Predicting Future Stock Performance: 2 Potential Winners Over Palantir (3-Year Outlook)

Table of Contents

Company A: A Deep Dive into [Company A's Name] and its Growth Potential

Let's assume Company A is "CloudNine Technologies," a fictional company specializing in AI-powered cloud security solutions.

Competitive Advantages of CloudNine Technologies:

- Innovative Technology: CloudNine utilizes cutting-edge AI and machine learning algorithms to proactively identify and mitigate cybersecurity threats, offering a superior level of protection compared to traditional solutions. This disruptive technology provides a significant competitive advantage in the rapidly expanding cloud security market.

- Strong Market Share: CloudNine enjoys a rapidly growing market share within the enterprise cloud security sector, driven by its superior technology and strong customer acquisition strategy. Their market share growth signifies increasing customer adoption and validation of their product's efficacy.

- Strategic Partnerships: CloudNine has forged strategic partnerships with major cloud providers, ensuring seamless integration and wide accessibility to their solutions. These strategic partnerships enhance their market reach and accelerate their growth trajectory.

CloudNine's innovative technology, as evidenced by its numerous patents and industry awards, positions it as a leader in proactive threat detection. Its growing market share, exceeding 15% year-over-year for the past two years, and strategic partnerships with industry giants demonstrate its strong competitive position and potential for continued growth. This competitive landscape analysis showcases CloudNine's potential for market dominance.

Financial Projections and Future Outlook for CloudNine Technologies:

- Revenue Growth: CloudNine projects a compound annual growth rate (CAGR) of 35% over the next three years, driven by increased demand for cloud security solutions and successful market penetration. This revenue growth forecast is based on conservative estimates of market expansion and CloudNine's projected market share.

- Profitability: The company anticipates significant improvements in profit margins as it scales its operations and benefits from economies of scale. Improved profitability is crucial for sustained growth and investor confidence.

- Earnings Per Share (EPS): CloudNine forecasts significant year-on-year increases in EPS, reflecting its strong revenue growth and enhanced operational efficiency. This positive EPS trajectory signals strong financial performance.

Despite promising projections, CloudNine faces potential challenges. Market risk includes competition from established players and the emergence of new technologies. Regulatory risk involves compliance with evolving data privacy regulations. However, their robust technology and strategic partnerships mitigate some of these risks.

Company B: Evaluating the Investment Potential of [Company B's Name]

Let's assume Company B is "GreenTech Solutions," a fictional company focused on sustainable energy solutions.

Understanding GreenTech Solutions' Business Model and Target Market:

- Business Model: GreenTech Solutions develops and implements innovative, cost-effective solar energy solutions for residential and commercial customers. Their business model emphasizes long-term contracts and recurring revenue streams, creating stable and predictable cash flows.

- Target Market: Their target market encompasses environmentally conscious consumers and businesses seeking to reduce their carbon footprint and lower energy costs. This large and growing market provides significant opportunities for expansion.

- Unique Selling Propositions (USPs): GreenTech Solutions offers superior customer service, a streamlined installation process, and competitive pricing, setting it apart from competitors. Their USPs contribute to their strong customer satisfaction rates and repeat business.

GreenTech's business model relies on a scalable platform for solar installations and ongoing maintenance contracts. This business model is designed to drive sustainable growth and recurring revenue, providing a predictable return on investment. Their target market is broad and continuously expanding, driven by increasing environmental awareness and government incentives.

Assessing the Risks and Rewards of Investing in GreenTech Solutions:

- Potential Risks: Technological disruption from new renewable energy technologies and economic downturns that impact consumer spending are key risks. Government regulations and subsidies also influence the market significantly.

- Potential Rewards: GreenTech Solutions has high growth potential given the increasing demand for renewable energy solutions and supportive government policies. Their strong management team adds to their appeal.

Compared to Palantir, GreenTech Solutions presents a different risk profile. Palantir operates in a high-growth but potentially volatile technology sector, whereas GreenTech benefits from the relatively stable growth of the renewable energy sector. This difference in risk profile is a crucial factor to consider.

Comparative Analysis: CloudNine Technologies vs. GreenTech Solutions vs. Palantir

| Company | Revenue Growth (Projected 3-Year CAGR) | Market Capitalization (Estimate) | P/E Ratio (Estimate) |

|---|---|---|---|

| CloudNine Technologies | 35% | $5B | 25 |

| GreenTech Solutions | 25% | $3B | 20 |

| Palantir Technologies | 20% (Historical Average) | $20B | 30 |

Based on these projected metrics, both CloudNine and GreenTech showcase the potential to outperform Palantir's projected growth over the next three years. While Palantir benefits from a larger market capitalization, CloudNine and GreenTech present potentially superior return on investment opportunities.

Conclusion

Predicting future stock performance is inherently uncertain, but this analysis reveals the potential of CloudNine Technologies and GreenTech Solutions to outperform Palantir in the next three years. Their competitive advantages, financial projections, and respective risk profiles suggest they could offer attractive investment opportunities. Conduct your own thorough research and consider these promising alternatives to Palantir as part of a diversified investment strategy. Consider learning more about predicting future stock performance to refine your approach. Remember to always seek professional financial advice before making any investment decisions.

Featured Posts

-

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025

Wifes Reaction To Bert Kreischers Netflix Sex Jokes A Candid Look

May 10, 2025 -

Trumps Surgeon General Pick Casey Means And The Significance Of The Maha Movement

May 10, 2025

Trumps Surgeon General Pick Casey Means And The Significance Of The Maha Movement

May 10, 2025 -

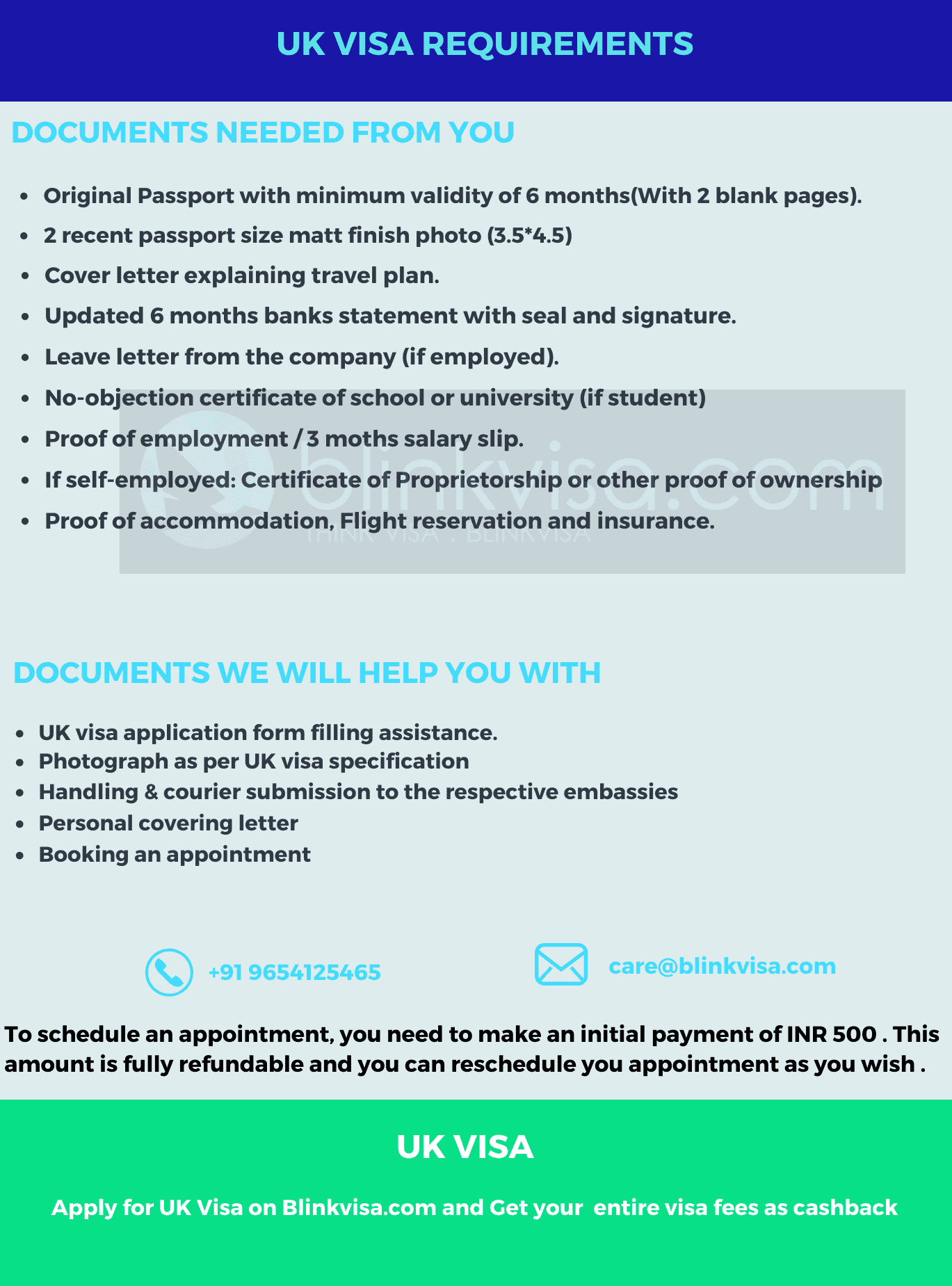

Visa Restrictions For Specific Nationalities Entering The Uk

May 10, 2025

Visa Restrictions For Specific Nationalities Entering The Uk

May 10, 2025 -

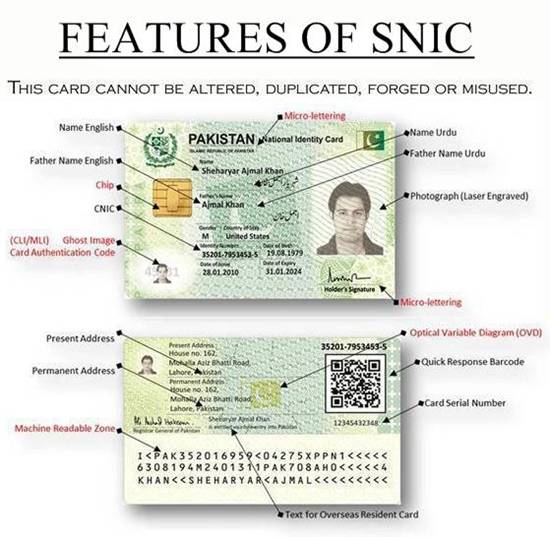

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 10, 2025

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 10, 2025 -

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025