Palantir Technology Stock: A Pre-May 5th Investment Analysis

Table of Contents

Palantir's Recent Financial Performance and Q4 2022 Earnings

Analyzing Palantir's recent financial performance is crucial for assessing its current health and future potential. This involves examining revenue growth, profitability, and the company's overall financial stability.

Revenue Growth and Profitability

Palantir's revenue growth trajectory reveals significant insights into its market position and growth potential. Examining year-over-year comparisons helps understand the sustainability of its growth rate. Key figures from the Q4 2022 earnings report are critical in this assessment. The impact of both government and commercial contracts needs careful consideration. Profitability metrics, including gross margin, operating margin, and net income, provide further insights into the efficiency and financial health of the company.

- Key figures from Q4 2022 earnings report: (Insert actual figures here, citing the source). This section should include specific numbers regarding revenue, gross margin, operating margin, and net income.

- Comparison to previous quarters: (Include a comparative analysis showing growth trends and any significant changes). Illustrate trends using charts or graphs where appropriate.

- Analysis of growth rate sustainability: (Discuss factors influencing the growth rate, such as market demand, competition, and the company's strategies). This should include a forward-looking perspective on the sustainability of the observed growth.

Cash Flow and Debt

A strong cash flow is essential for a company's long-term viability. Analyzing Palantir's cash flow generation and debt levels provides crucial information about its financial soundness. This analysis will examine the free cash flow, the debt-to-equity ratio, and ultimately assess the overall financial stability of the company.

- Free cash flow analysis: (Include calculations and interpretation of free cash flow. Is it positive? How does it compare to previous periods?)

- Debt-to-equity ratio: (Calculate and interpret the ratio. Is the company heavily leveraged? How does this compare to industry peers?)

- Assessment of financial stability: (Conclude on the overall financial health based on the cash flow and debt analysis). Consider the implications for future investments and potential stock valuation.

Future Growth Prospects and Market Opportunities

Palantir's future growth prospects depend heavily on its ability to secure and expand both government and commercial contracts. Analyzing these key areas provides insights into potential future growth.

Government Contracts and Expansion

Government contracts form a significant portion of Palantir's revenue stream. Assessing the potential for future contracts in existing and new government sectors, as well as potential geographic expansion, is crucial.

- Key government contracts secured: (List important contracts and their significance for Palantir's revenue).

- Analysis of the potential for future contracts: (Discuss the likelihood of securing new contracts based on current political climates, government spending, and Palantir's competitive standing).

- Geographic expansion opportunities: (Analyze the potential for growth in new international markets and the challenges associated with expanding operations internationally).

Commercial Market Penetration

Palantir's ability to penetrate the commercial market is another critical factor in its future growth. This involves identifying key sectors, understanding its competitive advantages (like its Foundry platform), and assessing its market share.

- Key commercial clients: (List significant commercial clients and the industries they represent).

- Market share analysis: (Estimate Palantir's market share and discuss its potential for growth within the competitive landscape).

- Competitive advantages (e.g., Foundry platform): (Analyze Palantir's competitive advantages and how they translate into market share gains and revenue growth).

Risks and Challenges Associated with Palantir Stock

While Palantir offers significant potential, several risks and challenges could impact its stock price. A thorough understanding of these factors is vital for informed investment decisions.

Valuation and Market Sentiment

Palantir's current valuation compared to its peers and the overall market sentiment towards the stock are crucial considerations. Price fluctuations can be heavily influenced by investor sentiment.

- Price-to-sales ratio: (Calculate and interpret the ratio. Compare it to industry peers to determine whether Palantir is overvalued or undervalued).

- Comparison to competitor valuations: (Compare Palantir's valuation metrics to those of its competitors to gauge its relative attractiveness).

- Analysis of recent investor sentiment: (Analyze news articles, analyst reports, and social media sentiment to understand the overall market feeling towards the stock).

Competition and Technological Disruption

The data analytics industry is highly competitive, and technological advancements can quickly disrupt existing businesses. Identifying key competitors and potential threats is crucial for evaluating Palantir's ability to maintain a competitive edge.

- Key competitors (e.g., Databricks, Snowflake): (List and analyze the strengths and weaknesses of key competitors).

- Analysis of technological advancements impacting Palantir's business: (Identify emerging technologies that could disrupt Palantir's business model and assess the company's ability to adapt).

- Strategies for maintaining a competitive advantage: (Analyze Palantir's strategies for maintaining its competitive edge, including innovation, strategic partnerships, and acquisitions).

Conclusion

This pre-May 5th analysis of Palantir Technology stock has explored its recent financial performance, future growth prospects, and associated risks. We've examined revenue growth, profitability, government contracts, commercial market penetration, valuation, and competitive threats. Ultimately, whether Palantir Technology stock is a worthwhile investment before May 5th depends on your individual risk tolerance and investment strategy. Conduct further due diligence and consult with a financial advisor before making any investment decisions regarding Palantir Technology stock. Remember to carefully consider all aspects of this analysis before investing in Palantir Technology Stock.

Featured Posts

-

The Elizabeth Stewart And Lilysilk Spring 2024 Collaboration A First Look

May 09, 2025

The Elizabeth Stewart And Lilysilk Spring 2024 Collaboration A First Look

May 09, 2025 -

R4 5

May 09, 2025

R4 5

May 09, 2025 -

1078 2025

May 09, 2025

1078 2025

May 09, 2025 -

Vozvraschenie Stivena Kinga V X Oskorbleniya V Adres Ilona Maska

May 09, 2025

Vozvraschenie Stivena Kinga V X Oskorbleniya V Adres Ilona Maska

May 09, 2025 -

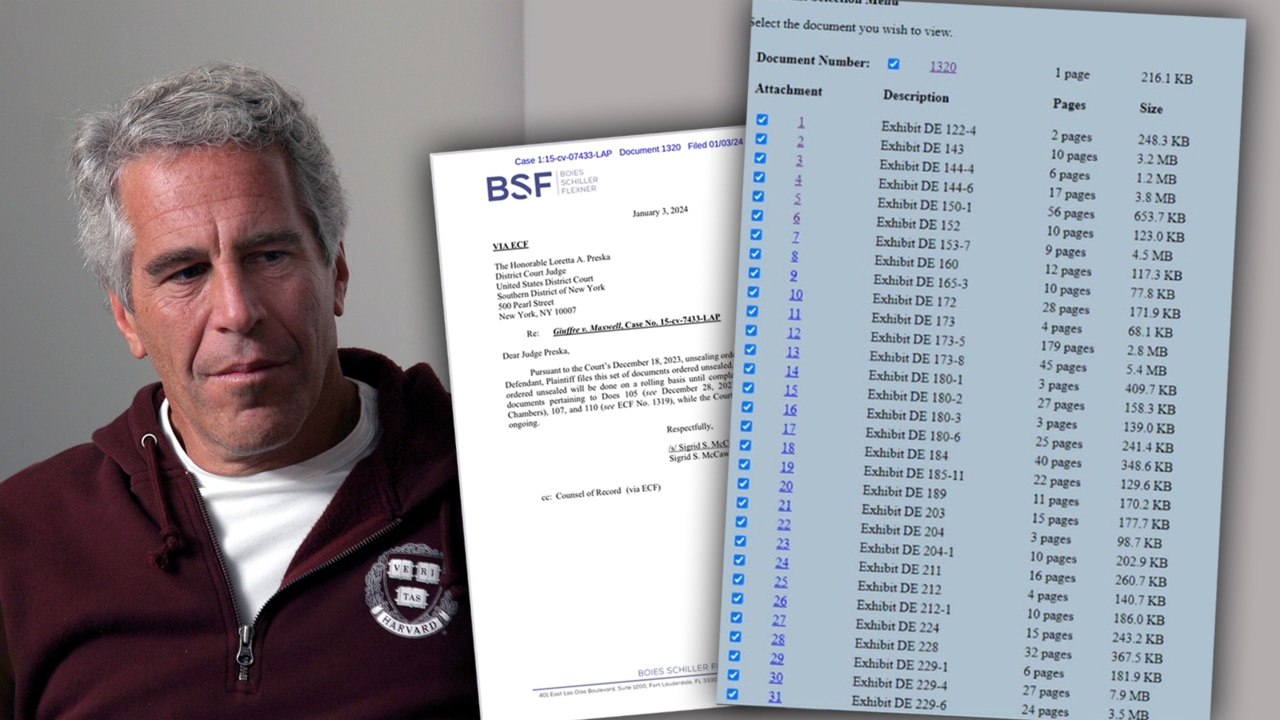

Pam Bondis Assertion Details On The Alleged Epstein Client List

May 09, 2025

Pam Bondis Assertion Details On The Alleged Epstein Client List

May 09, 2025