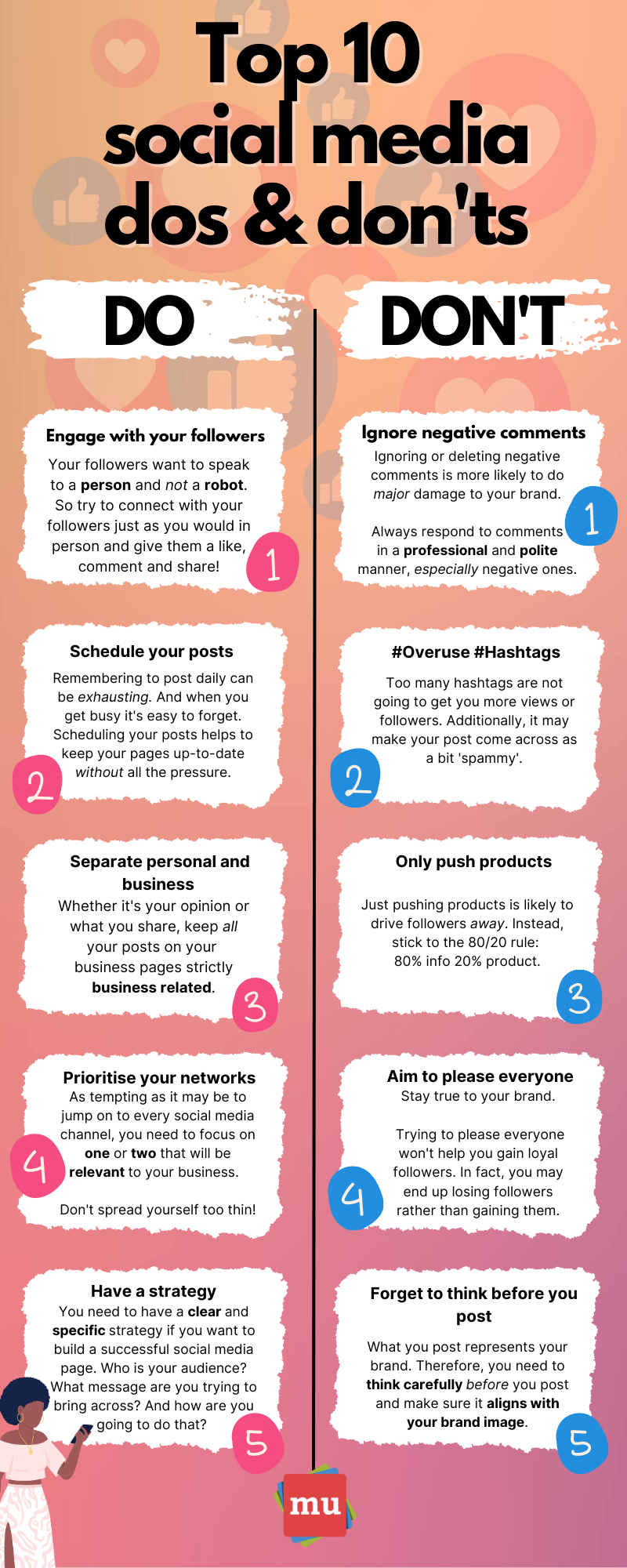

Private Credit Jobs: 5 Dos And Don'ts To Boost Your Application

Table of Contents

5 Dos to Land Your Dream Private Credit Job

Do Your Research: Understand the Firm and the Role

Thoroughly researching the specific private credit firm and the role you're applying for is paramount. This goes beyond a cursory glance at their website. You need a deep understanding of their investment strategy, portfolio companies, recent transactions, and even their competitors.

- Deep Dive into the Firm: Explore their website thoroughly, looking for press releases, investor presentations, and case studies to understand their investment philosophy and recent successes.

- Target Your Application: Tailor your resume and cover letter to highlight skills and experiences directly relevant to their specific needs. Generic applications rarely succeed.

- Cultural Fit: Demonstrate your understanding of the firm's culture and values. Research employee reviews on sites like Glassdoor to gain insights into the work environment.

- Network Before Applying: Utilize LinkedIn to research the hiring manager and team members. Understanding their backgrounds can help you tailor your application and conversation.

Showcase Relevant Skills and Experience in Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count. Highlighting relevant skills and quantifying your achievements is key to grabbing the recruiter's attention in the competitive private credit sector.

- Quantify Your Success: Use numbers to illustrate your impact. Instead of "Improved efficiency," write "Increased operational efficiency by 12%, resulting in $X cost savings."

- Keywords Matter: Incorporate keywords relevant to private credit and the specific job description. Review the job posting carefully and incorporate relevant terms naturally.

- Focus on Impact: Highlight experience in financial modeling, credit analysis, due diligence, portfolio management, debt restructuring, or other areas crucial for private credit roles.

- Showcase Technical Skills: Emphasize your skills in areas such as financial statement analysis, valuation (DCF, LBO modeling), and risk assessment. Private credit jobs require a strong technical foundation.

Network Strategically within the Private Credit Industry

Networking is invaluable in the private credit industry. It's not just about handing out resumes; it's about building relationships and gaining insights.

- Attend Industry Events: Attend conferences, seminars, and networking events focused on private credit and alternative investments.

- Leverage LinkedIn: Connect with professionals on LinkedIn, engage in relevant discussions, and join private credit groups.

- Informational Interviews: Reach out to individuals working in private credit for informational interviews. This provides valuable insights and can lead to unexpected opportunities.

- Tap into Your Network: Leverage your existing network. You might be surprised by the connections your friends, family, and former colleagues have in this field.

Prepare Thoroughly for the Interview Process

The interview stage is your chance to showcase your personality and expertise. Thorough preparation is key to success in securing private credit jobs.

- Practice, Practice, Practice: Practice answering common interview questions, particularly behavioral questions ("Tell me about a time you failed") and technical questions related to private credit, such as LBO modeling or credit risk assessment.

- Ask Thoughtful Questions: Prepare insightful questions to ask the interviewer, demonstrating genuine interest and engagement. Show you've done your research.

- Stay Updated: Research current market trends and relevant news in the private credit sector. Demonstrating up-to-date knowledge impresses interviewers.

- Professionalism Counts: Dress professionally and arrive on time (or even slightly early) for the interview. First impressions matter.

Follow Up After the Interview

A thoughtful follow-up demonstrates your continued interest and professionalism.

- Thank You Note: Send a personalized thank-you note to each interviewer within 24 hours, reiterating your interest and highlighting key discussion points from the interview.

- Polite Follow-Up: If you haven't heard back within a reasonable timeframe (typically 1-2 weeks), politely follow up with the recruiter or hiring manager.

5 Don'ts When Applying for Private Credit Jobs

Don't Neglect the Fundamentals

The basics matter. Overlooking these can significantly hinder your application.

- Avoid Generic Applications: Don't submit generic resume and cover letters. Tailor each application to the specific job and firm. Show you understand their unique needs.

- Proofread Carefully: Don't overlook proofreading for typos and grammatical errors. These details matter.

- Network Actively: Don't underestimate the importance of a strong professional network. Networking opens doors.

Don't Overlook the Technical Aspects

Private credit roles demand strong technical skills.

- Master Technical Skills: Don't underestimate the importance of technical skills in financial modeling, valuation, and credit analysis. These are fundamental to the role.

- Showcase Expertise: Don't be afraid to showcase your expertise in these areas. Quantify your accomplishments and highlight successful projects.

Don't Undersell Your Achievements

Your accomplishments deserve to be highlighted.

- Highlight Your Impact: Don't be shy about highlighting your accomplishments and quantifying your impact. Use numbers and data to support your claims.

Don't Be Unprepared for the Interview

Interview preparation is crucial.

- Thorough Research: Don't go into an interview without having thoroughly researched the firm and the role. Show genuine interest.

- Prepare Questions: Don't forget to prepare thoughtful questions to ask the interviewer. This shows engagement.

Don't Neglect Follow-Up

Following up shows your persistence and professionalism.

- Send Thank-You Notes: Don't fail to send thank-you notes after each interview. This is a simple yet powerful gesture.

- Politely Follow Up: Don't be afraid to politely follow up if you haven't heard back within a reasonable timeframe.

Conclusion

Securing a position in the exciting field of private credit requires preparation and strategic effort. By following these dos and don'ts, you can significantly improve your chances of landing your dream private credit job. Remember to meticulously research each firm, showcase your relevant skills, network effectively, prepare thoroughly for interviews, and follow up diligently. Start your job search today and take control of your career in private credit. Don't delay – apply for your dream private credit jobs now!

Featured Posts

-

Fathers Desperate Row For Sons 2 2 Million Treatment An Inspiring Story

May 25, 2025

Fathers Desperate Row For Sons 2 2 Million Treatment An Inspiring Story

May 25, 2025 -

Dazi Trump Sul 20 Impatto Sul Settore Moda

May 25, 2025

Dazi Trump Sul 20 Impatto Sul Settore Moda

May 25, 2025 -

The 17 Biggest Celebrity Reputation Falls

May 25, 2025

The 17 Biggest Celebrity Reputation Falls

May 25, 2025 -

Yevrobachennya 2025 Peredbachennya Konchiti Vurst Chotirokh Peremozhtsiv

May 25, 2025

Yevrobachennya 2025 Peredbachennya Konchiti Vurst Chotirokh Peremozhtsiv

May 25, 2025 -

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Latest Posts

-

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025 -

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025 -

Flood Alerts Explained Protecting Your Home And Family From Flooding

May 25, 2025

Flood Alerts Explained Protecting Your Home And Family From Flooding

May 25, 2025 -

Study Ranks Myrtle Beach Second Most Unsafe City Responds

May 25, 2025

Study Ranks Myrtle Beach Second Most Unsafe City Responds

May 25, 2025