Pressure Tactics: Taiwan's Financial Watchdog Investigates ETF Sales Practices

Table of Contents

The FSC's Investigation: Scope and Concerns

The FSC, Taiwan's primary financial market regulator, is responsible for ensuring fair and transparent practices within the financial industry. Their investigation into pressure tactics within the ETF market focuses on allegations of unethical sales behavior by financial advisors and brokerage firms. These allegations include:

- Misrepresentation of risk: Downplaying the inherent risks associated with specific ETFs, leading investors to believe they are less volatile or more profitable than they actually are.

- High-pressure sales calls: Employing aggressive and persistent sales tactics, often during inconvenient times or using manipulative language to coerce investors into making hasty decisions.

- Unsuitable product recommendations: Recommending ETFs that do not align with an investor's risk tolerance, financial goals, or investment timeline, resulting in significant financial losses.

Specific examples of alleged pressure tactics, while not publicly released in detail due to the ongoing investigation, include reports of advisors exaggerating potential returns and neglecting to discuss potential downsides. The FSC has the authority to impose substantial penalties, including hefty fines, license suspensions, and even criminal charges, for those found to have engaged in these illicit practices.

Impact on Investors and Market Confidence

The use of pressure tactics has far-reaching negative consequences for both individual investors and the overall market. Retail investors are particularly vulnerable, potentially suffering substantial financial losses due to unsuitable investments. This erosion of trust can lead to:

- Financial losses: Investors who are pressured into unsuitable investments may experience significant capital losses, potentially impacting their long-term financial security.

- Erosion of trust: The revelation of widespread pressure tactics can severely damage investor confidence in the ETF market and the financial advisory industry as a whole.

- Reduced market participation: Negative publicity and a lack of trust can discourage individuals from investing in ETFs, hindering the growth of the market.

The risks associated with investing in ETFs based on aggressive sales practices are considerable. Investors may be unaware of fees, hidden charges, or the underlying asset's volatility, leading to unexpected losses. Investor education and awareness are therefore crucial in protecting themselves from such exploitative practices.

Regulatory Response and Future Implications

The FSC's response to the allegations is multifaceted and aims to address the root causes of the problem. Planned actions include:

- Stricter regulations: Introducing more stringent rules and guidelines governing the sale of ETFs, particularly concerning disclosure of risks and suitability assessments.

- Increased oversight: Implementing more rigorous monitoring and surveillance of financial advisors and brokerage firms to detect and prevent unethical sales practices.

- Enhanced investor protection measures: Improving mechanisms for investor complaint handling, dispute resolution, and compensation for losses resulting from unethical sales practices.

These regulatory changes will undoubtedly impact the ETF market in Taiwan. Financial advisors and sales professionals must adapt to the new regulations, focusing on ethical and transparent sales practices. The long-term impact will likely be a more regulated, transparent, and ultimately safer market for investors.

Best Practices for Investors: Avoiding Pressure Tactics

Protecting yourself from pressure tactics requires vigilance and informed decision-making. Here's how to avoid becoming a victim:

- Conduct thorough due diligence: Research different ETFs and compare their performance, fees, and risk profiles before making any investment decisions.

- Understand your risk tolerance: Assess your personal risk tolerance and investment goals to ensure the ETFs you consider align with your financial objectives.

- Seek independent financial advice: Consult with an independent financial advisor who can provide unbiased recommendations based on your specific needs and circumstances.

- Never feel pressured: A reputable advisor will never pressure you into making a hasty investment decision. Walk away if you feel uncomfortable or pressured.

For further resources on investor education and protection, visit the FSC website (link to FSC website here).

Protecting Investors from Pressure Tactics in Taiwan's ETF Market

The FSC's investigation into pressure tactics in Taiwan's ETF market reveals a serious breach of trust and highlights the need for greater investor protection. The implications are significant, potentially impacting investor confidence, market stability, and the financial well-being of countless individuals. Ethical sales practices are paramount, and investors must be empowered to make informed decisions without succumbing to undue pressure. Protect yourself from pressure tactics in the ETF market; learn more about investor protection measures and report unethical practices today. Report any instances of unethical sales practices to the FSC to help maintain a fair and transparent ETF investment environment in Taiwan.

Featured Posts

-

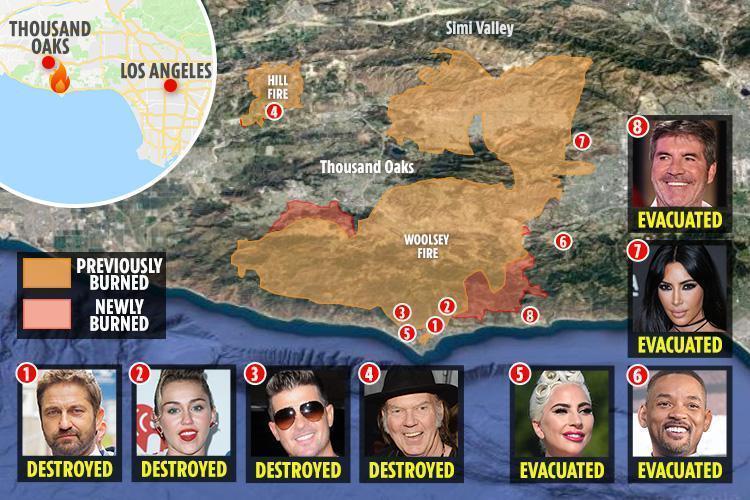

Palisades Fire A List Of Celebrities Who Lost Their Properties

May 16, 2025

Palisades Fire A List Of Celebrities Who Lost Their Properties

May 16, 2025 -

Bigface Discount From Jimmy Butler For Warriors Staff

May 16, 2025

Bigface Discount From Jimmy Butler For Warriors Staff

May 16, 2025 -

Paysandu Vs Bahia Resumen Del Encuentro Y Goles 0 1

May 16, 2025

Paysandu Vs Bahia Resumen Del Encuentro Y Goles 0 1

May 16, 2025 -

How To Watch San Diego Padres Games Without Cable Tv 2025

May 16, 2025

How To Watch San Diego Padres Games Without Cable Tv 2025

May 16, 2025 -

Rockies Visit Padres Home Winning Streak On The Line

May 16, 2025

Rockies Visit Padres Home Winning Streak On The Line

May 16, 2025

Latest Posts

-

Ufc 314 Aftermath Paddy Pimblett Names Ilia Topuria As Top Contender

May 16, 2025

Ufc 314 Aftermath Paddy Pimblett Names Ilia Topuria As Top Contender

May 16, 2025 -

Padres Vs Opponent Pregame Report Arraez Heyward Key To Victory

May 16, 2025

Padres Vs Opponent Pregame Report Arraez Heyward Key To Victory

May 16, 2025 -

Paddy Pimbletts Post Ufc 314 Callout Ilia Topuria At The Top

May 16, 2025

Paddy Pimbletts Post Ufc 314 Callout Ilia Topuria At The Top

May 16, 2025 -

Padres Aim For Sweep Arraez And Heyward In Starting Lineup

May 16, 2025

Padres Aim For Sweep Arraez And Heyward In Starting Lineup

May 16, 2025 -

Ilia Topuria On Paddy Pimbletts Ufc 314 Hit List

May 16, 2025

Ilia Topuria On Paddy Pimbletts Ufc 314 Hit List

May 16, 2025