Palantir Stock Investment Strategy Before May 5th

Table of Contents

Analyzing Palantir's Recent Performance and Future Prospects

Before formulating a Palantir investment strategy, a thorough understanding of the company's current financial health and future prospects is paramount. This involves reviewing several key aspects:

Keywords: Palantir earnings, Palantir revenue growth, Palantir government contracts, Palantir commercial growth, Palantir stock valuation.

-

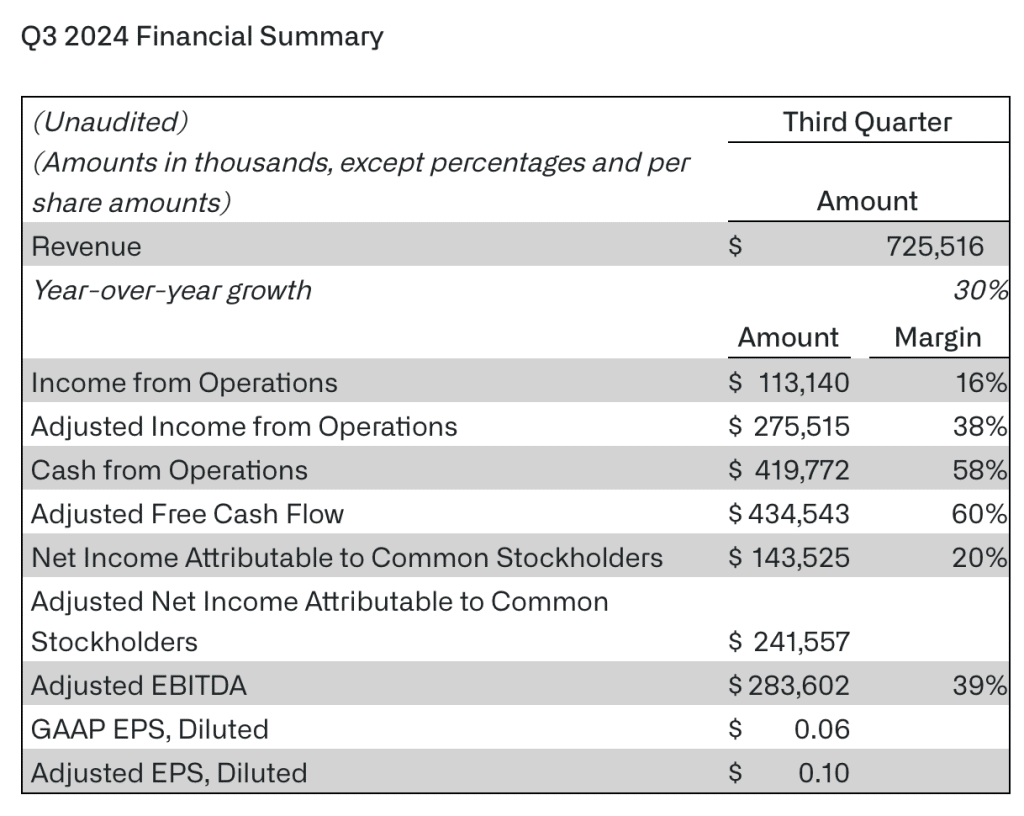

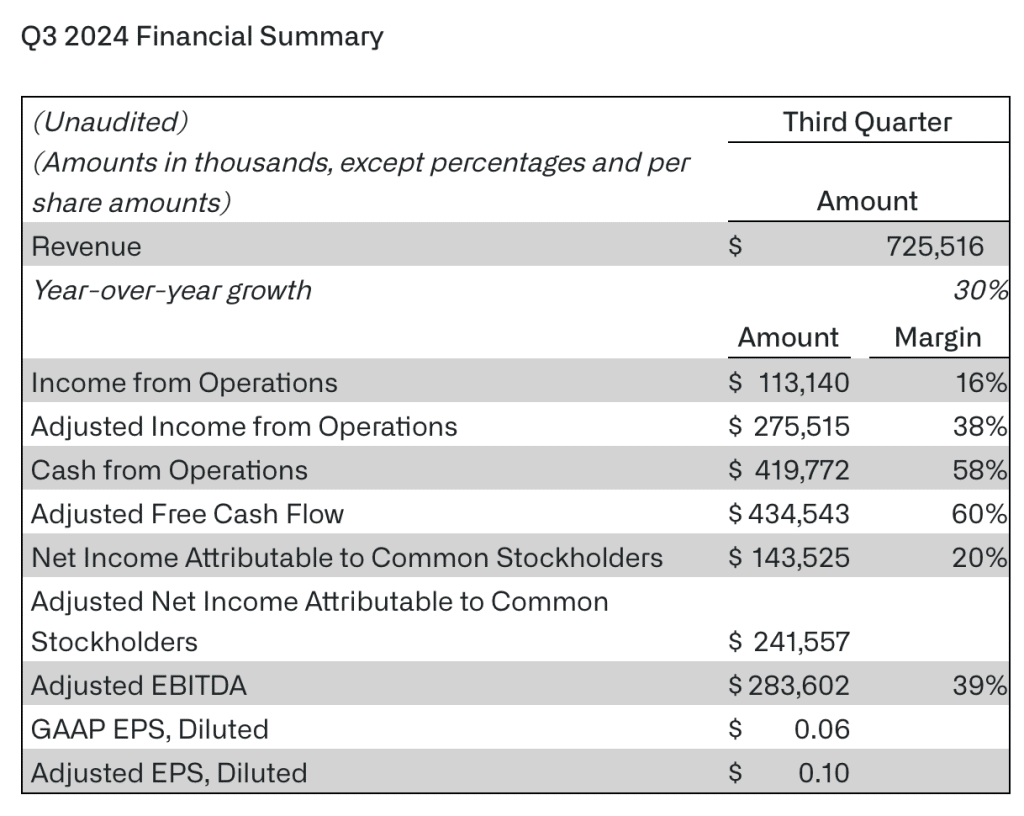

Reviewing Palantir's Recent Financial Reports: Scrutinize Palantir's recent earnings reports, focusing on key metrics such as revenue growth, operating income, and net income. Analyze the trends in these figures to identify growth patterns and potential challenges. A consistent upward trend in revenue suggests a healthy and expanding business, while a decline might indicate underlying issues requiring further investigation. Don't just look at the headline numbers; delve into the details of the income statement and cash flow statement for a complete picture.

-

Analyzing Government vs. Commercial Growth: Palantir operates in both the government and commercial sectors. Analyze the growth trajectory of each sector separately. Understanding the contribution of each segment to overall revenue is critical. A heavy reliance on government contracts might introduce increased risk associated with government spending cycles and policy changes. Conversely, strong commercial growth demonstrates broader market acceptance and diversification.

-

Assessing Geopolitical and Economic Impacts: Geopolitical instability and economic downturns significantly influence technology stocks. Assess how global events and economic conditions could affect Palantir's business. For example, increased government spending on defense could boost Palantir's government contracts, while an economic recession might reduce commercial demand for its big data analytics solutions.

-

Evaluating Innovation and Future Roadmap: Analyze Palantir's innovation pipeline and future product roadmap. Are they investing in research and development? Are they successfully launching new products and services that meet evolving market demands? A company with a strong commitment to innovation is better positioned for long-term growth.

-

Comparative Valuation: Compare Palantir's valuation metrics (such as Price-to-Sales ratio and Price-to-Earnings ratio) to its competitors in the big data and analytics market. This comparative analysis helps determine whether Palantir is undervalued or overvalued relative to its peers.

Understanding the Risks Associated with Palantir Stock

Investing in Palantir stock, like any technology stock, involves inherent risks. A prudent Palantir investment strategy necessitates a thorough understanding of these risks:

Keywords: Palantir stock risk, Palantir volatility, technology stock risk, investment risk assessment, market risk.

-

Volatility and Market Fluctuations: Palantir stock is known for its volatility. Its price can fluctuate significantly based on market sentiment, news events, and financial performance. This inherent volatility introduces significant risk for short-term investors.

-

Government Contract Dependence: A substantial portion of Palantir's revenue stems from government contracts. This dependence creates risks associated with government budget cuts, changes in procurement policies, and potential delays in contract awards.

-

Competitive Landscape: The big data and analytics market is highly competitive. Palantir faces competition from established players with significant resources and market share. This competition poses a threat to Palantir's market position and revenue growth.

-

Regulatory Environment: The regulatory landscape for data analytics and security is constantly evolving. Changes in regulations can impact Palantir's ability to operate and expand its business.

-

Financial Performance Risks: Analyze the company's profitability and cash flow. Consistent losses or inconsistent profitability can signal underlying weaknesses that impact the long-term sustainability of the business.

Developing a Personalized Palantir Investment Strategy Before May 5th

Creating a successful Palantir investment strategy requires a personalized approach based on your individual financial goals and risk tolerance:

Keywords: Palantir investment strategy, stock portfolio diversification, risk tolerance, investment timeline, buy, hold, sell Palantir.

-

Define Your Investment Goals and Risk Tolerance: Before investing in Palantir or any stock, clearly define your investment objectives (e.g., long-term growth, short-term gains, capital preservation) and assess your risk tolerance. Are you comfortable with significant price fluctuations? A higher risk tolerance might allow for a larger allocation to Palantir, while a lower tolerance might necessitate a more conservative approach.

-

Determine Your Investment Timeline: Are you investing for the short term or long term? Your investment timeline will significantly influence your investment strategy. Short-term investors need to be more sensitive to market fluctuations and might focus on trading opportunities. Long-term investors can afford to ride out short-term volatility.

-

Portfolio Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. A diversified portfolio reduces your overall exposure to any single investment's performance.

-

Entry and Exit Strategy: Develop a clear entry and exit strategy for Palantir stock. This might involve setting specific price targets for buying and selling, or using technical indicators to guide your investment decisions. This structured approach helps to manage risks and maximize potential profits.

-

Buy, Hold, or Sell Before May 5th?: Based on your analysis of Palantir's performance, prospects, risks, and your personalized investment strategy, determine whether to buy, hold, or sell Palantir before May 5th. This decision should be based on your research and not on speculation or market rumors.

Conclusion

Making informed investment decisions regarding Palantir stock before May 5th requires a thorough understanding of the company’s performance, future prospects, and inherent risks. By carefully analyzing the factors discussed above and developing a personalized strategy aligned with your investment goals and risk tolerance, you can approach this opportunity with greater confidence.

Call to Action: Don't delay your Palantir stock investment strategy. Conduct your own thorough due diligence and make informed decisions before May 5th. Remember, this analysis is for informational purposes only and is not financial advice. Consult with a qualified financial advisor before making any investment decisions. Start planning your Palantir investment strategy today!

Featured Posts

-

32

May 09, 2025

32

May 09, 2025 -

Trois Hommes Sauvagement Agresses Au Lac Kir A Dijon

May 09, 2025

Trois Hommes Sauvagement Agresses Au Lac Kir A Dijon

May 09, 2025 -

Statement From Williams Regarding Doohan In Light Of Colapinto Links

May 09, 2025

Statement From Williams Regarding Doohan In Light Of Colapinto Links

May 09, 2025 -

Taiwans Vice President Lai Warns Of New Totalitarian Threat

May 09, 2025

Taiwans Vice President Lai Warns Of New Totalitarian Threat

May 09, 2025 -

Solve Nyt Strands Wednesday March 12 Game 374 Hints And Answers

May 09, 2025

Solve Nyt Strands Wednesday March 12 Game 374 Hints And Answers

May 09, 2025