PBOC's Yuan Intervention Falls Short Of Expectations This Year

Table of Contents

H2: Factors Contributing to the Yuan's Underperformance

The Yuan's underperformance in 2024 is a result of a confluence of factors, each significantly impacting its value against major currencies, particularly the US dollar.

H3: Weakening Global Demand

Reduced global demand for Chinese exports is a major headwind for the Yuan. Slowing global growth, particularly in key export markets, has dampened demand for Chinese goods. The lingering effects of the trade war with the US also continue to impact export volumes.

- Slowing global growth: The International Monetary Fund (IMF) has revised down its global growth projections for 2024, impacting demand for Chinese goods and services.

- Trade war implications: While a formal trade war may have subsided, the lingering effects on supply chains and investor sentiment continue to weigh on Chinese exports.

- Reduced consumer spending in key markets: Weakening consumer confidence in major economies like Europe and the US has led to decreased imports from China.

Data showing a decline in China's export figures and a slowing GDP growth rate further supports this analysis. A weakening trade balance directly impacts the Yuan's exchange rate. Keywords: Global demand, exports, trade balance, economic slowdown.

H3: US Dollar Strength

The persistent strength of the US dollar is another crucial factor impacting the Yuan. Aggressive US interest rate hikes by the Federal Reserve have made the dollar a more attractive investment, increasing its demand globally. This strength puts downward pressure on other currencies, including the Yuan.

- US interest rate hikes: The Federal Reserve's monetary policy tightening has significantly increased US interest rates, making dollar-denominated assets more appealing to international investors.

- Safe-haven status of the dollar: During times of global uncertainty, investors often flock to the dollar as a safe-haven asset, further strengthening its value.

- Relative economic strength: The perceived relative economic strength of the US compared to other major economies also contributes to the dollar's appeal.

Data on US interest rates and the US Dollar Index (DXY) clearly show the upward trend, highlighting its impact on the Yuan's depreciation. Keywords: US dollar, interest rates, currency appreciation, safe-haven asset.

H3: Capital Outflows

Capital flight from China has also contributed to the weakening Yuan. Geopolitical uncertainties, changing investor sentiment, and regulatory changes have prompted some investors to move their assets elsewhere.

- Geopolitical uncertainty: Rising geopolitical tensions involving China have created uncertainty among investors, leading to capital outflows.

- Investor sentiment: Negative news regarding China's economy and regulatory environment can trigger shifts in investor sentiment, leading to capital flight.

- Regulatory changes: Changes in regulations impacting foreign investment can also influence capital flows out of China.

Data on capital flows, while often opaque, reveals trends suggesting significant outflows in recent months. Keywords: Capital outflow, foreign investment, financial markets, risk aversion.

H2: Limitations of PBOC Intervention Strategies

Despite the PBOC's efforts, its intervention strategies have faced limitations in effectively supporting the Yuan.

H3: Limited Effectiveness of Direct Intervention

Direct intervention, involving the PBOC buying Yuan in the foreign exchange market, has proven to be less effective than anticipated.

- Market size: The sheer size of the foreign exchange market makes it difficult for any single entity, even the PBOC, to significantly influence the exchange rate through direct intervention.

- Speculative trading: Speculative trading activities can easily overwhelm any attempts at direct intervention, making it challenging to maintain a stable exchange rate.

- Potential depletion of foreign currency reserves: Continuous intervention can lead to a depletion of the PBOC's foreign currency reserves, limiting its ability to intervene effectively in the long run. Keywords: Foreign exchange reserves, market manipulation, liquidity.

H3: Challenges in Balancing Growth and Stability

The PBOC faces a difficult trade-off between maintaining a stable Yuan and supporting economic growth.

- Impact of intervention on monetary policy: Intervention in the foreign exchange market can impact domestic monetary policy, making it challenging to manage inflation and interest rates effectively.

- Inflationary pressures: Increased money supply due to Yuan purchases can lead to inflationary pressures, further complicating the economic outlook. Keywords: Monetary policy, inflation, economic growth, policy trade-off.

3. Conclusion: The Future of PBOC Yuan Intervention – Looking Ahead

The underperformance of the PBOC's Yuan intervention in 2024 stems from a combination of weakening global demand, a strong US dollar, and capital outflows. The limitations of direct intervention and the challenge of balancing growth and stability further complicate the situation. The PBOC might consider alternative strategies, including adjustments to interest rates or capital controls, although each carries its own risks and implications. Stay informed about the ongoing developments in the PBOC's Yuan intervention strategies and their impact on the global economy. Continue monitoring the Yuan exchange rate and PBOC policy announcements for the latest updates. PBOC Yuan outlook 2024 remains uncertain, demanding close observation.

Featured Posts

-

Tam Krwz Ke Jwte Pr Mdah Ka Hmlh Swshl Mydya Pr Rdeml Ky Lhr

May 16, 2025

Tam Krwz Ke Jwte Pr Mdah Ka Hmlh Swshl Mydya Pr Rdeml Ky Lhr

May 16, 2025 -

Everest In A Week Anesthetic Gas Climb Raises Safety Concerns

May 16, 2025

Everest In A Week Anesthetic Gas Climb Raises Safety Concerns

May 16, 2025 -

Srochno Rossiya Vypustila Bolee 200 Raket I Dronov Po Ukraine

May 16, 2025

Srochno Rossiya Vypustila Bolee 200 Raket I Dronov Po Ukraine

May 16, 2025 -

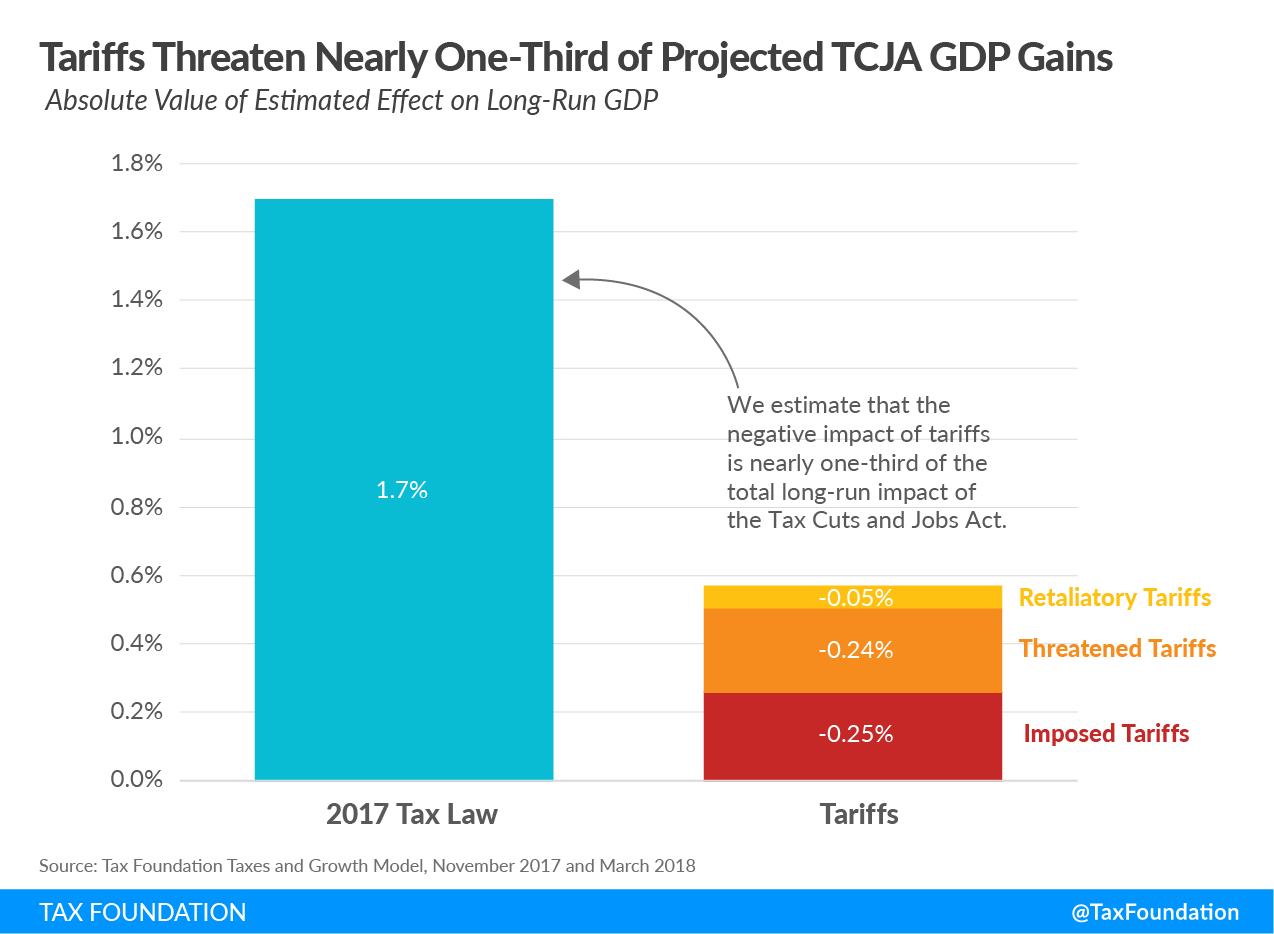

The Economic Impact Of Trumps Tariffs On California A 16 Billion Loss

May 16, 2025

The Economic Impact Of Trumps Tariffs On California A 16 Billion Loss

May 16, 2025 -

Voennaya Agressiya Rf Masshtabnaya Ataka Na Ukrainu S Primeneniem Bolee 200 Raket I Dronov

May 16, 2025

Voennaya Agressiya Rf Masshtabnaya Ataka Na Ukrainu S Primeneniem Bolee 200 Raket I Dronov

May 16, 2025

Latest Posts

-

Heat Butler Rift Jersey Numbers Hall Of Famers Comments Fuel Speculation

May 16, 2025

Heat Butler Rift Jersey Numbers Hall Of Famers Comments Fuel Speculation

May 16, 2025 -

Jimmy Butler Heat Tensions Hall Of Famer Weighs In Jersey Numbers Reveal Rift

May 16, 2025

Jimmy Butler Heat Tensions Hall Of Famer Weighs In Jersey Numbers Reveal Rift

May 16, 2025 -

Recruiting Challenges For The Miami Heat Insights From Jimmy Butlers Time With The Warriors

May 16, 2025

Recruiting Challenges For The Miami Heat Insights From Jimmy Butlers Time With The Warriors

May 16, 2025 -

Miami Heats Future Star Problem Lessons From Jimmy Butlers Golden State Connection

May 16, 2025

Miami Heats Future Star Problem Lessons From Jimmy Butlers Golden State Connection

May 16, 2025 -

Finding Stability Microsoft In The Face Of Global Trade Tensions

May 16, 2025

Finding Stability Microsoft In The Face Of Global Trade Tensions

May 16, 2025