Posthaste: Deciphering The Recent Tariff Ruling's Impact On Canadian Businesses

Table of Contents

Increased Import Costs and Their Ripple Effect on Canadian Businesses

The new tariff ruling has directly increased import costs for many Canadian businesses, creating a ripple effect throughout the economy. This section explores the specific sectors most heavily impacted and outlines strategies for mitigating these increased costs.

Specific Sectors Heavily Impacted

Several key sectors of the Canadian economy are facing significant challenges due to increased import costs resulting from the tariff ruling. These include:

- Manufacturing: Increased costs for raw materials like steel and aluminum are significantly impacting manufacturing output and profitability. This leads to higher prices for finished goods, potentially reducing competitiveness.

- Automotive: The automotive sector, heavily reliant on imported parts and components, faces substantial increases in production costs. This could lead to reduced vehicle production and higher prices for consumers.

- Agriculture: Farmers relying on imported fertilizers, machinery, and other inputs will see a direct impact on their operating costs, potentially affecting food prices and agricultural exports.

These increased costs for raw materials and intermediate goods are directly translating into higher prices for consumers. The cumulative effect across various industries could lead to a noticeable increase in the cost of living and reduced consumer spending.

Strategies for Mitigating Increased Import Costs

Canadian businesses need to proactively implement strategies to counter the effects of increased import costs. Some key approaches include:

- Sourcing alternative suppliers: Exploring international markets beyond those impacted by the tariffs can help diversify supply chains and reduce reliance on single sources.

- Negotiating with existing suppliers: Stronger relationships with existing suppliers may allow for more favorable pricing agreements or extended payment terms.

- Government assistance programs: The Canadian government offers various programs designed to support businesses facing trade challenges. Businesses should explore these options for potential financial assistance or tax incentives.

- Vertical integration: For some businesses, exploring vertical integration – taking control of a greater portion of the supply chain – may be a viable long-term solution to reduce reliance on external suppliers and mitigate tariff impacts.

- Hedging strategies: Implementing hedging strategies to mitigate currency risk is crucial for businesses involved in international trade. This can help to stabilize costs and protect profit margins.

Export Challenges Arising from Retaliatory Tariffs

The tariff ruling has not only increased import costs but also triggered retaliatory tariffs from other countries, creating significant challenges for Canadian exporters.

Potential for Reduced Export Demand

Retaliatory tariffs imposed by trading partners can significantly reduce demand for Canadian exports. This is particularly concerning for sectors that are already facing competitive pressures.

- Forest products: Increased tariffs on lumber and other wood products could lead to a loss of market share in key export markets.

- Agricultural products: Retaliatory tariffs on Canadian agricultural exports, such as wheat or canola, could severely impact the profitability of Canadian farmers and agri-businesses.

- Manufacturing goods: Various manufactured goods could face similar challenges, leading to reduced export volume and revenue for Canadian companies.

These reduced export demands can lead to significant losses in market share, potentially harming the long-term competitiveness of Canadian industries.

Strategies for Maintaining Export Competitiveness

Canadian businesses need to adapt and implement strategies to maintain their export competitiveness in the face of retaliatory tariffs. This includes:

- Diversification of export markets: Reducing reliance on single export markets by exploring new trading partners is crucial to mitigate risk.

- Improving product quality and competitiveness: Focusing on innovation and improving product quality can help Canadian businesses maintain their competitive edge in global markets.

- Government support and trade promotion: Leveraging government support programs and actively participating in trade promotion initiatives can help Canadian companies access new markets and navigate trade barriers.

The Long-Term Implications for the Canadian Economy

The long-term implications of the tariff ruling extend beyond individual businesses and reach the Canadian economy as a whole.

Impact on GDP Growth and Employment

The increased import costs and export challenges are likely to have a negative impact on Canada's GDP growth.

- Short-term effects: Reduced consumer spending and business investment could lead to slower economic growth in the short term.

- Long-term effects: Sustained higher prices and reduced competitiveness could hinder long-term economic growth and productivity.

- Employment implications: Job losses or shifts in employment sectors are possible, particularly in industries heavily impacted by the tariff increases.

- Inflationary pressures: The cumulative impact of higher import costs could lead to inflationary pressures, further complicating the economic outlook.

Government Response and Policy Implications

The Canadian government will likely play a key role in mitigating the negative impacts of the tariff ruling. This may include:

- New trade negotiations: Renegotiating trade agreements and seeking to resolve the underlying trade disputes will be crucial.

- Government support programs: Expanding or adapting existing support programs to better address the needs of businesses affected by the tariffs.

- Policy changes: Adjustments to trade policy or domestic policies may be necessary to support Canadian businesses and minimize the negative economic impacts. The effectiveness of these measures will be crucial in determining the long-term resilience of the Canadian economy.

Conclusion

This article has explored the far-reaching consequences of the recent tariff ruling on Canadian businesses, highlighting the increased import costs, export challenges, and potential long-term economic implications. Understanding these impacts is crucial for proactive adaptation. Canadian businesses must act posthaste to assess their vulnerability to these new tariffs and implement appropriate mitigation strategies. Staying informed about ongoing developments in trade policy and exploring available government support programs are essential for navigating this challenging environment. Don't wait—understand the impact of this tariff ruling and take steps to protect your business today. Proactive planning and swift action are key to mitigating the negative impacts of this tariff ruling and ensuring the long-term health and prosperity of Canadian businesses.

Featured Posts

-

Autissier Ce Qui M Interesse C Est De Faire Avec Les Autres Entretien Exclusif

May 31, 2025

Autissier Ce Qui M Interesse C Est De Faire Avec Les Autres Entretien Exclusif

May 31, 2025 -

Giro D Italia 2025 Final Stage Through Vatican City Honors Pope Francis

May 31, 2025

Giro D Italia 2025 Final Stage Through Vatican City Honors Pope Francis

May 31, 2025 -

Prince Died On March 26th The Impact Of Fentanyl

May 31, 2025

Prince Died On March 26th The Impact Of Fentanyl

May 31, 2025 -

Todays Nyt Mini Crossword Answers March 18 2025

May 31, 2025

Todays Nyt Mini Crossword Answers March 18 2025

May 31, 2025 -

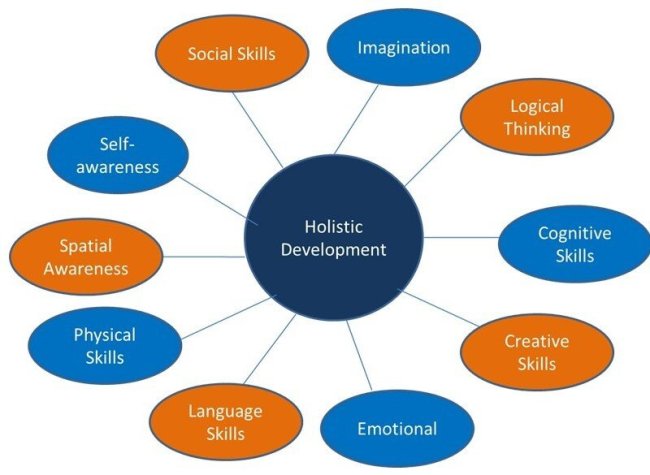

Understanding The Good Life A Holistic Approach

May 31, 2025

Understanding The Good Life A Holistic Approach

May 31, 2025