Posthaste Warning: Significant Threats Emerge In The World's Largest Bond Market

Table of Contents

Rising Inflation and Interest Rate Hikes

Inflation's relentless climb and the subsequent aggressive interest rate hikes by the Federal Reserve are significantly impacting the US Treasury bond market. These actions, while aimed at curbing inflation, create a double-edged sword for bondholders.

- Increased borrowing costs for the US government: Higher interest rates mean the US government faces escalating costs to finance its debt, potentially leading to increased borrowing and further expansion of the national debt.

- Reduced demand for existing bonds, leading to lower prices: As interest rates rise, newly issued bonds offer higher yields, making older bonds with lower yields less attractive. This decreased demand drives down the price of existing bonds.

- Potential for a debt crisis if interest rates rise too rapidly: A sharp increase in interest rates could overwhelm the government's ability to service its debt, potentially triggering a debt crisis with far-reaching global consequences.

- Impact on global markets due to the US Treasury market's significance: The US Treasury market is a benchmark for global bond markets. Its instability directly impacts investor confidence and capital flows worldwide, creating ripple effects throughout the international financial system. This interconnectedness means that instability in the US bond market is not a localized issue; its impact is truly global. Keywords: Inflation, interest rates, bond yields, US government debt, global markets.

Geopolitical Instability and its Ripple Effect

Geopolitical instability significantly impacts investor confidence in US Treasuries, often considered a "safe haven" asset. However, escalating global tensions can quickly erode this perception.

- Flight to safety vs. risk aversion: During periods of geopolitical uncertainty, investors may initially flock to US Treasuries as a safe haven. However, prolonged instability can lead to risk aversion, causing investors to pull out of all markets, including US Treasuries.

- Impact of sanctions and trade wars on market liquidity: Geopolitical events, such as sanctions and trade wars, can restrict capital flows and reduce market liquidity, amplifying volatility within the bond market.

- Increased volatility and uncertainty in the bond market: The uncertainty surrounding geopolitical events creates a volatile environment, making it difficult to predict bond prices and yields, increasing risk for investors.

- Examples of past geopolitical events affecting the bond market: Past crises, such as the 2008 financial crisis and the Russian invasion of Ukraine, demonstrate how geopolitical shocks can significantly impact the bond market, triggering sharp price swings and increased volatility. Keywords: Geopolitical risk, investor confidence, market volatility, US Treasury yields, global uncertainty.

The Growing National Debt and its Sustainability

The ever-expanding US national debt poses a significant threat to the long-term stability of the bond market. The sheer scale of the debt raises serious concerns about its sustainability.

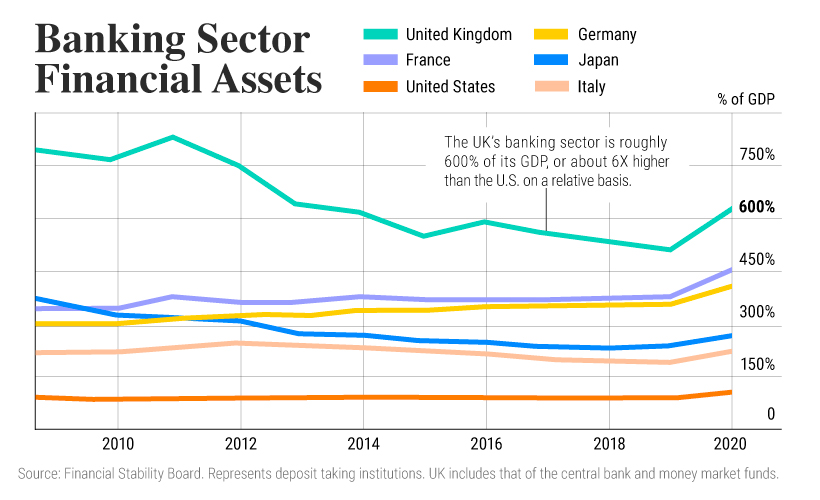

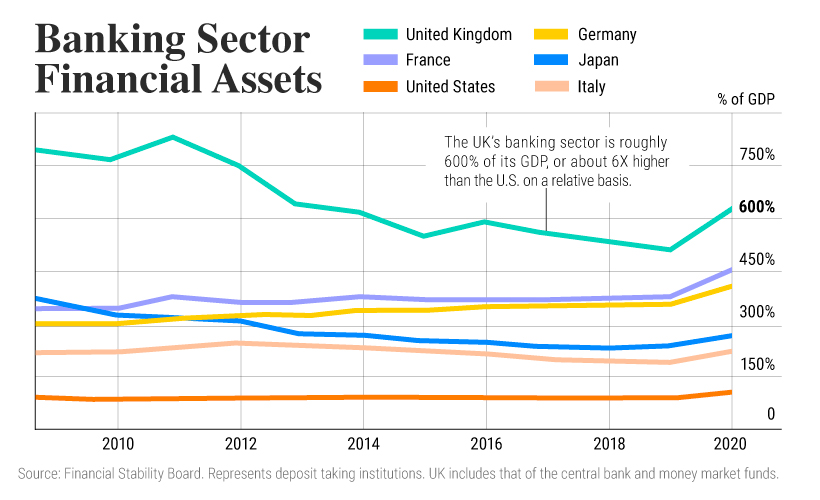

- Increased supply of Treasury bonds to finance the debt: To finance its increasing debt, the US government must issue more Treasury bonds, potentially flooding the market and depressing prices if demand doesn't keep pace.

- Potential for inflation if the debt isn't managed effectively: Uncontrolled debt growth can lead to increased government borrowing and money creation, fueling inflation and eroding the purchasing power of bondholders.

- Credit rating downgrades and their consequences: A credit rating downgrade would signal increased risk associated with US Treasury bonds, potentially leading to higher borrowing costs for the government and reduced investor confidence.

- The role of foreign investors in holding US debt: Foreign investors hold a substantial portion of US debt. A loss of confidence by these investors could trigger a significant sell-off, impacting bond prices and yields. Keywords: US national debt, debt sustainability, credit rating, sovereign debt, fiscal policy.

Technological Disruption and its Influence

The rise of financial technology (fintech) is reshaping the bond market, introducing both opportunities and challenges.

- The rise of algorithmic trading and its effects on volatility: Algorithmic trading can amplify market volatility, particularly during periods of uncertainty, as automated systems react rapidly to changing market conditions.

- Increased competition from alternative investments: The emergence of alternative investments, such as cryptocurrencies and DeFi products, offers investors choices beyond traditional bonds, potentially reducing demand for US Treasuries.

- The impact of decentralized finance (DeFi) on traditional bond markets: Decentralized finance (DeFi) platforms are exploring new ways to issue and trade bonds, potentially disrupting traditional market structures. Keywords: Fintech, algorithmic trading, decentralized finance (DeFi), alternative investments.

Navigating the Threats in the World's Largest Bond Market

In summary, the US Treasury bond market faces significant threats from rising inflation, geopolitical instability, the growing national debt, and the disruptive influence of new technologies. These challenges demand immediate and proactive attention. Understanding the dynamics of the US Treasury bond market is crucial in these turbulent times. Stay informed and proactively manage your investments to mitigate the risks associated with these significant threats to the bond market. Continue researching the US Treasury bond market and subscribe to reputable financial news sources to stay abreast of these critical developments.

Featured Posts

-

Milly Alcocks Supergirl Role In Netflixs Sirens A Cult Thriller

May 23, 2025

Milly Alcocks Supergirl Role In Netflixs Sirens A Cult Thriller

May 23, 2025 -

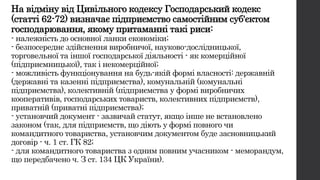

Gospodaryuvannya Bez Storonnikh Tov Z Odnim Uchasnikom

May 23, 2025

Gospodaryuvannya Bez Storonnikh Tov Z Odnim Uchasnikom

May 23, 2025 -

Elena Rybakina Kommentarii O Tekuschey Forme

May 23, 2025

Elena Rybakina Kommentarii O Tekuschey Forme

May 23, 2025 -

Liga Natsiy U Ye Fa 2025 Rezultati Ta Rozklad Matchiv Na 20 03 2025

May 23, 2025

Liga Natsiy U Ye Fa 2025 Rezultati Ta Rozklad Matchiv Na 20 03 2025

May 23, 2025 -

Review The Last Rodeo A Touching Bull Riding Tale

May 23, 2025

Review The Last Rodeo A Touching Bull Riding Tale

May 23, 2025

Latest Posts

-

Joe Jonas Responds To Couples Argument About Him

May 23, 2025

Joe Jonas Responds To Couples Argument About Him

May 23, 2025 -

How Joe Jonas Handled A Couples Fight Over Him

May 23, 2025

How Joe Jonas Handled A Couples Fight Over Him

May 23, 2025 -

Joe Jonas The Unexpected Response To A Couples Fight

May 23, 2025

Joe Jonas The Unexpected Response To A Couples Fight

May 23, 2025 -

The Jonas Brothers How Joe Handled A Couples Argument

May 23, 2025

The Jonas Brothers How Joe Handled A Couples Argument

May 23, 2025 -

Married Couples Fight Over Joe Jonas His Reaction

May 23, 2025

Married Couples Fight Over Joe Jonas His Reaction

May 23, 2025