Pakistan's Economic Crisis Deepens: IMF Review Of $1.3 Billion Loan

Table of Contents

The Current State of Pakistan's Economy

Pakistan's economic indicators paint a grim picture. Inflation has skyrocketed, impacting the cost of essential goods and pushing millions into poverty. The Pakistani Rupee has experienced a significant devaluation against the US dollar, further fueling inflation and increasing the cost of imports. Foreign exchange reserves have plummeted to dangerously low levels, limiting the country's ability to pay for essential imports and service its debts. Public debt continues to rise, placing immense strain on government finances.

- Inflation: Pakistan's inflation rate has reached alarming levels, exceeding [Insert Current Inflation Rate]% in [Insert Month, Year]. This high inflation rate erodes purchasing power and severely impacts the most vulnerable segments of the population.

- Currency Devaluation: The Pakistani Rupee has depreciated significantly against major currencies like the US dollar, making imports more expensive and exacerbating inflationary pressures. The current exchange rate is approximately [Insert Current Exchange Rate].

- Foreign Exchange Reserves: Pakistan's foreign exchange reserves have fallen to critically low levels, raising concerns about the country's ability to meet its external debt obligations and import essential goods. Recent figures show reserves at approximately [Insert Current Reserve Figures].

- Public Debt: Pakistan's public debt continues to climb, representing a significant portion of its GDP. This high debt level restricts the government's ability to invest in crucial sectors like education and healthcare.

These economic woes have had a devastating impact on essential services. Healthcare access has become increasingly difficult for many, while educational opportunities are being jeopardized due to budget cuts. The crisis has created widespread economic hardship, threatening social stability and political harmony.

The IMF's Conditions for Loan Disbursement

The IMF's $1.3 billion loan tranche is conditional upon Pakistan implementing a series of stringent reforms. These conditions typically include:

- Fiscal Consolidation: The IMF demands significant cuts in government spending, aiming to reduce the fiscal deficit. This often involves painful measures such as reducing subsidies on fuel and essential commodities.

- Structural Reforms: The IMF usually insists on structural reforms to improve the efficiency and transparency of state-owned enterprises, promote private sector growth, and improve governance.

- Monetary Policy Adjustments: The IMF typically recommends adjustments to monetary policy, including raising interest rates to curb inflation. This, however, can further stifle economic growth and investment.

These reforms, while intended to stabilize the economy in the long run, often have immediate and potentially harsh social and political consequences. They can lead to increased unemployment, reduced social welfare programs, and potentially trigger social unrest. The government faces the difficult task of balancing the IMF's demands with the need to protect its citizens from the worst impacts of these reforms.

Political Implications and Public Sentiment

The economic crisis and the IMF negotiations have significant political implications. The government faces immense pressure to secure the loan, but implementing the IMF's tough conditions is politically challenging and unpopular. Public sentiment is a mix of anger, frustration, and uncertainty. There's a widespread feeling that the current government hasn't handled the crisis effectively, leading to potential social unrest and political instability.

- Government Response: The government is navigating a precarious balance between fulfilling the IMF's demands and managing public discontent. The effectiveness of its response will play a crucial role in determining the political stability of the country.

- Public Protests: There's a potential for increased public protests and social unrest if the IMF's conditions lead to further hardship for the people.

- Political Fallout: The outcome of the IMF negotiations and the implementation of the reforms will undoubtedly have lasting political consequences, potentially influencing the upcoming elections and the future trajectory of Pakistani politics.

Potential Outcomes and Future Scenarios

The IMF review holds significant implications for Pakistan's future. If the loan is approved, it could provide crucial short-term stability and pave the way for economic recovery. However, the conditions attached to the loan could also cause further hardship in the short term. If the loan is not approved, Pakistan faces a much more severe crisis, potentially leading to a default on its debt and further economic decline.

- Loan Approval: A successful review and loan disbursement will offer some breathing room, enabling Pakistan to address its immediate financial needs and potentially implement reforms to foster long-term economic growth.

- Loan Rejection: A rejection by the IMF would plunge Pakistan deeper into crisis, potentially triggering a sovereign debt default and leading to further economic instability.

- Long-term Implications: Regardless of the immediate outcome, Pakistan needs to implement sustainable long-term economic reforms to address the underlying issues contributing to its economic vulnerabilities. This includes diversifying its economy, improving governance, and investing in human capital.

Conclusion: Navigating Pakistan's Economic Crisis - The Path Forward

Pakistan's economic crisis is profound and requires immediate and decisive action. The IMF review of the $1.3 billion loan is a critical juncture, with the potential to either alleviate the crisis or deepen it. The government faces enormous challenges in balancing the IMF's demands with the needs of its citizens. The success of any recovery hinges on the implementation of sustainable economic reforms and transparent governance. The path forward demands careful navigation, decisive action, and a commitment to long-term economic stability. Stay informed about developments regarding Pakistan's economic crisis and the IMF loan review by following reputable news sources and conducting further research; understanding this situation is crucial for grasping its long-term consequences.

Featured Posts

-

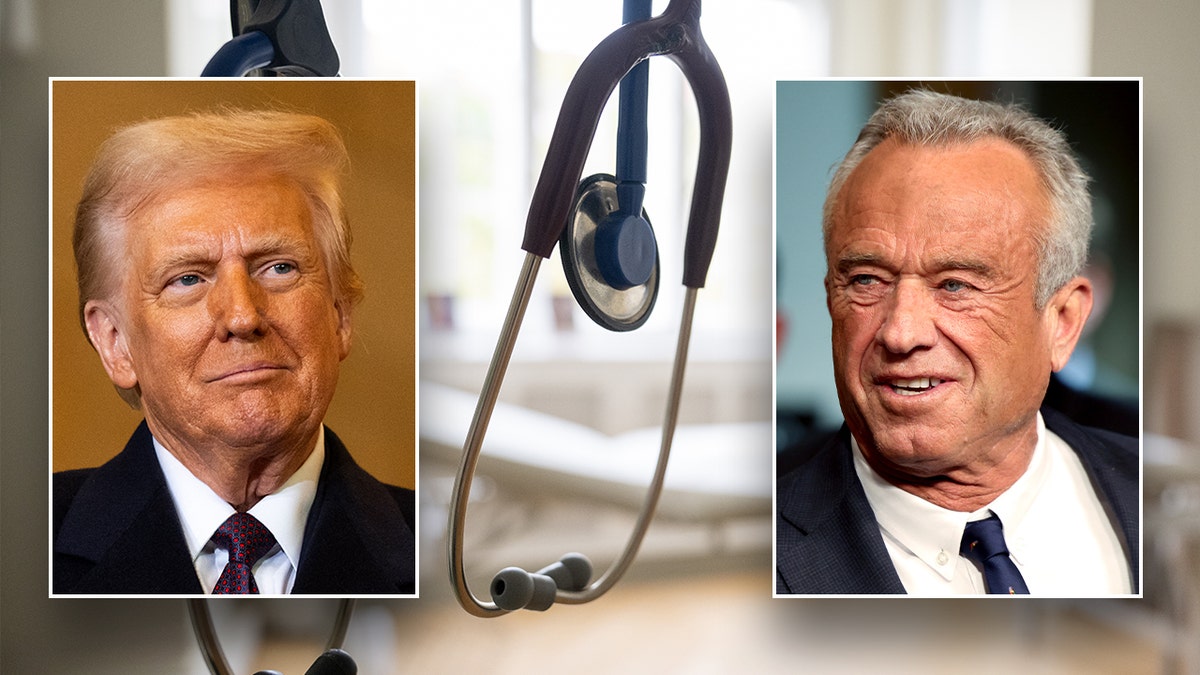

Surgeon General Nomination Trump Chooses Casey Means Leader Of The Maha Movement

May 09, 2025

Surgeon General Nomination Trump Chooses Casey Means Leader Of The Maha Movement

May 09, 2025 -

Judge Who Jailed Boris Becker Appointed To Head Nottingham Inquiry

May 09, 2025

Judge Who Jailed Boris Becker Appointed To Head Nottingham Inquiry

May 09, 2025 -

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 09, 2025

Young Thugs Uy Scuti Release Date Hints And Fan Reactions

May 09, 2025 -

Ma Qdmh Fyraty Me Alerby Alqtry Mndh Antqalh Mn Alahly

May 09, 2025

Ma Qdmh Fyraty Me Alerby Alqtry Mndh Antqalh Mn Alahly

May 09, 2025 -

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025

Young Thugs Uy Scuti When Can We Expect The New Album

May 09, 2025

Latest Posts

-

Transgender Individuals And The Legacy Of Trumps Executive Orders

May 10, 2025

Transgender Individuals And The Legacy Of Trumps Executive Orders

May 10, 2025 -

The Lived Experience How Trumps Executive Orders Affected Transgender Individuals

May 10, 2025

The Lived Experience How Trumps Executive Orders Affected Transgender Individuals

May 10, 2025 -

Executive Orders And The Transgender Community Your Testimony

May 10, 2025

Executive Orders And The Transgender Community Your Testimony

May 10, 2025 -

Trumps Executive Orders A Transgender Perspective

May 10, 2025

Trumps Executive Orders A Transgender Perspective

May 10, 2025 -

Sharing Transgender Experiences The Effects Of Trumps Executive Actions

May 10, 2025

Sharing Transgender Experiences The Effects Of Trumps Executive Actions

May 10, 2025