Palantir's 30% Drop: Time To Buy The Dip?

Table of Contents

Understanding the Reasons Behind Palantir's 30% Drop

Several factors contributed to Palantir's recent stock market downturn. Understanding these is crucial for any investor considering a Palantir investment.

Weakening Macroeconomic Conditions

The current macroeconomic environment significantly impacts tech stocks, particularly high-growth companies like Palantir. Rising interest rates and persistent inflation have reduced investor appetite for riskier assets. The Federal Reserve's monetary tightening policies aim to curb inflation, but this often leads to slower economic growth, negatively affecting the valuations of companies perceived as less stable in uncertain times.

- Rising interest rates: Higher borrowing costs make expansion and investment more expensive for companies like Palantir.

- Inflationary pressures: Increased operational costs and reduced consumer spending impact revenue growth projections.

- Reduced investor risk tolerance: Investors shift towards safer investments, leading to capital flight from higher-risk growth stocks.

Statistics show a general downturn in the tech sector, with many growth stocks experiencing significant corrections. The S&P 500 technology sector, for instance, experienced a [Insert relevant statistic on recent tech sector performance here – needs research to add]. This broader market trend exacerbated Palantir's individual challenges.

Concerns Regarding Palantir's Revenue Growth

While Palantir demonstrates strong potential in government and commercial data analytics, concerns linger regarding its revenue growth trajectory. Analyst predictions haven't always aligned with actual revenue figures, creating volatility in Palantir stock. Any perceived slowdown in growth, even temporary, can trigger selling pressure.

- Revenue growth deceleration: Recent reports suggest a slight slowing of revenue growth compared to previous quarters. (Insert specific data from financial reports).

- Contract delays: Delays in securing or finalizing large government contracts can impact short-term revenue projections.

- Competition in the data analytics market: The data analytics sector is fiercely competitive, with established players and emerging startups vying for market share.

Short-Term Market Sentiment and Volatility

Short-selling activity and overall market sentiment significantly influenced Palantir's price drop. Negative media coverage, fueled by concerns outlined above, can amplify selling pressure, leading to a self-fulfilling prophecy. Market volatility, a characteristic of the tech sector, further exacerbates these effects.

- Short-selling activity: A surge in short selling can amplify downward price movements. (Insert data on short interest if available).

- Negative media coverage: Negative news reports about revenue growth or competition can influence investor sentiment.

- Market volatility: The inherent volatility of the tech market magnifies the impact of any negative news.

Assessing Palantir's Long-Term Prospects: Is the Dip a Buying Opportunity?

Despite the recent drop, a thorough assessment of Palantir's long-term prospects is crucial for potential investors considering buying Palantir dip.

Strong Fundamentals and Long-Term Growth Potential

Palantir possesses strong fundamentals, including innovative technology and a strategic position in the expanding government and commercial data analytics markets. The long-term growth potential of the data analytics sector remains substantial, offering Palantir significant opportunity for expansion.

- Government contracts pipeline: Palantir's strong presence in the government sector provides a stable revenue stream and potential for future growth.

- Growing commercial adoption: Expanding commercial partnerships and adoption of Palantir's platform indicate strong growth prospects in the private sector.

- Technological innovation: Continuous investment in R&D ensures Palantir remains competitive in a rapidly evolving market.

Valuation Analysis

A key consideration for any Palantir investment is its valuation. Comparing Palantir's current valuation to its historical performance and competitors provides context. Metrics like the P/E ratio and PEG ratio, alongside more sophisticated methods such as discounted cash flow (DCF) analysis, should be considered.

- Current P/E ratio: [Insert current P/E ratio and context].

- Comparison to competitor valuations: [Compare valuation to competitors – needs research to add].

- Discounted cash flow analysis (DCF): [Include a brief discussion on DCF analysis and its implications for Palantir – needs research to add].

Risk Assessment

Investing in Palantir, like any growth stock, involves inherent risks. Understanding and mitigating these risks is essential.

- Market risks: The overall market environment can significantly influence Palantir's stock price.

- Competitive risks: Competition in the data analytics space could impact Palantir's market share.

- Execution risks: The successful execution of Palantir's business strategy is crucial for its long-term success. Diversification across your portfolio can help mitigate some of these risks.

Conclusion: Should You Buy the Palantir Dip?

The recent 30% drop in Palantir stock presents a complex scenario for investors. While the long-term growth potential remains promising, considerable risks persist. The macroeconomic environment, revenue growth concerns, and market sentiment all warrant careful consideration. This analysis isn't a recommendation to buy or sell Palantir stock; rather, it highlights crucial factors to assess before making any investment decisions.

Before investing in Palantir stock or considering a Palantir investment strategy, conduct thorough due diligence. Analyze the company's financial performance, consider the competitive landscape, and evaluate your personal risk tolerance and long-term financial goals. Remember, this information is for educational purposes only and should not be construed as financial advice.

Featured Posts

-

The Great Decoupling And Its Effects On Technological Advancement

May 09, 2025

The Great Decoupling And Its Effects On Technological Advancement

May 09, 2025 -

Sinoptiki Bessilny Pered Mayskimi Snegopadami

May 09, 2025

Sinoptiki Bessilny Pered Mayskimi Snegopadami

May 09, 2025 -

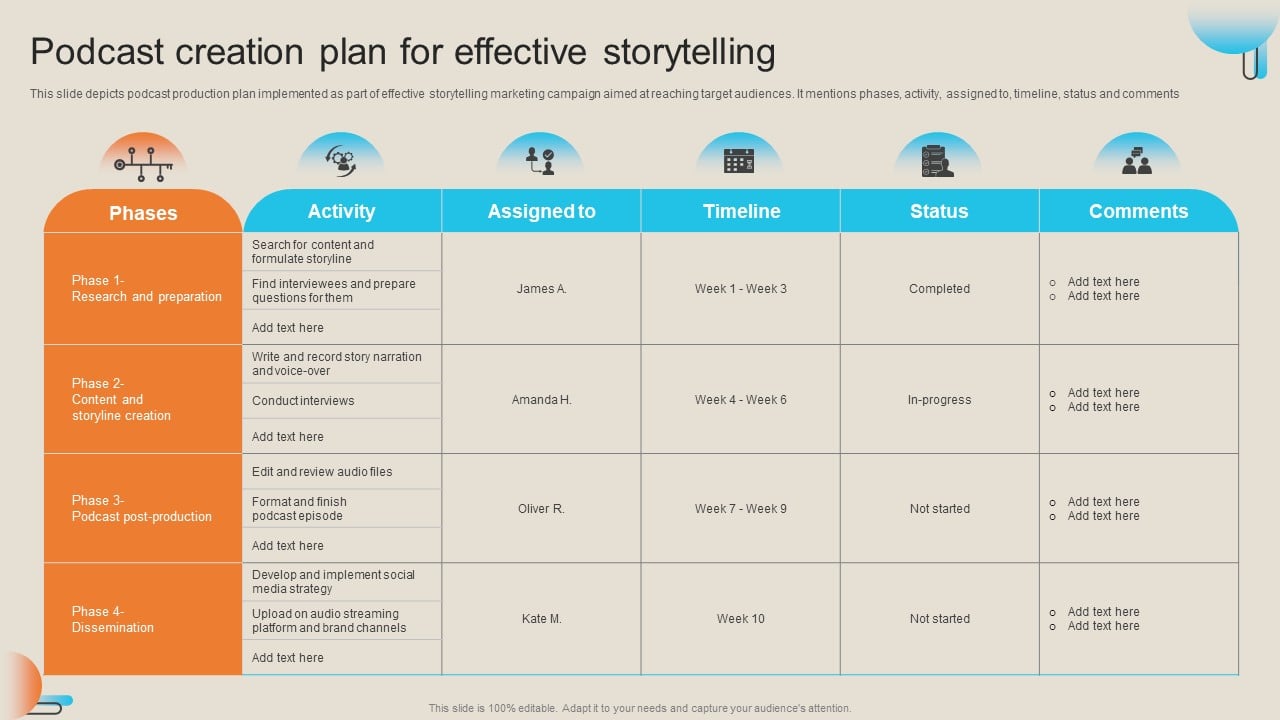

From Bathroom Boredom To Engaging Audio Ais Role In Podcast Creation

May 09, 2025

From Bathroom Boredom To Engaging Audio Ais Role In Podcast Creation

May 09, 2025 -

Njwm Krt Alqdm Almdkhnwn Qsshm Wtathyr Altdkhyn Ela Msyrthm

May 09, 2025

Njwm Krt Alqdm Almdkhnwn Qsshm Wtathyr Altdkhyn Ela Msyrthm

May 09, 2025 -

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 09, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 09, 2025