PFC Dividend 2025: March 12th Announcement - What To Expect

Table of Contents

Historical PFC Dividend Analysis

Understanding the past is key to predicting the future. Let's analyze the historical PFC dividend payouts to identify patterns and trends relevant to the upcoming March 12th announcement.

Past Dividend Trends

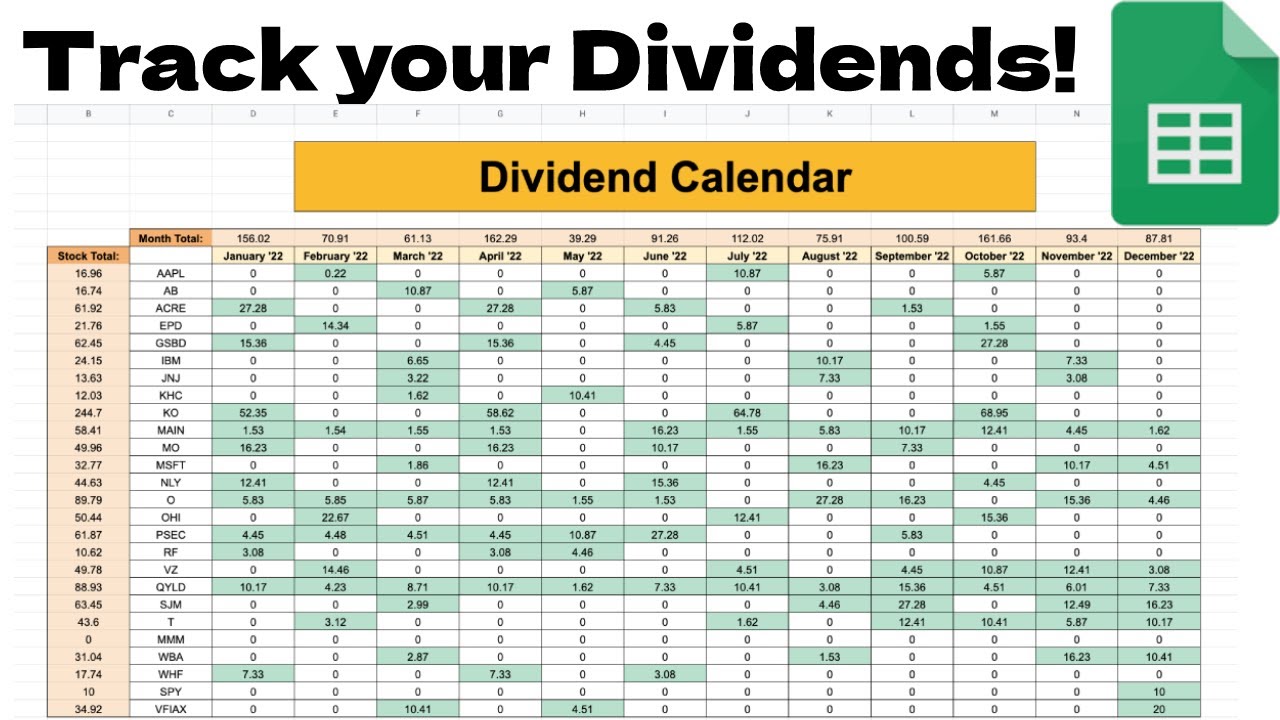

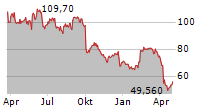

Examining the PFC dividend history over the last 5-10 years reveals valuable insights. The following chart illustrates the annual PFC dividend payouts:

[Insert Chart/Graph Here showing PFC dividend payouts over the last 5-10 years. Clearly label axes and include a source if data is from an external source.]

- Average annual dividend growth rate: (Insert calculated average annual growth rate here. For example: "Over the past decade, the average annual dividend growth rate has been approximately 5%.")

- Years with dividend increases/decreases and reasons behind them: (Explain years with significant changes, citing company press releases or financial reports as sources. For example: "In 2022, a slight decrease in the dividend was attributed to increased capital expenditure in new technologies.")

- Impact of market conditions on past dividend payouts: (Discuss how economic downturns or market volatility affected past dividend decisions. For example: "During the 2008 financial crisis, the PFC dividend remained relatively stable, demonstrating the company's resilience.")

Factors Influencing Past Dividend Decisions

Several key factors have historically influenced PFC's dividend policy:

- Company performance and earnings per share (EPS): Stronger EPS generally translates to higher dividend payouts.

- Capital expenditure plans: Significant investments in new projects might temporarily reduce dividend payouts.

- Share buyback programs: If the company repurchases its own shares, it might reduce funds available for dividends.

- Regulatory environment: Changes in tax laws or other regulations can impact dividend decisions.

Predicting the PFC Dividend for 2025

Predicting the PFC Dividend 2025 requires analyzing current financial performance and considering potential external factors.

Analyzing Current Financial Performance

To forecast a potential dividend amount, we need to assess PFC's current financial health:

- Recent quarterly earnings reports: (Summarize key data from recent reports, including revenue growth, profit margins, and net income. Cite the source of this data.)

- Analyst predictions for future performance: (Mention any reputable analyst forecasts and their predicted impact on the PFC dividend.)

- Comparison to industry peers: (Compare PFC's financial performance and dividend payout ratios to its competitors in the same industry.)

Considering External Factors

External factors can significantly influence the dividend announcement:

- Inflationary pressures: High inflation might constrain the company's ability to increase dividends.

- Global economic outlook: A recessionary environment could lead to a more conservative dividend policy.

- Competition within the industry: Intense competition might reduce profitability, affecting dividend payouts.

Strategies for PFC Shareholders

Preparing for and reacting to the PFC Dividend 2025 announcement requires a thoughtful strategy.

Preparing for the Announcement

Before March 12th, PFC shareholders should:

- Review personal financial goals: Align your dividend expectations with your overall financial plan.

- Understanding tax implications of dividend income: Factor tax implications into your investment strategy.

- Setting realistic expectations: Don't rely solely on speculation; base your expectations on sound financial analysis.

Post-Announcement Strategies

How you react to the announcement will depend on the actual dividend payout:

- Strategies for reinvesting dividends: Consider reinvesting dividends back into PFC shares or other investments.

- Adjusting investment portfolios based on the announcement: Rebalance your portfolio based on the dividend and your overall investment goals.

- Seeking professional financial advice: Consult a financial advisor for personalized guidance.

Conclusion

The March 12th announcement of the PFC Dividend 2025 is a crucial event for all PFC shareholders. By thoroughly analyzing historical trends, current financial performance, and potential external influences, you can formulate informed expectations about your PFC investment. Remember to carefully review your investment strategy and consider seeking professional financial advice. Stay informed and monitor the news closely for the official PFC dividend announcement. Don't miss out – stay updated on all things related to the PFC Dividend 2025! Make sure you're prepared for the PFC Dividend 2025 announcement on March 12th!

Featured Posts

-

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025 -

Accor Reports Shifting Travel Trends Favor Canada Over The United States

Apr 27, 2025

Accor Reports Shifting Travel Trends Favor Canada Over The United States

Apr 27, 2025 -

Offenlegung Nach Wp Hg 40 Abs 1 Pne Ag Veroeffentlicht Eqs Pvr

Apr 27, 2025

Offenlegung Nach Wp Hg 40 Abs 1 Pne Ag Veroeffentlicht Eqs Pvr

Apr 27, 2025 -

Offenlegung Gemaess Wp Hg Pne Ag Nutzt Eqs Pvr Fuer Europaweite Veroeffentlichung

Apr 27, 2025

Offenlegung Gemaess Wp Hg Pne Ag Nutzt Eqs Pvr Fuer Europaweite Veroeffentlichung

Apr 27, 2025 -

Turning Poop Into Podcast Gold How Ai Digests Repetitive Scatological Documents

Apr 27, 2025

Turning Poop Into Podcast Gold How Ai Digests Repetitive Scatological Documents

Apr 27, 2025

Latest Posts

-

Attorney General Highlights Fake Fentanyl Threat

May 10, 2025

Attorney General Highlights Fake Fentanyl Threat

May 10, 2025 -

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

High Potential The Impressive Season 1 Finale And Its Implications For The Future

May 10, 2025

High Potential The Impressive Season 1 Finale And Its Implications For The Future

May 10, 2025 -

High Potentials Bold Finale Why Abc Must Have Been Impressed

May 10, 2025

High Potentials Bold Finale Why Abc Must Have Been Impressed

May 10, 2025 -

Reaction Video Pam Bondis Laughter Amid Epstein Files Debate

May 10, 2025

Reaction Video Pam Bondis Laughter Amid Epstein Files Debate

May 10, 2025