Personal Loan Interest Rates Today: Find Your Lowest Rate

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several factors significantly impact the personal loan interest rates you'll qualify for. Understanding these allows you to improve your chances of securing a lower rate.

Your Credit Score: The Foundation of Your Rate

Your credit score is the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – your ability to repay the loan. A higher credit score translates to lower interest rates, reflecting lower risk to the lender.

- Excellent credit (750+): Expect the lowest personal loan rates, often in the range of 6-10% APR.

- Good credit (700-749): You'll likely qualify for rates between 10-15% APR.

- Fair credit (650-699): Rates will be considerably higher, potentially ranging from 15-25% APR or more.

- Poor credit (<650): Securing a personal loan might be difficult, and if approved, rates could exceed 25% APR. You might need to explore secured loans or consider credit building options first.

Your credit report, compiled by the three major credit bureaus (Equifax, Experian, and TransUnion), forms the basis of your credit score. Check your reports regularly for errors and take steps to improve your score before applying for a loan. This can significantly impact your chances of getting a low interest personal loan.

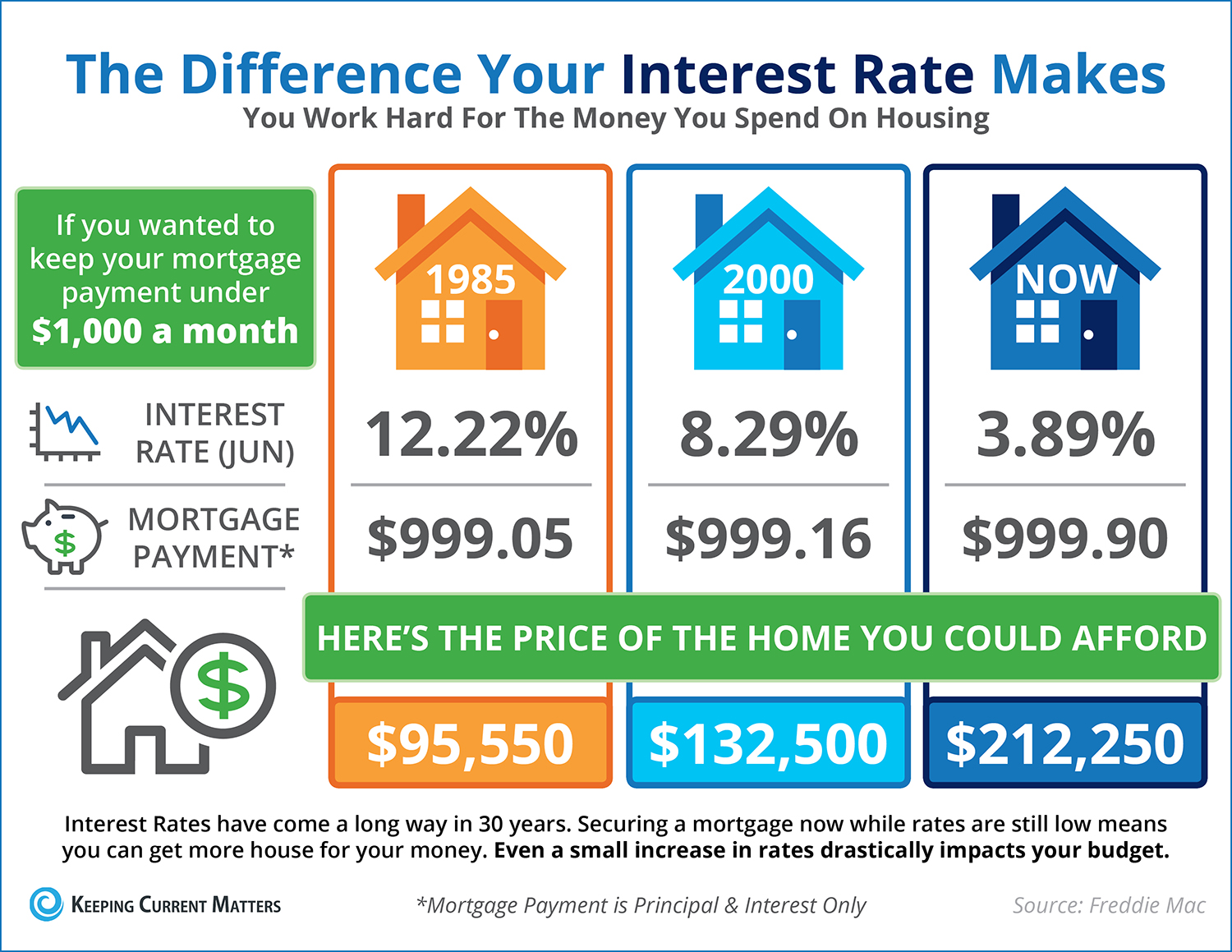

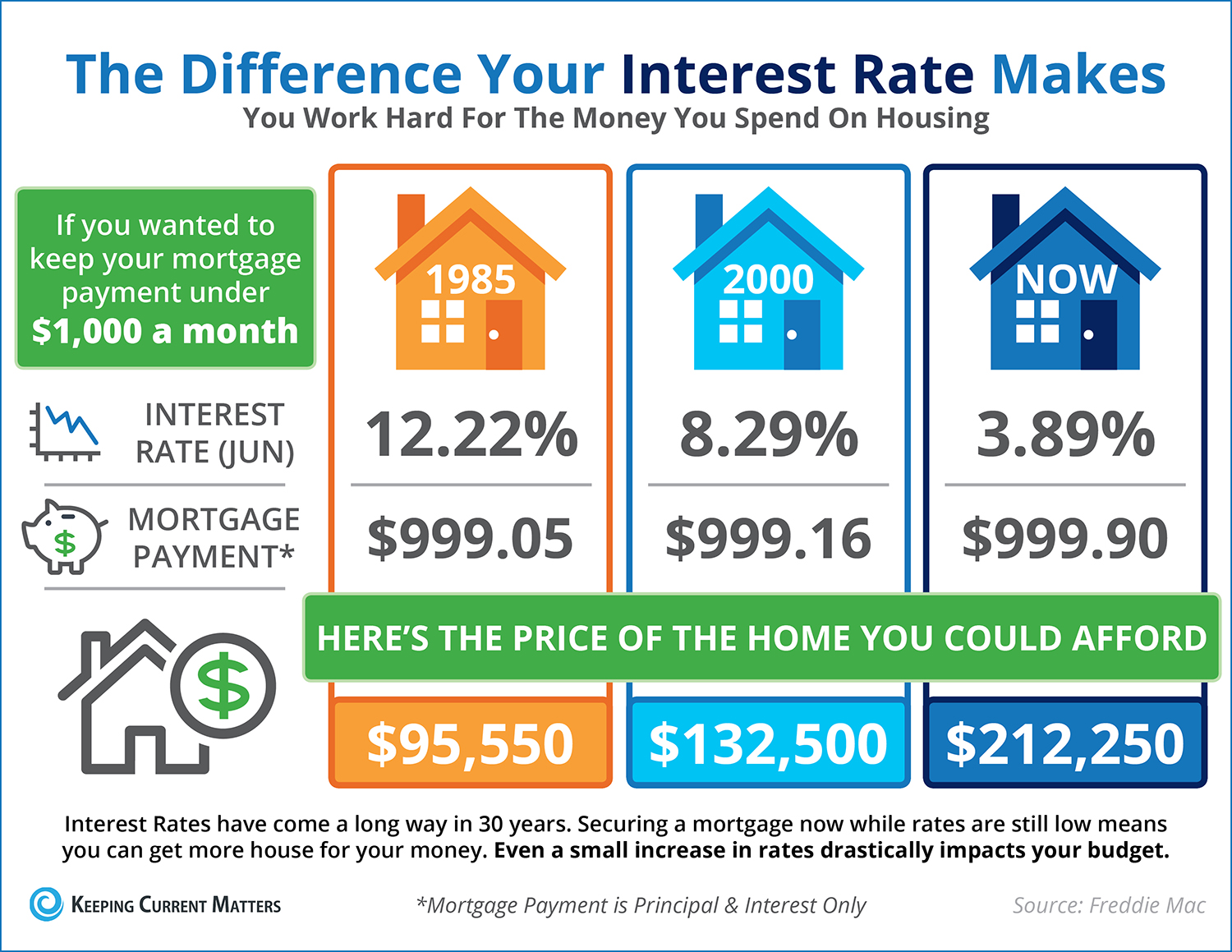

Loan Amount and Term: Balancing Payments and Total Cost

The amount you borrow and the loan term (repayment period) both influence your interest rate. Larger loan amounts and longer terms generally lead to higher interest rates due to increased risk for lenders.

- Example: A $10,000 loan over 3 years might have a lower interest rate than a $20,000 loan over 5 years.

However, longer terms result in lower monthly payments but higher total interest paid over the life of the loan. Carefully weigh the trade-offs between affordability and the overall cost of borrowing.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying personal loan interest rates.

- Banks: Often offer competitive rates, particularly for customers with excellent credit histories. However, they might have stricter approval requirements.

- Credit Unions: May offer lower rates than banks, especially for members, but their loan amounts and terms might be more limited.

- Online Lenders: Provide convenience and speed, often with a wider range of loan options. However, carefully compare rates and fees, as they can sometimes be higher than traditional lenders.

Comparing rates across different lender types is essential to finding the best deal.

Debt-to-Income Ratio (DTI): A Key Financial Indicator

Your debt-to-income ratio (DTI) – the percentage of your monthly income dedicated to debt payments – significantly impacts loan approval and interest rates. A lower DTI demonstrates better financial stability, leading to more favorable loan terms.

- DTI Calculation: Total monthly debt payments / Gross monthly income.

- Improving DTI: Reducing existing debts, increasing your income, or both, can lower your DTI and improve your chances of securing a low interest personal loan.

How to Find the Lowest Personal Loan Interest Rates

Finding the best personal loan interest rates requires proactive steps.

Compare Rates from Multiple Lenders

Shopping around is crucial. Don't settle for the first offer you receive.

- Use online resources: Many websites provide personal loan rate comparison tools.

- Check multiple lenders: Compare offers from banks, credit unions, and online lenders to find the most competitive rates.

Check for Pre-qualification Offers

Pre-qualification checks your eligibility without impacting your credit score significantly. This lets you compare multiple offers before formally applying.

- Pre-qualification vs. Formal Application: Pre-qualification provides a rate estimate; a formal application involves a hard credit pull and determines final approval.

- Compare pre-qualification offers: Use this information to negotiate better terms with lenders.

Negotiate the Interest Rate

Don't be afraid to negotiate with lenders. A strong credit score, competing offers, and excellent communication can often result in a lower interest rate.

Consider Secured vs. Unsecured Loans

Secured loans (using collateral like a car or savings account) usually offer lower interest rates than unsecured loans. However, consider the risks involved in using collateral.

Understanding the Fine Print: APR, Fees, and Repayment Terms

Before committing to a loan, carefully review all details.

APR (Annual Percentage Rate): The True Cost of Borrowing

The APR reflects the total cost of the loan, including interest and fees. A higher APR means a more expensive loan.

Fees and Charges

Be aware of various fees: origination fees, late payment fees, prepayment penalties, etc. These can significantly impact your total cost.

Repayment Terms

Carefully review the repayment schedule, including the loan term, monthly payments, and due dates.

Conclusion

Finding the lowest personal loan interest rates requires thorough research and comparison. By understanding the factors influencing rates and using the strategies outlined above, you'll improve your chances of securing a favorable loan. Don't settle for the first offer; compare rates from multiple lenders and negotiate for the best terms. Start your search for the lowest personal loan interest rates today!

Featured Posts

-

Ipswich Town Mc Kenna Cajuste Injury News And Training Update

May 28, 2025

Ipswich Town Mc Kenna Cajuste Injury News And Training Update

May 28, 2025 -

Samsung Galaxy S25 512 Go Test Et Evaluation

May 28, 2025

Samsung Galaxy S25 512 Go Test Et Evaluation

May 28, 2025 -

Pacers Vs Nets Tyrese Haliburtons Injury And Game Status

May 28, 2025

Pacers Vs Nets Tyrese Haliburtons Injury And Game Status

May 28, 2025 -

Alcaraz Defeats Sinner To Claim Italian Open Title

May 28, 2025

Alcaraz Defeats Sinner To Claim Italian Open Title

May 28, 2025 -

Top Strikers Arsenal Preference Tottenhams 58m Bid

May 28, 2025

Top Strikers Arsenal Preference Tottenhams 58m Bid

May 28, 2025

Latest Posts

-

Tileoptiko Programma Savvatoy 15 Martioy

May 30, 2025

Tileoptiko Programma Savvatoy 15 Martioy

May 30, 2025 -

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025 -

Kyriaki 16 3 Ti Na Deite Stin Tileorasi

May 30, 2025

Kyriaki 16 3 Ti Na Deite Stin Tileorasi

May 30, 2025 -

Odigos Tiletheasis Metadoseis Kyriakis 16 Martioy

May 30, 2025

Odigos Tiletheasis Metadoseis Kyriakis 16 Martioy

May 30, 2025 -

Programma Tileoptikon Metadoseon Kyriakis 16 Martioy

May 30, 2025

Programma Tileoptikon Metadoseon Kyriakis 16 Martioy

May 30, 2025