Pause On Diversity And Climate Disclosures: Canadian Regulators Respond To Criticism

Table of Contents

The Growing Pressure on Canadian Companies for ESG Reporting

The global emphasis on ESG reporting is undeniable, and Canada is increasingly aligning itself with international best practices. Investors are demanding greater transparency regarding a company's environmental impact, social responsibility, and governance structures. This demand is driven by several factors:

- Rising investor demand for transparent ESG data: Investors are increasingly using ESG factors to assess risk and opportunities, leading to a higher demand for reliable and comparable data. Sustainable investing is no longer a niche strategy; it's becoming mainstream.

- Growing pressure from consumers and civil society for corporate social responsibility: Consumers are increasingly conscious of the environmental and social impact of their purchasing decisions, putting pressure on companies to demonstrate their commitment to sustainability. This translates to increased scrutiny of corporate actions and reporting.

- Alignment with international ESG reporting standards: Canada is working towards harmonizing its ESG reporting standards with globally recognized frameworks like the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). This facilitates international comparability and reduces reporting burdens.

- The role of Canadian securities regulators (e.g., OSC, AMF) in promoting ESG disclosure: Canadian securities regulators, such as the Ontario Securities Commission (OSC) and the Autorité des marchés financiers (AMF), play a crucial role in driving the adoption of ESG reporting standards through guidance, regulations, and enforcement actions.

Criticisms of the Current Approach to Climate and Diversity Disclosures

While the push for enhanced ESG reporting is generally welcomed, the current approach in Canada has faced significant criticism:

- Concerns about the complexity and cost of compliance for smaller businesses: Smaller companies argue that the proposed regulations impose disproportionate costs and administrative burdens, potentially hindering their growth and competitiveness. They lack the resources of larger corporations to dedicate to comprehensive reporting.

- Debate regarding the effectiveness and consistency of current disclosure frameworks: Critics argue that existing frameworks lack clarity and consistency, making it difficult for companies to understand their obligations and for investors to compare data reliably. This lack of standardization undermines the value of the disclosures.

- Questions around the reliability and comparability of reported data: Concerns exist regarding the accuracy and comparability of reported ESG data, with the potential for "greenwashing"—the act of misleading consumers regarding a company's environmental practices. Robust verification mechanisms are needed to ensure data integrity.

- Concerns about "greenwashing" and the potential for misleading information: The lack of standardized metrics and verification processes makes it difficult to distinguish genuine efforts from superficial attempts to improve a company's ESG profile. This erodes trust in ESG reporting.

The Regulatory Response: A Pause or Re-evaluation?

Faced with this criticism, Canadian regulators have responded by pausing or reevaluating the proposed regulations. This reflects a commitment to a more measured and effective approach.

- Specific announcements and statements from Canadian regulators: The OSC and AMF have issued statements acknowledging the concerns raised and outlining their plans for review and consultation. These announcements highlight a willingness to adapt the regulatory approach based on stakeholder feedback.

- Reasons cited for the pause, including addressing criticisms and refining frameworks: The pause allows regulators to address the concerns surrounding complexity, cost, and data reliability. It provides an opportunity to refine the frameworks and ensure they are practical and effective.

- Potential impact on timelines for mandatory disclosure implementation: The pause will likely result in delays in the implementation of mandatory climate and diversity disclosures. This offers time for thorough review and consultation.

- Consultation processes and engagement with stakeholders: Regulators are engaging in extensive consultations with businesses, investors, and other stakeholders to gather feedback and inform the development of revised reporting requirements.

Potential Changes and Future Directions for Climate and Diversity Disclosures in Canada

Based on feedback received, several adjustments to the regulatory approach are anticipated:

- Simplified reporting requirements for certain company sizes or sectors: This could involve tiered reporting requirements, with less stringent standards for smaller companies or those in less impactful sectors.

- Enhanced guidance and clearer definitions to improve data quality: More detailed guidance and clearer definitions of key terms will enhance the reliability and comparability of reported data.

- Increased focus on materiality and relevance in disclosures: The focus will likely shift to material ESG issues that are most relevant to a company’s specific operations and risk profile, rather than a blanket approach.

- Exploration of alternative reporting frameworks or approaches: Regulators might explore the adoption of alternative reporting frameworks or approaches that better meet the needs of Canadian companies and investors.

Conclusion

The pause on mandatory climate and diversity disclosures in Canada reflects a necessary response to concerns regarding the complexity, cost, and effectiveness of the initial proposals. The criticisms raised highlight the need for a more nuanced and practical approach to ESG reporting. While the regulatory landscape is evolving, the underlying importance of ESG reporting for Canadian businesses remains unchanged. Proactive engagement with the ongoing consultations and a commitment to understanding the evolving regulatory landscape are crucial for companies to ensure compliance and demonstrate their commitment to sustainability. Staying informed about changes in Canadian climate and diversity disclosures is vital for navigating future regulatory changes effectively.

Featured Posts

-

Witness The Spectacle Rhs Wisleys Cherry Blossom Display

Apr 25, 2025

Witness The Spectacle Rhs Wisleys Cherry Blossom Display

Apr 25, 2025 -

Everything You Should Know 10 Insights Into The 2025 Los Angeles Marathon

Apr 25, 2025

Everything You Should Know 10 Insights Into The 2025 Los Angeles Marathon

Apr 25, 2025 -

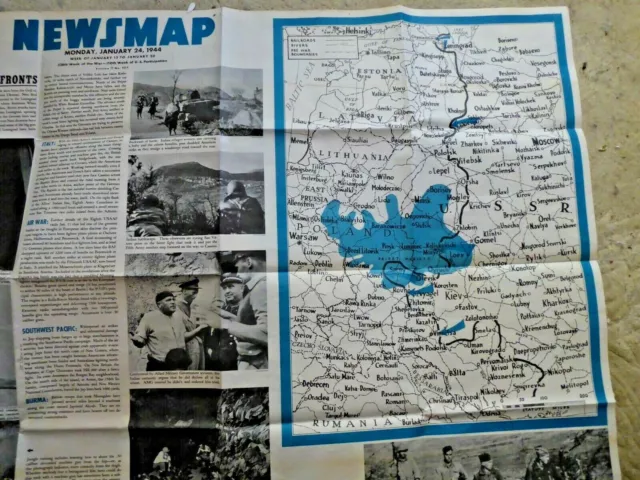

April 1945 Analyzing The Months Most Important News

Apr 25, 2025

April 1945 Analyzing The Months Most Important News

Apr 25, 2025 -

Russian Ambassadors Participation In German Wwii Event A Sign Of Detente Or Continued Tension

Apr 25, 2025

Russian Ambassadors Participation In German Wwii Event A Sign Of Detente Or Continued Tension

Apr 25, 2025 -

Zavershenie Rossiysko Ukrainskoy Voyny Slozhneyshaya Zadacha Dlya Trampa Foreign Policy

Apr 25, 2025

Zavershenie Rossiysko Ukrainskoy Voyny Slozhneyshaya Zadacha Dlya Trampa Foreign Policy

Apr 25, 2025

Latest Posts

-

To Buy Or Not To Buy Palantir Stock Before May 5th The Wall Street View

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th The Wall Street View

May 10, 2025 -

Stock Market Live Sensex Nifty Adani Ports And Top Movers Today

May 10, 2025

Stock Market Live Sensex Nifty Adani Ports And Top Movers Today

May 10, 2025 -

Sensex Live Market Soars Nifty Above 18800 Sector Wise Analysis

May 10, 2025

Sensex Live Market Soars Nifty Above 18800 Sector Wise Analysis

May 10, 2025 -

Palantir Pltr Stock Wall Streets Outlook Before May 5th

May 10, 2025

Palantir Pltr Stock Wall Streets Outlook Before May 5th

May 10, 2025 -

Sensex Today Live Stock Market Updates Nifty Adani Ports And More

May 10, 2025

Sensex Today Live Stock Market Updates Nifty Adani Ports And More

May 10, 2025