Podcast: Challenge Your Money Beliefs

Table of Contents

Identifying Your Limiting Money Beliefs

Our relationship with money is deeply rooted in our past experiences and societal conditioning. Understanding these roots is the first step in challenging your money beliefs and achieving financial abundance.

Recognizing the root of your financial anxieties.

Negative money beliefs often stem from various sources:

- Childhood experiences: Witnessing financial struggles or receiving negative messages about money during childhood can profoundly impact our adult financial behavior.

- Societal conditioning: Media portrayals and cultural narratives often perpetuate limiting beliefs about money, such as the idea that money is evil or that only the wealthy are successful.

- Negative self-talk: Inner critics can fuel self-doubt and sabotage financial progress. Phrases like "I'm not good with money" become self-fulfilling prophecies.

- Comparison to others: Constantly comparing your financial situation to others can lead to feelings of inadequacy and discontent, hindering progress.

- Fear of failure: The fear of making financial mistakes can paralyze action and prevent you from taking necessary steps towards your financial goals.

These experiences shape our perceptions of money, leading to limiting beliefs that manifest in various ways. For example, the belief "Money is the root of all evil" might lead to avoidance of financial planning or philanthropy, while "I'm not good with money" could manifest as impulsive spending and debt accumulation.

Common Limiting Beliefs & Their Impact

Several common limiting beliefs significantly impact financial well-being:

- Scarcity mindset: The belief that there's never enough money leads to anxiety, hoarding behavior, and missed opportunities.

- Fear of debt: While responsible debt management is crucial, an excessive fear of debt can prevent necessary borrowing for investments or education.

- Money equals happiness (or the opposite): Both extremes – believing money is the ultimate source of happiness or that pursuing money is inherently wrong – can be detrimental.

- Perfectionism in financial planning: The pursuit of a flawless financial plan can lead to procrastination and inaction.

These beliefs often result in unhealthy financial behaviors. For example, a scarcity mindset might lead to overspending to compensate for perceived lack, while the fear of debt could cause avoidance of investments with potentially high returns.

Journaling exercise to uncover hidden beliefs

To identify your unique money beliefs, dedicate some time to journaling. Consider these prompts:

- What are my earliest memories related to money?

- What messages about money did I receive from my family or society?

- What are my biggest financial fears?

- What are my current beliefs about money?

- What are my most significant financial successes and failures? What did I learn from each?

Reflecting on these questions can uncover deeply ingrained beliefs that are impacting your financial life.

Reframing Your Money Mindset

Overcoming limiting money beliefs requires actively reframing your money mindset. This involves shifting from scarcity to abundance and cultivating a more positive and empowering relationship with money.

Shifting from scarcity to abundance

Embrace an abundance mindset by:

- Practicing gratitude: Focusing on what you already have fosters a sense of appreciation and contentment.

- Utilizing visualization techniques: Imagine yourself achieving your financial goals to build confidence and motivation.

- Using affirmations: Repeat positive statements about your financial capabilities daily.

- Focusing on value creation: Focus on providing value to others, which can lead to increased financial opportunities.

Positive self-talk and replacing negative thoughts

Challenge negative self-talk related to money by:

- Employing cognitive reframing: Identify and reframe negative thoughts into more positive and realistic ones. For example, replace "I'm terrible with money" with "I am learning to manage my finances effectively."

- Challenging negative thoughts: Actively question the validity of negative beliefs. Are they based on facts or assumptions?

- Practicing self-compassion: Treat yourself with kindness and understanding, acknowledging that setbacks are part of the learning process.

Positive affirmations, such as "I am financially secure and abundant," can reinforce a more positive self-image and financial confidence.

Learning from successful money management strategies

Adopt healthier financial habits by:

- Creating a budget: Track your income and expenses to understand your spending patterns.

- Investing wisely: Explore various investment options to grow your wealth.

- Saving regularly: Develop a savings plan to secure your financial future.

- Managing debt effectively: Create a debt reduction plan to minimize interest payments.

- Planning for the future: Set financial goals and develop a plan to achieve them.

Taking Action to Achieve Your Financial Goals

Identifying and reframing your money beliefs is just the first step. Translating this awareness into action is crucial for achieving your financial goals.

Setting SMART financial goals

Set goals that are:

- Specific: Clearly define what you want to achieve.

- Measurable: Establish quantifiable metrics to track progress.

- Achievable: Set realistic goals that you can realistically accomplish.

- Relevant: Ensure your goals align with your values and overall life objectives.

- Time-bound: Set deadlines to maintain focus and motivation.

For example, instead of "get rich," aim for "save $10,000 for a down payment on a house within two years."

Creating an actionable financial plan

Develop a personalized financial plan that includes:

- Budgeting templates: Utilize budgeting apps or spreadsheets to track your income and expenses.

- Investment strategies: Research and select investment options suitable for your risk tolerance and financial goals.

- Debt reduction plans: Develop a strategy to pay down high-interest debts efficiently.

This plan should provide a roadmap to achieving your financial goals, outlining specific steps and timelines.

Seeking professional financial guidance

Consider seeking professional help from:

- Financial advisors: Receive personalized advice on investments, retirement planning, and wealth management.

- Money coaches: Gain support and guidance to improve your financial habits and mindset.

- Credit counselors: Obtain assistance with debt management and credit repair.

Professional guidance can provide valuable support and expertise in navigating complex financial matters.

Conclusion

This podcast explored the power of challenging your money beliefs and reframing your money mindset to unlock your financial potential. By identifying limiting beliefs, cultivating an abundance mindset, and taking concrete actions, you can achieve lasting financial freedom. Understanding and challenging your money beliefs is the cornerstone of building a healthy financial future.

Call to Action: Ready to challenge your money beliefs and embark on a journey towards financial freedom? Listen to the full podcast now, and start building a healthier relationship with money! Learn more about [link to podcast/website] and start your journey to financial abundance. Remember, challenging your money beliefs is the first step towards a more prosperous future.

Featured Posts

-

Broadcoms Extreme Price Hike On V Mware At And T Faces 1 050 Cost Increase

May 31, 2025

Broadcoms Extreme Price Hike On V Mware At And T Faces 1 050 Cost Increase

May 31, 2025 -

Analysis The Spain Blackout And The Implications For Grid Management

May 31, 2025

Analysis The Spain Blackout And The Implications For Grid Management

May 31, 2025 -

Bannatyne Health Club Essex New Padel Court Plans Revealed

May 31, 2025

Bannatyne Health Club Essex New Padel Court Plans Revealed

May 31, 2025 -

Ingleby Barwicks Bannatyne Spa New Padel Courts Construction

May 31, 2025

Ingleby Barwicks Bannatyne Spa New Padel Courts Construction

May 31, 2025 -

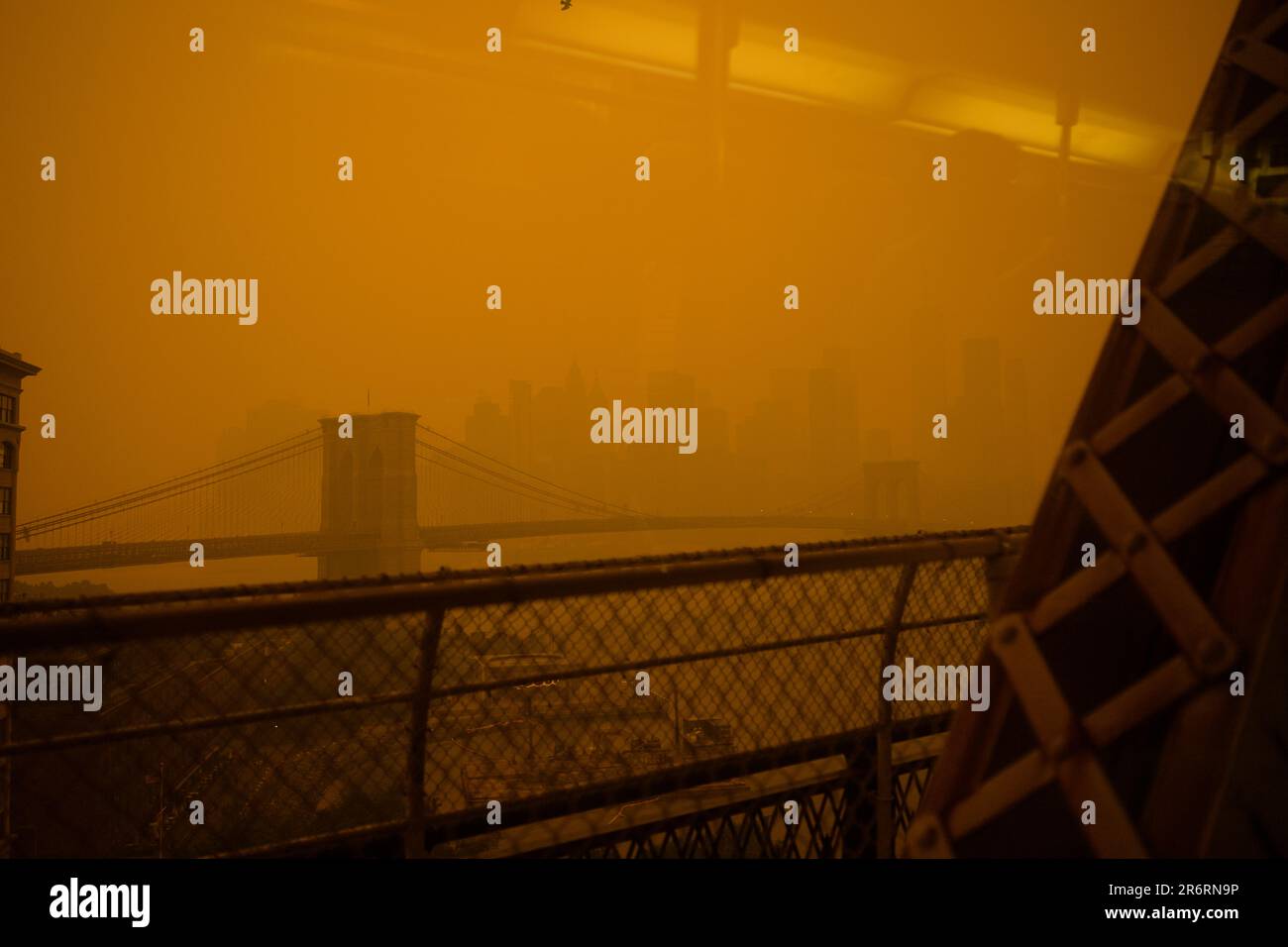

Canadian Wildfires Cause Dangerous Air Quality In Minnesota

May 31, 2025

Canadian Wildfires Cause Dangerous Air Quality In Minnesota

May 31, 2025