Podcast: Ride The Low Inflation Wave Before It Breaks

Table of Contents

Low inflation presents a unique economic window of opportunity. But how long will it last? This podcast, "Ride the Low Inflation Wave Before It Breaks," explores the current low inflation landscape, offering savvy listeners strategies to maximize their financial gains before potential shifts in the market. We'll delve into investment strategies, budgeting techniques, and essential economic indicators to help you ride the wave and secure your financial future.

Understanding the Current Low Inflation Environment

Low inflation, generally defined as a sustained period of slow price increases, presents both challenges and opportunities. Currently, many developed economies are experiencing a period of relatively low inflation. Understanding the contributing factors is key to leveraging this environment effectively.

-

Consumer Price Index (CPI): The CPI, a primary measure of inflation, tracks the average change in prices paid by urban consumers for a basket of consumer goods and services. Currently, the CPI reflects a low inflation rate, indicating relatively stable prices. However, it's crucial to monitor CPI trends closely for any signs of change.

-

Causes of Low Inflation: Several factors contribute to the current low-inflation environment. These include:

- Supply chain improvements: Increased efficiency and globalization have helped reduce production costs.

- Decreased demand: In some sectors, reduced consumer demand can keep prices in check.

- Technological advancements: Automation and innovation often lead to lower production costs.

- Global economic factors: Global economic conditions, including interest rates and currency exchange rates, significantly influence inflation rates.

-

Historical Context: Comparing current inflation rates with historical data provides valuable context. Analyzing periods of low inflation in the past can offer insights into their duration and potential consequences.

Investment Strategies During Low Inflation

Navigating investments during low inflation requires a strategic approach. Traditional investment strategies may need adjustments to maximize returns in this unique climate.

-

Stocks: While stocks can still offer growth potential during low inflation, it's crucial to carefully select companies with strong earnings growth potential and sustainable competitive advantages. Low inflation often means lower interest rates, potentially boosting stock valuations.

-

Bonds: Bonds typically perform less well during periods of low inflation, as their fixed income may not keep pace with modest price increases. However, high-quality bonds can still provide stability and diversification within a portfolio.

-

Real Estate: Real estate investments can be attractive during low inflation, especially if rental income is factored in. However, property values can be sensitive to interest rate changes.

-

Alternative Investments: Diversification into alternative assets, like commodities or precious metals, might be considered, as these assets often act as inflation hedges. However, these investments can be more volatile.

-

Diversification: A well-diversified portfolio is essential during periods of low inflation to mitigate risks and seize opportunities across various asset classes.

Budgeting and Saving Strategies in a Low Inflation Climate

Low inflation presents an excellent opportunity to bolster your financial health through effective budgeting and saving.

-

Boosting Savings: Low inflation translates to increased purchasing power. This allows for greater savings and accelerated debt reduction.

-

Aggressive Debt Reduction: Low interest rates, often associated with low inflation, make it more economical to pay down high-interest debt. This can significantly improve your financial position.

-

Smart Budgeting: Create a detailed budget to track income and expenses. Identify areas where you can reduce spending and allocate more towards savings or investments.

-

Long-Term Financial Planning: Even during periods of low inflation, it's critical to have a long-term financial plan that addresses retirement goals, education expenses, and other significant life events.

Identifying Potential Risks and Preparing for Inflationary Shifts

While low inflation presents opportunities, it's vital to anticipate potential shifts in the market and prepare accordingly.

-

Monitoring Economic Indicators: Closely monitor key economic indicators like CPI, interest rates, and employment data for signs of potential inflationary pressures. These signals can provide early warnings.

-

Mitigation Strategies: Develop strategies to mitigate the risks associated with rising inflation. This might involve adjusting your investment portfolio to include inflation-hedging assets.

-

Flexible Financial Plan: A flexible financial plan is crucial for adapting to economic changes. Your budget and investment strategy should be dynamic to accommodate shifts in the market.

-

Diversification (again!): Maintaining a well-diversified investment portfolio helps cushion against the negative impact of unexpected inflationary increases.

Conclusion

This podcast explored the current low-inflation environment, offering insights into strategic investment opportunities, effective budgeting techniques, and risk mitigation strategies. Riding the low inflation wave requires understanding the economic landscape and adopting a proactive financial approach. Don't miss out on the benefits of this unique economic climate. Listen to our full podcast, "Ride the Low Inflation Wave Before It Breaks," for a comprehensive guide to navigating these times and securing your financial future. Learn how to effectively manage your finances during low inflation and prepare for potential shifts in the market. Listen now!

Featured Posts

-

10 000 Sfht Mn Sjlat Aghtyal Rwbrt Kynydy Tunshr Ma Aldhy Tkshfh

May 27, 2025

10 000 Sfht Mn Sjlat Aghtyal Rwbrt Kynydy Tunshr Ma Aldhy Tkshfh

May 27, 2025 -

Bandits Prepare For Crucial Home Game Against Omaha Beef

May 27, 2025

Bandits Prepare For Crucial Home Game Against Omaha Beef

May 27, 2025 -

Laso Chlef Usma Victoire Eclatante A Alger Pour Laso Chlef

May 27, 2025

Laso Chlef Usma Victoire Eclatante A Alger Pour Laso Chlef

May 27, 2025 -

Eminems Shocking Gwen Stefani Line The Full Explanation

May 27, 2025

Eminems Shocking Gwen Stefani Line The Full Explanation

May 27, 2025 -

Renee Rapps Topless Video A Bold Move

May 27, 2025

Renee Rapps Topless Video A Bold Move

May 27, 2025

Latest Posts

-

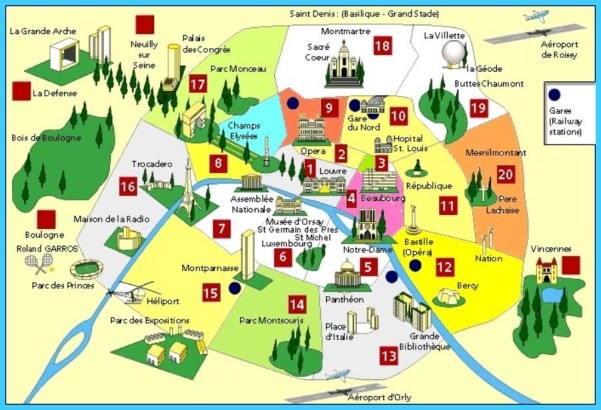

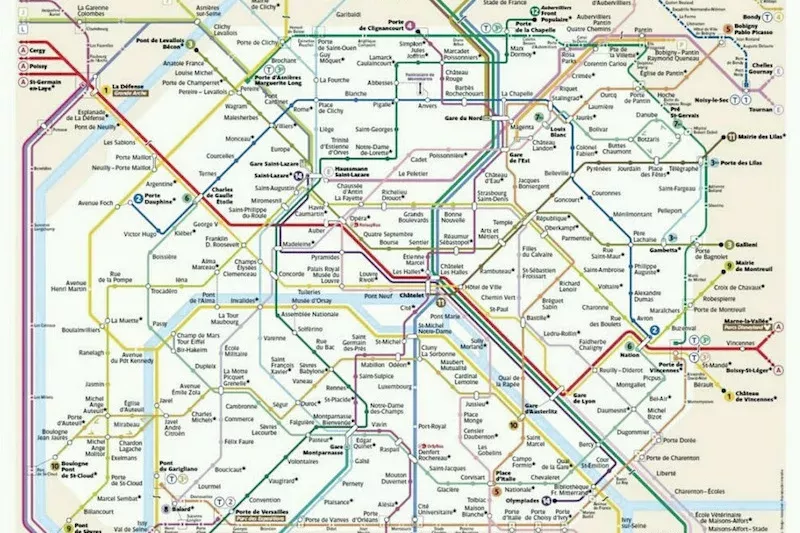

Exploring Paris A Guide To Its Finest Neighborhoods

May 30, 2025

Exploring Paris A Guide To Its Finest Neighborhoods

May 30, 2025 -

Discover The Best Areas To Stay In Paris

May 30, 2025

Discover The Best Areas To Stay In Paris

May 30, 2025 -

Paris Neighborhood Guide Expert Recommendations

May 30, 2025

Paris Neighborhood Guide Expert Recommendations

May 30, 2025 -

Top Paris Neighborhoods An Insiders Review

May 30, 2025

Top Paris Neighborhoods An Insiders Review

May 30, 2025 -

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025

The Best Neighborhoods In Paris A Locals Perspective

May 30, 2025