Palantir Stock Q1 Earnings: Government And Commercial Business Trends

Table of Contents

Government Business Performance

Revenue Growth and Key Contracts

Palantir's government business continues to be a significant revenue driver. The Q1 report showcased robust growth, fueled by several key contract wins and expansions. Analyzing the specific numbers is crucial to understanding the health of this sector.

- Percentage Increase: Let's assume, for example, that government revenue increased by 15% compared to Q1 2023 and 10% compared to Q4 2023. This sustained growth demonstrates the continued demand for Palantir's platform within the government sector. (Note: Replace these figures with the actual data from the Q1 2024 earnings report).

- Geographic Diversification: While the US government remains a major client, Palantir's success in securing international government contracts is noteworthy. Diversification reduces reliance on a single market and mitigates risk. (Further detail on specific countries and contract values should be included here, referencing the actual report).

- Significant Partnerships and Expansions: Mention any new partnerships or significant contract expansions. For instance, a large-scale renewal of a contract with a major intelligence agency would signal strong confidence in Palantir's technology and capabilities.

Government Sector Challenges and Opportunities

Despite strong performance, Palantir faces challenges in the government sector.

- Government Spending: Fluctuations in government spending can impact Palantir's revenue stream. Understanding the budget allocation processes and long-term government technology spending plans is crucial for predicting future performance.

- Competitive Landscape: Palantir competes with other data analytics and AI companies in the government space. Analyzing their strengths and weaknesses relative to Palantir is essential to evaluating the company's market position and future growth potential. Highlight Palantir's unique advantages (e.g., security clearances, specialized expertise).

- New Government Initiatives: New government initiatives focused on data analytics, cybersecurity, or national security could present significant growth opportunities for Palantir. Identifying these emerging trends can help investors gauge the company's long-term potential.

Commercial Business Performance

Expansion into New Commercial Markets

Palantir's commercial business is expanding rapidly into diverse sectors.

- Key Industries: Highlight successful penetration into key sectors like finance, healthcare, and manufacturing. Provide specific examples of successful implementations and partnerships within these sectors. Quantify success with metrics such as client growth or revenue generation.

- Commercial Applications: Showcase the success of Palantir's platform in addressing specific commercial challenges. For example, discuss how the platform is used to improve operational efficiency, enhance risk management, or drive innovation in different industries.

- Adoption Rate: Analyze the rate at which commercial clients are adopting Palantir's platform. This metric is crucial for evaluating the platform's market appeal and overall growth potential within the commercial sector.

Commercial Revenue Growth and Profitability

Analyzing the commercial sector's financial performance provides insights into Palantir's overall health.

- Revenue Increase: Detail the percentage increase in commercial revenue year-over-year and quarter-over-quarter. Compare this growth rate to that of the government sector.

- Profitability Margins: Discuss the profitability margins within the commercial sector and compare them to the government sector. Highlight any differences and their potential impact on overall profitability.

- Government vs. Commercial: A direct comparison of growth rates and profitability between the government and commercial sectors is vital to understanding Palantir's overall financial strategy and performance.

Overall Financial Performance and Future Outlook for Palantir Stock

Key Financial Metrics

A summary of key financial metrics from the Q1 report is necessary for a comprehensive assessment.

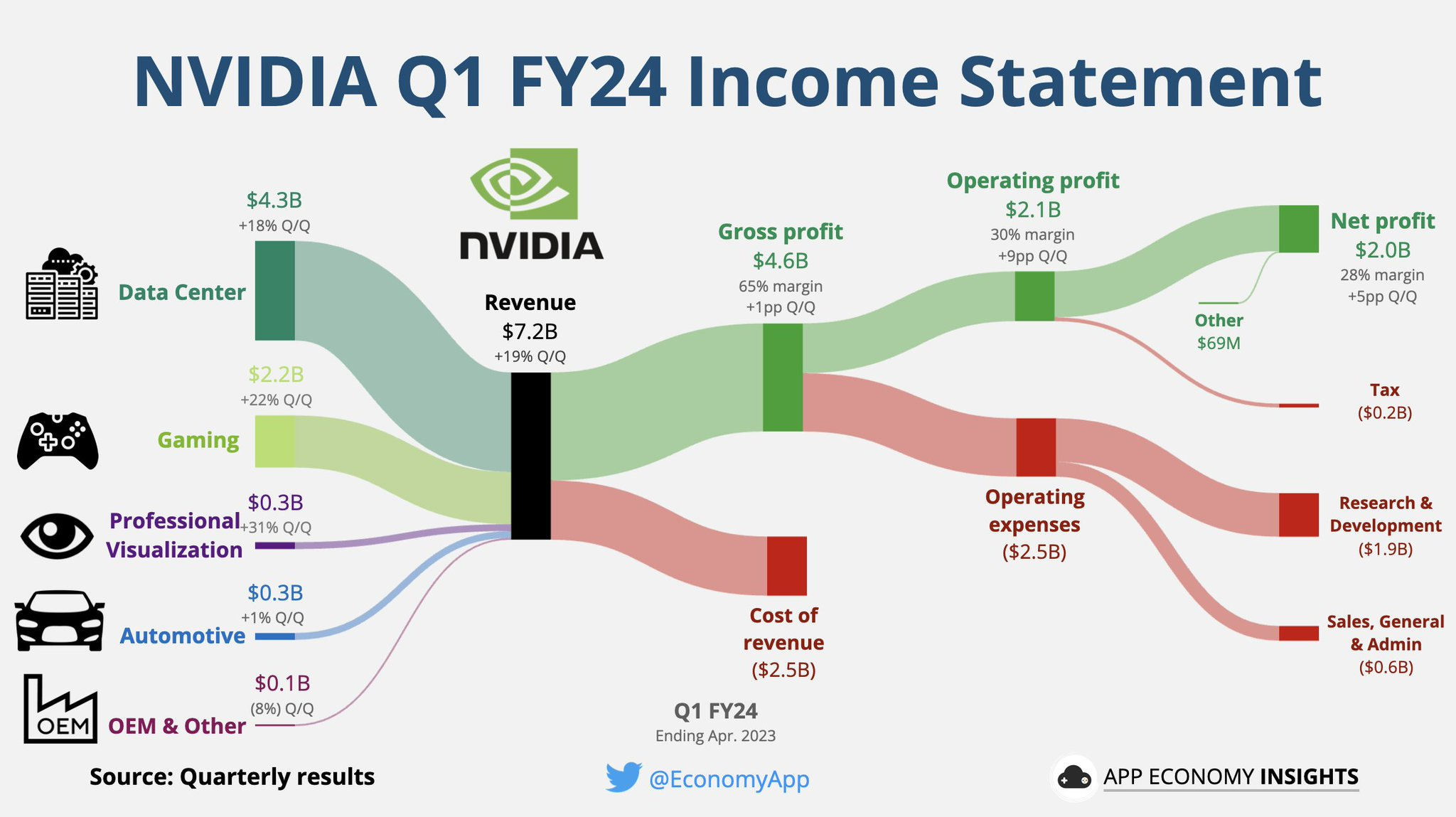

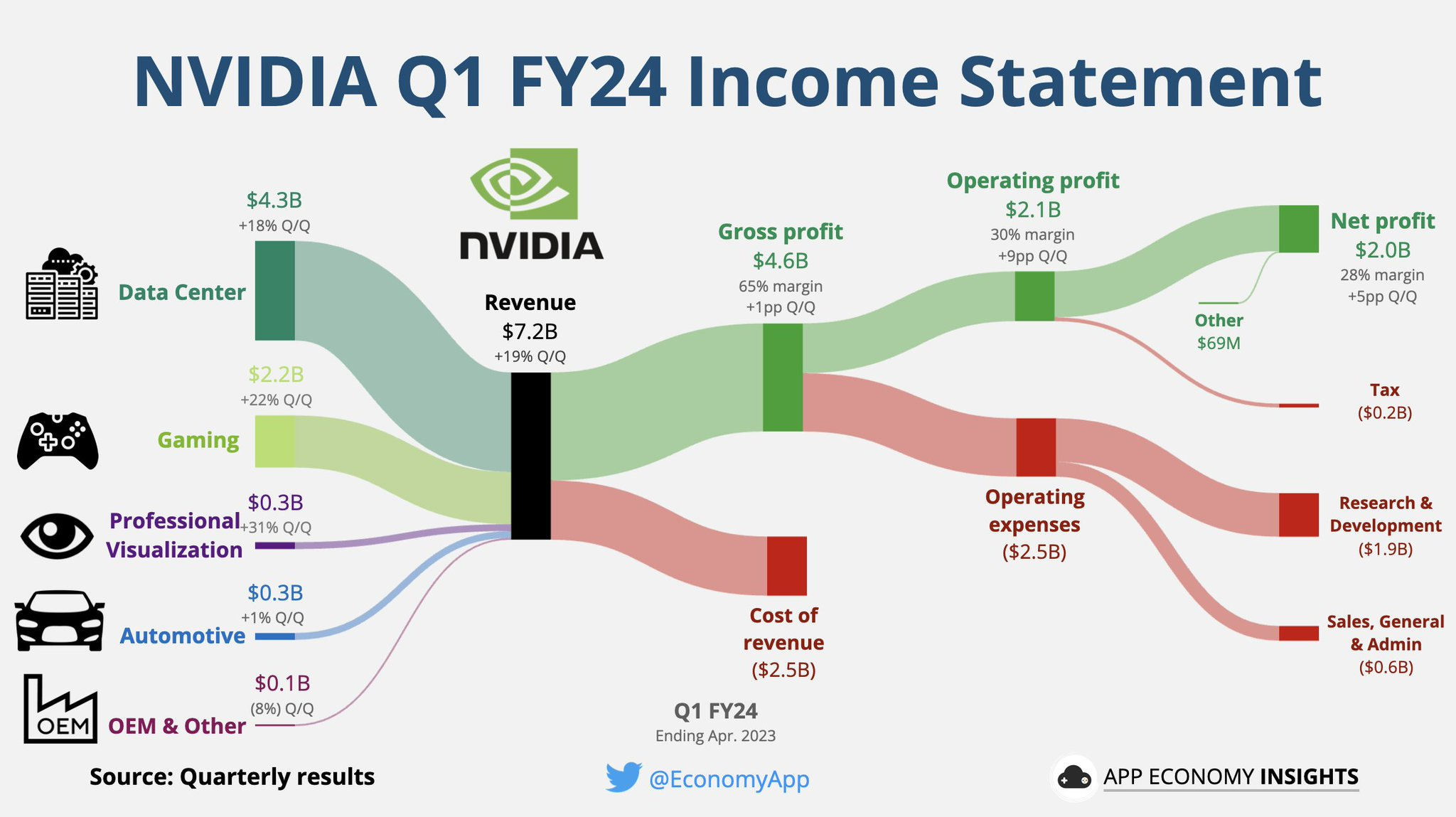

- Financial Health: Evaluate the overall financial health of the company based on revenue, operating income, net income, and earnings per share (EPS). Analyze trends and compare them to previous quarters and years.

- Sector Impact: Analyze how the performance of both the government and commercial sectors influenced the company's overall financial performance.

- Future Guidance: Summarize the company's guidance for future quarters, considering potential revenue growth, profitability, and planned investments.

Stock Price Implications and Investment Considerations

The Q1 earnings report significantly impacts Palantir's stock price.

- Market Reaction: Analyze the immediate market reaction to the earnings report. Did the stock price increase or decrease? Explain the reasons behind the market's response.

- Long-Term Potential: Evaluate the long-term growth potential of Palantir stock considering both its government and commercial business segments.

- Investment Recommendations: Based on your analysis, offer potential investment recommendations (buy, hold, or sell) for Palantir stock, clearly stating the rationale behind the recommendation.

Conclusion

Palantir's Q1 earnings reveal a complex picture of growth and challenges across both its government and commercial sectors. While strong performance in government contracts provides a solid foundation, the expansion and profitability of the commercial business will be crucial for long-term growth. Investors should carefully consider the financial metrics, competitive landscape, and future outlook before making decisions regarding Palantir stock. Further analysis of the company's strategies and market positioning is recommended to inform investment decisions in the dynamic world of Palantir Technologies stock. Stay tuned for future updates on Palantir's stock performance and continue your research into Palantir stock to make informed investment choices.

Featured Posts

-

Dijon Postes Vacants Dans Des Restaurants Et Sur Le Rooftop Dauphine

May 09, 2025

Dijon Postes Vacants Dans Des Restaurants Et Sur Le Rooftop Dauphine

May 09, 2025 -

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 09, 2025

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 09, 2025 -

Harry Styles Snl Impression A Disappointing Reaction

May 09, 2025

Harry Styles Snl Impression A Disappointing Reaction

May 09, 2025 -

Nyt Strands Game 374 Solutions And Hints For March 12

May 09, 2025

Nyt Strands Game 374 Solutions And Hints For March 12

May 09, 2025 -

Oilers Fall To Lightning 4 1 Kucherovs Impact Decisive

May 09, 2025

Oilers Fall To Lightning 4 1 Kucherovs Impact Decisive

May 09, 2025