Palantir Stock: A 40% Increase By 2025? Is It Realistic?

Table of Contents

Palantir Technologies (PLTR) has experienced a rollercoaster ride since its IPO, leaving many investors wondering about its future trajectory. A common question circulating is: is a 40% increase in Palantir stock price by 2025 a realistic expectation? This article aims to provide a comprehensive analysis, exploring the factors that could contribute to – or hinder – such substantial growth in Palantir stock. We'll delve into the company's current market position, growth potential, and the inherent risks involved in predicting such a significant price surge.

Palantir's Current Market Position and Growth Potential

Palantir's success hinges on its ability to capitalize on two key market segments: government contracts and commercial market expansion.

Government Contracts and Revenue Streams

Palantir's government contracts form a substantial portion of its revenue. These contracts, particularly within the defense sector, provide a stable revenue stream. However, the long-term reliance on government funding presents both opportunities and challenges.

- Size and Stability: The sheer size of government contracts ensures significant revenue. However, the renewal process and potential budgetary constraints introduce some level of uncertainty.

- Growth Potential: The increasing adoption of data analytics within government agencies presents a significant avenue for growth. Increased defense spending, coupled with the need for sophisticated data analysis tools, creates a favorable environment.

- Upcoming Contracts: Keeping a close eye on upcoming contract renewals and bids is crucial. Success in securing new, large-scale government contracts will be instrumental in driving revenue growth and influencing Palantir stock price.

- Data Point: Government spending on data analytics and cybersecurity is projected to grow at a significant rate in the coming years, providing potential fuel for Palantir's growth in this sector.

Commercial Market Expansion and Adoption

Palantir's success in the commercial sector depends on the widespread adoption of its Foundry platform. This requires demonstrating significant value and establishing a strong competitive advantage.

- Progress and Partnerships: Palantir has been actively expanding its commercial client base, securing partnerships with major corporations across various industries. Successful case studies demonstrating the effectiveness of Foundry are key to attracting new clients.

- Competitive Landscape: The data analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir's ability to differentiate itself through innovative features and superior customer service will be critical.

- Market Share and Growth: Analyzing Palantir's market share within the commercial data analytics sector provides insights into its competitive positioning and growth trajectory. The potential for substantial market share gains remains a key driver for future stock performance. Software as a Service (SaaS) models are crucial to scalability here.

Factors That Could Drive a 40% Increase in Palantir Stock

Several factors could contribute to a significant surge in Palantir stock price.

Technological Innovation and Product Development

Continuous innovation and the development of cutting-edge products are crucial for Palantir to maintain its competitive edge.

- R&D Efforts: Investment in research and development is essential for staying ahead of the curve. Focus on Artificial Intelligence (AI) and Machine Learning (ML) integration can significantly enhance Palantir's offerings.

- Impact of AI/ML: AI and ML are transforming the data analytics landscape. Palantir's ability to effectively leverage these technologies will determine its competitiveness and future growth prospects.

- Breakthroughs and Releases: Any significant technological breakthroughs or the release of innovative new products or software updates will likely have a positive impact on investor sentiment and, consequently, the Palantir stock price.

Macroeconomic Factors and Market Sentiment

Broader macroeconomic trends and investor sentiment play a crucial role in influencing Palantir stock price.

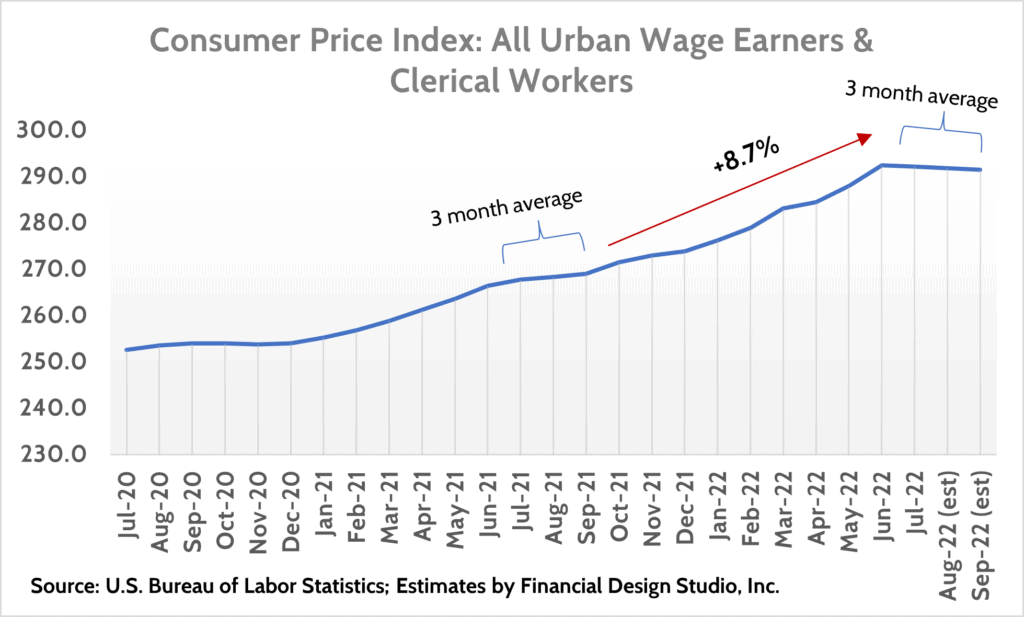

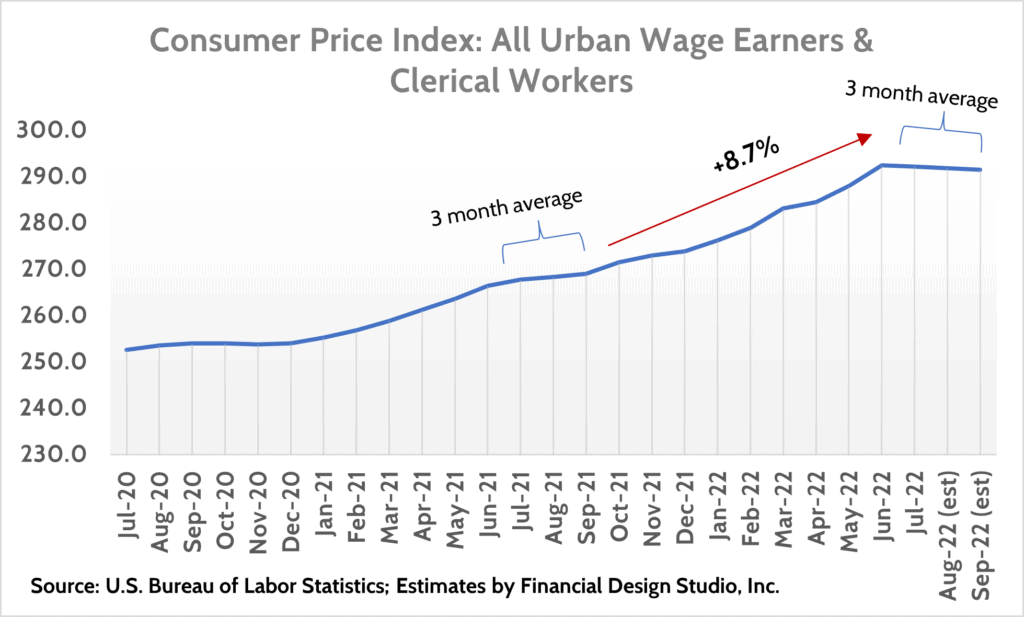

- Market Conditions: Interest rates, inflation, and overall economic outlook significantly influence investor behavior and risk appetite. A positive economic climate typically favors growth stocks like Palantir.

- Investor Confidence: Investor confidence in data analytics companies, and the technology sector as a whole, directly impacts stock valuations. Positive news and successful execution of the company's strategy can boost investor confidence.

- Stock Market Trends: Understanding broader market trends and investor sentiment towards the technology sector are crucial in predicting Palantir stock movements.

Risks and Challenges That Could Prevent a 40% Increase

While the potential for growth is substantial, several risks and challenges could hinder a 40% increase in Palantir stock by 2025.

Competition and Market Saturation

Palantir faces intense competition in the data analytics market.

- Competitive Threats: Several established players and emerging companies pose significant threats. Maintaining a competitive edge requires continuous innovation and superior customer service.

- Market Saturation: The potential for market saturation and price wars cannot be ignored. Palantir must differentiate itself to avoid being squeezed by competitors.

- Competitive Advantage: Developing and maintaining a sustainable competitive advantage is paramount for long-term success and strong stock performance.

Financial Performance and Profitability

Palantir's financial performance is another key factor to consider.

- Financial Statements: A thorough analysis of Palantir's financial statements, including revenue growth, profitability (earnings per share or EPS), and debt levels, is crucial.

- Sustainability of Growth: The sustainability of revenue growth and the company's path to profitability are key concerns for investors. Any indication of slowing growth or persistent losses could negatively impact stock valuation.

- Financial Risk: Identifying and assessing potential financial risks, such as high debt levels or reliance on a limited number of large clients, is crucial for making informed investment decisions.

Conclusion

Predicting a 40% increase in Palantir stock by 2025 is a bold prediction. While Palantir's government contracts and potential for commercial expansion offer significant growth opportunities, several factors, including competition, macroeconomic conditions, and its financial performance, could significantly impact this outcome. A thorough risk assessment and careful consideration of these factors are essential. Before making any investment decisions concerning Palantir stock, conduct thorough due diligence and consult with a financial advisor. Continue researching the Palantir stock price and its potential for future growth to make informed decisions about your investment strategy.

Featured Posts

-

Metas Whats App Spyware Verdict A Costly Setback But Not The End

May 10, 2025

Metas Whats App Spyware Verdict A Costly Setback But Not The End

May 10, 2025 -

How Trumps Policies Affected Transgender People Personal Stories

May 10, 2025

How Trumps Policies Affected Transgender People Personal Stories

May 10, 2025 -

New Report Potential Changes To Uk Visa Application Process For Selected Nationalities

May 10, 2025

New Report Potential Changes To Uk Visa Application Process For Selected Nationalities

May 10, 2025 -

2025 Hurun Global Rich List Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025

2025 Hurun Global Rich List Elon Musks 100 Billion Loss And Continued Reign

May 10, 2025 -

Wynne Evans Strictly Scandal A Turning Point With Fresh Evidence

May 10, 2025

Wynne Evans Strictly Scandal A Turning Point With Fresh Evidence

May 10, 2025