Pound Gains Momentum After UK Inflation Report: BOE Rate Cut Bets Diminish

Table of Contents

UK Inflation Report Details & Market Reaction

The recently published UK inflation report revealed figures that surprised many analysts. The Consumer Price Index (CPI) rose to [insert actual CPI percentage], exceeding market expectations of [insert expected CPI percentage]. Similarly, the Retail Price Index (RPI) showed [insert actual RPI percentage] inflation, further solidifying the picture of a stronger-than-anticipated inflationary environment. This unexpected surge in inflation directly impacted market sentiment.

The immediate market reaction was a sharp appreciation of the Pound against major global currencies. The Pound surged against the US dollar (USD) and the Euro (EUR), demonstrating the market's confidence in the UK economy's resilience amidst inflationary pressures.

- GBP/USD: Increased by [insert percentage change]

- GBP/EUR: Increased by [insert percentage change]

- Significant Volatility: The currency markets experienced noticeable volatility in the hours following the report's release, with sharp price swings reflecting the uncertainty surrounding the BOE's future actions. [Insert a chart or graph illustrating Pound movement here].

Diminished Expectations of a BOE Rate Cut

Prior to the inflation report, market analysts widely anticipated a potential rate cut by the Bank of England. This expectation was fueled by concerns about slowing economic growth and the potential for a recession. However, the unexpectedly high inflation figures significantly diminished the likelihood of a rate cut in the near term. The BOE, tasked with maintaining price stability, is now more likely to focus on combating inflation, even at the potential cost of slower economic growth.

- Impact on Government Borrowing: Higher interest rates generally increase the cost of government borrowing, impacting the UK's fiscal position.

- Mortgage Rates and Consumer Spending: The possibility of higher interest rates will directly impact mortgage rates, potentially cooling down the housing market and dampening consumer spending.

- Expert Opinions: [Quote relevant expert opinions and analyst forecasts on future interest rate decisions, citing the source].

Impact on UK Economy and Financial Markets

The Pound's strength has broad implications for various sectors of the UK economy. While it makes imports cheaper, it could negatively impact exports by making UK goods more expensive for international buyers. This could particularly affect industries heavily reliant on international trade, such as manufacturing and tourism.

- Impact on UK Businesses: Businesses involved in exporting goods and services may face reduced competitiveness due to the stronger Pound.

- Investor Sentiment: The Pound's appreciation may signal increased investor confidence in the UK economy's long-term prospects.

- Future Pound Movement: The future direction of the Pound will depend on various economic factors, both domestic and global.

Long-Term Outlook for the Pound

While the recent surge in the Pound is positive news, maintaining this momentum remains uncertain. Several factors could influence the Pound's future trajectory, including the ongoing impact of Brexit, global economic growth, and geopolitical developments. The UK economy still faces significant challenges, including high inflation and potential energy supply issues.

- Key Risks: Further inflationary pressures, a global economic slowdown, and unforeseen geopolitical events could negatively impact the Pound's value.

- Potential Scenarios: The Pound could see further appreciation if inflation cools down and economic growth remains robust. Conversely, a global recession or renewed Brexit uncertainties could lead to depreciation.

Conclusion: Pound's Strength and the Road Ahead

In conclusion, the recent UK inflation report has significantly boosted the Pound's value, reducing the likelihood of a BOE rate cut and altering market expectations. The strengthened Pound has wide-ranging implications for the UK economy, affecting various sectors from exports to consumer spending. While the current outlook appears positive, the Pound's future performance depends on a complex interplay of economic and geopolitical factors. Stay tuned for further updates on the Pound and the UK economy as the situation unfolds. Monitor the Pound's movement closely to understand its impact on your financial decisions.

Featured Posts

-

Freddie Flintoff On Horrific Car Crash A Heartbreaking Confession

May 23, 2025

Freddie Flintoff On Horrific Car Crash A Heartbreaking Confession

May 23, 2025 -

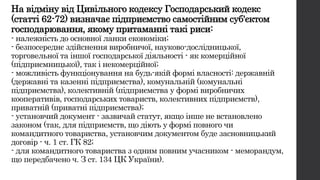

Gospodaryuvannya Bez Storonnikh Tov Z Odnim Uchasnikom

May 23, 2025

Gospodaryuvannya Bez Storonnikh Tov Z Odnim Uchasnikom

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025 -

Crawleys Late Innings Deny Gloucestershire County Victory

May 23, 2025

Crawleys Late Innings Deny Gloucestershire County Victory

May 23, 2025 -

Sorteo Entradas Cb Gran Canaria Unicaja Lista De Ganadores

May 23, 2025

Sorteo Entradas Cb Gran Canaria Unicaja Lista De Ganadores

May 23, 2025

Latest Posts

-

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025

Bbc Radio 1s Big Weekend Full Lineup Featuring Jorja Smith Biffy Clyro And Blossoms

May 24, 2025 -

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Joy Crookes I Know You D Kill Exploring The Themes And Sound

May 24, 2025

Joy Crookes I Know You D Kill Exploring The Themes And Sound

May 24, 2025 -

Listen Now Joy Crookes Unveils Powerful New Single I Know You D Kill

May 24, 2025

Listen Now Joy Crookes Unveils Powerful New Single I Know You D Kill

May 24, 2025 -

Joy Crookes I Know You D Kill A Deep Dive Into The New Song

May 24, 2025

Joy Crookes I Know You D Kill A Deep Dive Into The New Song

May 24, 2025