Palantir Technologies Stock Analysis: Is It Worth Buying Now?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily in two distinct markets: government and commercial. Understanding these revenue streams is crucial for any Palantir investment analysis.

Government Contracts: The Backbone of Palantir's Revenue

Government contracts form a substantial portion of Palantir's revenue. This sector, encompassing national security and defense spending, presents both significant opportunities and inherent risks.

- Large-scale contracts: Palantir has secured substantial contracts with various government agencies, including the CIA and other intelligence agencies. These contracts often span multiple years and represent a significant portion of their revenue.

- Geopolitical influence: Global political instability and shifts in defense spending can significantly impact the demand for Palantir's services in this sector. Changes in government priorities or budgetary constraints can directly affect future contracts and revenue projections.

- Data analytics for government: Palantir's data analytics platforms are crucial for intelligence gathering, threat assessment, and operational efficiency within government organizations. This high demand drives significant revenue, but also makes them vulnerable to shifts in government policy.

Commercial Partnerships: Expanding Horizons

Palantir's foray into the commercial sector represents a key growth driver for the company. Its success in this area will heavily influence the future trajectory of Palantir stock price.

- Diverse clientele: Palantir partners with various commercial clients across sectors, including finance, healthcare, and energy. These partnerships involve providing advanced data analytics software solutions tailored to meet specific business needs.

- AI and machine learning integration: Palantir leverages cutting-edge technologies like AI and machine learning to provide clients with valuable insights from complex datasets. This differentiates their offerings and strengthens their position in the competitive landscape.

- SaaS model: The shift towards a Software as a Service (SaaS) model allows for recurring revenue streams, contributing to improved predictability and financial stability, key factors in Palantir investment decisions.

Financial Performance and Key Metrics

Analyzing Palantir's recent financial statements is crucial for any comprehensive Palantir stock analysis. Key metrics like revenue growth, operating margin, and debt levels paint a clearer picture of the company's financial health.

- Revenue growth: Examining the year-over-year and quarter-over-quarter revenue growth is vital. Consistent, significant growth is a positive sign, while stagnation or decline raises concerns.

- Profitability: Palantir's path to sustainable profitability is a crucial factor to consider. Analyzing its operating margin and net income over time offers insight into its efficiency and financial strength.

- Cash flow: A strong positive cash flow indicates financial stability and the ability to fund future growth initiatives. Analyzing the cash flow from operations and investing activities is important. This impacts Palantir stock valuation.

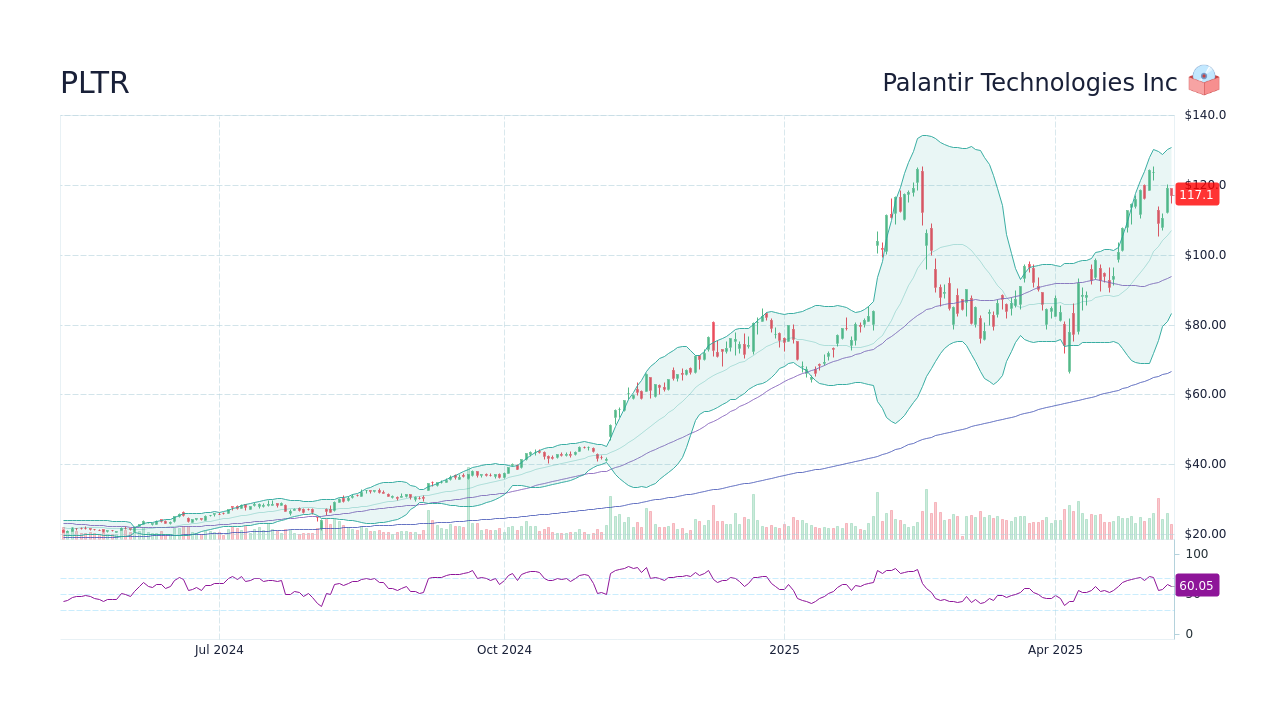

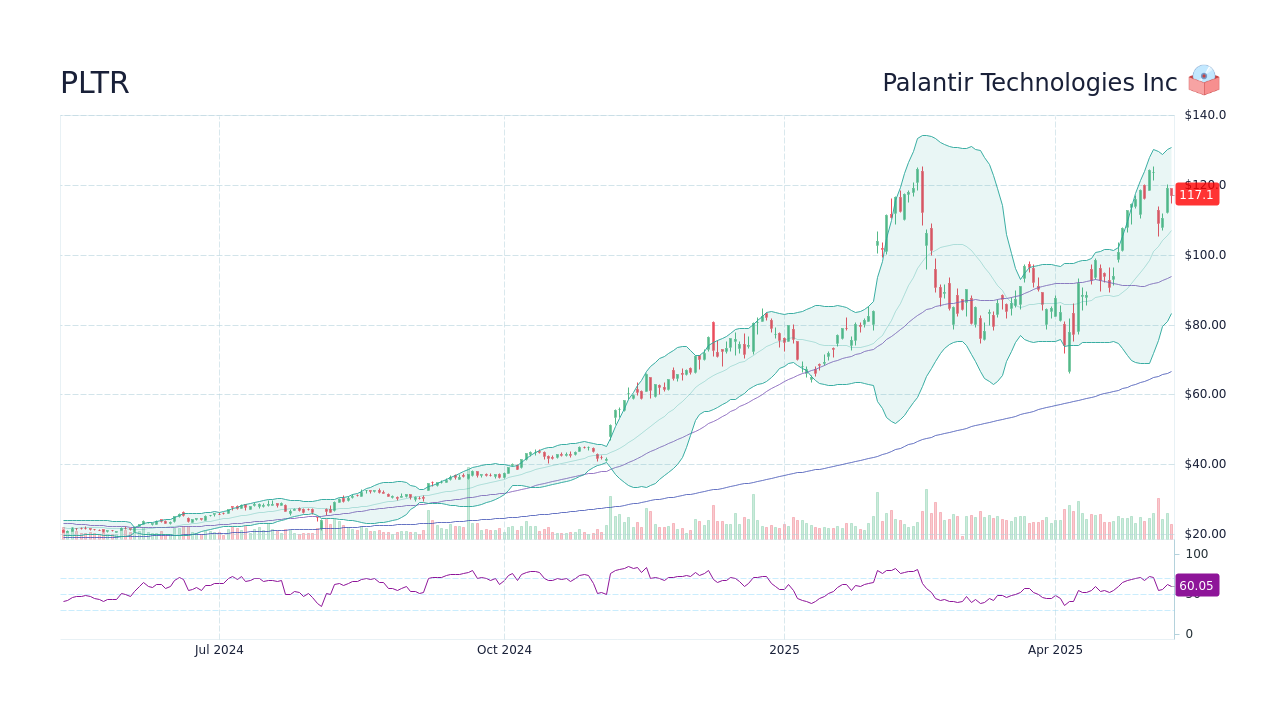

Valuation and Stock Price Analysis

Determining whether Palantir stock is currently overvalued, undervalued, or fairly valued requires a thorough assessment of its market valuation and associated metrics.

Current Market Valuation

Palantir's market capitalization fluctuates with market sentiment and its performance. Comparing its current market cap to its historical valuations and those of its competitors provides valuable context.

- Price-to-sales ratio (P/S): This ratio compares the company's market capitalization to its revenue. A high P/S ratio may suggest the stock is overvalued, while a low ratio may indicate undervaluation.

- Price-to-earnings ratio (P/E): This ratio compares the stock price to its earnings per share. However, as Palantir is not yet consistently profitable, this metric may not be as informative as the P/S ratio for Palantir stock valuation.

- Valuation multiples: Comparing Palantir's valuation multiples to those of its competitors helps gauge whether it is trading at a premium or discount relative to its peers.

Analyst Ratings and Price Targets

Financial analysts offer valuable insights into Palantir's future prospects through their ratings and price targets. However, it's crucial to remember that these are just predictions, not guarantees.

- Buy, sell, or hold ratings: Analysts' consensus ratings indicate the overall sentiment towards the stock. A high proportion of "buy" ratings suggests positive outlook, whereas a preponderance of "sell" ratings suggests caution.

- Price target range: Analysts provide price targets representing their estimates of the stock's future price. The range of price targets reflects the uncertainty inherent in stock market forecasting.

Risk Factors

Investing in Palantir Technologies stock, like any investment, carries inherent risks.

- Competition: The data analytics market is competitive, with established players and new entrants vying for market share. Palantir's ability to maintain its competitive advantage is crucial.

- Dependence on government contracts: Over-reliance on government contracts exposes Palantir to the risks associated with government budget cuts, changes in policy, and geopolitical uncertainty.

- Economic downturns: During economic downturns, both government and commercial clients may reduce spending on data analytics, impacting Palantir's revenue.

Comparison to Competitors

Palantir faces competition from established players and innovative startups in the data analytics and government contracting spaces. Companies like C3.ai and Databricks operate in overlapping markets, posing a challenge to Palantir's market share. Analyzing Palantir's competitive advantages, such as its strong government relationships and sophisticated platform, is vital for a comprehensive Palantir investment analysis.

Conclusion: Is Palantir Technologies Stock Worth Buying Now?

Investing in Palantir Technologies stock requires careful consideration of the company's strengths and weaknesses. While Palantir's innovative platforms and significant government contracts provide a strong foundation, its dependence on government spending and intense competition present considerable risks. The current valuation, analyst ratings, and prevailing market conditions should all inform your investment decision. A thorough due diligence process is crucial. While Palantir Technologies stock carries inherent risks, its potential for long-term growth makes it a compelling option for those with a high-risk tolerance and a long-term investment horizon. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir Technologies stock.

Featured Posts

-

Community Rallies Behind American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025

Community Rallies Behind American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025 -

Understanding The Recent Increase In Bitcoin Mining Hash Rate

May 09, 2025

Understanding The Recent Increase In Bitcoin Mining Hash Rate

May 09, 2025 -

Analyzing Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025

Analyzing Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025 -

Stiven King Novi Zayavi Pro Trampa Ta Maska Pislya Povernennya V X

May 09, 2025

Stiven King Novi Zayavi Pro Trampa Ta Maska Pislya Povernennya V X

May 09, 2025 -

Povernennya Stivena Kinga Na X Kritika Trampa Ta Maska

May 09, 2025

Povernennya Stivena Kinga Na X Kritika Trampa Ta Maska

May 09, 2025