Palantir's Potential: Can It Achieve A $1 Trillion Valuation By The End Of The Decade?

Table of Contents

Palantir's Strengths and Competitive Advantages

Palantir's current position rests on several key pillars that contribute to its significant potential.

Dominant Position in Government and Intelligence

Palantir enjoys a strong and enduring foothold within the government and intelligence sectors. Its Palantir government contracts represent a substantial portion of its revenue, fueled by its role in providing crucial national security data analytics. The company’s established relationships with key agencies, including those in the US and allied nations, ensure a consistent stream of long-term contracts, contributing significantly to its recurring revenue. These contracts are not easily replicated, providing a strong competitive moat.

- Long-term contracts minimize revenue volatility.

- Deep integration with government systems creates high switching costs for clients.

- Proven track record of delivering critical national security solutions.

Growing Commercial Market Penetration

While government contracts form a crucial foundation, Palantir's expansion into the commercial market is a key driver of its future growth. Its data analytics platform is increasingly adopted by businesses across various sectors. Successful case studies in finance, healthcare, and other industries demonstrate the value proposition of Palantir's enterprise software. The potential for growth within these commercial sectors is substantial, offering a path towards significant revenue diversification.

- Strong adoption in the financial services sector for fraud detection and risk management.

- Growing use in healthcare for improving operational efficiency and patient care.

- Expansion into new commercial sectors like manufacturing and supply chain management.

Technological Innovation and Future-Proofing

Palantir's commitment to software innovation is evident in its ongoing investments in research and development. The company continues to push the boundaries of data integration through its use of cutting-edge technologies like Palantir AI and machine learning (ML). These advancements not only enhance the capabilities of its existing products but also position the company to capitalize on emerging market opportunities, making it future-proof.

- Significant investments in AI and ML capabilities for enhanced data analysis.

- Continuous development of new features and functionalities to meet evolving customer needs.

- A focus on user experience to improve accessibility and usability.

Challenges and Risks Facing Palantir

Despite its strengths, Palantir faces several challenges that could hinder its journey to a $1 trillion valuation.

Competition and Market Saturation

The data analytics market is highly competitive, with established players and new entrants vying for market share. Identifying Palantir competitors like AWS, Microsoft, and other specialized analytics firms is crucial. The potential for market saturation and increased competition is a significant risk. Palantir needs to continually innovate and differentiate its offerings to maintain its competitive edge.

- Competition from large cloud providers with extensive data analytics capabilities.

- Emergence of specialized niche players focusing on specific industries or data types.

- The need for continuous innovation to stay ahead of the technological curve.

Dependence on Government Contracts

A significant portion of Palantir's revenue is derived from government funding and associated contract risk. Fluctuations in government budgets and potential changes in political priorities could negatively impact revenue streams. The company is actively working on Palantir revenue diversification by expanding its commercial presence, but this remains a key risk factor.

- Vulnerability to changes in government priorities and spending patterns.

- Potential for contract delays or cancellations affecting financial projections.

- The need for a balanced revenue portfolio to mitigate risk.

Profitability and Valuation Metrics

Analyzing Palantir stock price, market capitalization, and profitability is vital in assessing the feasibility of its trillion-dollar valuation. While the company shows significant growth potential, achieving such a high valuation requires consistent and substantial profitability. Comparing its valuation to other tech companies of similar size and trajectory is crucial for a realistic assessment.

- Need to demonstrate consistent profitability and sustainable growth.

- Maintaining investor confidence and a positive market outlook.

- Achieving profitability margins comparable to other successful technology companies.

Conclusion: Palantir's Path to a Trillion-Dollar Valuation

Palantir's potential to reach a $1 trillion valuation by 2033 is undeniably significant. Its strong position in the government sector, coupled with its growing commercial presence and commitment to technological innovation, presents a compelling case for future growth. However, challenges related to competition, reliance on government contracts, and the need to demonstrate consistent profitability cannot be ignored. A balanced perspective acknowledges both the substantial potential and the inherent risks. To further explore Palantir's potential, we encourage you to delve into its investor relations materials and follow industry news related to Palantir's data analytics and software solutions. The journey towards a trillion-dollar valuation will be a dynamic one, demanding consistent innovation and adaptation within the ever-evolving landscape of big data.

Featured Posts

-

Caso Maddie Mc Cann Polonesa Detida Apos Alegacao Chocante No Reino Unido

May 09, 2025

Caso Maddie Mc Cann Polonesa Detida Apos Alegacao Chocante No Reino Unido

May 09, 2025 -

Is Micro Strategy Stock Or Bitcoin The Smarter Investment In 2025

May 09, 2025

Is Micro Strategy Stock Or Bitcoin The Smarter Investment In 2025

May 09, 2025 -

Kas Nutiko Dakota Johnson Ir Skandalas Del Kraujingu Plintu Nuotrauku

May 09, 2025

Kas Nutiko Dakota Johnson Ir Skandalas Del Kraujingu Plintu Nuotrauku

May 09, 2025 -

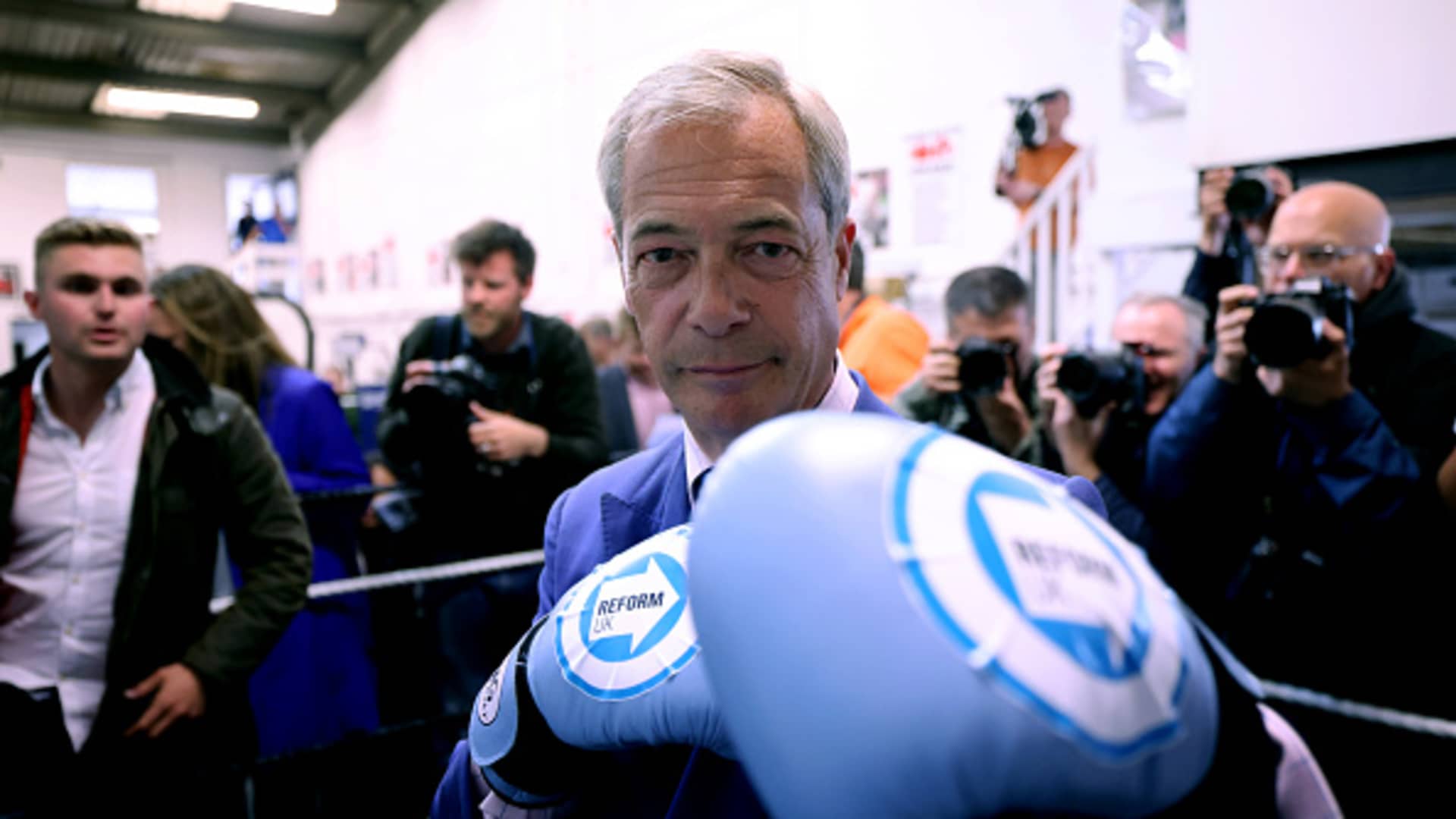

Can Nigel Farages Reform Party Deliver An Analysis Of Its Potential

May 09, 2025

Can Nigel Farages Reform Party Deliver An Analysis Of Its Potential

May 09, 2025 -

Kilmar Abrego Garcia De La Violencia Salvadorena A La Polarizacion Politica Estadounidense

May 09, 2025

Kilmar Abrego Garcia De La Violencia Salvadorena A La Polarizacion Politica Estadounidense

May 09, 2025