Pakistan's Crypto Diplomacy: PCC's 50-Day Impact

Table of Contents

Early Policy Initiatives and Regulatory Framework

The PCC's initial 50 days were marked by the development of foundational policy proposals aimed at creating a comprehensive regulatory framework for cryptocurrency in Pakistan. These early initiatives focused on establishing a balance between promoting innovation in blockchain technology and protecting investors from potential risks. The potential impact of these policies on crypto trading, investment, and overall blockchain technology development within Pakistan is substantial.

- Specific policy proposals: Early reports suggest the PCC is exploring licensing frameworks for cryptocurrency exchanges, establishing clear guidelines for Initial Coin Offerings (ICOs), and proposing taxation policies for crypto transactions. Details regarding specific tax rates and licensing requirements are still emerging.

- Feasibility and effectiveness: The feasibility of these policies hinges on several factors, including the existing legal infrastructure, the capacity of regulatory bodies to enforce new rules, and the level of public understanding and acceptance of cryptocurrency. The effectiveness will depend on the clarity, transparency, and adaptability of the regulations.

- Comparison to other countries: The PCC's approach is being compared to regulatory models in countries like Singapore, the UAE, and El Salvador, each with varying degrees of success in balancing innovation and risk mitigation. The effectiveness of Pakistan's approach will only become clear with time and further analysis of its implementation.

- Public statements and reports: While official reports might be limited in the early stages, any public statements released by the PCC regarding its policy direction will be key indicators of its overall strategy for "Pakistan crypto regulation" and "blockchain regulation Pakistan." Analyzing these statements is essential for understanding the long-term strategy.

Engagement with Stakeholders and Public Perception

A key aspect of the PCC's early work has been its engagement with various stakeholders. This includes businesses operating in the cryptocurrency space, individual investors, blockchain developers, and the general public. Building consensus and fostering a positive public perception are critical for successful crypto adoption in Pakistan.

- Stakeholder meetings and consultations: The PCC's efforts to engage with stakeholders through workshops, seminars, and open forums are vital for gathering diverse perspectives and ensuring that regulations are both effective and acceptable to the community. The details of these engagements, including the number of participants and the feedback received, will be important metrics for evaluating the PCC's success.

- Public opinion and social media analysis: Monitoring public opinion through surveys, social media sentiment analysis, and traditional media coverage provides valuable insights into the public's perception of the PCC and its initiatives. Understanding the "public opinion crypto Pakistan" is crucial for adjusting strategies accordingly.

- Controversies and criticisms: Any controversies or criticisms faced by the PCC during its first 50 days need to be addressed transparently. These instances can offer opportunities for improvement and increased stakeholder trust. Open dialogue is vital for mitigating negative perceptions within the "Pakistan crypto community."

Impact on Crypto Investment and Market Activity

Assessing the impact of the PCC's actions on cryptocurrency investment and market activity in Pakistan is crucial. This requires analyzing trading volumes, investor sentiment, and the overall growth of the crypto market in Pakistan during the 50-day period.

- Trading volumes: Comparing trading volumes before and after the PCC's establishment provides a quantifiable measure of market activity. An increase in "crypto trading volume Pakistan" could suggest positive investor sentiment and growing confidence in the regulatory framework being developed.

- Investor sentiment: Analyzing market indicators like price fluctuations, trading patterns, and the overall tone of discussions within the crypto community can shed light on investor sentiment. A shift in sentiment reflects the market's response to the PCC's actions and the implications for "crypto investment Pakistan."

- Investment inflows and outflows: Tracking investment flows into and out of the Pakistan cryptocurrency market during this period provides valuable data on how investors perceive the PCC’s initiatives and their impact on "Pakistan crypto market" growth.

Challenges and Future Outlook for Pakistan's Crypto Diplomacy

Despite the potential, the PCC faces significant challenges in shaping Pakistan's crypto future. Addressing these hurdles is crucial for the long-term success of Pakistan's crypto diplomacy.

- Regulatory uncertainty, technological limitations, and public skepticism: Regulatory uncertainty, the lack of comprehensive technological infrastructure, and persistent public skepticism represent key challenges. Overcoming these requires strong collaboration between the PCC, technology providers, and public awareness campaigns.

- Future goals and objectives of the PCC: The PCC's future plans will be key to determining its long-term impact on the "Pakistan crypto ecosystem." These goals, along with their feasibility and alignment with broader national economic strategies, should be closely monitored.

- Long-term impact predictions: Predicting the long-term impact of the PCC on Pakistan's crypto ecosystem requires careful consideration of various factors, including the evolution of global cryptocurrency regulations, technological advancements, and the evolving dynamics of the local financial landscape. Understanding the "future of crypto in Pakistan" is crucial for its success.

Conclusion: Evaluating the 50-Day Impact of Pakistan's Crypto Diplomacy through the PCC

The PCC's first 50 days have laid the groundwork for a more regulated and potentially thriving cryptocurrency landscape in Pakistan. While challenges remain, the early policy initiatives, stakeholder engagement, and the initial impact on market activity offer a glimpse into the potential of Pakistan's crypto diplomacy. The PCC's role in shaping the future of cryptocurrency in Pakistan is undeniable. To stay informed about this evolving space, follow Pakistan's crypto journey, stay updated on PCC developments, and learn more about Pakistan's crypto diplomacy. We encourage you to share your thoughts and insights in the comments section below and help shape the conversation around this important topic.

Featured Posts

-

Vandenberg Sfb Hosts Space X Starlink Launch 27 Satellites Deployed

May 29, 2025

Vandenberg Sfb Hosts Space X Starlink Launch 27 Satellites Deployed

May 29, 2025 -

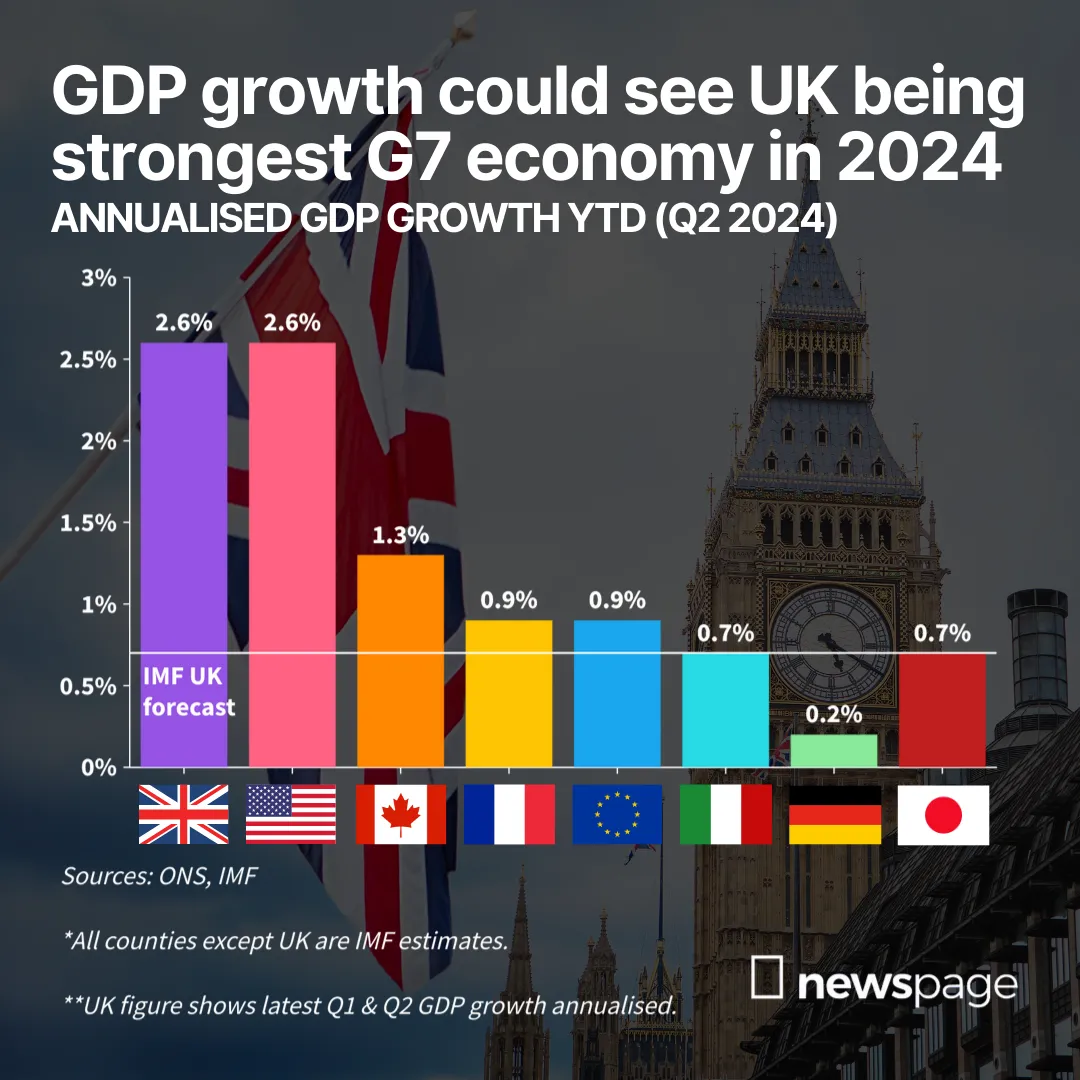

King Charles Iii A Strongest G7 Economy The Governments Mission

May 29, 2025

King Charles Iii A Strongest G7 Economy The Governments Mission

May 29, 2025 -

Analysis Johann Zarcos Substantial Improvement At The Cota Moto Gp Grand Prix

May 29, 2025

Analysis Johann Zarcos Substantial Improvement At The Cota Moto Gp Grand Prix

May 29, 2025 -

Why Joan Mir Wasnt Celebrating A Look At His Recent Moto Gp Success

May 29, 2025

Why Joan Mir Wasnt Celebrating A Look At His Recent Moto Gp Success

May 29, 2025 -

Unforeseen Success Pcc Community Markets 2024 Financial Performance

May 29, 2025

Unforeseen Success Pcc Community Markets 2024 Financial Performance

May 29, 2025