Podcast: Low Inflation: A Podcast On Making The Most Of Current Economic Conditions

Table of Contents

- Understanding the Implications of Low Inflation

- Defining Low Inflation and its Causes

- The Impact of Low Inflation on Savings and Investments

- Strategic Financial Planning in a Low-Inflation Environment

- Budgeting and Debt Management

- Investing for Growth and Long-Term Security

- Opportunities Presented by Low Inflation

- Increased Purchasing Power

- Strategic Spending and Long-Term Planning

- Conclusion

Understanding the Implications of Low Inflation

Defining Low Inflation and its Causes

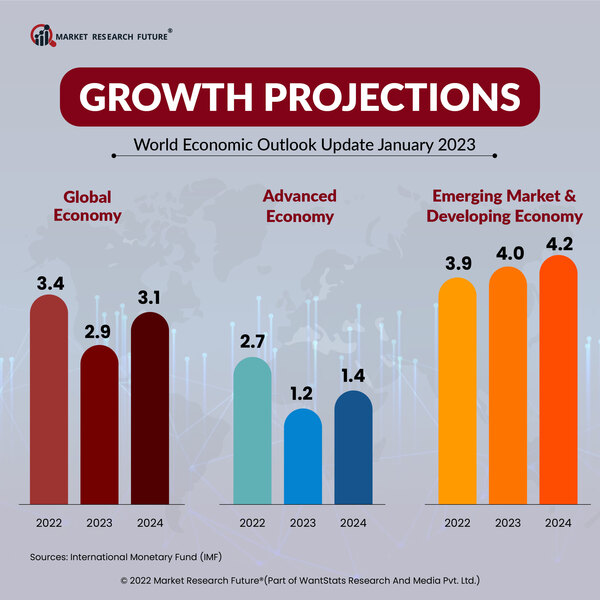

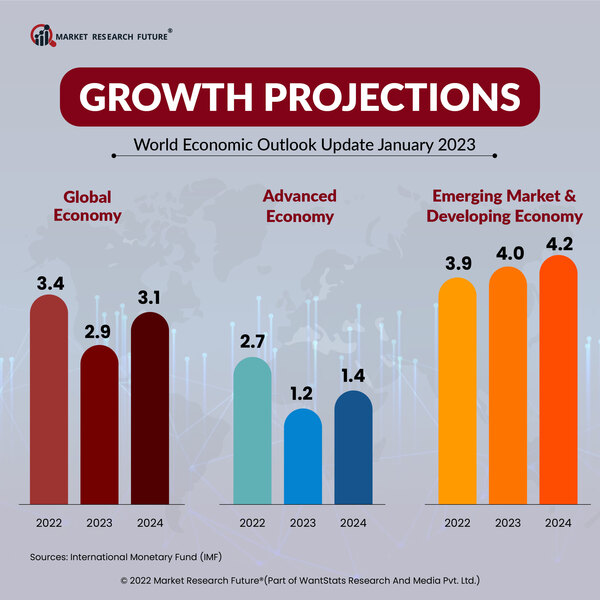

Low inflation is generally defined as a Consumer Price Index (CPI) increase below 2% annually. This signifies a slow and steady rise in the overall price of goods and services. Several factors contribute to low inflation. Decreased consumer demand, resulting from economic uncertainty or shifts in consumer behavior, can suppress price increases. Technological advancements, particularly in manufacturing and automation, can drive down production costs, leading to lower prices. Global economic factors, such as increased competition or decreased commodity prices, also play a significant role.

- Examples of low-inflation scenarios: Japan's prolonged period of deflation, the Eurozone's experience with near-zero inflation in recent years.

- Comparison to historical inflation rates: Comparing current low inflation rates to historical highs helps illustrate the current economic climate and its implications for financial planning. Understanding this historical context is crucial for making informed decisions.

The Impact of Low Inflation on Savings and Investments

Low inflation directly impacts the purchasing power of your savings. While your savings may grow at a certain rate, their real value – their purchasing power – increases slowly or even declines if the inflation rate is negative (deflation). This presents challenges for investors aiming for high returns, as traditional investment strategies may yield lower real returns.

- Strategies for optimizing savings in a low-inflation economy: Consider high-yield savings accounts, money market accounts, or short-term certificates of deposit (CDs) for slightly better returns than traditional savings accounts. Explore inflation-protected securities like TIPS (Treasury Inflation-Protected Securities).

- Investment options to consider: Diversify your portfolio across various asset classes, including stocks, bonds, and real estate. Look for investments with the potential for growth that outpaces inflation.

Strategic Financial Planning in a Low-Inflation Environment

Budgeting and Debt Management

Creating a detailed budget is paramount during periods of low inflation. Tracking your income and expenses helps identify areas where you can reduce spending and allocate funds more effectively. Effective debt management is crucial; strategies like refinancing loans to lower interest rates can significantly impact your financial health.

- Tips for reducing expenses: Identify non-essential expenses and look for ways to cut back. Utilize budgeting apps to track spending habits and gain insights into your financial behavior.

- Debt consolidation strategies: Explore debt consolidation loans to simplify payments and potentially secure a lower interest rate. Negotiate with creditors to reduce your debt burden.

Investing for Growth and Long-Term Security

Investing remains crucial even in a low-inflation environment. Diversification is key; spreading your investments across various asset classes reduces risk. Consider stocks, bonds, real estate, and potentially alternative investments like commodities or precious metals. Your investment strategy should align with your risk tolerance and long-term financial goals.

- Diversification strategies: Allocate your investments across different asset classes, sectors, and geographic regions. Consider using a mix of growth and income-oriented investments.

- Risk tolerance assessment: Before investing, assess your risk tolerance. Are you comfortable with potentially higher risk for potentially higher returns, or do you prefer a more conservative approach prioritizing capital preservation?

- Long-term investment planning: Develop a long-term investment plan that aligns with your retirement goals and other financial objectives. Regularly review and adjust your investment strategy based on changing economic conditions.

Opportunities Presented by Low Inflation

Increased Purchasing Power

Low inflation means your money goes further. Your purchasing power increases, allowing you to buy more goods and services with the same amount of money. This is a significant advantage, particularly for larger purchases.

- Examples of purchases that benefit from low inflation: Buying a house, a car, or investing in major home improvements can become more affordable during periods of low inflation.

- Saving money on everyday expenses: Stable prices on everyday goods allow for better budgeting and long-term savings.

Strategic Spending and Long-Term Planning

Low inflation provides an excellent opportunity for strategic long-term planning. With stable prices, you can plan major purchases and investments with greater certainty. This allows you to focus on achieving your long-term financial goals, such as retirement or homeownership.

- Examples of long-term goals and how to plan for them effectively: Setting clear financial goals, developing a detailed savings plan, and utilizing investment vehicles suitable for long-term growth are crucial for maximizing the benefits of low inflation.

Conclusion

This article provides a comprehensive guide to understanding and navigating the challenges and opportunities presented by low inflation. By strategically planning your budget, managing debt effectively, and diversifying your investments, you can significantly enhance your financial well-being in this economic climate. Remember, proactive financial management is key to making the most of low inflation.

Call to Action: Listen to our podcast, "Navigating Low Inflation: Smart Strategies for Economic Success," to gain actionable insights and learn how to successfully manage your finances during periods of low inflation. Develop your low-inflation strategy today! Don't let low inflation limit your financial growth – learn how to make it work for you.

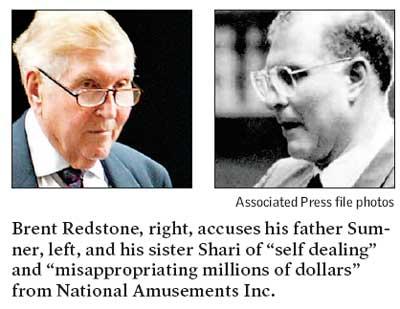

The Redstone Family Feud A Legacy Of Conflict And Control

The Redstone Family Feud A Legacy Of Conflict And Control

Ataque A Policiais Bandidos Rompem Cerco E Abrem Fogo

Ataque A Policiais Bandidos Rompem Cerco E Abrem Fogo

Blue Book Exams A Necessary Evil Or A Valuable Tool

Blue Book Exams A Necessary Evil Or A Valuable Tool

Unite Du Ps Bouamrane Face A Faure Au Congres

Unite Du Ps Bouamrane Face A Faure Au Congres

Uproxx Music 20 An Exclusive Interview With Simone Joy Jones

Uproxx Music 20 An Exclusive Interview With Simone Joy Jones