Palantir Technologies Stock Forecast: Analyzing The Predictions Before May 5th

Table of Contents

Analyzing Recent Financial Performance and Key Metrics

Understanding Palantir's recent financial health is crucial for any Palantir investment. Examining key metrics provides valuable insights into the company's performance and future potential.

Revenue Growth and Profitability

Palantir's recent financial reports reveal a complex picture. While revenue growth has been positive, profitability remains a key area of focus for investors. Let's examine some key figures:

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figure]. This represents [percentage] growth compared to the same period last year.

- Full-Year 2022 Revenue: [Insert actual full-year 2022 revenue figure]. This shows [percentage] year-over-year growth.

- Profit Margins: Palantir's operating margins stand at [Insert margin percentage]. This indicates [positive or negative interpretation] compared to industry benchmarks.

Analyzing these figures against previous quarters and industry competitors like [mention competitors e.g., Databricks, Snowflake] is essential for a comprehensive Palantir stock price prediction. Any significant deviation from projected figures could heavily influence investor sentiment and the Palantir Technologies stock forecast.

Customer Acquisition and Retention

Palantir's success hinges on its ability to secure and retain clients. Recent developments offer insights into this crucial area:

- New Government Contracts: Palantir secured significant contracts with [mention specific government agencies, if available], demonstrating its strong presence in the government sector.

- Commercial Sector Growth: Expansion in the commercial sector has been [positive/negative/mixed]. Key wins include partnerships with [mention specific companies, if available].

- Customer Churn: The customer churn rate is [insert percentage, if available], indicating [positive or negative] performance in retaining existing clients.

The diversity and strength of Palantir's customer base directly impact its long-term growth trajectory and should be considered in any Palantir investment strategy.

Evaluating Market Sentiment and Analyst Predictions

Market sentiment and analyst opinions play a significant role in shaping the Palantir Technologies stock forecast.

Current Analyst Ratings and Price Targets

Analyst ratings for PLTR stock are currently [summarize the overall sentiment: bullish, bearish, or neutral]. A range of price targets exists, reflecting the diversity of opinions:

- Bullish Predictions: Some analysts predict a price target of [insert price] based on [briefly state reasoning].

- Bearish Predictions: Others foresee a price of [insert price] due to [briefly state reasoning].

- Average Price Target: The average price target from leading analysts currently sits around [insert average price].

It’s essential to understand the rationale behind these varying predictions, considering factors such as projected revenue growth, market competition, and overall economic conditions.

News and Events Affecting Palantir's Stock

Recent news and events significantly impact investor sentiment.

- New Product Launches: The launch of [mention any new product or service] could [positively/negatively] affect the Palantir stock price.

- Strategic Partnerships: New partnerships with [mention any companies] could [positively/negatively] influence the Palantir Technologies stock forecast.

- Geopolitical Events: Global events could create uncertainty in the market, influencing investor confidence in PLTR stock.

Carefully tracking these events and their market impact is crucial for accurate Palantir stock price prediction.

Identifying Potential Risks and Opportunities

A comprehensive Palantir Technologies stock forecast needs to consider both the potential risks and opportunities.

Competitive Landscape and Technological Disruptions

Palantir operates in a competitive market, facing challenges from established players and emerging technologies.

- Key Competitors: Palantir's main competitors include [mention key competitors]. Their strengths lie in [briefly explain competitors' advantages].

- Technological Disruptions: The emergence of [mention disruptive technologies] poses a potential threat to Palantir's dominance.

- Innovation and Adaptation: Palantir's ability to innovate and adapt to changing market dynamics will be crucial for its future success.

A careful assessment of the competitive landscape and potential technological disruptions is crucial for a realistic Palantir Technologies stock forecast.

Geopolitical Factors and Regulatory Concerns

Geopolitical factors and regulatory changes can significantly impact Palantir's operations and stock price.

- Regulatory Hurdles: Navigating regulatory landscapes in different countries presents potential challenges.

- Geopolitical Risks: Global instability could affect Palantir's business in certain regions.

- Risk Management: Palantir's risk management strategies will play a key role in mitigating potential threats.

Understanding these risks and how Palantir is addressing them is essential for any investor considering a Palantir investment.

Conclusion

This Palantir Technologies stock forecast analysis reveals a complex picture, highlighting both the potential upside and downside risks associated with PLTR stock. While recent financial performance shows positive growth in certain areas, the competitive landscape, technological advancements, and geopolitical factors present significant considerations. The varied analyst predictions underscore the uncertainty surrounding Palantir's future trajectory.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in stocks involves inherent risk, and past performance is not indicative of future results.

Call to Action: While this Palantir Technologies stock forecast provides valuable insights, remember to conduct thorough due diligence before making any investment decisions related to PLTR stock. Consult with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance. Remember to regularly review your Palantir Technologies stock forecast based on the latest market data and news.

Featured Posts

-

How The Fentanyl Crisis Influenced The U S China Trade Agenda

May 09, 2025

How The Fentanyl Crisis Influenced The U S China Trade Agenda

May 09, 2025 -

Le Rapprochement Renaissance Modem Les Enjeux De La Clarification Politique Par Elisabeth Borne

May 09, 2025

Le Rapprochement Renaissance Modem Les Enjeux De La Clarification Politique Par Elisabeth Borne

May 09, 2025 -

Expert Prediction Arsenal Absent From Champions League Final Rio Ferdinand

May 09, 2025

Expert Prediction Arsenal Absent From Champions League Final Rio Ferdinand

May 09, 2025 -

Vu Bao Mau Tat Tre Tien Giang Tang Cuong Giam Sat Va Dao Tao

May 09, 2025

Vu Bao Mau Tat Tre Tien Giang Tang Cuong Giam Sat Va Dao Tao

May 09, 2025 -

Cong Luan Day Song Truoc Loi Khai Bao Mau Bao Hanh Tre Em Tien Giang

May 09, 2025

Cong Luan Day Song Truoc Loi Khai Bao Mau Bao Hanh Tre Em Tien Giang

May 09, 2025

Latest Posts

-

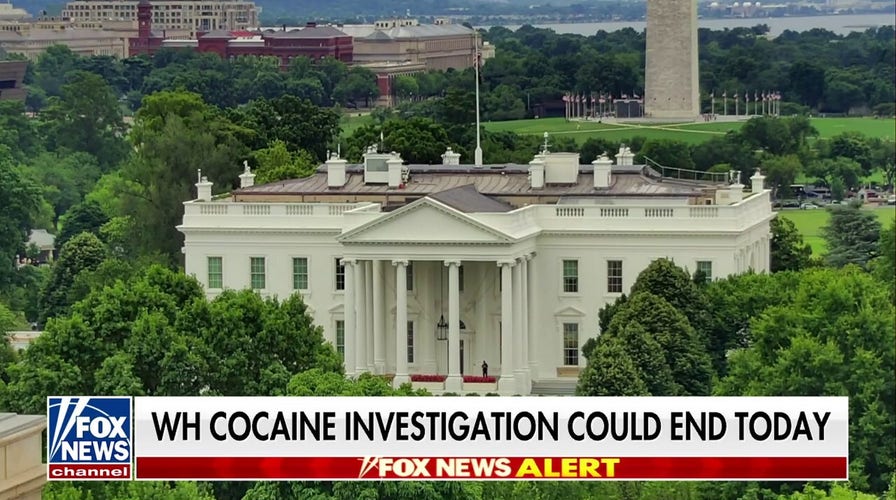

Secret Service Investigation Final Report On Cocaine Found At White House

May 10, 2025

Secret Service Investigation Final Report On Cocaine Found At White House

May 10, 2025 -

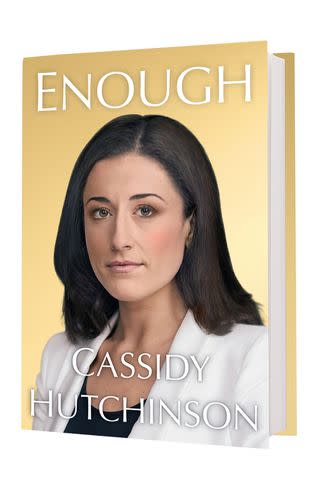

Cassidy Hutchinsons Memoir A Jan 6 Witness Tells All This Fall

May 10, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Tells All This Fall

May 10, 2025 -

Los Angeles Palisades Fires A Comprehensive List Of Celebrity Home Losses

May 10, 2025

Los Angeles Palisades Fires A Comprehensive List Of Celebrity Home Losses

May 10, 2025 -

Deutsche Bank Strengthens Defense Finance Capabilities With Dedicated Team

May 10, 2025

Deutsche Bank Strengthens Defense Finance Capabilities With Dedicated Team

May 10, 2025 -

Deutsche Banks New Deals Team Targets Expansion In The Defense Finance Sector

May 10, 2025

Deutsche Banks New Deals Team Targets Expansion In The Defense Finance Sector

May 10, 2025