Personal Loans For Bad Credit: Up To $5000 With Direct Lenders

Table of Contents

Understanding Personal Loans for Bad Credit

What constitutes "bad credit"? Generally, a credit score below 670 is considered bad, impacting your eligibility for favorable loan terms. This means you'll likely face higher interest rates on a personal loan compared to someone with excellent credit. Understanding this is crucial before you begin your search for a $5000 loan.

It's important to differentiate between direct lenders and third-party brokers. Direct lenders are financial institutions that provide loans directly to borrowers, while brokers act as intermediaries, connecting borrowers with multiple lenders. Using a direct lender often means faster processing times and avoids paying broker fees.

- Factors Affecting Interest Rates: Your credit score is the biggest factor. The loan amount and loan term also play significant roles; larger loans and longer terms typically result in higher interest rates.

- Comparison Shopping is Key: Always compare interest rates and fees from several direct lenders before committing to a loan. A small difference in interest can save you hundreds, or even thousands, of dollars over the life of the loan.

- Beware of Debt Traps: High-interest loans can quickly become overwhelming if not managed carefully. Understand the total cost of borrowing before signing any agreement.

Finding Direct Lenders for $5000 Loans with Bad Credit

Finding reputable direct lenders offering $5000 loans for bad credit requires thorough research. Leverage online resources to compare lenders, read reviews, and check credentials. Avoid lenders with hidden fees or predatory practices. The advantages of going directly to the source are numerous: you cut out the middleman, potentially saving money on fees and experiencing faster processing times for your loan application.

Improving your chances of approval is possible. Consider securing a co-signer with good credit. A co-signer shares responsibility for repayment, reducing the lender's risk.

- Online Resources: Use comparison websites, online reviews (such as Trustpilot or Yelp), and the Better Business Bureau to research direct lenders.

- Essential Questions: Before applying, ask lenders about their interest rates, fees, repayment terms, and any prepayment penalties.

- Verify Legitimacy: Check the lender's licensing and registration to ensure they are operating legally and ethically.

The Application Process: Steps to Secure Your Loan

Applying for a personal loan with a direct lender is typically done online. The process involves completing an application form and providing necessary documentation. Accuracy is paramount; incorrect information can delay or even deny your application. The processing time varies depending on the lender and the complexity of your application, but expect it to take anywhere from a few days to a couple of weeks.

- Required Documents: Prepare documents like proof of income (pay stubs, tax returns), valid ID, and bank statements.

- Application Tips: Complete the application forms accurately and thoroughly. Provide all requested documentation promptly.

- Understand the Terms: Carefully review the loan agreement before signing, ensuring you understand all terms and conditions.

Managing Your Personal Loan Responsibly

Responsible loan repayment is crucial to avoid damaging your credit further. Create a realistic budget that includes your loan payment. Set up automatic payments through online banking to ensure timely repayments. Missing payments can lead to late fees and negatively impact your credit score. If you encounter difficulties, contact your lender immediately to discuss potential options like debt consolidation or alternative repayment plans.

- Budgeting is Essential: Allocate a specific amount from your monthly budget for loan repayment.

- Automate Payments: Utilize online banking tools to automatically deduct your loan payment each month.

- Proactive Communication: If you anticipate problems making payments, contact your lender promptly to discuss solutions.

Securing Your Future with Personal Loans for Bad Credit

Securing a personal loan with bad credit is achievable by working with reputable direct lenders. Remember, responsible borrowing and repayment are key. Thorough research, careful comparison shopping, and proactive communication with your lender will significantly improve your chances of success. Start your search for a personal loan for bad credit up to $5000 with a direct lender today! Don't let your credit score hold you back from achieving your financial goals. Finding the right $5000 personal loan for bad credit doesn't have to be daunting; take control of your financial future.

Featured Posts

-

Corbin Burnes Injury How It Affects The Nl West Race

May 28, 2025

Corbin Burnes Injury How It Affects The Nl West Race

May 28, 2025 -

Man Utd Star Criticised For Clumsy Error Elephant Touch Incident

May 28, 2025

Man Utd Star Criticised For Clumsy Error Elephant Touch Incident

May 28, 2025 -

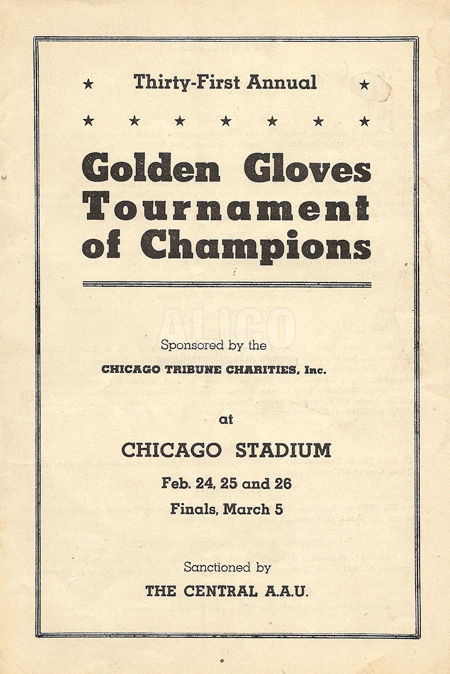

Cassius Clays Golden Gloves Victory A Chicago Landmark

May 28, 2025

Cassius Clays Golden Gloves Victory A Chicago Landmark

May 28, 2025 -

Wawali Balikpapan Taman Kota Baru Di Setiap Kecamatan

May 28, 2025

Wawali Balikpapan Taman Kota Baru Di Setiap Kecamatan

May 28, 2025 -

Fenerbahcelileri Heyecanlandiran Ronaldo Goeruentueleri Portekiz Kampindan Suerpriz

May 28, 2025

Fenerbahcelileri Heyecanlandiran Ronaldo Goeruentueleri Portekiz Kampindan Suerpriz

May 28, 2025

Latest Posts

-

Plires Programma Tileoptikon Metadoseon Gia To Savvato 10 5

May 30, 2025

Plires Programma Tileoptikon Metadoseon Gia To Savvato 10 5

May 30, 2025 -

Ti Na Deite Stin Tileorasi Tin Kyriaki 11 5

May 30, 2025

Ti Na Deite Stin Tileorasi Tin Kyriaki 11 5

May 30, 2025 -

Savvatiatikes Tileoptikes Ekpompes 10 Maioy Olokliromenos Odigos

May 30, 2025

Savvatiatikes Tileoptikes Ekpompes 10 Maioy Olokliromenos Odigos

May 30, 2025 -

Tileoptiko Programma Kyriaki 11 Maioy

May 30, 2025

Tileoptiko Programma Kyriaki 11 Maioy

May 30, 2025 -

Odigos Tileorasis Gia Tin Kyriaki 11 5

May 30, 2025

Odigos Tileorasis Gia Tin Kyriaki 11 5

May 30, 2025