Palantir Stock: 40% Growth By 2025 – A Detailed Investment Risk Assessment

Table of Contents

Palantir's Growth Potential: Factors Contributing to a 40% Projection

Several key factors contribute to the projected 40% growth of Palantir stock by 2025. This growth isn't guaranteed, but the underlying trends are promising for long-term investors.

Palantir Government Contracts and Data Analytics

Palantir's success is significantly tied to its strong presence in government contracts. Its data analytics platforms are highly sought after by defense and intelligence agencies worldwide.

- Strong Government Presence: Palantir boasts numerous substantial contracts with government bodies, providing critical data analytics and AI-driven solutions for national security and intelligence gathering.

- Growing Demand for Data Analytics: The public sector's increasing reliance on advanced data analytics and AI for efficient operations and threat mitigation fuels demand for Palantir's offerings.

- Increased Government Spending: Anticipated increases in government spending on national security initiatives translate directly into potential revenue growth for Palantir.

- Successful Partnerships: Examples like Palantir's partnerships with various US agencies demonstrate the platform's effectiveness and pave the way for future contracts. This success reinforces the potential for Palantir government contracts to drive substantial growth. The ability to leverage these relationships effectively is a key component in understanding Palantir's potential.

Keywords: Palantir government contracts, data analytics stock, AI investment, national security.

Palantir Commercial Market Expansion

Beyond the government sector, Palantir's commercial market expansion represents a significant growth driver. Its Foundry platform is gaining traction across various industries.

- Foundry Platform Adoption: The increasing adoption of Palantir's Foundry platform across sectors like healthcare, finance, and energy showcases its versatility and market applicability. This widespread use signifies significant potential for commercial growth.

- Global Expansion: Opportunities abound in emerging markets and international expansion, presenting substantial untapped potential for revenue generation. This international growth is crucial for diversifying Palantir's revenue streams.

- Competitive Advantages: Palantir's Foundry platform offers unique advantages over competitors, including its robust data integration capabilities and user-friendly interface. This creates a sustainable competitive advantage, contributing to market share growth.

- Market Trend Analysis: Analyzing current market trends, such as the increasing demand for data-driven decision-making, indicates a favorable environment for Palantir's continued commercial growth. This analysis highlights the potential for further expansion into untapped markets.

Keywords: Palantir Foundry, commercial growth, data analytics market, international expansion.

Technological Innovation and Future-Proofing

Palantir's commitment to research and development is crucial for its long-term viability and competitive edge.

- AI and Machine Learning: Palantir's investments in AI and machine learning are vital for enhancing its platform's capabilities and adapting to evolving technological landscapes. This continuous improvement helps ensure the long-term relevance of Palantir's offerings.

- New Product Offerings: The potential for new product offerings and strategic partnerships strengthens Palantir's position in the market and reinforces its ability to meet evolving client needs.

- Adaptability: Palantir's demonstrated ability to adapt to changing technological trends is vital for maintaining a competitive edge in the dynamic data analytics industry. This adaptability is crucial for attracting and retaining clients in a highly competitive market.

- Long-Term Viability: This ongoing commitment to innovation ensures the long-term viability of Palantir's technology and its relevance to future markets, thereby reducing the long-term risk associated with the investment.

Keywords: Palantir AI, technological innovation, future-proof investment, machine learning.

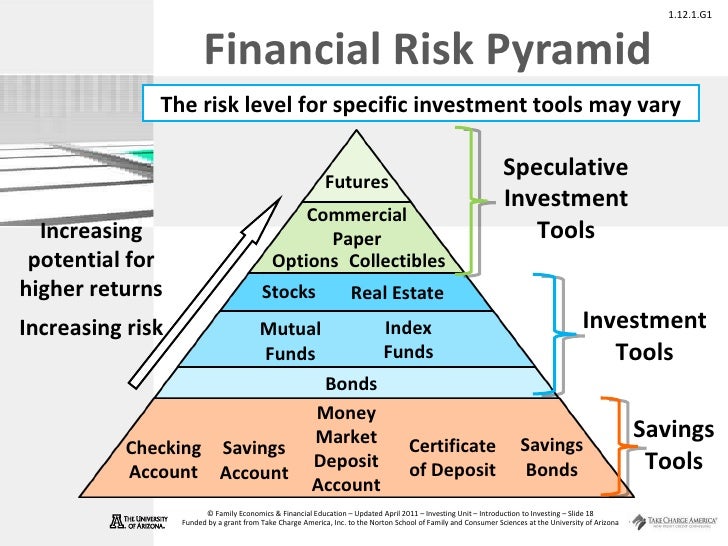

Significant Risks Associated with Investing in Palantir Stock

Despite the growth potential, investing in Palantir stock carries significant risks.

Valuation and Market Volatility

Palantir's valuation is sensitive to market fluctuations and investor sentiment.

- Valuation Sensitivity: Palantir's stock price can experience substantial swings due to overall market conditions and investor sentiment toward the company. This volatility presents a substantial risk to investors.

- Market Fluctuations: Macroeconomic factors and broader market trends significantly impact Palantir's stock valuation, creating uncertainty for investors.

- Competitor Comparison: Comparing Palantir's valuation to competitors in the data analytics sector helps understand its relative pricing and potential for future growth.

Keywords: Palantir stock valuation, market volatility, high-risk investment.

Competition and Market Share

Palantir faces competition from established tech giants and emerging startups.

- Competitive Landscape: The data analytics market is highly competitive, with established players and new entrants constantly vying for market share.

- Market Share Analysis: Analyzing Palantir's current market share and its potential for future growth is crucial to assessing its long-term prospects.

- Competitive Threats: Threats from established tech giants with substantial resources and emerging startups with innovative technologies pose significant challenges to Palantir's continued market dominance.

Keywords: Palantir competitors, market share, competitive landscape.

Dependence on Government Contracts

Palantir's reliance on government contracts presents a potential vulnerability.

- Government Contract Risk: Heavy reliance on government contracts exposes Palantir to the risk of budget cuts, policy changes, or shifts in government priorities. This dependence presents a significant risk to revenue stability.

- Policy Changes: Changes in government policies or funding cuts could negatively impact Palantir's revenue streams. This unpredictability necessitates a diversified revenue strategy.

- Revenue Diversification: Palantir's ability to diversify its revenue streams, reducing its reliance on government contracts, is critical to mitigating this risk.

Keywords: Palantir government reliance, revenue diversification, contract risk.

Conclusion

This detailed risk assessment of Palantir stock (PLTR) highlights the significant growth potential, fueled by strong government contracts, commercial market expansion, and technological innovation. The 40% growth projection by 2025 is ambitious, but achievable given the right circumstances. However, investors must carefully consider the inherent risks, including valuation volatility, competition, and dependence on government contracts. While the potential rewards are substantial, the risks are equally significant. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Palantir. Remember to carefully evaluate the risk profile of Palantir stock before committing your capital. A thorough understanding of Palantir's business and its competitive environment is crucial before investing in Palantir stock.

Featured Posts

-

Barys San Jyrman Altryq Nhw Alfwz Blqb Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Altryq Nhw Alfwz Blqb Dwry Abtal Awrwba

May 09, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Yine De Kazancli Mi

May 09, 2025

Bitcoin Madenciliginin Azalan Karliligi Yine De Kazancli Mi

May 09, 2025 -

Figma Vs Adobe Word Press And Canva How Ai Is Reshaping Design

May 09, 2025

Figma Vs Adobe Word Press And Canva How Ai Is Reshaping Design

May 09, 2025 -

Handhaven Van De Band Nederland India De Aanpak Van Brekelmans

May 09, 2025

Handhaven Van De Band Nederland India De Aanpak Van Brekelmans

May 09, 2025 -

Market Prediction Identifying Stocks To Outperform Palantir Within 3 Years

May 09, 2025

Market Prediction Identifying Stocks To Outperform Palantir Within 3 Years

May 09, 2025