Palantir Stock: Blowouts And The Highest Multiple On Wall Street

Table of Contents

Palantir Technologies (PLTR) stock has captivated investors with its seemingly paradoxical position: a high valuation multiple amongst tech stocks, yet boasting significant revenue growth and a unique position in the burgeoning data analytics market. This article will delve into the factors contributing to Palantir's high multiple, examining both the potential blowouts and the inherent risks involved in investing in this controversial, high-growth company.

Palantir's High Valuation: A Premium Price for Big Data Expertise

Palantir's high valuation is a reflection of its strong revenue growth and its unique position in the data analytics market. This premium price is justified, according to some analysts, by its significant government contracts and its growing dominance in the enterprise software sector. However, understanding the nuances of this valuation is critical before investing in PLTR stock.

Government Contracts and Revenue Growth

Palantir's substantial government contracts form a cornerstone of its revenue stream, providing a degree of stability often lacking in other high-growth tech companies. These contracts, often multi-year and high-value, contribute significantly to its bottom line and offer a predictable revenue stream.

- Recent contract wins: Palantir has secured numerous large contracts in recent years, including significant deals with various branches of the US government and international defense agencies. The specific values of these contracts are often confidential, but their impact on future earnings is undeniable.

- Future government spending: Increased global geopolitical instability and the growing importance of data analytics in national security are expected to drive continued growth in government spending on data solutions, benefiting Palantir significantly.

- Key Government Clients (Examples): While specific contract details are often undisclosed for security reasons, publicly known clients include agencies within the US Department of Defense and intelligence communities, along with international government bodies.

Enterprise Software Market Domination

Beyond government contracts, Palantir is making significant inroads into the rapidly expanding enterprise software market. Its proprietary software platforms offer unparalleled data integration and analytics capabilities, setting it apart from competitors.

- Unique Capabilities: Palantir's platforms excel at integrating disparate data sources, providing actionable insights for businesses across various sectors. This capability is a key competitive advantage.

- Successful Enterprise Clients: Palantir boasts a growing list of Fortune 500 companies utilizing its platforms for operational efficiency, risk management, and strategic decision-making. Case studies showcasing tangible results further solidify its market position.

- Key Software Features: Key features driving Palantir's success include its powerful data integration capabilities, advanced analytics tools, and robust security features, crucial for enterprise clients.

Future Growth Potential and Innovation

Palantir's potential for future growth is substantial, fueled by ongoing innovation and expansion into new markets. Significant investments in research and development are driving the development of new products and services.

- Areas of Innovation: Palantir is investing heavily in AI, machine learning, and cloud-based solutions, positioning itself for future growth in these rapidly evolving sectors.

- Future Product Development: The company continuously develops new features and expands its platform offerings to meet the evolving needs of its clients.

- Market Expansion: Palantir is actively exploring new market segments and geographies, broadening its revenue streams and reducing reliance on any single sector.

The Risks of Investing in Palantir Stock: Understanding the Potential Blowouts

Despite the potential for significant growth, investing in Palantir stock carries substantial risk. Its high valuation, dependence on government contracts, and competitive landscape all present potential challenges.

High Valuation Risks

Palantir's high price-to-earnings (P/E) ratio presents a significant risk. A slowdown in growth could trigger a stock price correction, impacting investor returns. Comparing its valuation to other companies in the data analytics sector is crucial for a balanced assessment.

Dependence on Government Contracts

Reliance on government contracts exposes Palantir to political and budgetary risks. Changes in government policy or spending cuts could negatively impact revenue and future growth. Contract delays or cancellations also represent potential downsides.

Competition in the Data Analytics Market

The data analytics market is increasingly competitive, with established tech giants and agile startups vying for market share. Palantir faces stiff competition from companies with significant resources and market presence.

Analyzing the Palantir Stock Price: A Long-Term Investment?

Whether Palantir stock represents a sound long-term investment depends on several factors, including the company's ability to sustain its growth trajectory, successfully penetrate the enterprise market, and navigate the inherent risks associated with its business model.

Factors influencing future stock price: Market sentiment toward tech stocks, the success of new product launches, and the overall performance of the global economy will all significantly influence Palantir's stock price.

Buy or Sell? Determining the optimal time to buy or sell Palantir stock requires careful consideration of market conditions, financial projections, and individual risk tolerance. It is not possible to provide specific financial advice in this context.

Conclusion

This article explored the complex factors influencing Palantir stock, highlighting both its significant growth potential and inherent risks associated with its high valuation and reliance on government contracts. Investing in Palantir requires a careful assessment of these opposing forces.

Call to Action: Thorough due diligence is crucial before investing in high-multiple stocks like Palantir. Conduct your own research and consult with a financial advisor before making any investment decisions concerning Palantir stock (PLTR) or any other high-growth company. Understanding the potential blowouts and the long-term prospects of Palantir stock is essential for informed investing.

Featured Posts

-

Nba Free Agency 2024 Warriors Efforts To Keep Kevon Looney

May 07, 2025

Nba Free Agency 2024 Warriors Efforts To Keep Kevon Looney

May 07, 2025 -

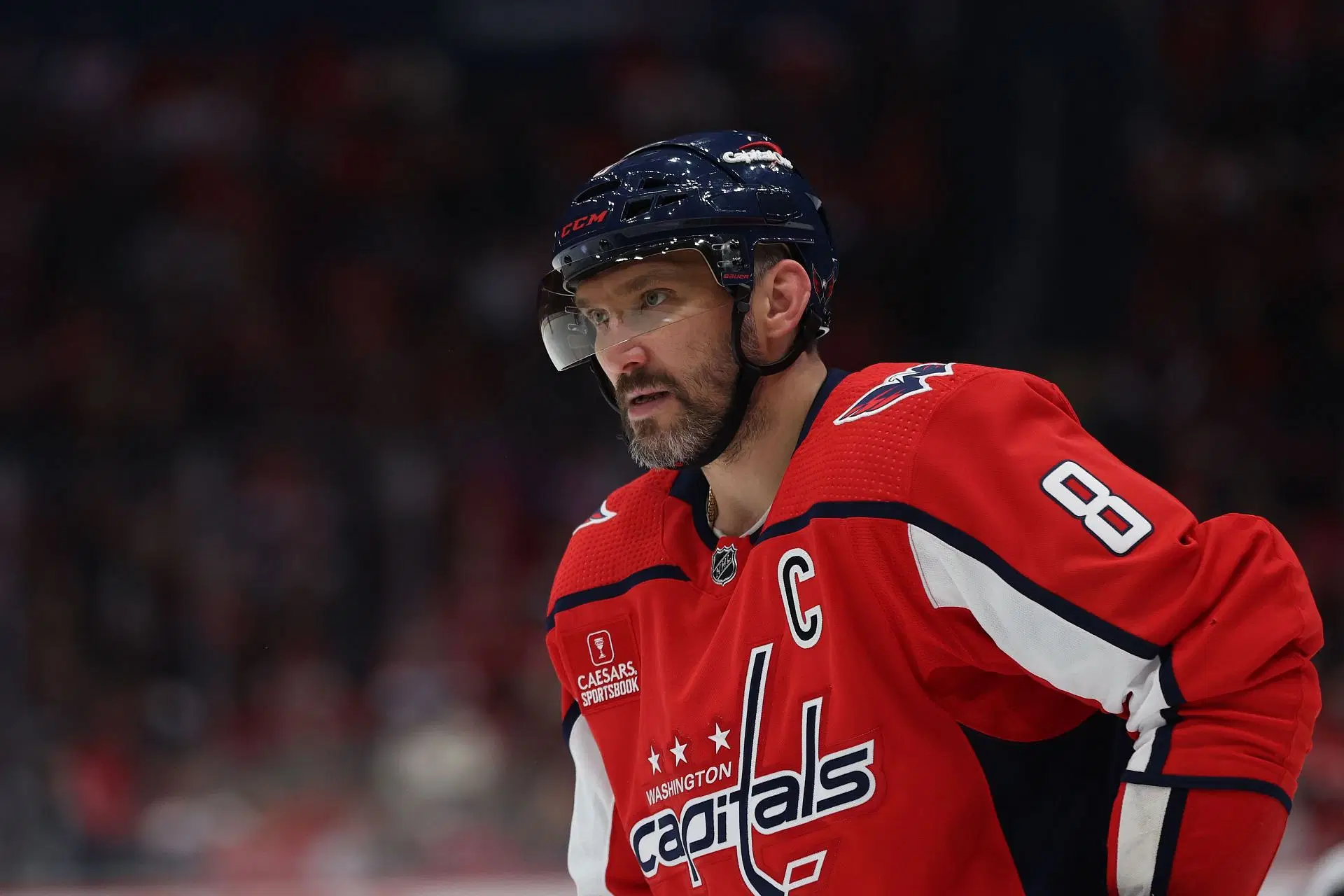

Future Russian Nhl Stars Learning From Alex Ovechkin

May 07, 2025

Future Russian Nhl Stars Learning From Alex Ovechkin

May 07, 2025 -

Steelers Decline Trade Offers For Star Wideout Chase Claypool

May 07, 2025

Steelers Decline Trade Offers For Star Wideout Chase Claypool

May 07, 2025 -

Zendayas Unexpected Spider Man Audition Reveal

May 07, 2025

Zendayas Unexpected Spider Man Audition Reveal

May 07, 2025 -

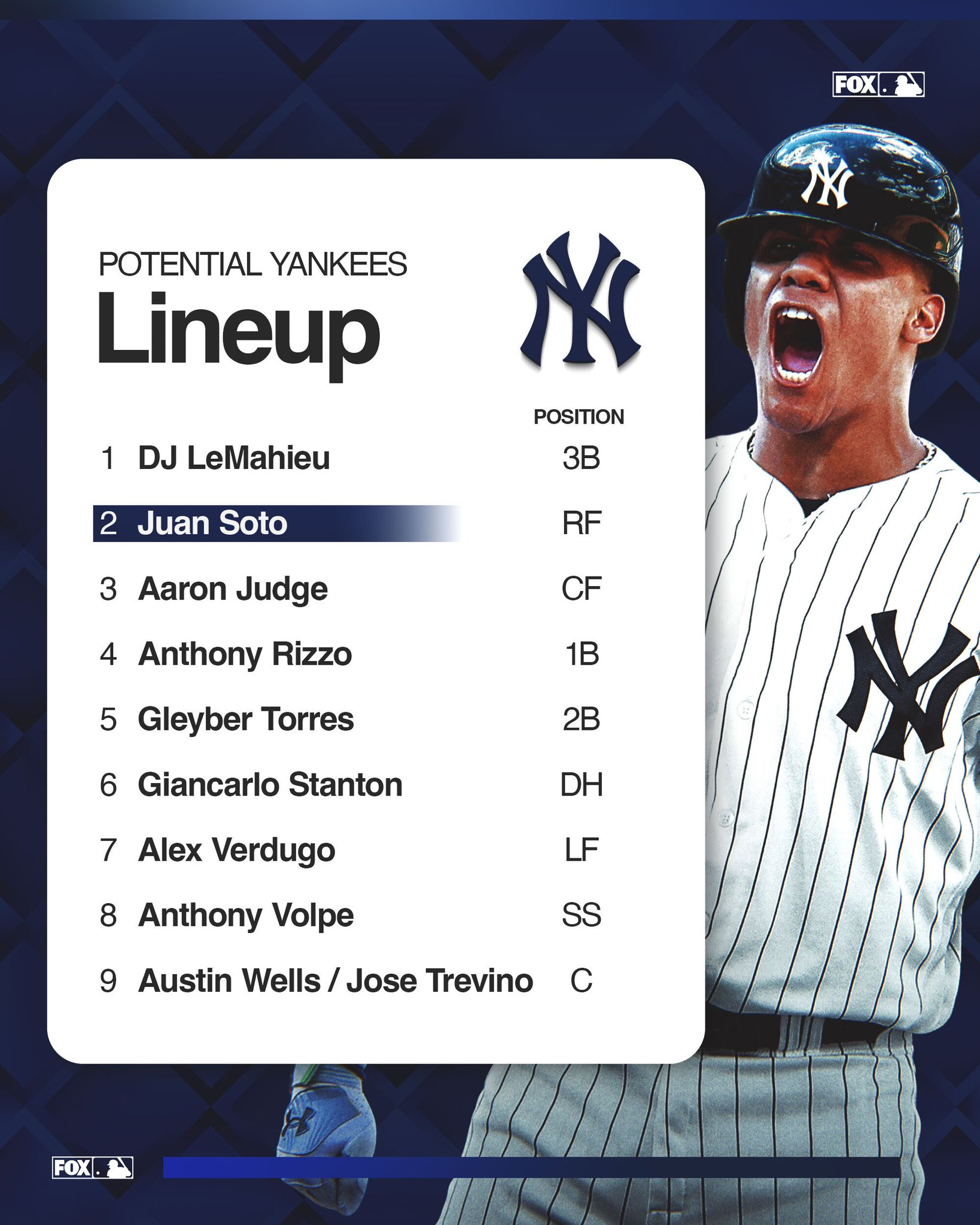

A Look Back 2000 Yankees Season Diary The 500 Mark

May 07, 2025

A Look Back 2000 Yankees Season Diary The 500 Mark

May 07, 2025

Latest Posts

-

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025

Kriptoda Yeni Bir Cag Spk Nin Aciklamalari Ve Analizi

May 08, 2025 -

Kripto Para Wall Street Kurumlarinin Degisen Tutumu Ve Gelecegi

May 08, 2025

Kripto Para Wall Street Kurumlarinin Degisen Tutumu Ve Gelecegi

May 08, 2025 -

Rusya Merkez Bankasi Nin Kripto Para Uyarisi Ne Anlama Geliyor Ve Nelere Dikkat Etmeliyiz

May 08, 2025

Rusya Merkez Bankasi Nin Kripto Para Uyarisi Ne Anlama Geliyor Ve Nelere Dikkat Etmeliyiz

May 08, 2025 -

Spk Nin Kripto Para Piyasalarina Etkisi Yeni Reguelasyonlar Ve Gelecek

May 08, 2025

Spk Nin Kripto Para Piyasalarina Etkisi Yeni Reguelasyonlar Ve Gelecek

May 08, 2025 -

Wall Street Ten Kripto Para Yatirimlarina Yeni Bir Bakis

May 08, 2025

Wall Street Ten Kripto Para Yatirimlarina Yeni Bir Bakis

May 08, 2025