Paytm Payments Bank Penalized ₹5.45 Crore By FIU For Money Laundering Violations

Table of Contents

The FIU's Findings and the Penalty Imposed

The FIU's investigation into Paytm Payments Bank uncovered several serious shortcomings in its compliance with the Prevention of Money Laundering Act (PMLA). The investigation likely involved scrutinizing a large volume of transactions to identify suspicious activity. While the specific details of each transaction flagged by the FIU may not be publicly available due to confidentiality reasons, the general nature of the violations points to systemic weaknesses within the bank's operations. The ₹5.45 crore penalty reflects the severity of these violations and the potential risk they posed to the financial system. The calculation of the penalty likely takes into account factors such as the number and nature of violations, the amount of money involved, and the bank's overall cooperation during the investigation.

- Lack of KYC Compliance: Insufficient Know Your Customer (KYC) checks allowed potentially risky accounts to operate without proper identification and verification.

- Insufficient Transaction Monitoring: The bank failed to adequately monitor transactions for suspicious patterns indicative of money laundering activities. This includes failing to flag high-value transactions, unusual transaction frequencies, or transactions linked to known high-risk entities.

- Failure to Report Suspicious Activities: Despite potentially identifying suspicious activities, Paytm Payments Bank failed to file timely and accurate suspicious transaction reports (STRs) with the FIU, hindering investigations.

- Weaknesses in Internal Controls: A lack of robust internal controls and risk management systems allowed the violations to occur and persist. This includes weaknesses in staff training, inadequate record-keeping, and ineffective oversight.

Implications for Paytm Payments Bank

The ₹5.45 crore penalty carries significant implications for Paytm Payments Bank. The damage extends beyond the financial penalty itself.

- Reputational Damage: The negative publicity surrounding this penalty will undoubtedly impact Paytm's brand image and trust amongst customers. This can lead to a loss of market share to competitors.

- Increased Regulatory Scrutiny: Paytm Payments Bank can expect heightened scrutiny from regulators in the future, potentially leading to more frequent audits and stricter compliance requirements.

- Financial Implications: Beyond the penalty, Paytm Payments Bank will likely incur increased operational costs related to implementing improved compliance measures and addressing the identified weaknesses. There's also the potential for further penalties if future violations are detected.

- Customer Trust Erosion: The news could erode customer trust, potentially causing customers to switch to other digital payment platforms perceived as more reliable and secure.

Response from Paytm Payments Bank

Paytm Payments Bank is yet to release a comprehensive public statement addressing the specifics of the FIU's findings and the penalty. However, any official response will likely include a commitment to enhanced compliance, remedial actions, and a renewed focus on preventing future violations. Expect to see statements emphasizing investments in technology and training to improve AML and KYC procedures.

Broader Implications for the Digital Payments Industry in India

The Paytm Payments Bank case serves as a cautionary tale for the entire digital payments industry in India.

-

Increased Regulatory Scrutiny: This incident will likely trigger increased regulatory scrutiny across the board, leading to more stringent enforcement of AML regulations.

-

Strengthened AML Regulations: Expect the government to strengthen AML regulations further to close any loopholes and enhance the effectiveness of combating financial crimes.

-

Impact on Fintech Innovation: While stricter regulations might temporarily hamper innovation, the long-term impact will be positive, leading to a more secure and trustworthy digital payments ecosystem.

-

Enhanced KYC and AML Compliance: All players in the digital payments space will need to prioritize KYC and AML compliance, investing in technology and training to ensure adherence to regulations.

-

Impact on Other Players: Other fintech companies will likely review their own AML and KYC processes to ensure they are meeting the highest standards of compliance.

-

Increased Focus on Risk Management: Risk management will become paramount, with companies investing in advanced technologies and procedures to detect and prevent suspicious activities.

-

Potential for Stricter Regulations: This case could lead to stricter regulations and penalties for non-compliance, emphasizing the need for proactive measures.

Conclusion

The ₹5.45 crore penalty imposed on Paytm Payments Bank for money laundering violations underscores the critical importance of robust AML and KYC compliance in India's rapidly growing digital payments sector. This case serves as a stark warning to all financial technology companies. Ignoring regulatory compliance can lead to severe consequences, including hefty fines, reputational damage, and loss of customer trust. Proactive compliance, robust internal controls, and continuous monitoring are no longer optional but essential for survival and success in the Indian digital payments landscape. Understanding the intricacies of Paytm Payments Bank's money laundering violations and the subsequent penalty is crucial for navigating this evolving regulatory environment. Take proactive steps to ensure your organization's compliance and safeguard against potential penalties.

Featured Posts

-

Latest Caloocan Election Results Malapitan Holds Commanding Advantage

May 15, 2025

Latest Caloocan Election Results Malapitan Holds Commanding Advantage

May 15, 2025 -

Bse Stocks Surge Sensex Rise Fuels Double Digit Gains

May 15, 2025

Bse Stocks Surge Sensex Rise Fuels Double Digit Gains

May 15, 2025 -

Dijital Veri Tabani Ve Isguecue Piyasasi Ledra Pal Daki Carsamba Rehberi

May 15, 2025

Dijital Veri Tabani Ve Isguecue Piyasasi Ledra Pal Daki Carsamba Rehberi

May 15, 2025 -

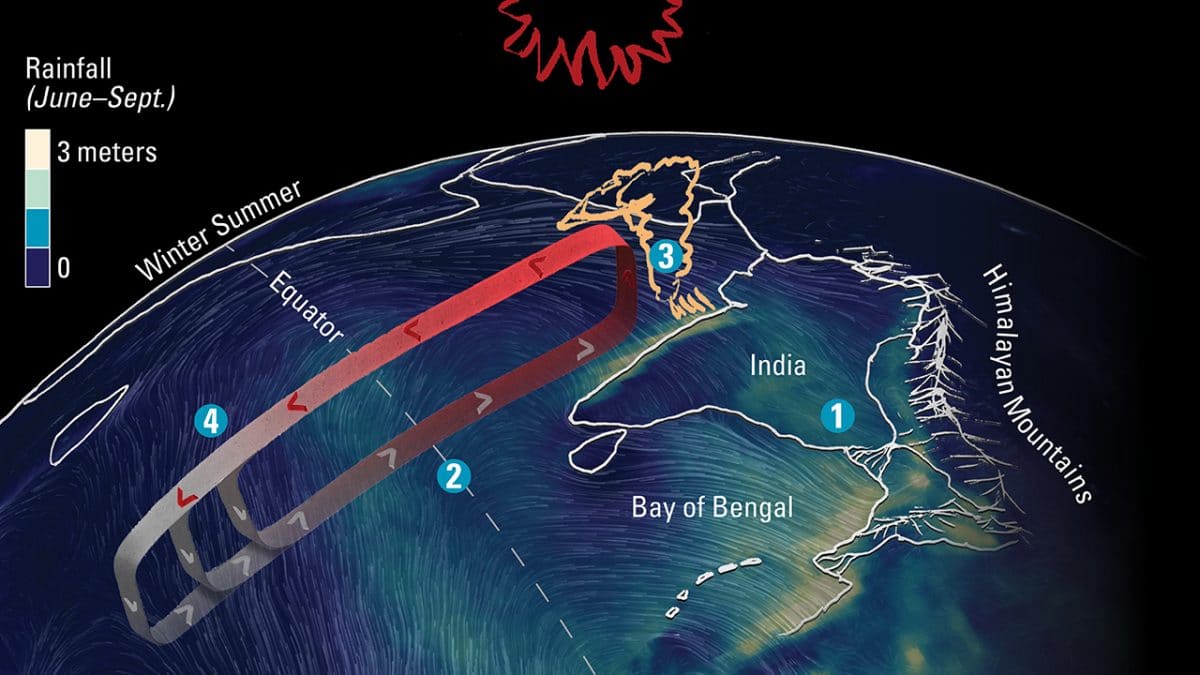

Monsoon Prediction Good News For Indias Farm Sector And Consumption

May 15, 2025

Monsoon Prediction Good News For Indias Farm Sector And Consumption

May 15, 2025 -

De Npo En Grensoverschrijdend Gedrag Verantwoording En Transparantie

May 15, 2025

De Npo En Grensoverschrijdend Gedrag Verantwoording En Transparantie

May 15, 2025

Latest Posts

-

Actie Tegen Npo De Rol Van Frederieke Leeflang Onder De Loep

May 15, 2025

Actie Tegen Npo De Rol Van Frederieke Leeflang Onder De Loep

May 15, 2025 -

Analyse De Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025

Analyse De Actie Tegen Npo Baas Frederieke Leeflang

May 15, 2025 -

De Gevolgen Van De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025

De Gevolgen Van De Actie Tegen Npo Directeur Frederieke Leeflang

May 15, 2025 -

Wordt Frederieke Leeflang Npo Baas Getroffen Door Een Nieuwe Actie

May 15, 2025

Wordt Frederieke Leeflang Npo Baas Getroffen Door Een Nieuwe Actie

May 15, 2025 -

Reacties Op De Actie Gericht Tegen Frederieke Leeflang Npo Baas

May 15, 2025

Reacties Op De Actie Gericht Tegen Frederieke Leeflang Npo Baas

May 15, 2025