Private Credit Jobs: 5 Dos And Don'ts For Success

Table of Contents

DO: Network Strategically within the Private Credit Industry

The private credit industry thrives on relationships. Building a strong network is essential for uncovering hidden opportunities and gaining valuable insights.

Attend Industry Events

Conferences like SuperReturn, alongside smaller industry meetups and networking events, provide invaluable opportunities to connect with professionals.

- Prepare talking points: Showcase your knowledge of private credit investment strategies, your understanding of credit analysis, and your enthusiasm for the field. Highlight any relevant projects or experiences, such as working on discounted cash flow (DCF) models or leveraged buyout (LBO) models.

- Follow up: After each event, send personalized emails to the people you connected with, reinforcing your interest and offering further insights or resources related to private credit.

- Active listening: Networking isn't just about self-promotion. Actively listen to others’ experiences in private credit, showing genuine interest in their perspectives and career paths. This can lead to unexpected connections and opportunities.

Utilize Online Platforms

LinkedIn is your primary online networking tool. Use it strategically to connect with recruiters and professionals in private credit roles.

- Optimize your profile: Use keywords such as "private credit analyst," "private debt," "alternative lending," "credit fund," "investment management," and "financial services" throughout your profile. Showcase your skills in credit analysis and financial modeling.

- Engage actively: Join relevant LinkedIn groups and participate in discussions. Share insightful articles about private credit investment strategies and market trends. This demonstrates your knowledge and initiative.

- Follow influencers: Follow key players and firms in the private credit space to stay informed about industry news and potential job opportunities.

Informational Interviews

Informational interviews are invaluable for gaining insider perspectives. Reach out to professionals already working in private credit jobs to learn about their career paths and day-to-day responsibilities.

- Prepare thoughtful questions: Ask about their career trajectory, the skills they find most valuable, the challenges they face, and their advice for someone entering the field.

- Show genuine interest: Focus on learning from their experiences, expressing your enthusiasm for a career in private credit and demonstrating your understanding of the industry.

- Express gratitude: Always send a thank-you note after the interview, reinforcing your interest and reiterating your appreciation for their time.

DON'T: Underestimate the Importance of Financial Modeling Skills

Proficiency in financial modeling and credit analysis is non-negotiable for success in private credit jobs.

Master Excel and Financial Modeling

Private credit roles rely heavily on financial modeling and analysis. Become exceptionally proficient in Excel, mastering advanced functions.

- Practice regularly: Create discounted cash flow (DCF) models, leveraged buyout (LBO) models, and other relevant financial models. The more you practice, the more comfortable and efficient you'll become.

- Understand valuation techniques: Develop a deep understanding of various valuation methods used to assess the creditworthiness of borrowers and the potential returns of private credit investments.

- Seek feedback: Share your models with experienced professionals and seek constructive criticism to improve your skills.

Neglect Credit Analysis Techniques

Develop strong credit analysis skills, including a comprehensive understanding of financial statements, credit scoring, and risk assessment.

- Interpret financial ratios: Learn to analyze financial statements and interpret key financial ratios to assess the creditworthiness of borrowers.

- Identify key credit risks: Develop the ability to identify and evaluate different types of credit risks, including default risk, interest rate risk, and liquidity risk.

- Understand credit scoring models: Gain familiarity with various credit scoring models and their application in the context of private credit lending.

Ignore Industry-Specific Software

Familiarize yourself with industry-specific software used for portfolio management and deal structuring.

- Research popular software: Research the software commonly used by private credit firms and consider obtaining relevant certifications to enhance your skills and marketability.

- Seek training: Many institutions offer training courses on these software programs, enhancing your expertise and making you a more attractive candidate for private credit jobs.

DO: Highlight Relevant Experience and Skills on Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

Tailor Your Resume

Customize your resume for each private credit job application, highlighting the skills and experiences most relevant to the specific role.

- Use keywords: Integrate keywords from the job description to increase the chances of your resume being identified by applicant tracking systems (ATS).

- Quantify your achievements: Whenever possible, quantify your accomplishments using metrics and numbers to demonstrate the impact of your work.

- Focus on accomplishments: Use the action verb method to showcase your accomplishments rather than simply listing your responsibilities.

Craft a Compelling Cover Letter

Your cover letter should demonstrate your passion for private credit and your understanding of the industry.

- Articulate your career goals: Clearly state your career aspirations and explain how your skills and experiences align with the specific role and the firm's culture.

- Showcase your knowledge: Demonstrate your understanding of current market trends and recent events within the private credit industry.

- Highlight your enthusiasm: Express your genuine interest in the specific firm and the role, demonstrating your research and due diligence.

Showcase Relevant Projects

Include details on relevant projects or coursework that showcase your abilities in financial modeling, credit analysis, or deal structuring.

- Quantify your results: Whenever possible, provide quantitative results to demonstrate the impact of your work on the project's success.

- Highlight your contributions: Clearly articulate your specific contributions to the project and how you leveraged your skills to achieve the desired outcomes.

DON'T: Overlook the Importance of Soft Skills

Technical skills are crucial, but soft skills are equally important for success in private credit.

Communication Skills

Excellent communication is essential for building relationships with clients, colleagues, and management.

- Practice clear communication: Develop your ability to communicate clearly and concisely, both verbally and in writing.

- Adapt your communication style: Learn to tailor your communication style to different audiences, ensuring your message is effectively conveyed.

Teamwork and Collaboration

Private credit often involves working in teams, requiring strong collaboration skills.

- Highlight teamwork experiences: Provide examples of successful teamwork experiences in your resume and cover letter, demonstrating your ability to collaborate effectively with others.

- Embrace diverse perspectives: Showcase your ability to work effectively with individuals from diverse backgrounds and perspectives.

Problem-Solving and Analytical Skills

The ability to identify, analyze, and solve complex problems is essential.

- Provide concrete examples: In your interviews, use the STAR method (Situation, Task, Action, Result) to illustrate your problem-solving and analytical skills through concrete examples.

- Show critical thinking: Demonstrate your ability to think critically and analyze complex situations to develop effective solutions.

DO: Prepare Thoroughly for Interviews

Thorough preparation is key to acing your private credit job interviews.

Research the Firm and Interviewers

Thoroughly research the private credit firm and the interviewers to demonstrate your interest and prepare insightful questions.

- Understand their investment strategy: Research the firm's investment strategy, recent deals, and company culture to demonstrate your understanding of their business.

- Use LinkedIn effectively: Use LinkedIn to research the interviewers' background and experience to help you tailor your answers and ask informed questions.

Practice Behavioral Questions

Prepare for behavioral interview questions by using the STAR method (Situation, Task, Action, Result) to structure your answers.

- Use specific examples: Focus on demonstrating your skills and experiences using specific examples that highlight your accomplishments and quantifiable results.

- Practice your delivery: Practice answering common behavioral questions aloud to refine your delivery and ensure your answers are clear and concise.

Prepare Technical Questions

Prepare for technical questions on financial modeling, credit analysis, and valuation techniques.

- Practice case studies: Practice solving case studies and be ready to explain your thought process clearly and concisely.

- Review fundamental concepts: Review fundamental concepts in finance, accounting, and credit analysis to refresh your knowledge and ensure you're prepared for technical questions.

Conclusion

Securing a successful career in private credit jobs demands a strategic and multifaceted approach. By following these dos and don'ts, and focusing on developing your expertise in private debt, alternative credit, and private lending, you significantly increase your chances of landing your dream job. Remember to hone your financial modeling skills, tailor your applications, and prepare thoroughly for interviews. Don't delay; start building your private credit career today!

Featured Posts

-

Lywnardw Dy Kabryw Hl Anthk Qaedt Almwaedt Alkhast Bh

May 13, 2025

Lywnardw Dy Kabryw Hl Anthk Qaedt Almwaedt Alkhast Bh

May 13, 2025 -

Liga Die Angespannte Stimmung In Hannover Drohkulisse Und Derby Ersatz

May 13, 2025

Liga Die Angespannte Stimmung In Hannover Drohkulisse Und Derby Ersatz

May 13, 2025 -

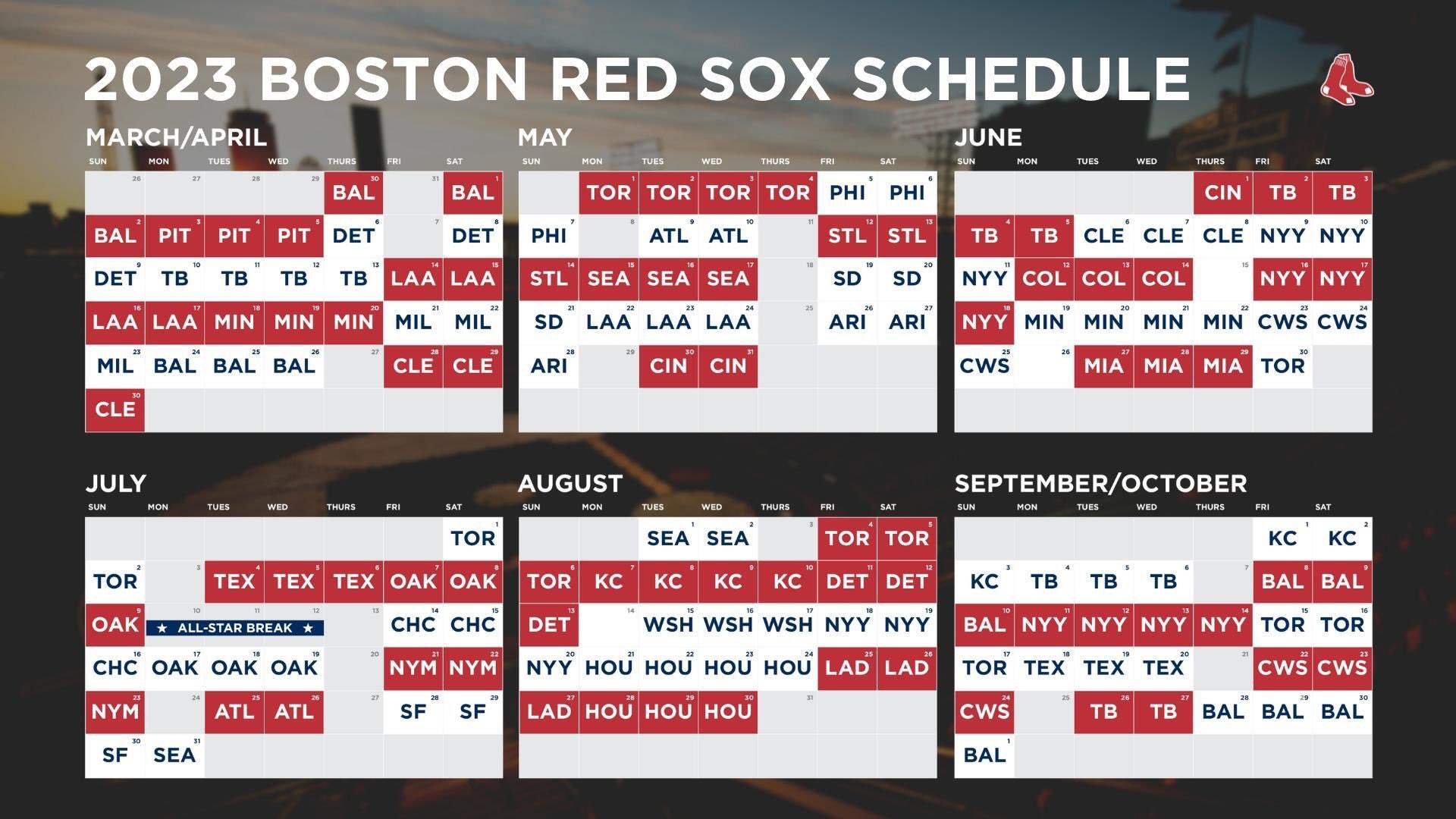

Live Stream Texas Rangers Vs Boston Red Sox Mlb Game Free Access

May 13, 2025

Live Stream Texas Rangers Vs Boston Red Sox Mlb Game Free Access

May 13, 2025 -

The Coronation Street Connection How A Small Role Shaped Sir Ian Mc Kellens Career

May 13, 2025

The Coronation Street Connection How A Small Role Shaped Sir Ian Mc Kellens Career

May 13, 2025 -

Duke Vs Oregon Ncaa Tournament Live Updates And How To Watch

May 13, 2025

Duke Vs Oregon Ncaa Tournament Live Updates And How To Watch

May 13, 2025