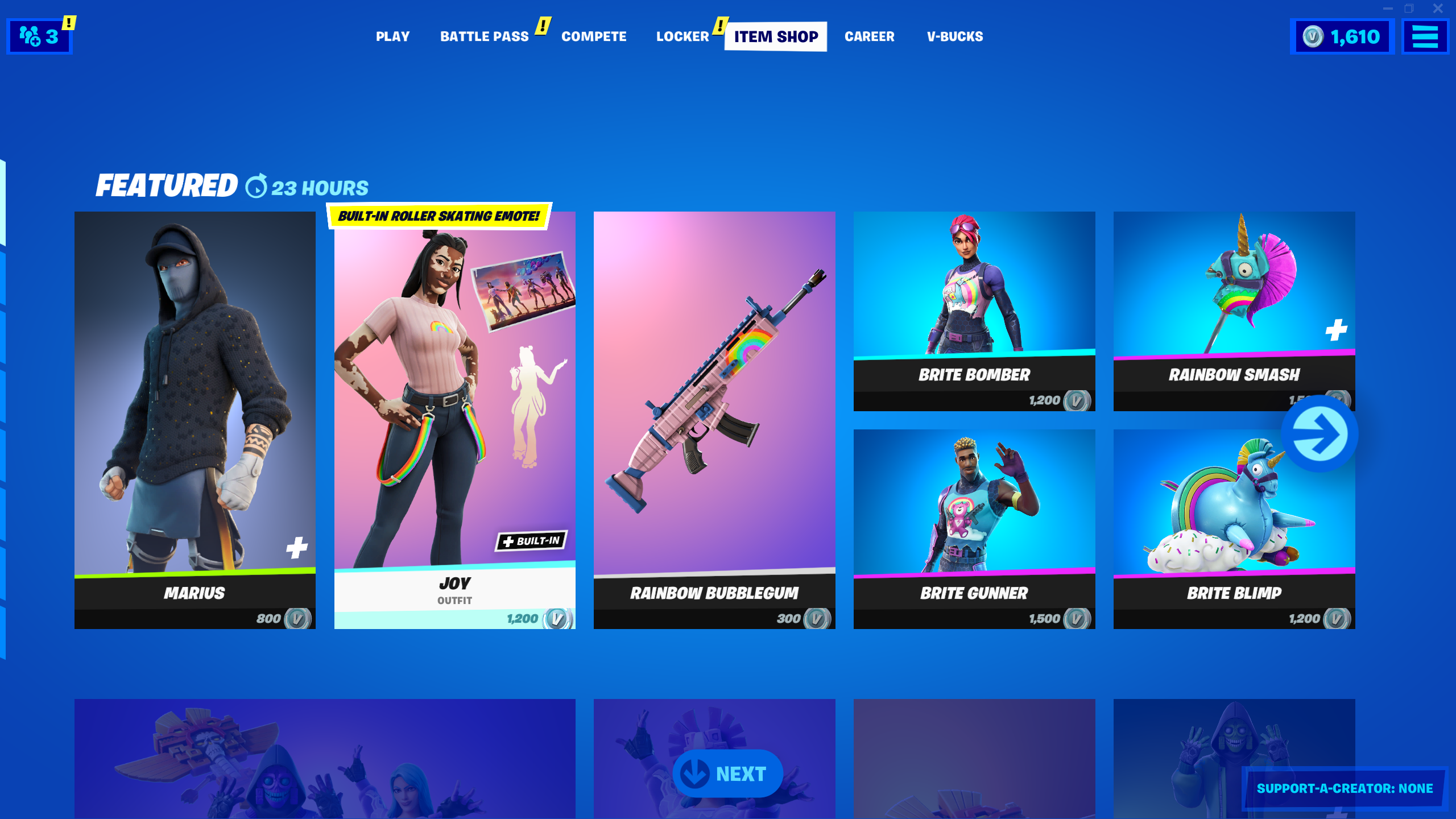

Fortnites Item Shop Update Highly Anticipated Skins Restock

May 17, 2025

Fortnites Item Shop Update Highly Anticipated Skins Restock

May 17, 2025 -

Ny Knicks Vs Brooklyn Nets Live Stream Tv Channel And Game Time April 13 2025

May 17, 2025

Ny Knicks Vs Brooklyn Nets Live Stream Tv Channel And Game Time April 13 2025

May 17, 2025

Latest Posts

-

Meo Kalorama 2025 Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Lead Stellar Lineup

May 18, 2025

Meo Kalorama 2025 Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Lead Stellar Lineup

May 18, 2025 -

Pet Shop Boys Fka Twigs Jorja Smith Father John Misty Headline Meo Kalorama 2025 Full Lineup Announced

May 18, 2025

Pet Shop Boys Fka Twigs Jorja Smith Father John Misty Headline Meo Kalorama 2025 Full Lineup Announced

May 18, 2025 -

5 26

May 18, 2025

5 26

May 18, 2025 -

Asamh Bn Ladn Awr Alka Yagnk Ayk Ghyr Memwly Telq Ka Ankshaf

May 18, 2025

Asamh Bn Ladn Awr Alka Yagnk Ayk Ghyr Memwly Telq Ka Ankshaf

May 18, 2025 -

Alka Yagnk Ke Mtabq Asamh Bn Ladn Ky Shkhsyt Ka Jayzh

May 18, 2025

Alka Yagnk Ke Mtabq Asamh Bn Ladn Ky Shkhsyt Ka Jayzh

May 18, 2025