Pharmaceutical M&A: How Recordati In Italy Navigates Tariff Volatility

Table of Contents

Recordati's M&A Strategy in a Turbulent Landscape

Understanding Recordati's Business Model and Acquisition Targets

Recordati is a leading Italian pharmaceutical company specializing in the development, manufacturing, and marketing of pharmaceutical products. Its core business focuses on branded specialty pharmaceuticals, concentrating on specific therapeutic areas with high unmet medical needs. Recordati's acquisition targets typically involve companies with complementary product portfolios, often specializing in areas like cardiology, endocrinology, and gastroenterology. Its geographic focus spans Europe and beyond, exposing it to a diverse range of tariff regimes and potential trade barriers.

- Specific therapeutic areas Recordati focuses on: Cardiology, endocrinology, gastroenterology, and other areas with high unmet medical needs.

- Geographic regions where Recordati operates and potential tariff impacts: Europe (particularly Italy, where its headquarters are located), other regions in the European Union, as well as selected regions globally. Tariff fluctuations in these regions significantly affect import/export costs.

- Types of companies Recordati typically acquires: Smaller pharmaceutical companies with established products, promising drug candidates in late-stage development, or those with strong market positions in specific geographic areas.

Proactive Tariff Risk Assessment and Mitigation

Recordati employs a robust due diligence process to assess potential tariff risks before initiating any M&A activity. This involves a comprehensive analysis of the target company's supply chains, import/export regulations, and potential trade barriers impacting its products. The company uses this information to develop specific mitigation strategies, such as diversifying sourcing, establishing strategic partnerships, and employing hedging strategies against currency fluctuations.

- Key steps in Recordati's due diligence process for tariff risk assessment: Comprehensive analysis of supply chains, detailed review of import/export documentation, assessment of potential regulatory changes, and expert consultations.

- Specific mitigation strategies (e.g., hedging, diversification, alternative sourcing): Recordati likely uses a combination of currency hedging strategies to offset currency exchange rate risks, diversifies sourcing of raw materials and finished goods to reduce dependence on specific regions, and may actively seek strategic partnerships to secure access to markets and bypass potential trade barriers.

- Examples of successful risk mitigation from past acquisitions: While specific examples are usually confidential, successful mitigation would demonstrate a reduced financial impact from unexpected tariff increases on acquired product lines following a merger or acquisition.

Adapting to Changing Regulatory Environments

The pharmaceutical industry faces frequent changes in regulations and trade policies. Recordati demonstrates a strong capacity to adapt to these evolving environments. This includes monitoring changes in tariffs and trade agreements, participating in industry associations to influence policy, and engaging in proactive lobbying efforts to navigate regulatory hurdles.

- Examples of regulatory changes that have impacted Recordati’s M&A activity: Changes to import/export regulations within the EU, new trade agreements affecting specific regions, and evolving healthcare policies in different countries.

- Specific strategies employed to navigate regulatory hurdles: Proactive engagement with regulatory authorities, utilizing legal expertise to navigate complex regulations, and incorporating regulatory compliance into M&A due diligence processes.

- Recordati’s engagement with industry bodies and policymakers: Participating in relevant industry associations, engaging in lobbying activities to influence beneficial trade policies, and actively monitoring regulatory changes.

Financial Implications and Long-Term Strategy

Impact of Tariff Volatility on Financial Performance

Tariff fluctuations directly influence Recordati's financial performance, impacting both its M&A activities and its overall profitability. The company incorporates tariff uncertainty into its financial projections and carefully assesses the potential impact on pricing strategies and investment decisions.

- Examples of how tariffs have affected specific acquisitions: Increased tariffs on imported raw materials could affect the profitability of products from an acquired company.

- How Recordati incorporates tariff risk into its financial models: Contingency planning, sensitivity analysis (testing the impact of varying tariff levels), and scenario planning for different trade scenarios are likely used.

- Impact on profitability and investment decisions: Higher tariffs can lead to reduced profitability, potentially affecting investment decisions related to future acquisitions or product development.

Recordati's Long-Term Vision and Future M&A Plans

Recordati's long-term vision involves continued growth in the pharmaceutical market, carefully considering the complexities of tariff volatility. Their future M&A plans will likely prioritize acquisitions that minimize tariff-related risks while maximizing synergistic benefits.

- Recordati’s long-term growth strategies in the pharmaceutical market: Continued expansion through strategic acquisitions, leveraging its expertise in specific therapeutic areas, and focusing on innovative products.

- How their M&A strategy adapts to changing global trade dynamics: Diversification of supply chains, a focus on companies with strong regional presence, and strategic partnerships to mitigate risks.

- Potential future acquisitions and their strategic significance: Acquisitions will likely focus on consolidating market share in existing therapeutic areas, entering new therapeutic markets strategically, or expanding into new geographic regions while proactively mitigating risks posed by tariffs.

Conclusion: Successfully Navigating Pharmaceutical M&A in a World of Tariff Volatility: Lessons from Recordati

Recordati's success in navigating the complexities of pharmaceutical M&A in a volatile tariff environment highlights the importance of proactive risk assessment, strategic mitigation, and adaptability. Their robust due diligence process, focus on diversification, and engagement with regulatory bodies serve as a valuable model for other pharmaceutical companies. By learning from Recordati's experience, pharmaceutical companies can better position themselves for successful mergers and acquisitions, even amidst the uncertainties of global trade. To learn more about navigating the challenges of Pharmaceutical M&A and developing robust strategies for mitigating tariff volatility in your own organization, consider consulting experts in international trade and M&A within the pharmaceutical industry. Effective mergers and acquisitions require expert guidance in today’s complex global market.

Featured Posts

-

Swysra Rqm Qyasy Jdyd Ltnawl Tbq Alraklyt

Apr 30, 2025

Swysra Rqm Qyasy Jdyd Ltnawl Tbq Alraklyt

Apr 30, 2025 -

Dzilijan Anderson Nova Elegancija U Retro Izdanju

Apr 30, 2025

Dzilijan Anderson Nova Elegancija U Retro Izdanju

Apr 30, 2025 -

Upcoming Tariff Price Hikes Retailers Warning To Consumers

Apr 30, 2025

Upcoming Tariff Price Hikes Retailers Warning To Consumers

Apr 30, 2025 -

Ipo

Apr 30, 2025

Ipo

Apr 30, 2025 -

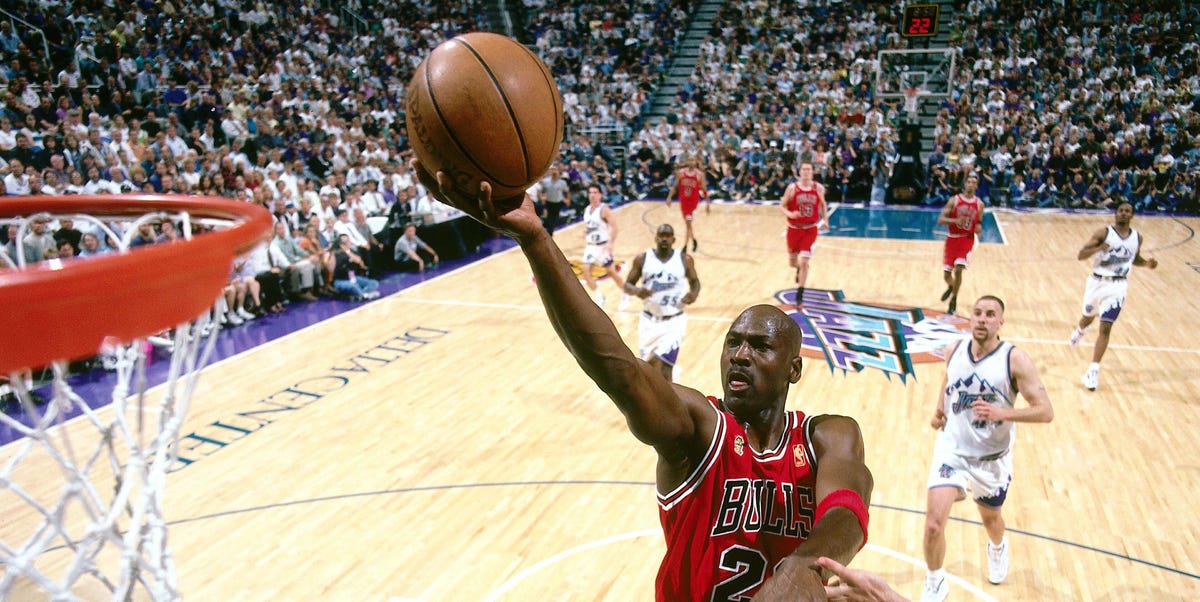

Essential Michael Jordan Fast Facts For Basketball Fans

Apr 30, 2025

Essential Michael Jordan Fast Facts For Basketball Fans

Apr 30, 2025