Pre-Market Jump For Live Music Stocks Following Tumultuous Week

Table of Contents

Analysis of the Pre-Market Surge in Live Music Stocks

The pre-market surge saw some live music stocks experience an impressive jump, with certain tickers showing increases exceeding 10%. Specific stocks like LIVE Nation (LYV) and smaller players in the concert promotion space saw significant gains. This unexpected boost in investor confidence begs the question: what drove this positive shift?

Positive Investor Sentiment

Improving concert attendance figures and robust ticket sales are key drivers of this positive sentiment. The sector is showing signs of a strong recovery from pandemic-related setbacks.

- Strong Q3 earnings reports: Several major players in the live music industry reported better-than-expected Q3 earnings, indicating a strong rebound in revenue.

- Successful new tours announced: The announcement of highly anticipated tours by major artists has injected renewed optimism into the market, signaling a robust pipeline of future events.

- Positive industry forecasts: Leading market analysts have issued positive forecasts for the live music industry, projecting continued growth in the coming years. These predictions, based on strong current trends, are bolstering investor confidence.

Economic Factors Contributing to the Rise

The overall economic climate also plays a crucial role. While inflation remains a concern, some signs point towards easing economic anxieties.

- Decreasing inflation rates: A slight decrease in inflation rates suggests that consumers may have more disposable income to allocate towards entertainment.

- Increased consumer confidence: Rising consumer confidence indicates a willingness to spend on experiences like live music concerts.

- Reduced interest rates: Lower interest rates can stimulate economic activity, indirectly benefiting industries such as live music which thrive on consumer spending.

Technological Advancements and Their Impact

Technological innovation is also impacting the live music industry and investor sentiment.

- Successful NFT ticket sales: The increasing adoption of NFTs for ticket sales offers new revenue streams and enhanced fan engagement opportunities.

- Improved artist-fan interaction through social media: Social media platforms are revolutionizing artist-fan interaction, creating a more personalized and engaging experience, leading to increased loyalty and ticket sales.

- Data-driven marketing campaigns: The use of data analytics allows for more targeted and effective marketing campaigns, maximizing ticket sales and revenue.

Lingering Concerns and Potential Risks for Live Music Stocks

Despite the pre-market jump, several concerns remain for investors in live music stocks.

Inflationary Pressures and Ticket Prices

Rising inflation poses a significant challenge. Increased operational costs for venues and rising production costs for artists are putting pressure on ticket prices.

- Consumer resistance to high ticket prices: Consumers may become increasingly resistant to high ticket prices, impacting demand.

- Impact of inflation on operational costs for venues: Increased energy costs, staffing costs, and other operational expenses could squeeze profit margins for venues. This could lead to reduced concert offerings or higher ticket prices.

Competition and Market Saturation

The live music industry is not without its competitive pressures.

- Competition from other entertainment options: Consumers have a wide array of entertainment options to choose from, leading to increased competition for live music events.

- Challenges in attracting younger audiences: Attracting younger audiences who prefer streaming services to live events is a key challenge for the industry. The evolving habits and preferences of younger generations requires a nuanced marketing strategy.

Conclusion

The pre-market jump in live music stocks reflects a confluence of positive factors, including improved concert attendance, strong financial performance by key players, and easing economic anxieties. However, challenges such as inflationary pressures, high ticket prices, and intense competition remain. While the current indicators are positive for live music stocks, investors should proceed with caution.

Call to Action: While the pre-market jump offers exciting prospects for investors, further analysis of live music stocks and the wider economic climate remains crucial. Continue monitoring key market indicators like concert attendance rates, inflation, and economic forecasts, and stay informed about the latest developments in the live music industry before making any investment decisions. Consider diversifying your portfolio and seeking professional financial advice when investing in volatile sectors like live music stocks.

Featured Posts

-

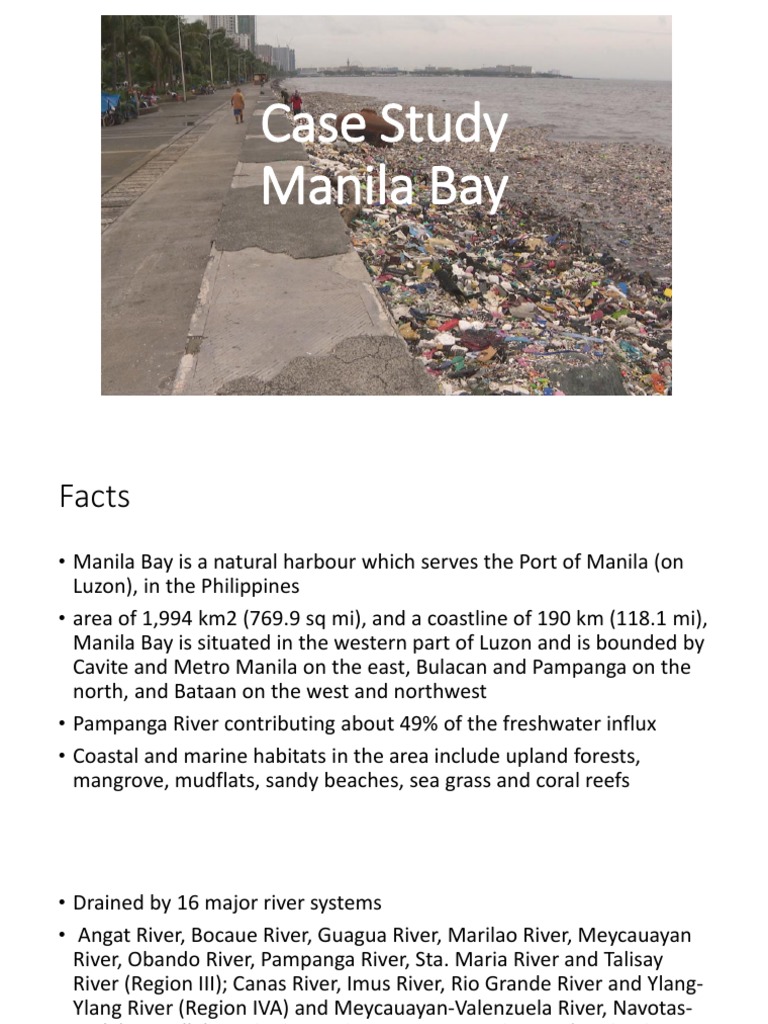

Assessing The Long Term Health Of Manila Bay

May 30, 2025

Assessing The Long Term Health Of Manila Bay

May 30, 2025 -

Glacier Collapse Engulfs Swiss Village One Person Missing

May 30, 2025

Glacier Collapse Engulfs Swiss Village One Person Missing

May 30, 2025 -

Endgames Popular Avenger Reveals They Re Not Returning To The Franchise

May 30, 2025

Endgames Popular Avenger Reveals They Re Not Returning To The Franchise

May 30, 2025 -

The Significance Of Post Credit Scenes A Case Study Of Marvel And Sinner

May 30, 2025

The Significance Of Post Credit Scenes A Case Study Of Marvel And Sinner

May 30, 2025 -

Test Drive Carjacking How To Protect Yourself During A Test Drive

May 30, 2025

Test Drive Carjacking How To Protect Yourself During A Test Drive

May 30, 2025